In the age of digital, when screens dominate our lives The appeal of tangible, printed materials hasn't diminished. In the case of educational materials or creative projects, or just adding the personal touch to your home, printables for free are a great source. We'll take a dive through the vast world of "Nebraska Personal Property Tax Rate," exploring what they are, how to find them, and how they can enhance various aspects of your life.

Get Latest Nebraska Personal Property Tax Rate Below

Nebraska Personal Property Tax Rate

Nebraska Personal Property Tax Rate -

Please refer to the Sarpy County Treasurer for information regarding paying taxes 2023 Tax Rates Sheet 2023 Board Levied Tax Rates 2023 Abstract of Assessment and Tax Rates View Historical Tax Rates Abstract of Assessment and Tax Rates and Board of Levied Tax Rates View various tax rate sheets for Sarpy County

Nebraska net book value is the taxable value for personal property taxation It is the Nebraska adjusted basis of the tangible personal property multiplied by the appropriate depreciation factor based on the year placed in service and the recovery period

Nebraska Personal Property Tax Rate encompass a wide assortment of printable materials that are accessible online for free cost. They come in many designs, including worksheets templates, coloring pages and more. The appeal of printables for free is in their versatility and accessibility.

More of Nebraska Personal Property Tax Rate

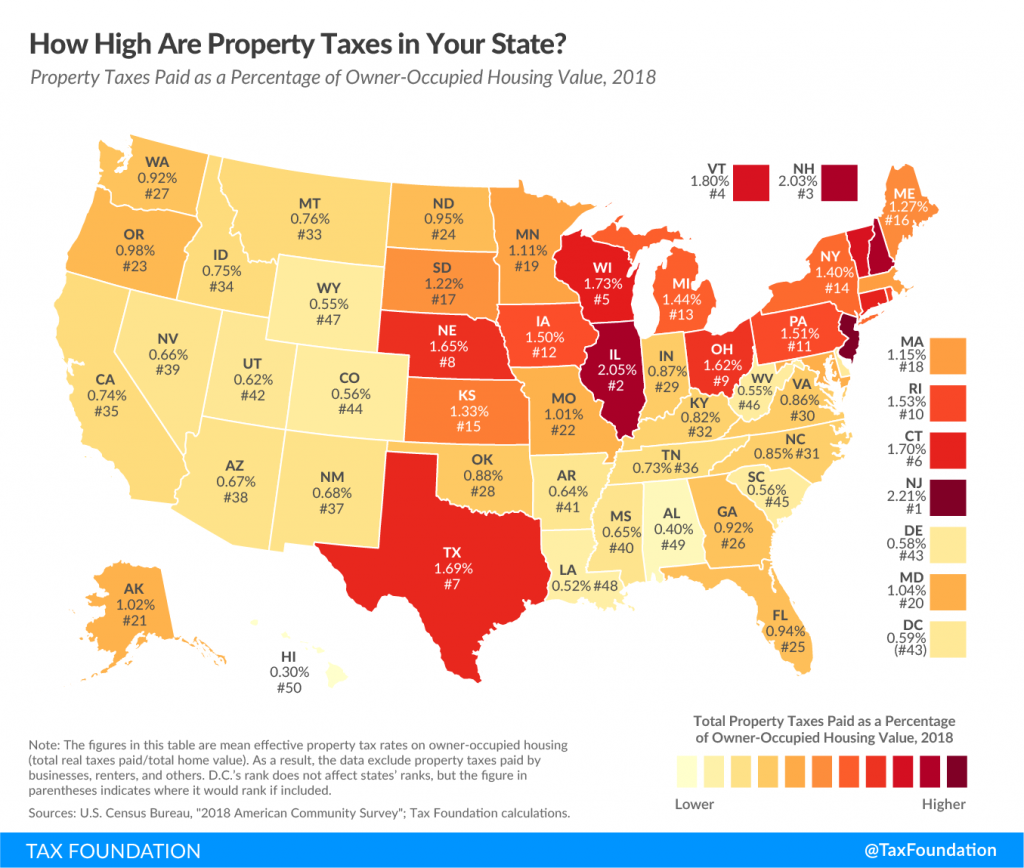

How High Are Property Taxes In Your State American Property Owners

How High Are Property Taxes In Your State American Property Owners

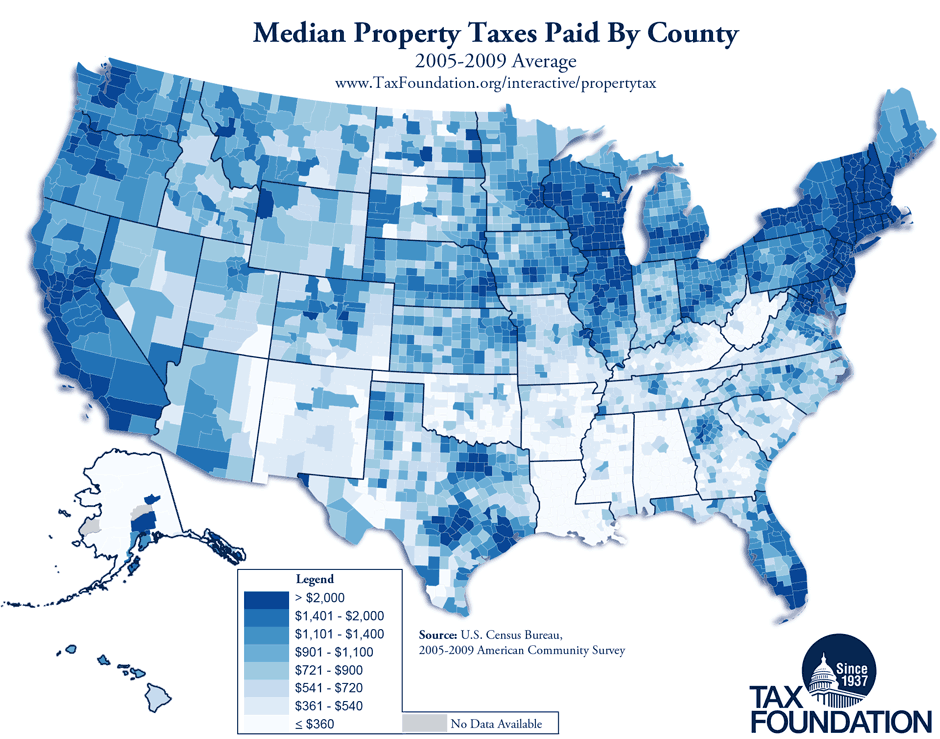

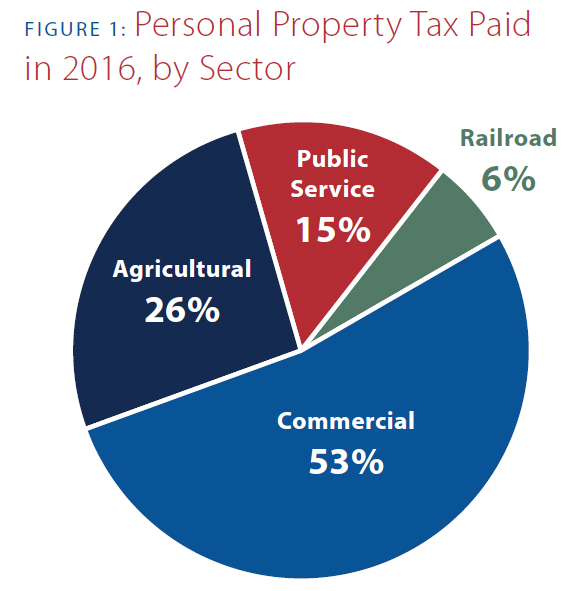

An In Depth Look at Nebraska s Personal Property Tax The personal property tax in Nebraska makes up 5 6 percent or 217 1 million of the total property taxes collected statewide Rural Nebraskans pay the most on a per person basis at 211 87

Nebraska Personal Property Get Started Learn more Processing

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

Customization: The Customization feature lets you tailor printables to your specific needs for invitations, whether that's creating them or arranging your schedule or even decorating your house.

-

Educational Value: Downloads of educational content for free can be used by students of all ages, which makes them a useful tool for teachers and parents.

-

It's easy: Access to an array of designs and templates is time-saving and saves effort.

Where to Find more Nebraska Personal Property Tax Rate

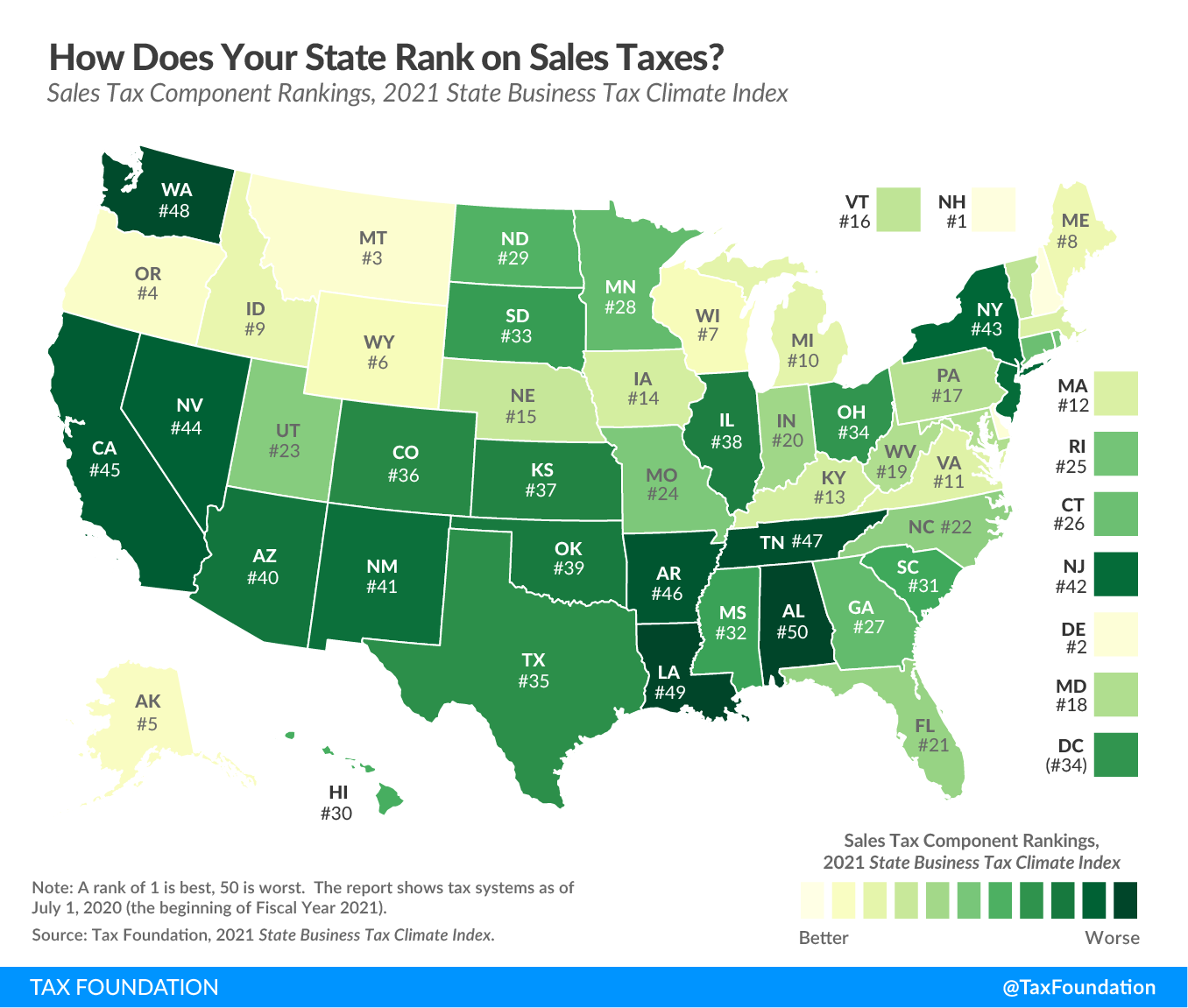

A List Of The 10 Worst Property Taxes By States

A List Of The 10 Worst Property Taxes By States

Today property tax is the primary revenue raising tool for political subdivisions and in fiscal year 2018 2019 property tax revenue comprised approximately 37 4 percent of all state and local tax revenue collected in Nebraska Property tax calculation can be summarized by Property tax Assessed Taxable Property x Rate Credits

What is taxable personal property Personal property is defined as tangible depreciable income producing property including machinery equipment furniture and fixtures Who must file a Nebraska personal property return Anyone that owns or holds any taxable tangible personal property on January 1 12 01 a m of each year

We hope we've stimulated your interest in printables for free Let's find out where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of applications.

- Explore categories such as interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- Great for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers post their original designs and templates for no cost.

- The blogs covered cover a wide variety of topics, ranging from DIY projects to party planning.

Maximizing Nebraska Personal Property Tax Rate

Here are some unique ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Print worksheets that are free to aid in learning at your home and in class.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Nebraska Personal Property Tax Rate are a treasure trove of practical and imaginative resources catering to different needs and preferences. Their access and versatility makes them a wonderful addition to both personal and professional life. Explore the many options of Nebraska Personal Property Tax Rate today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually available for download?

- Yes they are! You can print and download these tools for free.

-

Are there any free templates for commercial use?

- It's determined by the specific terms of use. Always review the terms of use for the creator prior to using the printables in commercial projects.

-

Do you have any copyright rights issues with Nebraska Personal Property Tax Rate?

- Some printables may have restrictions on their use. Be sure to check the terms and condition of use as provided by the creator.

-

How can I print Nebraska Personal Property Tax Rate?

- You can print them at home with an printer, or go to the local print shop for better quality prints.

-

What software must I use to open printables free of charge?

- Most PDF-based printables are available in the format of PDF, which can be opened using free programs like Adobe Reader.

Property Tax Map Gadgets 2018

This Time It s Personal Nebraska s Personal Property Tax

Check more sample of Nebraska Personal Property Tax Rate below

Nebraska Inheritance Tax Worksheets

How Do Pa s Property Taxes Stack Up Nationally This Map Will Tell You

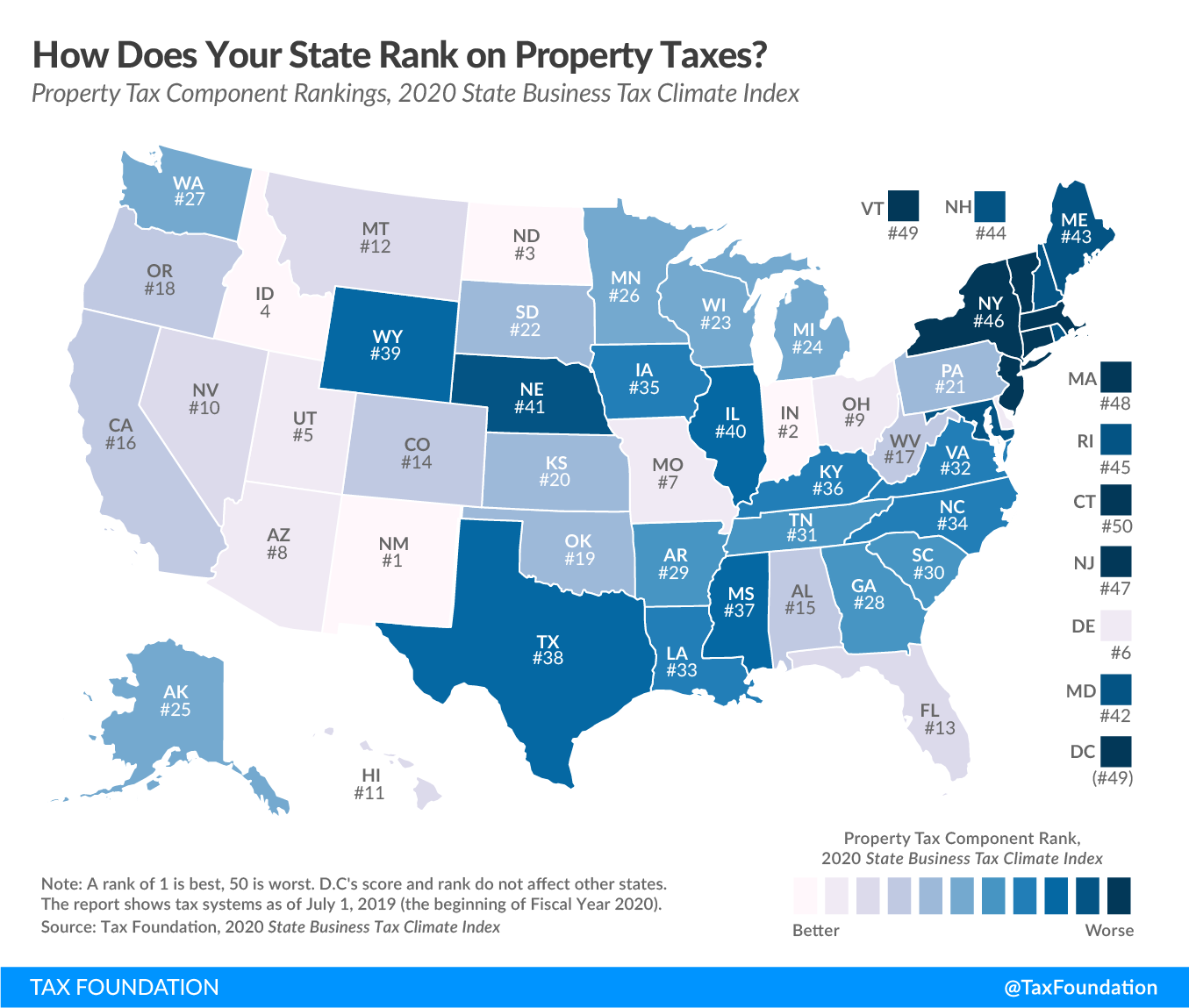

Ranking Property Taxes On The 2020 State Business Tax Climate Index

Best Worst State Property Tax Codes Tax Foundation

To What Extent Does Your State Rely On Property Taxes Hawaii Free Press

Nebraska Personal Property Vanguard Appraisals Inc

https://revenue.nebraska.gov/sites/revenue...

Nebraska net book value is the taxable value for personal property taxation It is the Nebraska adjusted basis of the tangible personal property multiplied by the appropriate depreciation factor based on the year placed in service and the recovery period

https://smartasset.com/taxes/nebraska-property-tax-calculator

At 1 51 Nebraska has the eighth highest average effective property tax rate in the U S The typical homeowner in Nebraska can expect to pay 3 091 annually towards their property tax bill Not in Nebraska Enter your financial details to calculate your taxes Enter Your Location Assessed Home Value Dismiss Average County Tax Rate0 0

Nebraska net book value is the taxable value for personal property taxation It is the Nebraska adjusted basis of the tangible personal property multiplied by the appropriate depreciation factor based on the year placed in service and the recovery period

At 1 51 Nebraska has the eighth highest average effective property tax rate in the U S The typical homeowner in Nebraska can expect to pay 3 091 annually towards their property tax bill Not in Nebraska Enter your financial details to calculate your taxes Enter Your Location Assessed Home Value Dismiss Average County Tax Rate0 0

Best Worst State Property Tax Codes Tax Foundation

How Do Pa s Property Taxes Stack Up Nationally This Map Will Tell You

To What Extent Does Your State Rely On Property Taxes Hawaii Free Press

Nebraska Personal Property Vanguard Appraisals Inc

KRVN 880 KRVN 93 1 KAMI Board Of Directors

Nebraska Personal Representative Bond A Comprehensive Guide

Nebraska Personal Representative Bond A Comprehensive Guide

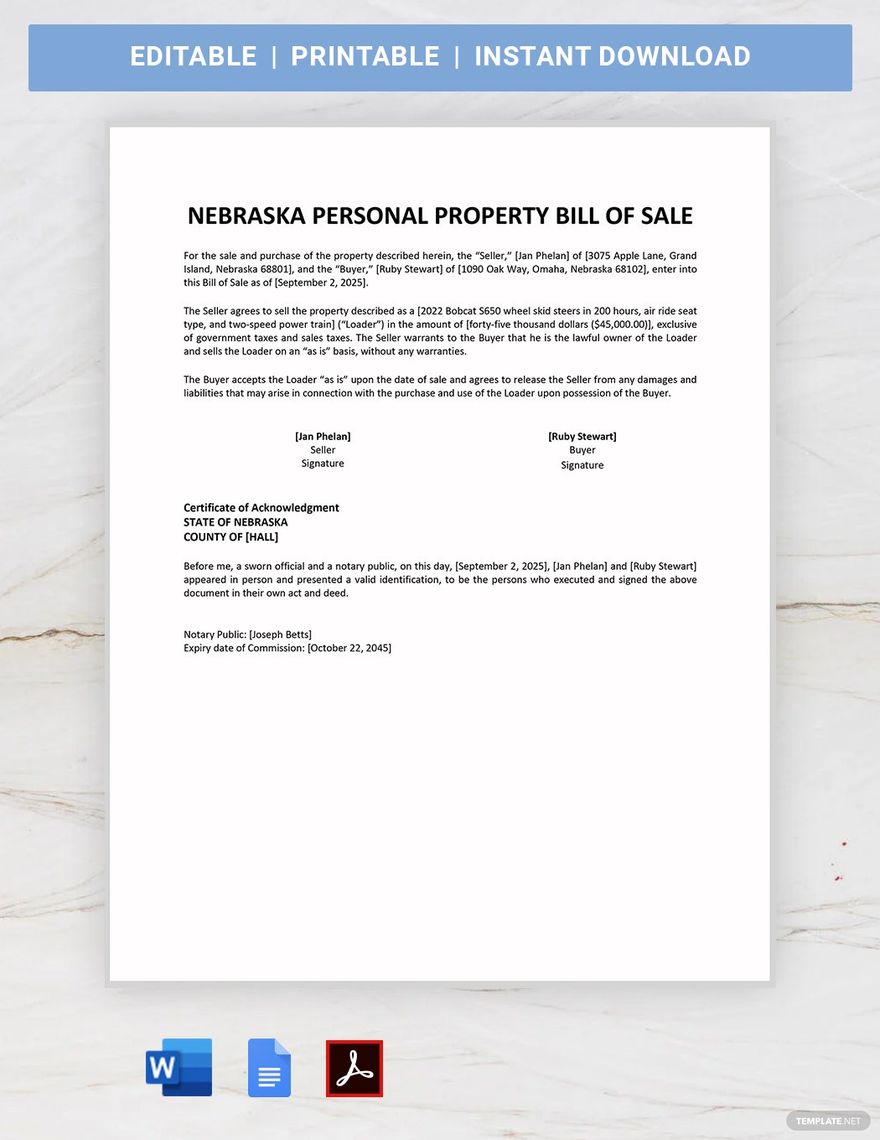

Nebraska Personal Property Bill Of Sale Template Download In Word