Today, where screens rule our lives The appeal of tangible printed material hasn't diminished. Be it for educational use or creative projects, or simply adding an individual touch to the home, printables for free can be an excellent resource. With this guide, you'll dive through the vast world of "Rebate Amount Under Income Tax," exploring the benefits of them, where to find them and how they can enhance various aspects of your daily life.

Get Latest Rebate Amount Under Income Tax Below

Rebate Amount Under Income Tax

Rebate Amount Under Income Tax -

Web 11 avr 2023 nbsp 0183 32 11 April 2023 Income Tax Rebate What is rebate in income tax Income tax rebate is a benefit provided by the government to taxpayers that allows them to reduce their total tax liability It is the reduction in the amount of tax to the taxpayers by the government in order to promote savings and investment

Web The maximum amount of rebate that can be claimed is Rs 12 500 So if your total tax liability is less than Rs 12 500 the whole amount will be granted as rebate under Section 87A of the Income Tax Act The rebate claimed by an individual will be applied to his her total tax liability before cess is added at 4

Printables for free include a vast range of downloadable, printable resources available online for download at no cost. These printables come in different styles, from worksheets to templates, coloring pages and much more. The value of Rebate Amount Under Income Tax lies in their versatility and accessibility.

More of Rebate Amount Under Income Tax

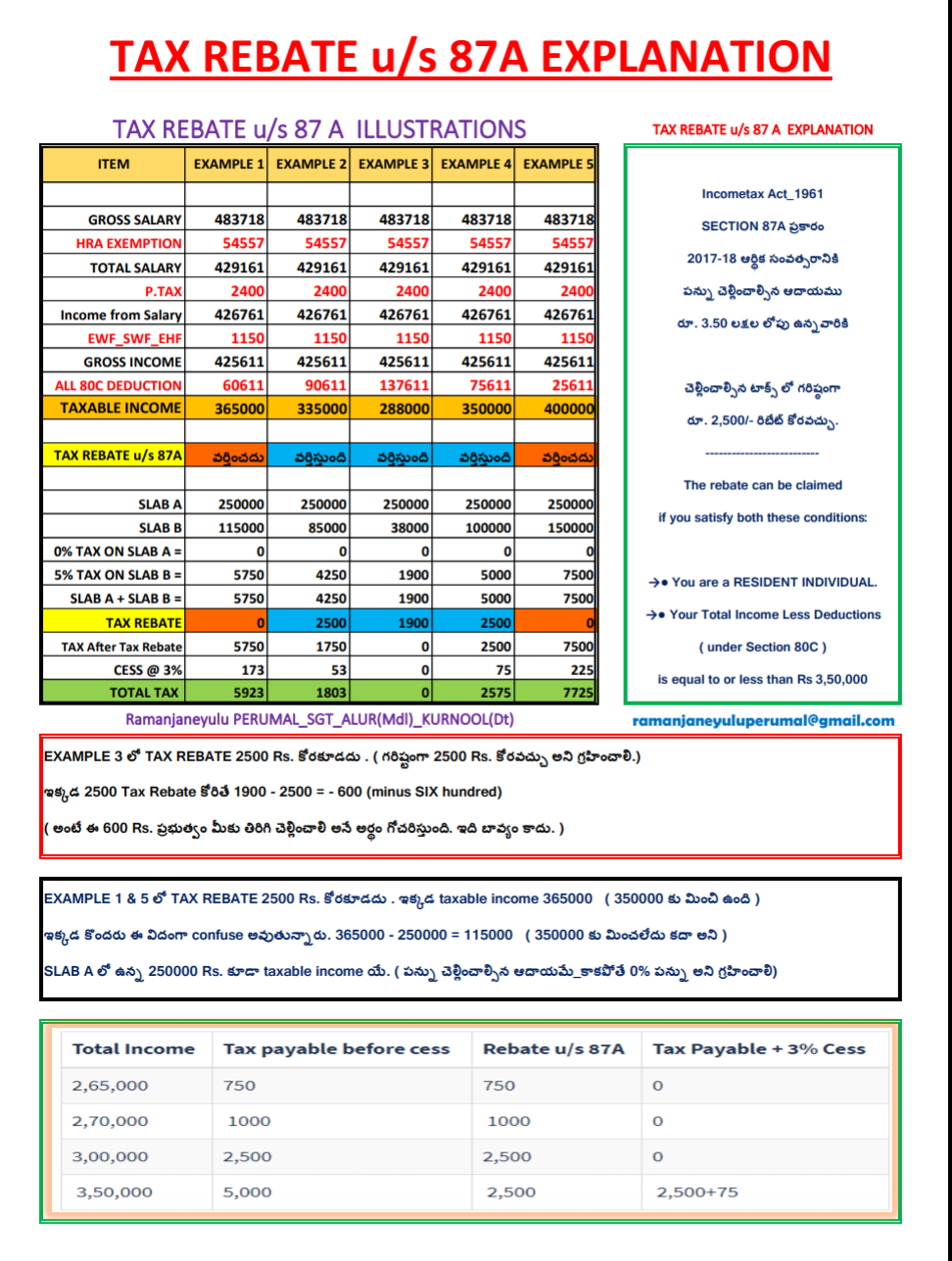

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Income Tax Rebate U s 87A For A Y 2017 18 F Y 2016 17

Web 1 d 233 c 2022 nbsp 0183 32 In prior years the State of California authorized a rebate of 5 000 for the purchase of light duty zero emission or plug in electric vehicles and 3 000 for plug in hybrid vehicles Let an expert do your

Web 3 f 233 vr 2023 nbsp 0183 32 Any individual opting for the new tax regime for any financial year till FY 2022 23 ending on March 31 2023 would be eligible for a tax rebate of Rs 12 500 if their taxable income does not exceed Rs 5 lakh in a financial year

The Rebate Amount Under Income Tax have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Customization: There is the possibility of tailoring designs to suit your personal needs in designing invitations or arranging your schedule or decorating your home.

-

Educational Impact: Downloads of educational content for free provide for students of all ages, making them a useful tool for parents and teachers.

-

Convenience: The instant accessibility to a myriad of designs as well as templates reduces time and effort.

Where to Find more Rebate Amount Under Income Tax

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Revised Tax Rebate Under Section 87A FY 2019 2020 Explained

Web Income cap for EV tax credit For the most part these changes took effect on Jan 1 2023 and will remain in effect until Jan 1 2032 Always check the IRS website for updates Find the

Web noun C TAX FINANCE uk us Add to word list an amount of money that is paid back to you if you have paid too much tax More than 2 million taxpayers will receive checks totaling 1 billion because of the federal tax rebate program a reduction in the amount of tax that has to be paid on something

Since we've got your interest in printables for free Let's see where the hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection and Rebate Amount Under Income Tax for a variety uses.

- Explore categories like furniture, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets along with flashcards, as well as other learning tools.

- Great for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- These blogs cover a wide array of topics, ranging from DIY projects to party planning.

Maximizing Rebate Amount Under Income Tax

Here are some ideas create the maximum value of Rebate Amount Under Income Tax:

1. Home Decor

- Print and frame gorgeous artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets to reinforce learning at home also in the classes.

3. Event Planning

- Design invitations and banners and other decorations for special occasions like birthdays and weddings.

4. Organization

- Stay organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Rebate Amount Under Income Tax are a treasure trove with useful and creative ideas that cater to various needs and preferences. Their accessibility and flexibility make them an invaluable addition to each day life. Explore the vast collection of Rebate Amount Under Income Tax today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I use free printables for commercial use?

- It depends on the specific terms of use. Always consult the author's guidelines before utilizing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may come with restrictions on usage. You should read the conditions and terms of use provided by the creator.

-

How do I print printables for free?

- You can print them at home using either a printer or go to a local print shop to purchase higher quality prints.

-

What program do I need to open printables for free?

- A majority of printed materials are in PDF format. They is open with no cost software such as Adobe Reader.

Section 87A Tax Rebate Under Section 87A Rebates Income Tax Tax

Income Tax Slab For Ay 2020 21 And Financial Year 2019 20

Check more sample of Rebate Amount Under Income Tax below

Singapore Corporate Tax Rates Budget 2016 Announces Higher Tax Rebates

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

What Is Rebate Under Section 87A For AY 2020 21 Financial Control

Income Tax And Rebate For Apartment Owners Association

How The Drive Clean Rebate Works NYSERDA

How To Claim Tax Rebate Under Income Tax Goyal Mangal Company

https://www.bankbazaar.com/tax/tax-rebate.html

Web The maximum amount of rebate that can be claimed is Rs 12 500 So if your total tax liability is less than Rs 12 500 the whole amount will be granted as rebate under Section 87A of the Income Tax Act The rebate claimed by an individual will be applied to his her total tax liability before cess is added at 4

https://topviews.org/what-is-rebate-in-income-tax-understanding-the...

Web 4 ao 251 t 2023 nbsp 0183 32 The maximum rebate amount for income tax in South Carolina is 800 What is a rebate in income tax and how does it work A rebate in income tax is a refund or credit given to taxpayers by the government for overpaying their taxes or meeting certain criteria It is a way to reduce the amount of tax owed or provide additional funds to taxpayers

Web The maximum amount of rebate that can be claimed is Rs 12 500 So if your total tax liability is less than Rs 12 500 the whole amount will be granted as rebate under Section 87A of the Income Tax Act The rebate claimed by an individual will be applied to his her total tax liability before cess is added at 4

Web 4 ao 251 t 2023 nbsp 0183 32 The maximum rebate amount for income tax in South Carolina is 800 What is a rebate in income tax and how does it work A rebate in income tax is a refund or credit given to taxpayers by the government for overpaying their taxes or meeting certain criteria It is a way to reduce the amount of tax owed or provide additional funds to taxpayers

Income Tax And Rebate For Apartment Owners Association

All You Need To Know About Tax Rebate Under Section 87A By Enterslice

How The Drive Clean Rebate Works NYSERDA

How To Claim Tax Rebate Under Income Tax Goyal Mangal Company

TAX REBATE 2017 18 Clarification Under Section 87 A MANNAMweb

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

New Income Tax Slab And Tax Rebate Credit Under Section 87A With

How To Check Whether You Are Eligible For The Tax Rebate On Rs 5 Lakhs