In the digital age, where screens dominate our lives but the value of tangible printed materials isn't diminishing. If it's to aid in education project ideas, artistic or simply adding a personal touch to your space, Non Qualified Annuity Taxation At Death are now a vital resource. Through this post, we'll take a dive in the world of "Non Qualified Annuity Taxation At Death," exploring their purpose, where they are, and how they can enhance various aspects of your lives.

Get Latest Non Qualified Annuity Taxation At Death Below

Non Qualified Annuity Taxation At Death

Non Qualified Annuity Taxation At Death -

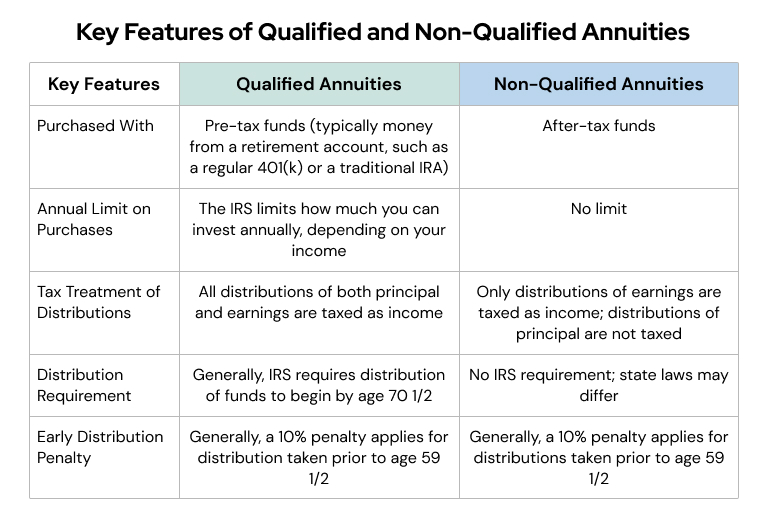

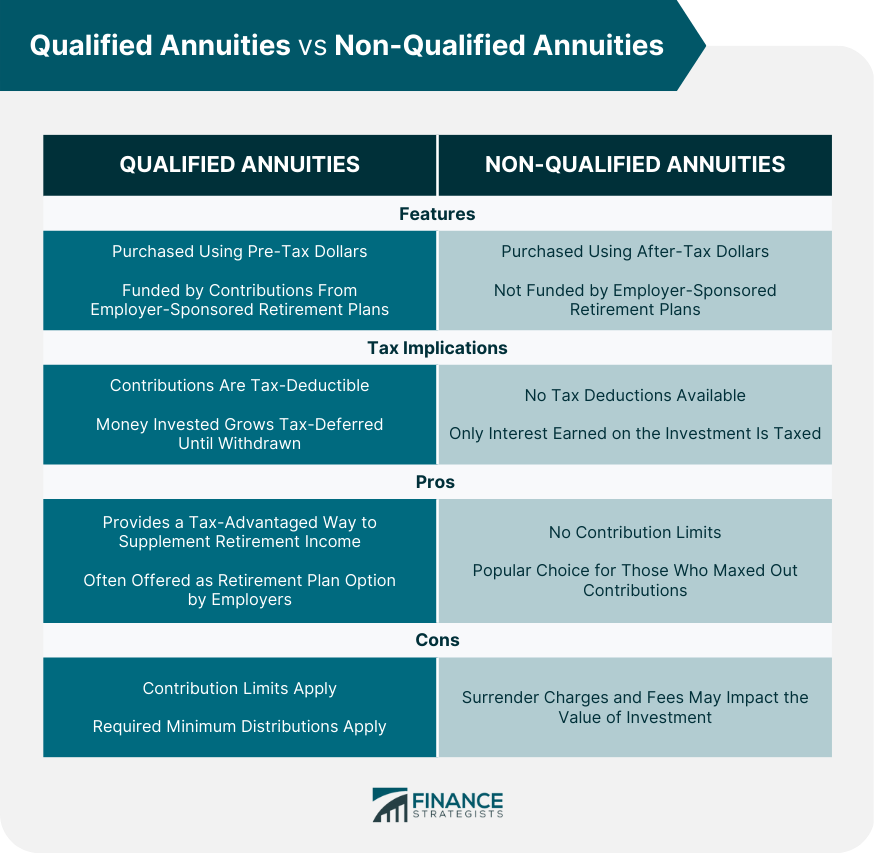

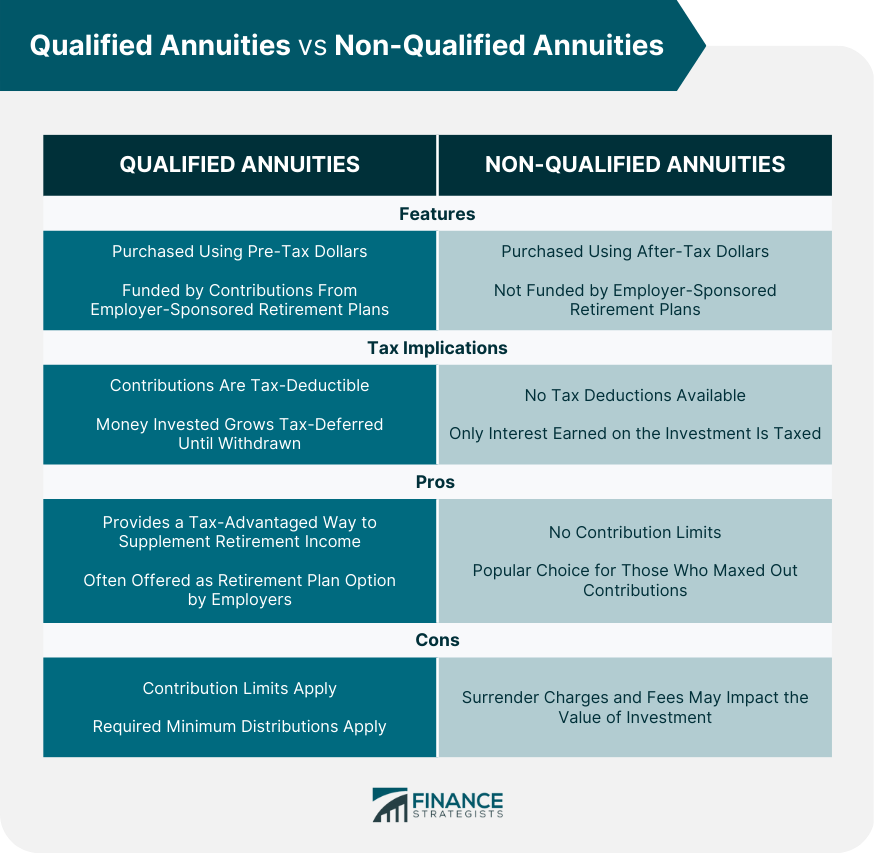

Non qualified means the annuity is not held in an IRA or another type of qualified retirement account It s an underused planning tool but more insurance companies are offering this option now

Taxing Inherited Non Qualified Annuities Someone who inherits a non qualified annuity will have to pay taxes on withdrawals of the earnings but not the principal just like the original owner would This

Non Qualified Annuity Taxation At Death provide a diverse assortment of printable materials that are accessible online for free cost. The resources are offered in a variety forms, including worksheets, templates, coloring pages, and many more. The great thing about Non Qualified Annuity Taxation At Death is their flexibility and accessibility.

More of Non Qualified Annuity Taxation At Death

Qualified Vs Non Qualified Annuities Taxes Distribution

Qualified Vs Non Qualified Annuities Taxes Distribution

What happens to the money in an annuity after the owner dies depends on the type of annuity and its specific provisions Some annuities stop payments when the

Non qualified variable annuities are tax deferred investment vehicles with a unique tax structure These investments grow without incurring taxes until the time funds are taken

Print-friendly freebies have gained tremendous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

customization We can customize printables to your specific needs, whether it's designing invitations, organizing your schedule, or even decorating your house.

-

Educational value: Downloads of educational content for free offer a wide range of educational content for learners from all ages, making these printables a powerful source for educators and parents.

-

Affordability: immediate access a myriad of designs as well as templates saves time and effort.

Where to Find more Non Qualified Annuity Taxation At Death

Non Qualified Annuities Everything You Need To Know Safe Wealth Plan

Non Qualified Annuities Everything You Need To Know Safe Wealth Plan

Key Takeaways The original annuity contract holder must include a death benefit provision and name a beneficiary There are different tax consequences for

The rules are that annuity death benefits must be distributed at the death of the owner If you are a surviving spouse you can take ownership of the annuity including any riders and death

Now that we've piqued your curiosity about Non Qualified Annuity Taxation At Death We'll take a look around to see where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Non Qualified Annuity Taxation At Death for various reasons.

- Explore categories such as decorations for the home, education and craft, and organization.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free with flashcards and other teaching tools.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for no cost.

- The blogs are a vast range of topics, including DIY projects to planning a party.

Maximizing Non Qualified Annuity Taxation At Death

Here are some new ways of making the most of Non Qualified Annuity Taxation At Death:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use printable worksheets from the internet for teaching at-home also in the classes.

3. Event Planning

- Make invitations, banners and other decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable planners or to-do lists. meal planners.

Conclusion

Non Qualified Annuity Taxation At Death are a treasure trove of practical and innovative resources which cater to a wide range of needs and interest. Their accessibility and flexibility make them a great addition to the professional and personal lives of both. Explore the many options that is Non Qualified Annuity Taxation At Death today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly absolutely free?

- Yes you can! You can print and download these resources at no cost.

-

Can I use free printables for commercial use?

- It's based on the rules of usage. Always check the creator's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright issues when you download Non Qualified Annuity Taxation At Death?

- Some printables may contain restrictions concerning their use. Always read the conditions and terms of use provided by the designer.

-

How do I print Non Qualified Annuity Taxation At Death?

- Print them at home using any printer or head to the local print shop for top quality prints.

-

What program do I require to open Non Qualified Annuity Taxation At Death?

- The majority of PDF documents are provided as PDF files, which can be opened using free programs like Adobe Reader.

Can I Convert A Qualified Annuity To A Roth Ira Choosing Your Gold IRA

Calculating Annuity Payments For An Annuity YouTube

Check more sample of Non Qualified Annuity Taxation At Death below

What Is A Non Qualified Annuity Due

Question On The Chapter Exemptions From GST Part 1 Exemptions From

Qualified Annuities Vs Non Qualified Annuities What s The Difference

Best Annuity Rates Canvas Annuity

How Non Qualified Annuities Can Reduce Your Client s Tax Bill YouTube

Annuities Vs Mutual Funds The Complete Guide Trust Point

https://smartasset.com/estate-planning/inherit…

Taxing Inherited Non Qualified Annuities Someone who inherits a non qualified annuity will have to pay taxes on withdrawals of the earnings but not the principal just like the original owner would This

https://smartasset.com/financial-advisor/how-t…

In other words you can t exchange a qualified for a nonqualified annuity or vice versa to try and escape taxation The main

Taxing Inherited Non Qualified Annuities Someone who inherits a non qualified annuity will have to pay taxes on withdrawals of the earnings but not the principal just like the original owner would This

In other words you can t exchange a qualified for a nonqualified annuity or vice versa to try and escape taxation The main

Best Annuity Rates Canvas Annuity

Question On The Chapter Exemptions From GST Part 1 Exemptions From

How Non Qualified Annuities Can Reduce Your Client s Tax Bill YouTube

Annuities Vs Mutual Funds The Complete Guide Trust Point

Qualified Non Qualified Annuities What Is The Difference YouTube

Non Qualified Vs Qualified Annuities Differences Pros Cons

Non Qualified Vs Qualified Annuities Differences Pros Cons

How Is A Non Qualified Annuity Taxed YouTube