In this day and age in which screens are the norm and the appeal of physical printed items hasn't gone away. Whether it's for educational purposes in creative or artistic projects, or simply adding an individual touch to the area, Ny State Property Tax Deduction are a great source. Here, we'll take a dive into the world of "Ny State Property Tax Deduction," exploring the benefits of them, where to find them and how they can improve various aspects of your lives.

Get Latest Ny State Property Tax Deduction Below

Ny State Property Tax Deduction

Ny State Property Tax Deduction -

The new tax credit included in the state s 212 billion budget approved this week by the Legislature and Gov Andrew Cuomo will apply to eligible homeowners whose property tax bill exceeds 6

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less

Ny State Property Tax Deduction encompass a wide collection of printable items that are available online at no cost. These printables come in different formats, such as worksheets, templates, coloring pages and much more. The appealingness of Ny State Property Tax Deduction is their versatility and accessibility.

More of Ny State Property Tax Deduction

2021 Nc Standard Deduction Standard Deduction 2021

2021 Nc Standard Deduction Standard Deduction 2021

Page last reviewed or updated February 6 2024 Local governments and school districts in New York State can opt to grant a reduction on the amount of property taxes paid by qualifying senior citizens This is accomplished by reducing the taxable assessment of the senior s home by as much as 50

How to report your property tax credit If you received a check for the School Tax Relief STAR credit you do not need to do anything on your New York State income tax return unless you itemize your deductions If you itemize your deductions reduce your itemized deduction for real estate taxes paid by the total amount of any STAR credit

Ny State Property Tax Deduction have gained a lot of popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or costly software.

-

customization: This allows you to modify print-ready templates to your specific requirements whether you're designing invitations planning your schedule or even decorating your house.

-

Educational Benefits: These Ny State Property Tax Deduction cater to learners of all ages, which makes them a vital aid for parents as well as educators.

-

Affordability: You have instant access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Ny State Property Tax Deduction

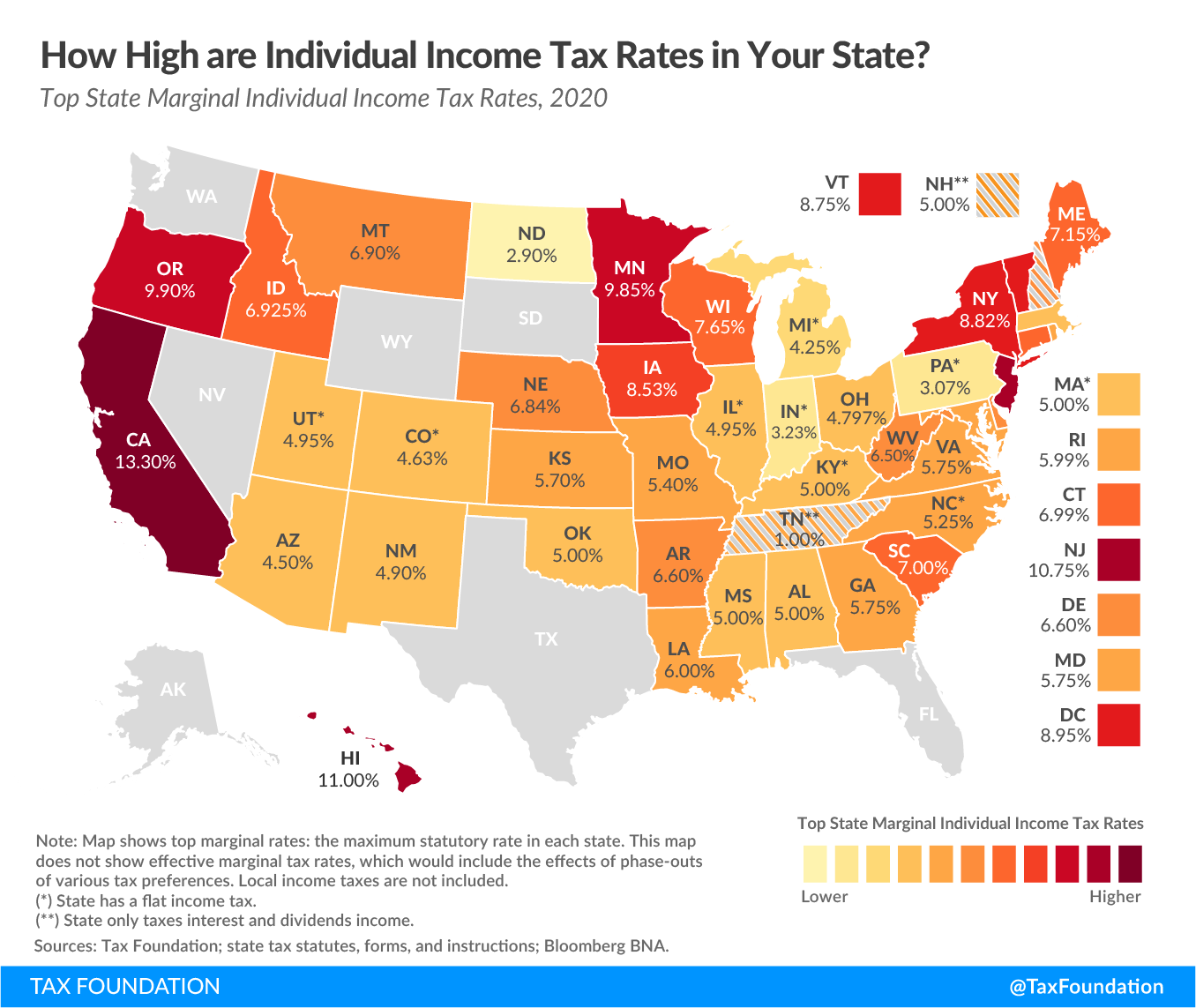

John Brown s Notes And Essays How High Are Property Taxes In Your

John Brown s Notes And Essays How High Are Property Taxes In Your

By Nick Reisman Albany PUBLISHED 2 07 PM ET Apr 08 2021 The newly approved 212 billion state budget includes relief for qualifying homeowners in New York who pay among the highest tax levies in the country But not everyone will qualify for the relief as part of the state budget which is tied to household income

Property taxes are based on the value of real property The property tax is an ad valorem tax meaning that it is based on the value of real property Real property commonly known as real estate is land and any permanent structures on it Without accounting for exemptions properties of equal value in the same community should pay

Since we've got your interest in Ny State Property Tax Deduction Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Ny State Property Tax Deduction designed for a variety goals.

- Explore categories like the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide worksheets that can be printed for free as well as flashcards and other learning materials.

- Perfect for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs covered cover a wide variety of topics, starting from DIY projects to planning a party.

Maximizing Ny State Property Tax Deduction

Here are some inventive ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets for teaching at-home and in class.

3. Event Planning

- Create invitations, banners, as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Stay organized by using printable calendars along with lists of tasks, and meal planners.

Conclusion

Ny State Property Tax Deduction are an abundance filled with creative and practical information that cater to various needs and needs and. Their accessibility and versatility make them a fantastic addition to both personal and professional life. Explore the vast array of Ny State Property Tax Deduction and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Ny State Property Tax Deduction truly absolutely free?

- Yes, they are! You can download and print these documents for free.

-

Are there any free printables for commercial purposes?

- It depends on the specific conditions of use. Be sure to read the rules of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues with Ny State Property Tax Deduction?

- Certain printables could be restricted regarding their use. Be sure to check the terms and regulations provided by the author.

-

How do I print printables for free?

- You can print them at home with your printer or visit the local print shops for better quality prints.

-

What program do I need to run printables at no cost?

- Most PDF-based printables are available in the PDF format, and is open with no cost software such as Adobe Reader.

The Standard Deduction And Itemized Deductions After Tax Reform

Drawbacks In Property Taxation System Of Pakistan Zameen Blog

Check more sample of Ny State Property Tax Deduction below

Rental Property Tax Worksheets

Rental Property Tax Deductions Second Mortgage Mortgage Tips Home

How To Claim The Property Tax Deduction DaveRamsey

Upstate NY Has Some Of The Highest Property Tax Rates In The Nation

Starting With 2018 Tax Returns Individuals Will Face A Cap Of 10 000

Property Tax Deduction Ny State PRORFETY

https://www.tax.ny.gov/pit/credits/real-property-tax-relief-credit.htm

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less

https://www.tax.ny.gov/help/taxpayer-education/tax...

The real property tax credit may be available to New York State residents who have household gross incomes of 18 000 or less and pay either real property taxes or rent for their residences If all members of your household are under age 65 the credit can be as much as 75

Real property tax relief credit Who is eligible You are entitled to this refundable credit if you meet all of the following requirements for the tax year you are subject to tax under Tax Law Article 22 you were a New York State resident for all of the tax year your qualified gross income is 250 000 or less

The real property tax credit may be available to New York State residents who have household gross incomes of 18 000 or less and pay either real property taxes or rent for their residences If all members of your household are under age 65 the credit can be as much as 75

Upstate NY Has Some Of The Highest Property Tax Rates In The Nation

Rental Property Tax Deductions Second Mortgage Mortgage Tips Home

Starting With 2018 Tax Returns Individuals Will Face A Cap Of 10 000

Property Tax Deduction Ny State PRORFETY

Rental Property Tax Deductions American Landlord

GOP Tax Reform The Property Tax Deduction Won t Be Scrapped CBS News

GOP Tax Reform The Property Tax Deduction Won t Be Scrapped CBS News

PERSONAL TAX Tax Deduction On Municipal Tax Only On Let out Property