In a world in which screens are the norm however, the attraction of tangible, printed materials hasn't diminished. Be it for educational use for creative projects, simply adding a personal touch to your home, printables for free have become an invaluable resource. Through this post, we'll take a dive deeper into "Proposed Relief Rebate In The Cares Act," exploring the different types of printables, where you can find them, and how they can be used to enhance different aspects of your lives.

Get Latest Proposed Relief Rebate In The Cares Act Below

Proposed Relief Rebate In The Cares Act

Proposed Relief Rebate In The Cares Act -

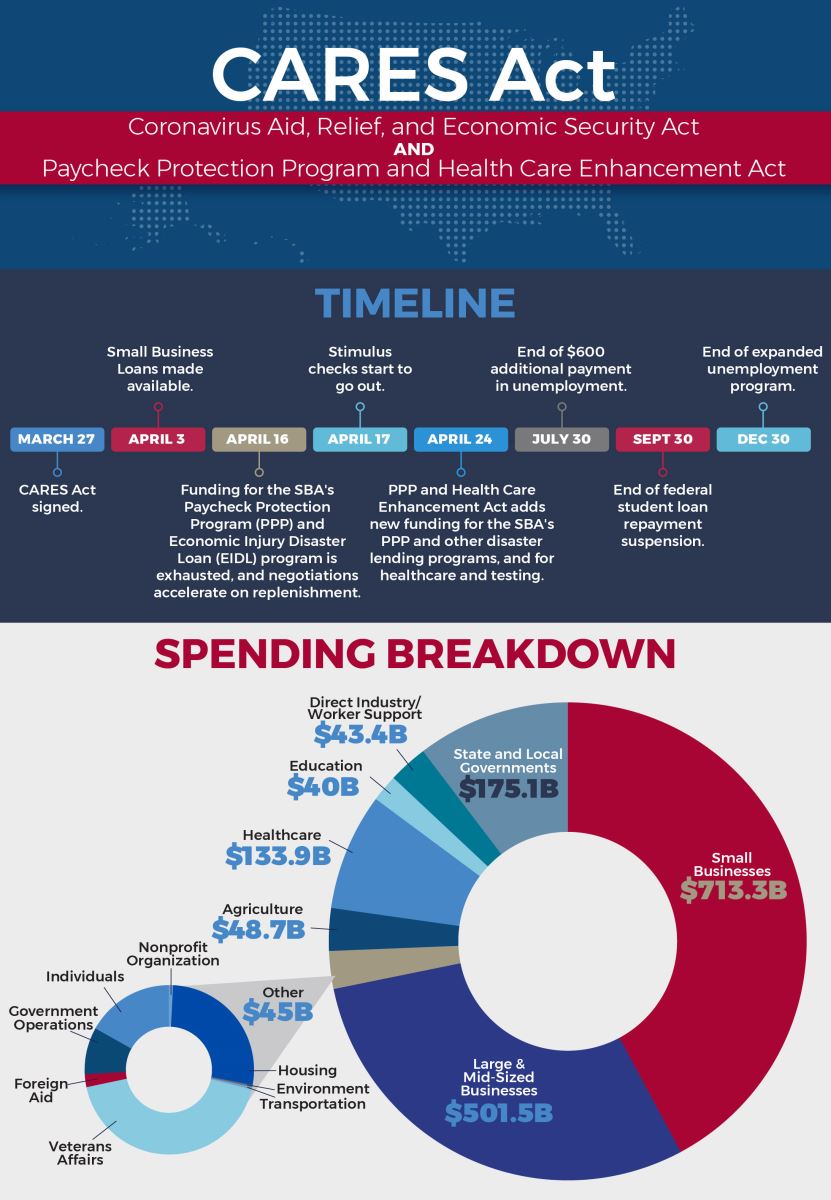

Web 17 avr 2020 nbsp 0183 32 CARES Act P L 116 136 Updated April 17 2020 The Coronavirus Aid Relief and Economic Security Act CARES Act P L 116 136 which was signed into

An additional 900 billion in relief was attached to the Consolidated Appropriations Act 2021 which was passed by Congress on December 21 2020 and signed by President Trump on December 27 after some CARES Act programs being renewed had already expired Afficher plus

The Proposed Relief Rebate In The Cares Act are a huge range of printable, free resources available online for download at no cost. They are available in a variety of types, such as worksheets coloring pages, templates and more. The benefit of Proposed Relief Rebate In The Cares Act lies in their versatility as well as accessibility.

More of Proposed Relief Rebate In The Cares Act

Senate Republicans Release Economic Relief Plan For Individuals And

Senate Republicans Release Economic Relief Plan For Individuals And

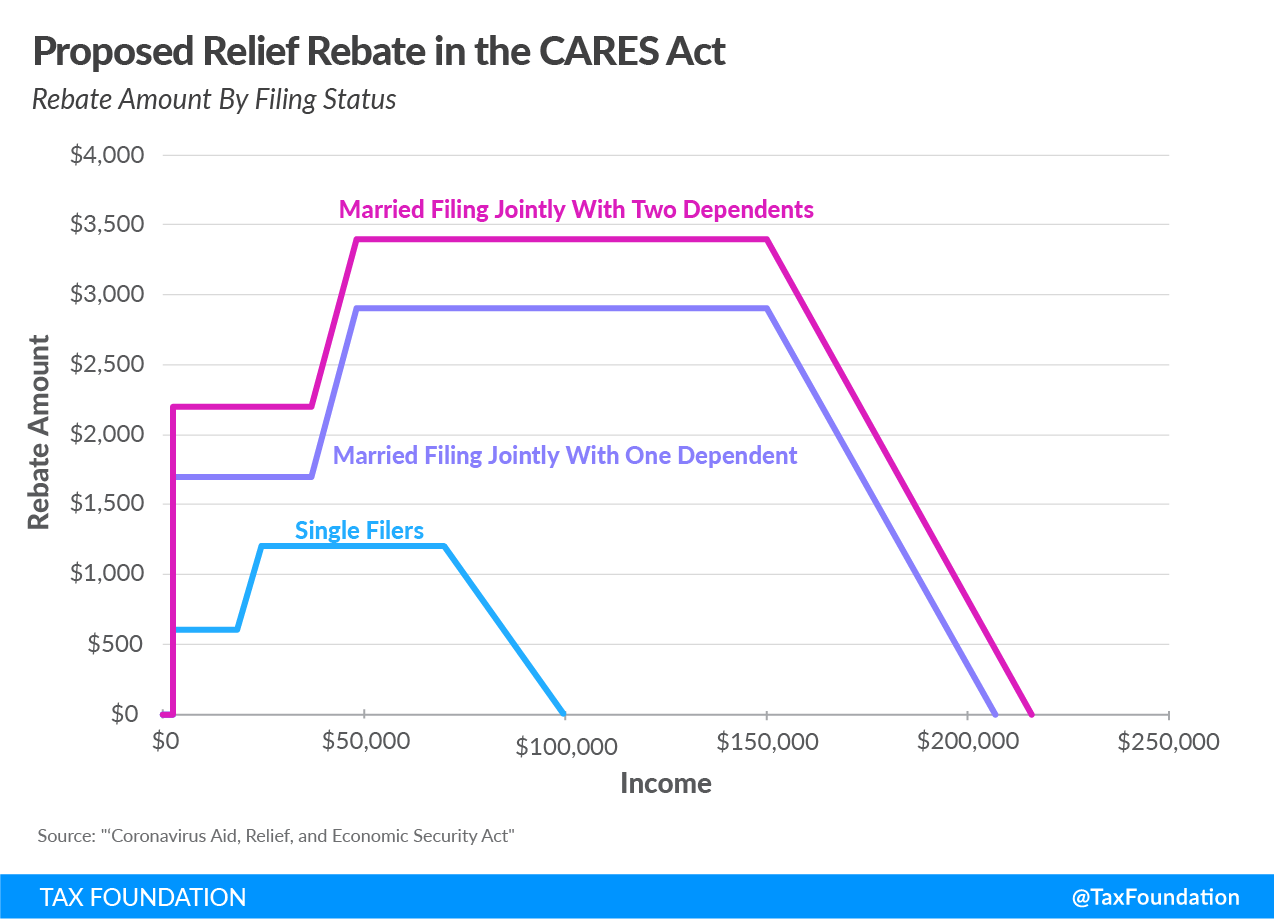

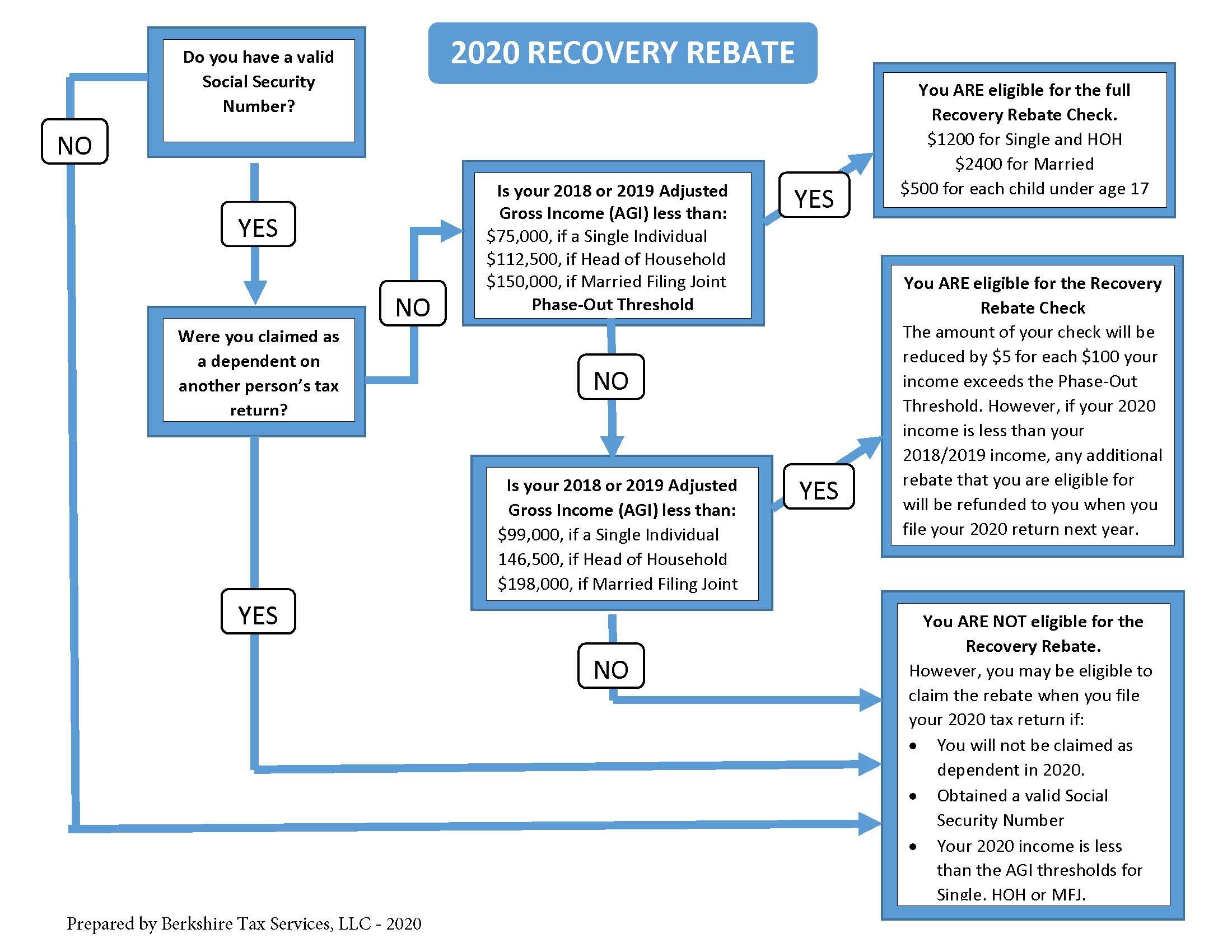

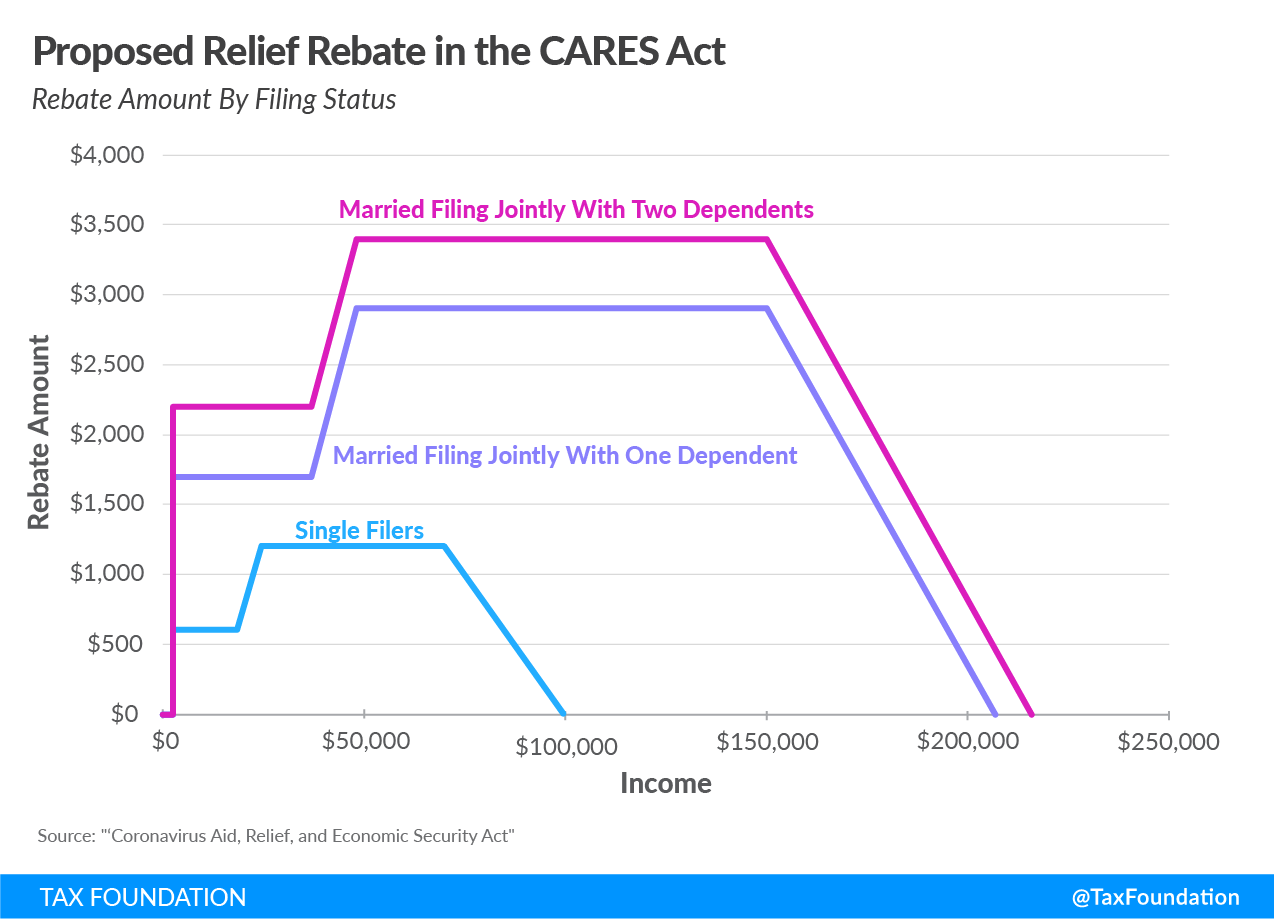

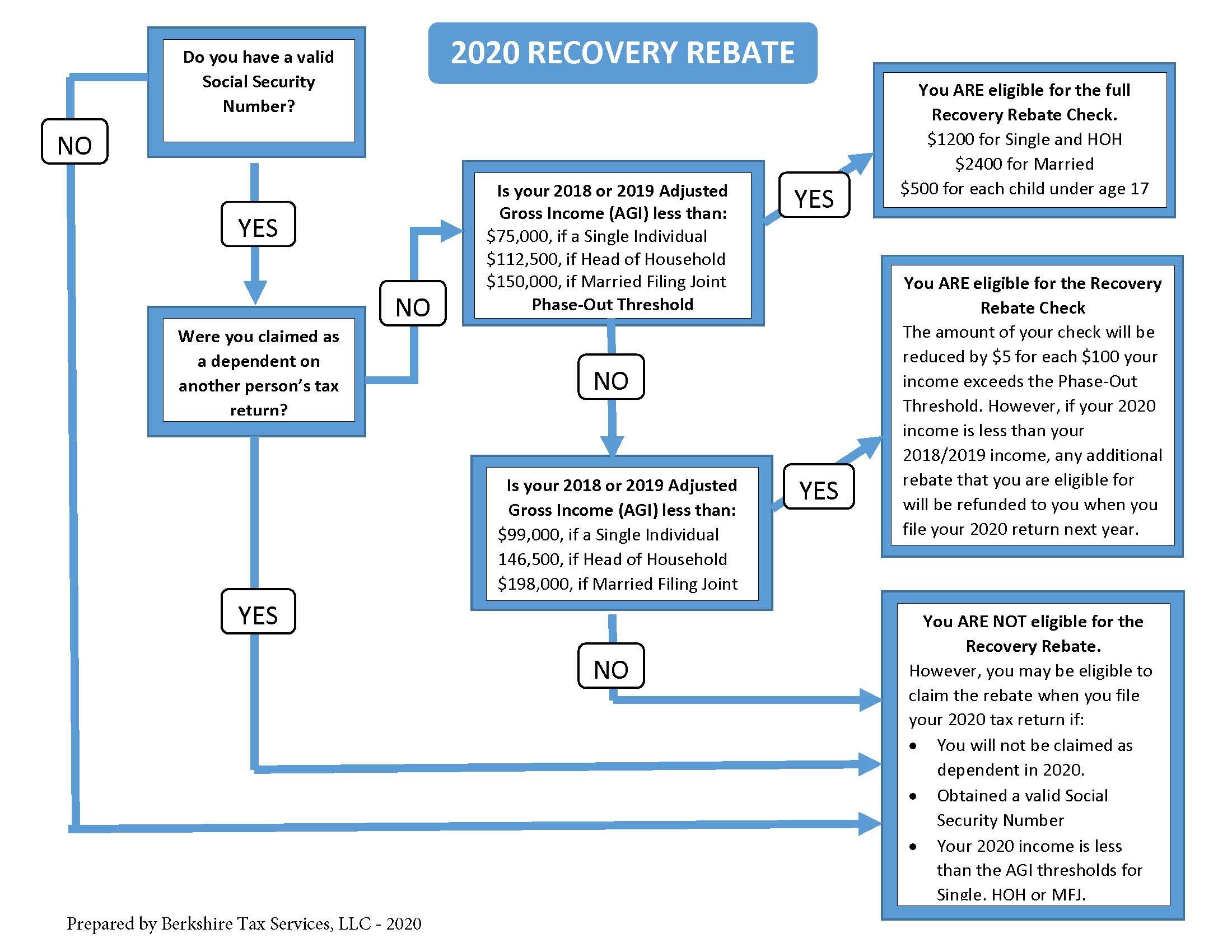

Web 30 mars 2020 nbsp 0183 32 The rebate phases out at 75 000 for singles 112 500 for heads of household and 150 000 for joint taxpayers at 5 percent per dollar of qualified income

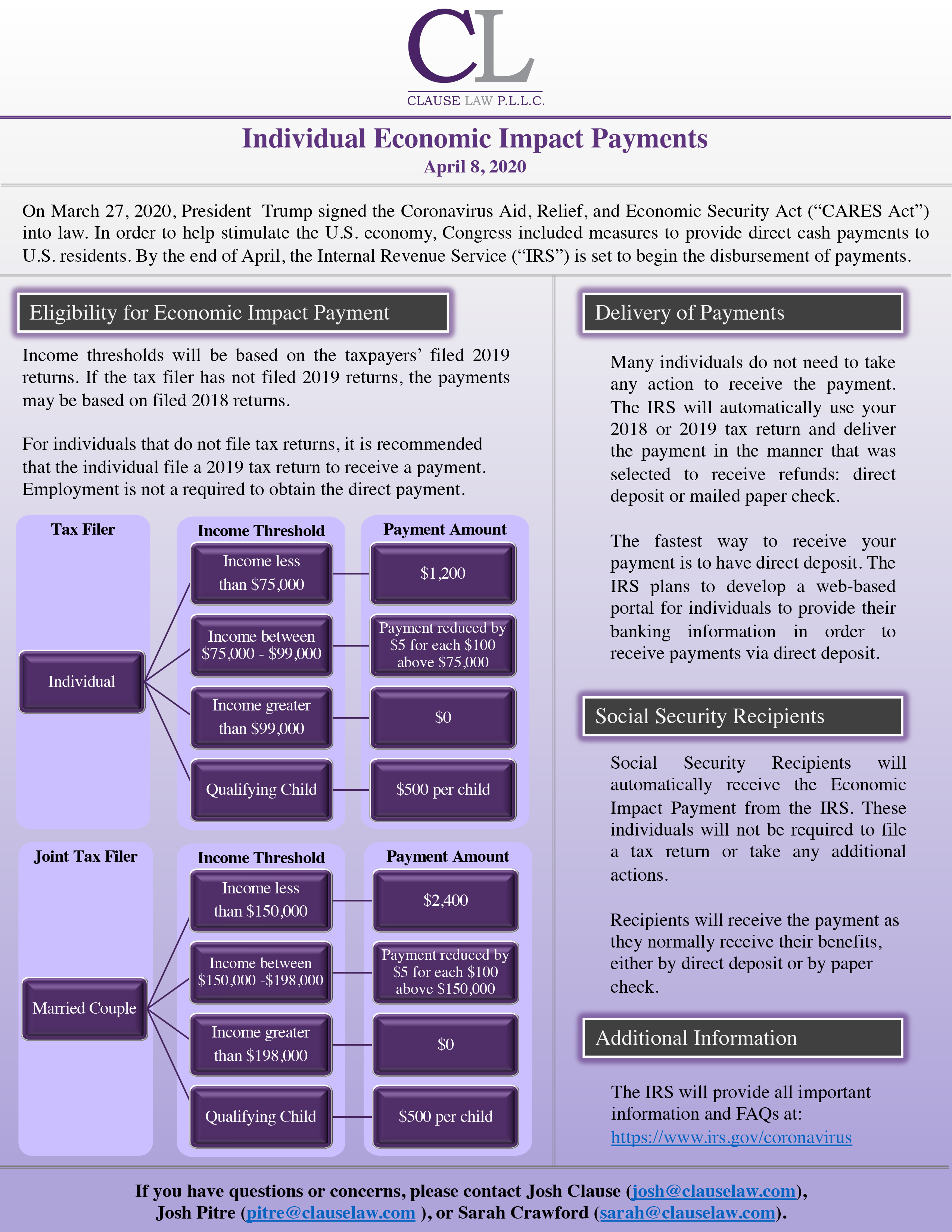

Web 26 mars 2020 nbsp 0183 32 Most individuals earning less than 75 000 can expect a one time cash payment of 1 200 Married couples would each receive a check and families would get

Proposed Relief Rebate In The Cares Act have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or costly software.

-

Individualization The Customization feature lets you tailor printables to your specific needs be it designing invitations for your guests, organizing your schedule or decorating your home.

-

Education Value Printables for education that are free can be used by students of all ages. This makes them a useful device for teachers and parents.

-

It's easy: Access to a variety of designs and templates, which saves time as well as effort.

Where to Find more Proposed Relief Rebate In The Cares Act

The CARES Act Funding Breakdown

The CARES Act Funding Breakdown

Web 28 avr 2020 nbsp 0183 32 One such proposal the Coronavirus Aid Relief and Economic Security CARES Act P L 116 136 was signed into law on March 27 2020 Tax relief for

Web 31 mars 2020 nbsp 0183 32 Rebates in the CARES Act as Taxpayers eligible for the credit could also receive 500 for each child eligible for the child tax credit The total credit to phase out at

We've now piqued your interest in Proposed Relief Rebate In The Cares Act We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Proposed Relief Rebate In The Cares Act to suit a variety of goals.

- Explore categories such as interior decor, education, management, and craft.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free as well as flashcards and other learning materials.

- This is a great resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- The blogs covered cover a wide array of topics, ranging including DIY projects to planning a party.

Maximizing Proposed Relief Rebate In The Cares Act

Here are some ways that you can make use of Proposed Relief Rebate In The Cares Act:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners and decorations for special events like weddings and birthdays.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Proposed Relief Rebate In The Cares Act are a treasure trove of innovative and useful resources that cater to various needs and desires. Their accessibility and flexibility make them a fantastic addition to every aspect of your life, both professional and personal. Explore the plethora of Proposed Relief Rebate In The Cares Act right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really gratis?

- Yes, they are! You can print and download these materials for free.

-

Does it allow me to use free printing templates for commercial purposes?

- It's dependent on the particular terms of use. Always read the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables could have limitations on use. Make sure you read the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- Print them at home with your printer or visit a local print shop for high-quality prints.

-

What program do I require to open printables that are free?

- Most printables come with PDF formats, which can be opened using free software such as Adobe Reader.

The CARES Act Recovery Rebates Fee Only Financial Advisor Deer Park

CARES Act How Much You Can Expect The Suquamish Tribe

Check more sample of Proposed Relief Rebate In The Cares Act below

Calam o Get Fast ERTC Refund Take This Free CARES Act Rebate

The CARES Act Paycheck Protection Program What You Need To Know

Recovery Rebate Income Limits Recovery Rebate

2020 Recovery Rebate Berkshire Tax Services LLC

Check Status Of Recovery Rebate Recovery Rebate

CARES Act Relief Summary For Nonprofits BakerHostetler JDSupra

https://en.wikipedia.org/wiki/CARES_Act

An additional 900 billion in relief was attached to the Consolidated Appropriations Act 2021 which was passed by Congress on December 21 2020 and signed by President Trump on December 27 after some CARES Act programs being renewed had already expired Afficher plus

https://www.aei.org/economics/the-care-act-who-will-get-

Web 30 mars 2020 nbsp 0183 32 The entire rebate amount phases out by five cents per dollar that a tax filer s adjusted gross income exceeds 75 000 150 000 for married couples filing jointly

An additional 900 billion in relief was attached to the Consolidated Appropriations Act 2021 which was passed by Congress on December 21 2020 and signed by President Trump on December 27 after some CARES Act programs being renewed had already expired Afficher plus

Web 30 mars 2020 nbsp 0183 32 The entire rebate amount phases out by five cents per dollar that a tax filer s adjusted gross income exceeds 75 000 150 000 for married couples filing jointly

2020 Recovery Rebate Berkshire Tax Services LLC

The CARES Act Paycheck Protection Program What You Need To Know

Check Status Of Recovery Rebate Recovery Rebate

CARES Act Relief Summary For Nonprofits BakerHostetler JDSupra

Eligible Dependents In The CARES Act And HEROES Act Economic Relief

The CARES Act Relief Bill And How It Can Help You As A Homeowner pdf

The CARES Act Relief Bill And How It Can Help You As A Homeowner pdf

Updated CARES Act Provides Relief To Individuals And Businesses