In this day and age where screens rule our lives however, the attraction of tangible printed materials hasn't faded away. Whatever the reason, whether for education project ideas, artistic or simply to add some personal flair to your space, Rebate Electric Car Federal Tax Refund are now an essential source. Here, we'll take a dive deep into the realm of "Rebate Electric Car Federal Tax Refund," exploring what they are, how to locate them, and how they can enhance various aspects of your lives.

Get Latest Rebate Electric Car Federal Tax Refund Below

Rebate Electric Car Federal Tax Refund

Rebate Electric Car Federal Tax Refund - Electric Car Federal Tax Credit Refundable, Is The Federal Ev Tax Credit Refundable, Income Tax Rebate On Electric Car, Is There A Federal Tax Credit For Electric Cars

Web 24 avr 2023 nbsp 0183 32 2022 s Inflation Reduction Act revamped the Federal Electric Vehicle Tax Credit Here s what you need to know about the new program By John M Vincent and Jim Motavalli Fact checked by

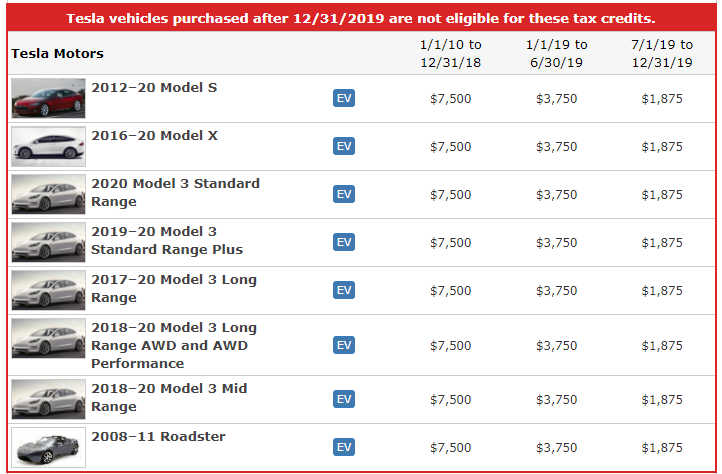

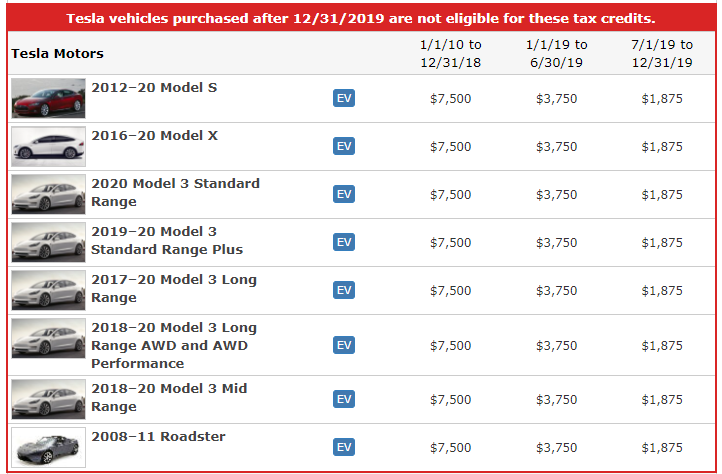

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of Afficher plus

Printables for free cover a broad selection of printable and downloadable content that can be downloaded from the internet at no cost. The resources are offered in a variety forms, including worksheets, templates, coloring pages and more. The great thing about Rebate Electric Car Federal Tax Refund lies in their versatility as well as accessibility.

More of Rebate Electric Car Federal Tax Refund

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

Federal Electric Car Rebate And Tax Withholdings 2023 Carrebate

Web 7 janv 2023 nbsp 0183 32 For the first time in years some Teslas will qualify for a 7 500 federal tax credit for new electric vehicles But only some

Web Beginning January 1 2023 if you buy a qualified used electric vehicle EV or fuel cell vehicle FCV from a licensed dealer for 25 000 or less you may be eligible for a used

Rebate Electric Car Federal Tax Refund have risen to immense popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Flexible: Your HTML0 customization options allow you to customize printed materials to meet your requirements such as designing invitations and schedules, or even decorating your house.

-

Educational Value Printing educational materials for no cost cater to learners of all ages, which makes them a vital tool for teachers and parents.

-

An easy way to access HTML0: Fast access a variety of designs and templates cuts down on time and efforts.

Where to Find more Rebate Electric Car Federal Tax Refund

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Federal Tax Rebate For Electric Cars 2022 2023 Carrebate

Web 12 avr 2023 nbsp 0183 32 The Inflation Reduction Act of 2022 made several changes to the tax credits provided for qualified plug in electric drive motor vehicles including adding fuel cell

Web 7 mai 2022 nbsp 0183 32 Federal income tax credit up to 7 500 Currently 7 500 is the maximum amount available to buyers of new fully electric or plug in hybrid cars leasing only

Since we've got your interest in printables for free Let's look into where you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Rebate Electric Car Federal Tax Refund for various motives.

- Explore categories like decorating your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- Ideal for parents, teachers or students in search of additional resources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates free of charge.

- These blogs cover a wide spectrum of interests, that includes DIY projects to party planning.

Maximizing Rebate Electric Car Federal Tax Refund

Here are some ways in order to maximize the use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home and in class.

3. Event Planning

- Invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Rebate Electric Car Federal Tax Refund are a treasure trove of practical and imaginative resources catering to different needs and desires. Their accessibility and flexibility make them an invaluable addition to the professional and personal lives of both. Explore the vast array of Rebate Electric Car Federal Tax Refund right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Rebate Electric Car Federal Tax Refund really available for download?

- Yes they are! You can download and print these files for free.

-

Does it allow me to use free printables in commercial projects?

- It's contingent upon the specific conditions of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright violations with Rebate Electric Car Federal Tax Refund?

- Some printables may contain restrictions in use. Make sure you read the terms and regulations provided by the author.

-

How can I print Rebate Electric Car Federal Tax Refund?

- Print them at home with a printer or visit an in-store print shop to get high-quality prints.

-

What program must I use to open Rebate Electric Car Federal Tax Refund?

- The majority of PDF documents are provided in the format of PDF, which can be opened using free software like Adobe Reader.

Government Rebates Electric Cars 2023 Carrebate

Federal Tax Rebate For Electric Cars 2023 Carrebate

Check more sample of Rebate Electric Car Federal Tax Refund below

Canada Federal Electric Car Rebate 2022 2022 Carrebate

Washington Electric Car Tax Rebate 2023 Carrebate Californiarebates

Federal Rebate On Electric Cars ElectricCarTalk

Tax Rebates Electric Cars 2023 Carrebate

Delaware Electric Car Tax Rebate Printable Rebate Form

Rebate On Electric Cars 2022 Carrebate

https://www.irs.gov/credits-deductions/credits-for-new-electric...

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of Afficher plus

https://www.nerdwallet.com/article/taxes/ev-tax-credit-electric...

Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks

If you bought a new qualified plug in electric vehicle EV in 2022 or before you may be eligible for a clean vehicle tax credit up to 7 500 under Internal Revenue Code Section 30D The credit equals 2 917 for a vehicle with a battery capacity of at least 5 kilowatt hours kWh Plus 417 for each kWh of Afficher plus

Web 27 ao 251 t 2022 nbsp 0183 32 People who buy new electric vehicles may be eligible for a tax credit as high as 7 500 and used electric car owners may qualify for up to 4 000 in tax breaks

Tax Rebates Electric Cars 2023 Carrebate

Washington Electric Car Tax Rebate 2023 Carrebate Californiarebates

Delaware Electric Car Tax Rebate Printable Rebate Form

Rebate On Electric Cars 2022 Carrebate

Rebates For Used Electric Cars 2023 Carrebate

Electric Cars Canada Rebate 2023 Carrebate

Electric Cars Canada Rebate 2023 Carrebate

Rebates And Incentives For Electric Cars 2023 Carrebate