In a world when screens dominate our lives, the charm of tangible, printed materials hasn't diminished. Whether it's for educational purposes as well as creative projects or just adding a personal touch to your area, Michigan Transfer Tax Rebate are now a useful source. In this article, we'll take a dive deep into the realm of "Michigan Transfer Tax Rebate," exploring what they are, where they can be found, and how they can enhance various aspects of your lives.

Get Latest Michigan Transfer Tax Rebate Below

Michigan Transfer Tax Rebate

Michigan Transfer Tax Rebate - Michigan Transfer Tax Refund, Michigan Transfer Tax Refund Form, Mi Transfer Tax Refund, State Of Michigan Transfer Tax Refund, Who Pays Transfer Tax In Michigan, What Is Transfer Tax In Michigan

Web 23 f 233 vr 2023 nbsp 0183 32 The state transfer tax rate in Michigan is 3 75 for every 500 of property value or 0 75 of the transferred property s value In addition to the state tax each individual county levies an additional transfer tax of 0 55 per 500

Web 20 avr 2022 nbsp 0183 32 The state transfer tax rate is 3 75 for every 500 of value transferred For instance the SRETT on a house that sold for 300 000 would be 2 250 Each Michigan county may also assess a separate county transfer tax which is

Michigan Transfer Tax Rebate cover a large assortment of printable, downloadable material that is available online at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages and more. The appealingness of Michigan Transfer Tax Rebate is their flexibility and accessibility.

More of Michigan Transfer Tax Rebate

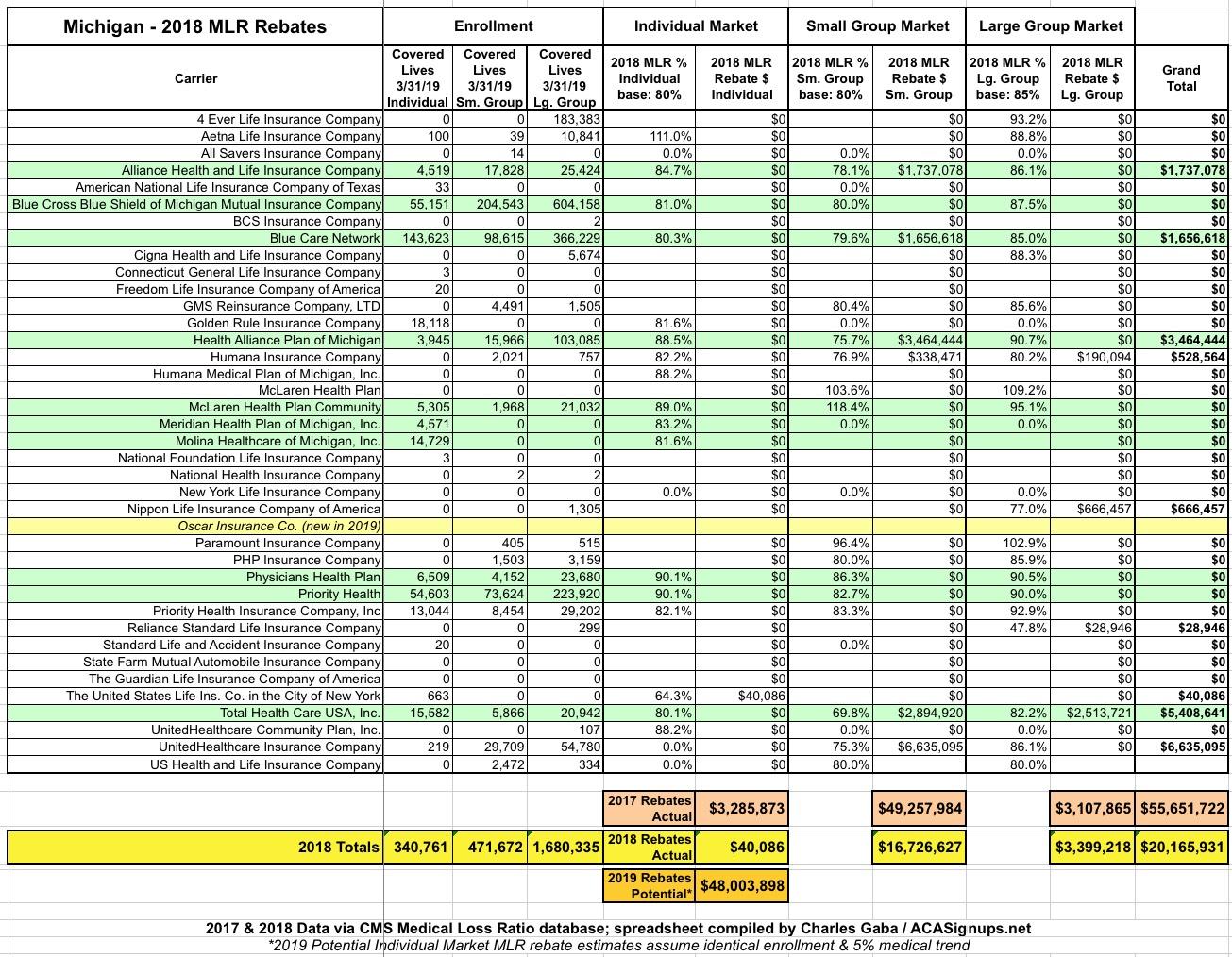

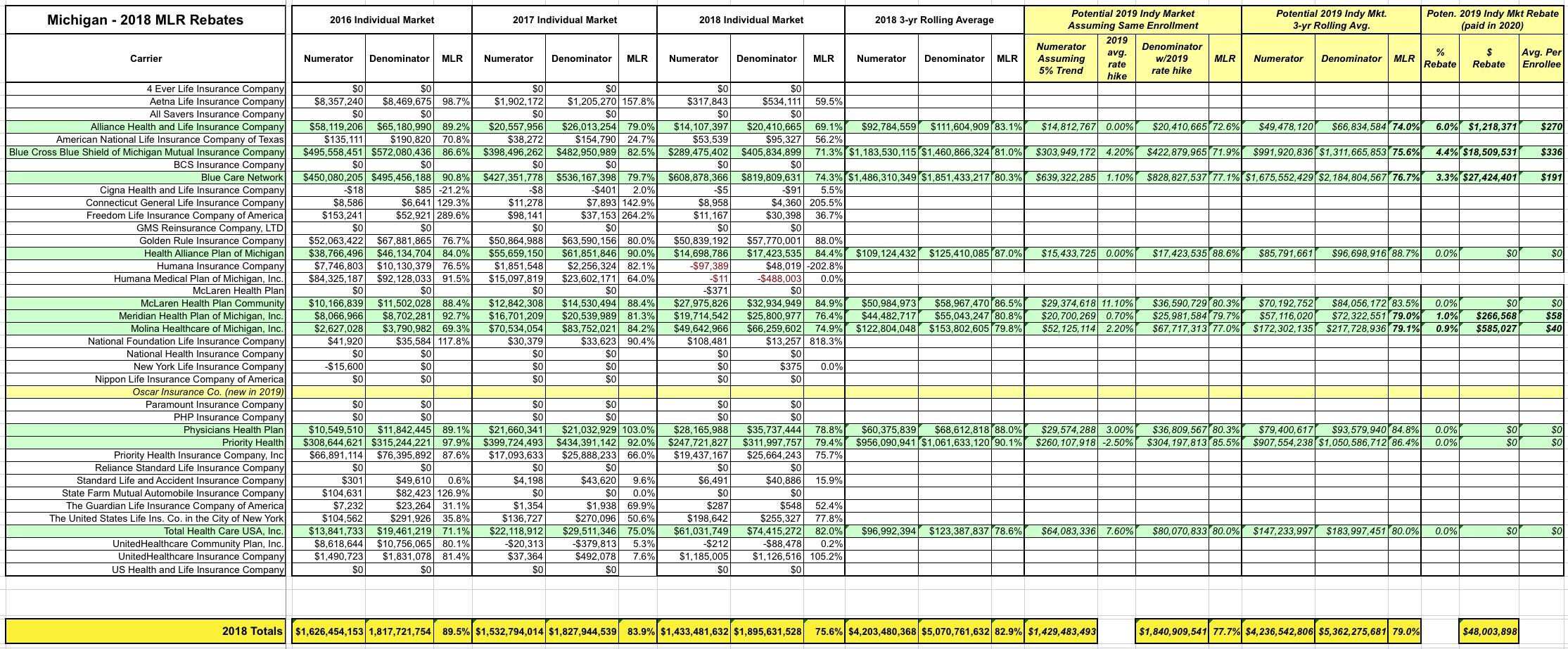

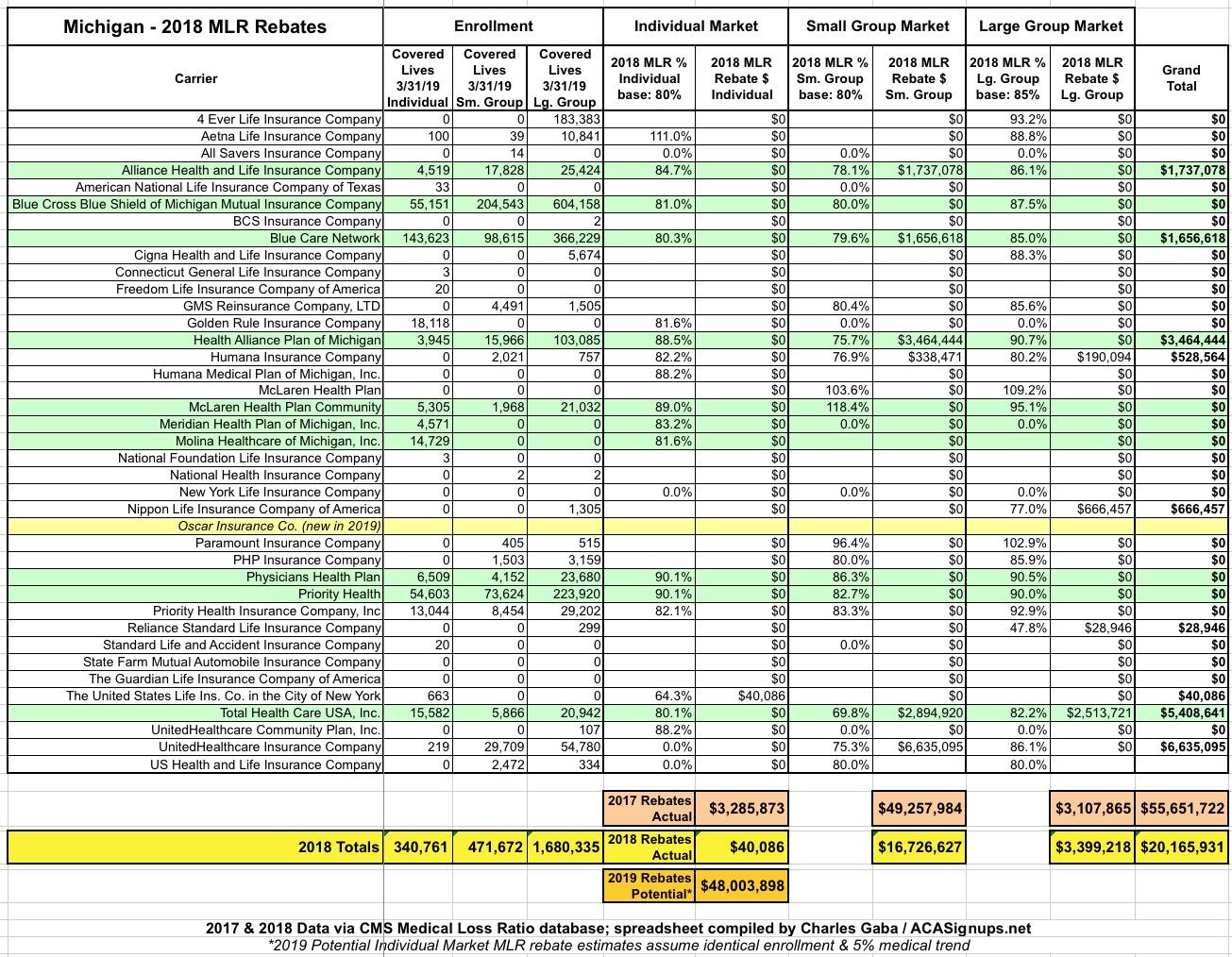

Exclusive Michigan 2018 MLR Rebate Payments Potential 2019 Rebates

Exclusive Michigan 2018 MLR Rebate Payments Potential 2019 Rebates

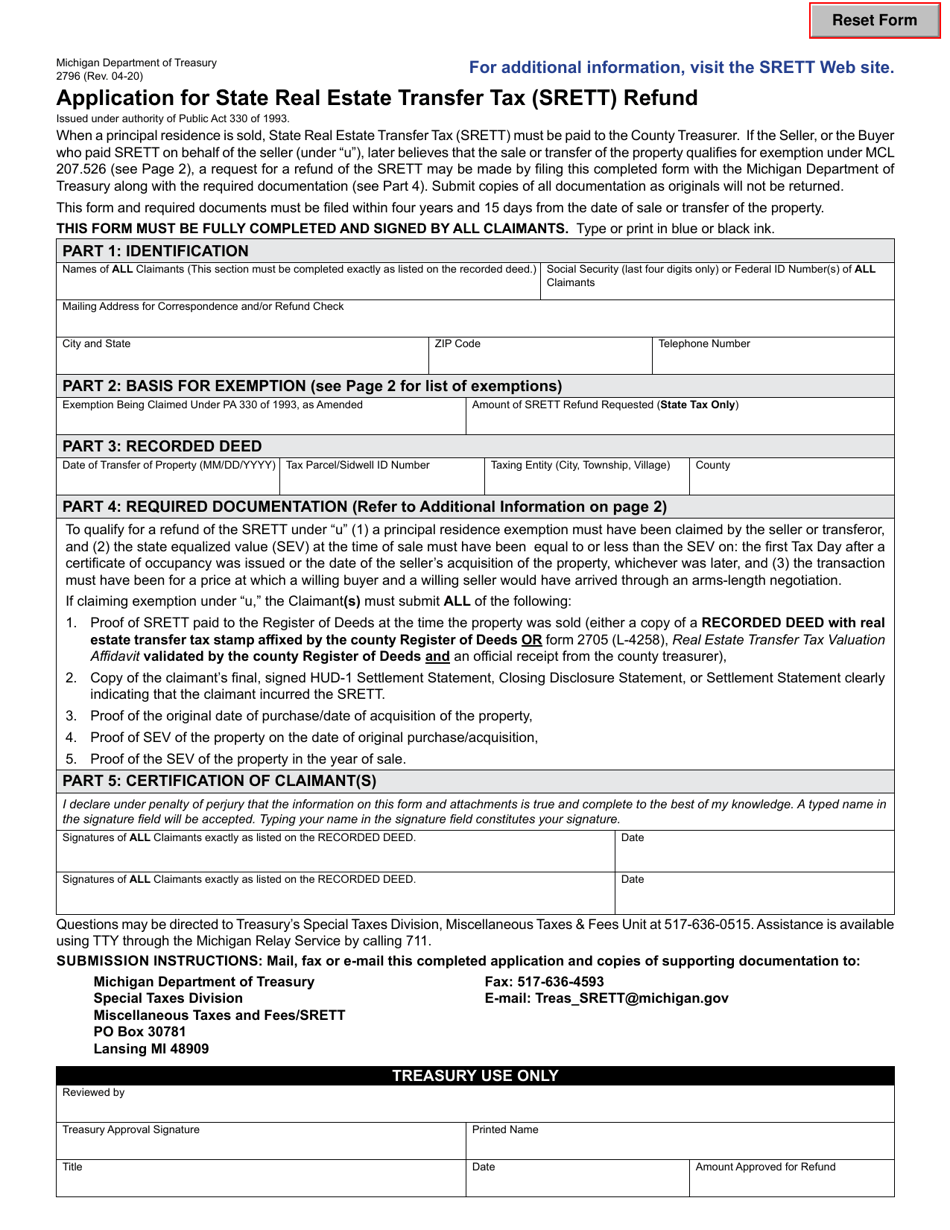

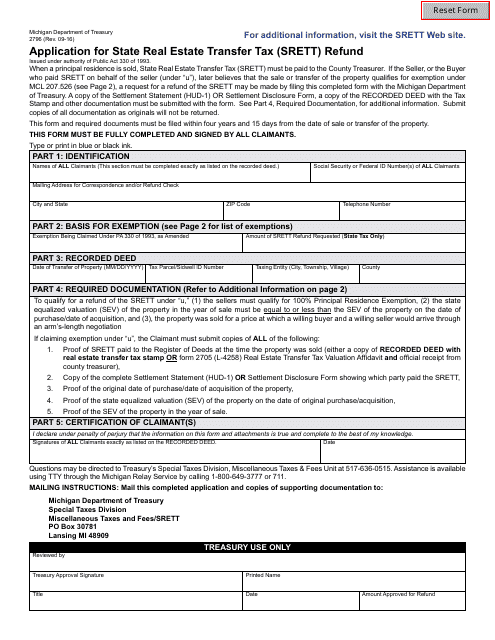

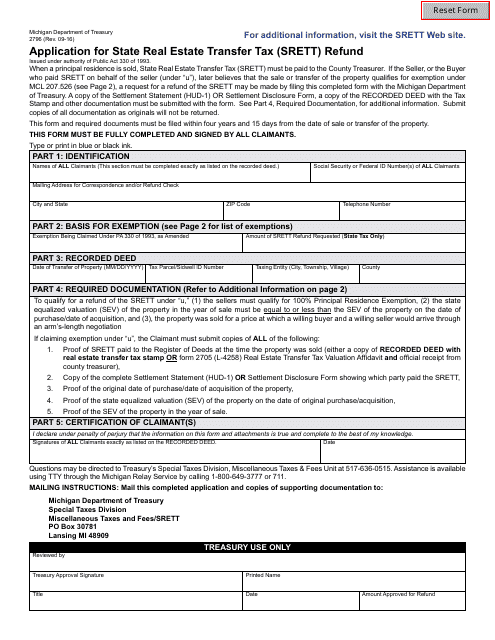

Web Michigan Department of Treasury 2796 Rev 01 23 Application for State Real Estate Transfer Tax SRETT Refund Issued under authority of Public Act 330 of 1993 When a

Web The Michigan Department of Treasury website provides a transfer tax refund form for filing the request for refund along with directions as to the required documentation for

The Michigan Transfer Tax Rebate have gained huge appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

customization We can customize printables to fit your particular needs, whether it's designing invitations planning your schedule or even decorating your house.

-

Educational Worth: Printables for education that are free are designed to appeal to students from all ages, making them a valuable tool for parents and educators.

-

Convenience: Access to a myriad of designs as well as templates helps save time and effort.

Where to Find more Michigan Transfer Tax Rebate

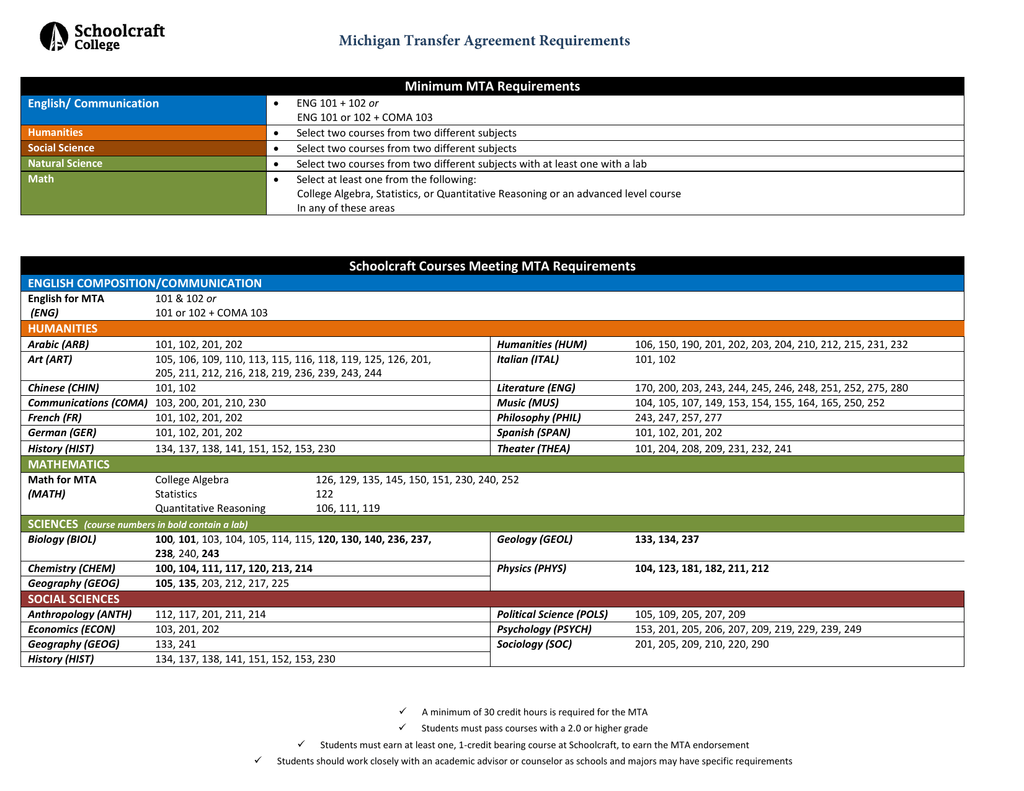

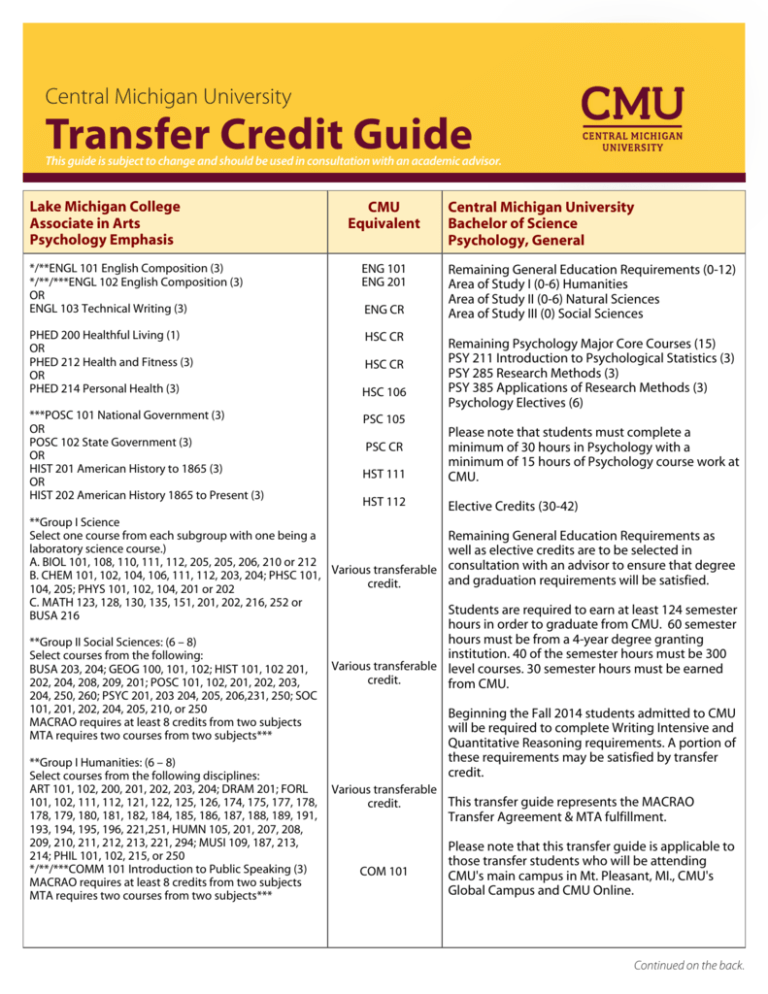

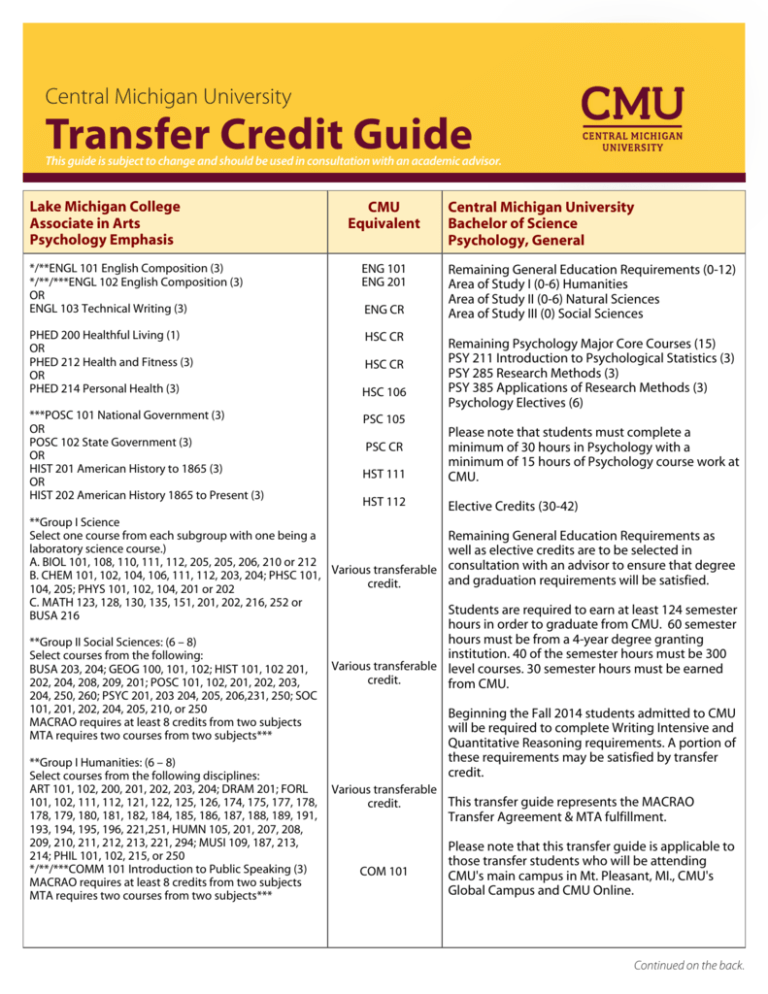

Michigan Transfer Agreement Requirements Minimum MTA Requirements

Michigan Transfer Agreement Requirements Minimum MTA Requirements

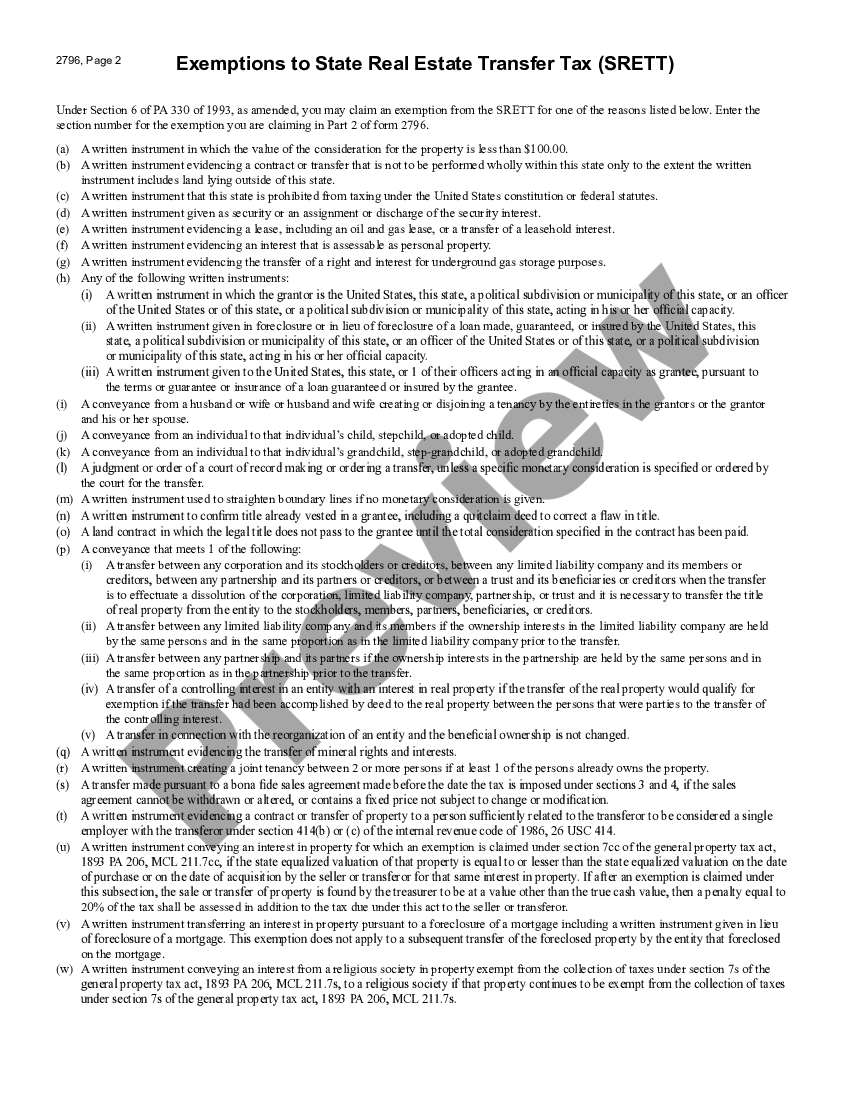

Web Only for the State of Michigan portion of the transfer tax may be exempted The tax is 3 75 for each 500 00 or fraction of 500 00 of the total value of the interests in real

Web 20 avr 2016 nbsp 0183 32 Previously a Michigan homeowner would be exempt from paying the state transfer tax if they met the following requirements 1 The property qualifies for a 100 Principal Residence Exemption

Now that we've ignited your interest in printables for free, let's explore where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Michigan Transfer Tax Rebate designed for a variety goals.

- Explore categories such as home decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- Ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for free.

- These blogs cover a broad variety of topics, that includes DIY projects to party planning.

Maximizing Michigan Transfer Tax Rebate

Here are some creative ways of making the most use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or festive decorations to decorate your living areas.

2. Education

- Print free worksheets for reinforcement of learning at home for the classroom.

3. Event Planning

- Design invitations and banners and decorations for special events such as weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Michigan Transfer Tax Rebate are an abundance of practical and imaginative resources designed to meet a range of needs and preferences. Their accessibility and versatility make them an invaluable addition to both professional and personal lives. Explore the vast world of Michigan Transfer Tax Rebate right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can download and print these items for free.

-

Do I have the right to use free printables for commercial use?

- It's dependent on the particular usage guidelines. Always consult the author's guidelines prior to printing printables for commercial projects.

-

Are there any copyright violations with Michigan Transfer Tax Rebate?

- Certain printables could be restricted on use. Be sure to check the terms and conditions set forth by the author.

-

How do I print Michigan Transfer Tax Rebate?

- Print them at home with either a printer or go to the local print shops for more high-quality prints.

-

What software must I use to open printables for free?

- The majority of PDF documents are provided in PDF format. These is open with no cost software like Adobe Reader.

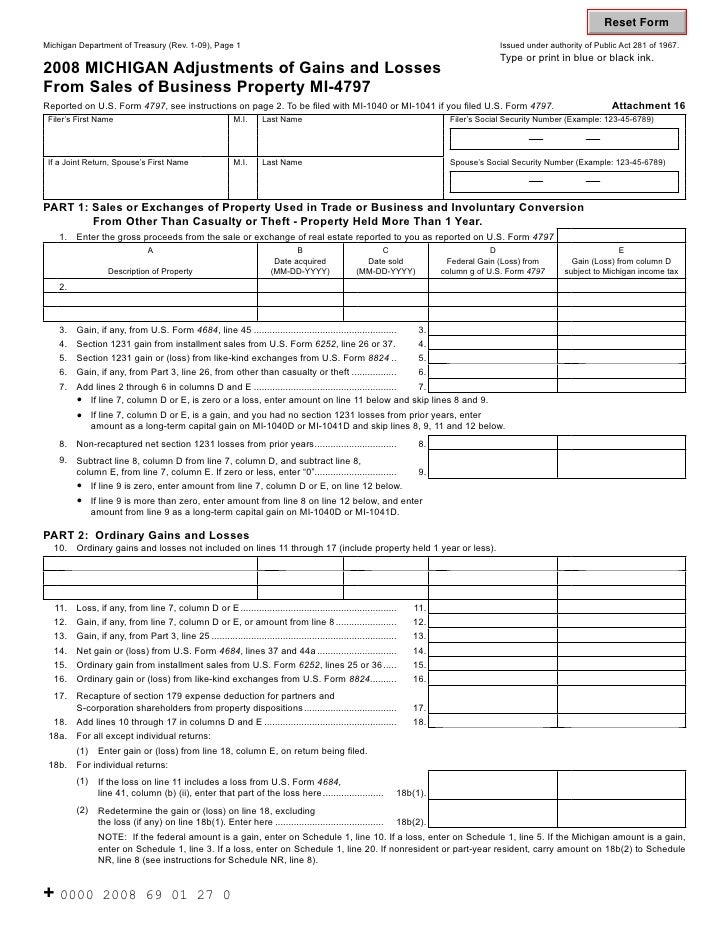

MI 4797 261956 7 Michigan gov Documents Taxes

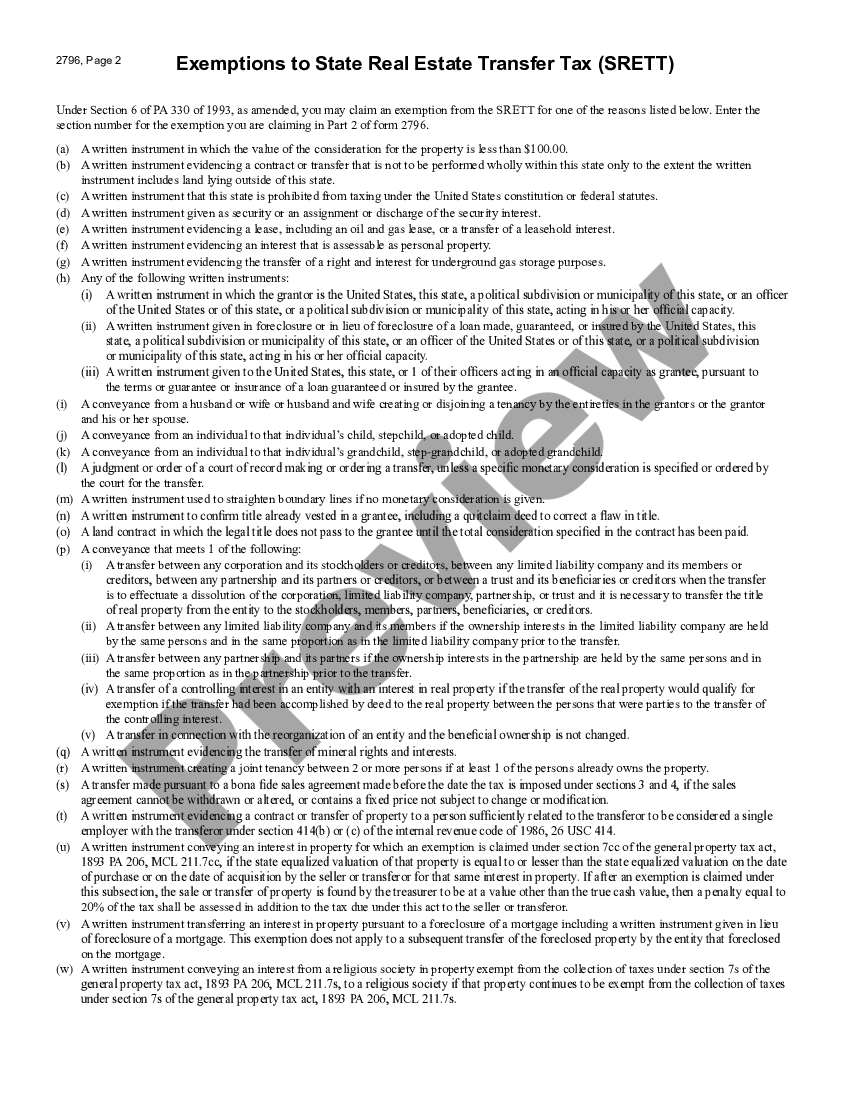

Form 2796 Download Fillable PDF Or Fill Online Application For State

Check more sample of Michigan Transfer Tax Rebate below

Exclusive Michigan 2018 MLR Rebate Payments Potential 2019 Rebates

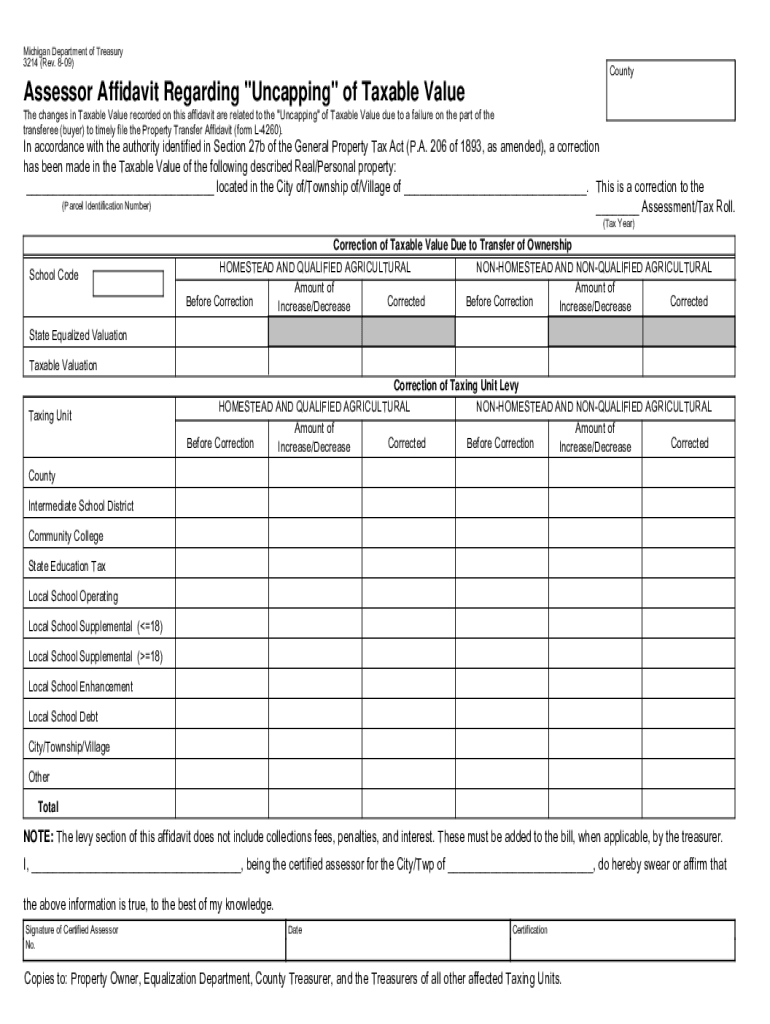

Download Michigan Property Transfer Affidavit For Free FormTemplate

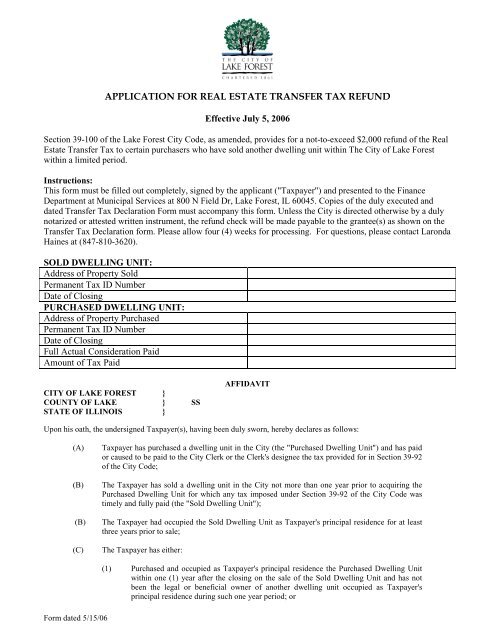

Real Estate Transfer Tax Rebate Form City Of Lake Forest

Michigan Application For Real Estate Transfer Tax Refund Michigan

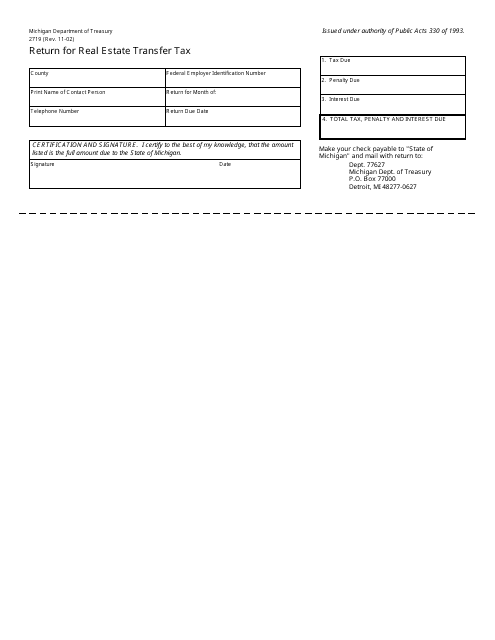

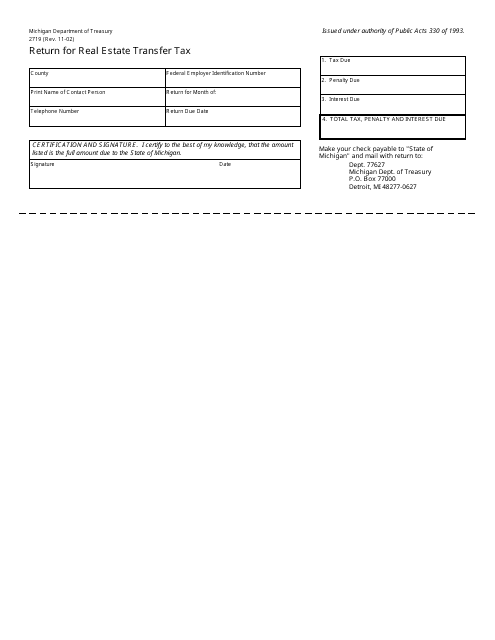

Form 2719 Download Printable PDF Or Fill Online Return For Real Estate

Form 2796 Download Fillable PDF Application For State Real Estate

https://www.formyplan.com/estate-planning/estate-planning-basics/2022/...

Web 20 avr 2022 nbsp 0183 32 The state transfer tax rate is 3 75 for every 500 of value transferred For instance the SRETT on a house that sold for 300 000 would be 2 250 Each Michigan county may also assess a separate county transfer tax which is

https://www.mirealtors.com/Portals/0/Documents/StateRealE…

Web was paid the party who paid the tax almost always the seller can obtain a refund for a sale on or after June 24 2011 The exemption matters at 0 75 state transfer tax on

Web 20 avr 2022 nbsp 0183 32 The state transfer tax rate is 3 75 for every 500 of value transferred For instance the SRETT on a house that sold for 300 000 would be 2 250 Each Michigan county may also assess a separate county transfer tax which is

Web was paid the party who paid the tax almost always the seller can obtain a refund for a sale on or after June 24 2011 The exemption matters at 0 75 state transfer tax on

Michigan Application For Real Estate Transfer Tax Refund Michigan

Download Michigan Property Transfer Affidavit For Free FormTemplate

Form 2719 Download Printable PDF Or Fill Online Return For Real Estate

Form 2796 Download Fillable PDF Application For State Real Estate

2017 2023 Form MI Transfer Of Ownership GuidelinesFill Online

Transfer Credit Guide Central Michigan University

Transfer Credit Guide Central Michigan University

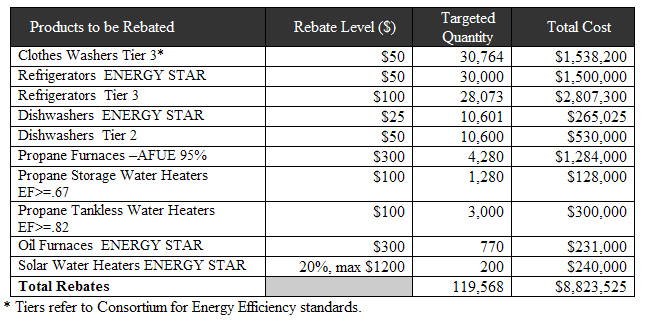

Michigan Appliance Rebate Program GreeningDetroit