In this age of electronic devices, with screens dominating our lives, the charm of tangible printed materials isn't diminishing. For educational purposes, creative projects, or simply to add an extra personal touch to your area, Pension Relief Higher Rate are now a vital source. The following article is a dive to the depths of "Pension Relief Higher Rate," exploring the benefits of them, where they are, and how they can add value to various aspects of your daily life.

Get Latest Pension Relief Higher Rate Below

Pension Relief Higher Rate

Pension Relief Higher Rate -

Home Pensions retirement Tax and pensions Tax relief on pension contributions There are two ways you can get tax relief on your pension contributions If you re in a workplace pension scheme your employer chooses which method to use and must apply it to all staff Find out how tax relief works here What s in this guide

If you are a higher rate taxpayer you could reclaim an additional 20 tax on your pension contributions for a total of 40 tax relief This is one of the biggest benefits of saving into a pension getting tax reliefs on everything you pay in

Printables for free cover a broad array of printable materials online, at no cost. They are available in a variety of styles, from worksheets to templates, coloring pages, and more. The attraction of printables that are free is their versatility and accessibility.

More of Pension Relief Higher Rate

How Higher Interest Rates And Inflation Impact Pension Plans PNC Insights

How Higher Interest Rates And Inflation Impact Pension Plans PNC Insights

Broadly you start paying a higher rate tax at just over 50 000 of income a year and the additional rate starts at 125 140 in the current 2024 25 tax year For earned income the tax rates are 40 and 45 respectively which means there is a further 20 or 25 to reclaim on pension contributions for higher and additional rate taxpayers

You can claim an extra 20 tax relief on 30 000 the amount you paid higher rate tax on through your tax return or by contacting HMRC There is no extra relief on the remaining 5 000 you contributed to your pension How higher rate tax relief helps your pension

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

Customization: They can make printables to your specific needs when it comes to designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Value: Free educational printables offer a wide range of educational content for learners of all ages, which makes these printables a powerful instrument for parents and teachers.

-

Simple: instant access numerous designs and templates can save you time and energy.

Where to Find more Pension Relief Higher Rate

How To Claim Pension Higher Rate Tax Relief

How To Claim Pension Higher Rate Tax Relief

If you re a basic rate taxpayer you will receive 20 tax relief on your personal pension payments 40 if you re a higher rate taxpayer and 45 for all additional rate taxpayers How is personal pension tax relief calculated for basic rate taxpayers For all personal pensions basic rate tax relief is always claimed at source

26 January 2024 5 min read We ve seen in the Member contributions tax relief and annual allowance article there are various methods of giving tax relief on individual pension contributions but how is higher rate or additional rate tax relief given Key facts Higher and additional rate tax relief

In the event that we've stirred your interest in Pension Relief Higher Rate, let's explore where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a vast selection and Pension Relief Higher Rate for a variety needs.

- Explore categories like furniture, education, the arts, and more.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets or flashcards as well as learning materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- These blogs cover a broad spectrum of interests, everything from DIY projects to party planning.

Maximizing Pension Relief Higher Rate

Here are some innovative ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home also in the classes.

3. Event Planning

- Invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars, to-do lists, and meal planners.

Conclusion

Pension Relief Higher Rate are an abundance of practical and innovative resources that can meet the needs of a variety of people and desires. Their accessibility and versatility make them a wonderful addition to both professional and personal lives. Explore the wide world of Pension Relief Higher Rate right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Pension Relief Higher Rate really absolutely free?

- Yes, they are! You can download and print these tools for free.

-

Do I have the right to use free printing templates for commercial purposes?

- It's based on specific terms of use. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables might have limitations regarding their use. Check the terms and regulations provided by the author.

-

How do I print Pension Relief Higher Rate?

- You can print them at home with a printer or visit the local print shop for higher quality prints.

-

What software will I need to access printables for free?

- The majority of printed documents are with PDF formats, which is open with no cost software, such as Adobe Reader.

Pension TaxDash

Financial Concept Pension Free Stock Photo Public Domain Pictures

Check more sample of Pension Relief Higher Rate below

What Is Pension Tax Relief Moneybox Save And Invest

How To Claim Higher Rate Tax Relief On Pension Contributions

Fed Policymakers Paused On Its Rate Hikes Since March 2022 And Kept

How To Claim Higher Rate Pension Tax Relief 2024 Updated RECHARGUE

Clive Owen LLP Claiming Higher Rate Tax Relief For Pension Contributions

Kentucky Teachers Defend A Broken Pension System National Review

https://www.unbiased.co.uk/discover/pensions...

If you are a higher rate taxpayer you could reclaim an additional 20 tax on your pension contributions for a total of 40 tax relief This is one of the biggest benefits of saving into a pension getting tax reliefs on everything you pay in

https://www.which.co.uk/money/pensions-and...

Higher rate taxpayers can claim 40 pension tax relief Additional rate taxpayers can claim 45 pension tax relief In Scotland income tax is banded differently and pension tax relief is applied in a slightly alternative way Starter rate taxpayers pay 19 income tax but get 20 pension tax relief Basic rate taxpayers pay 20 income tax and

If you are a higher rate taxpayer you could reclaim an additional 20 tax on your pension contributions for a total of 40 tax relief This is one of the biggest benefits of saving into a pension getting tax reliefs on everything you pay in

Higher rate taxpayers can claim 40 pension tax relief Additional rate taxpayers can claim 45 pension tax relief In Scotland income tax is banded differently and pension tax relief is applied in a slightly alternative way Starter rate taxpayers pay 19 income tax but get 20 pension tax relief Basic rate taxpayers pay 20 income tax and

How To Claim Higher Rate Pension Tax Relief 2024 Updated RECHARGUE

How To Claim Higher Rate Tax Relief On Pension Contributions

Clive Owen LLP Claiming Higher Rate Tax Relief For Pension Contributions

Kentucky Teachers Defend A Broken Pension System National Review

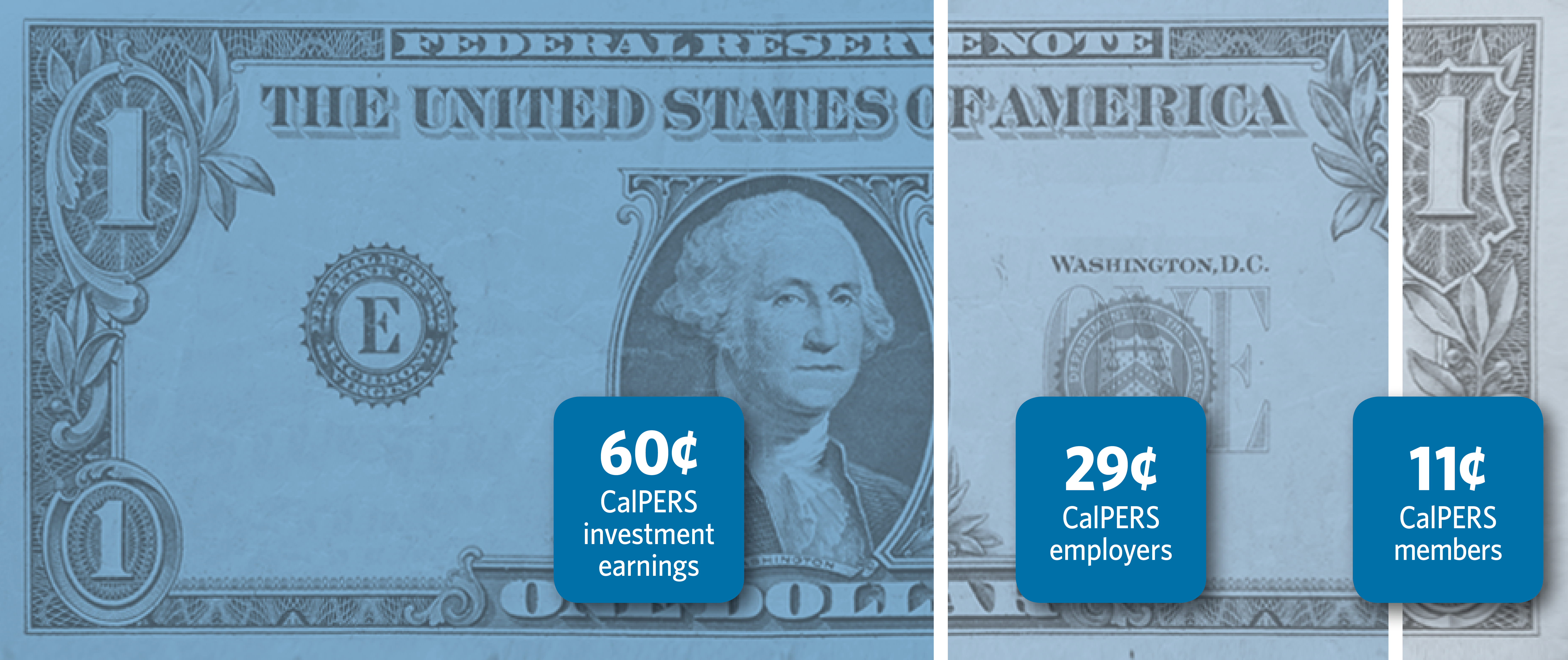

Who Pays For CalPERS Pensions CalPERS

APTF KOTABOMMALI Check Pension Details

APTF KOTABOMMALI Check Pension Details

Pension Fund Free Of Charge Creative Commons Green Highway Sign Image