In the digital age, where screens dominate our lives and the appeal of physical printed materials hasn't faded away. Whether it's for educational purposes as well as creative projects or just adding an individual touch to the area, Medical Bills Income Tax Rebate are a great resource. For this piece, we'll dive into the world "Medical Bills Income Tax Rebate," exploring what they are, where to get them, as well as how they can enrich various aspects of your daily life.

Get Latest Medical Bills Income Tax Rebate Below

Medical Bills Income Tax Rebate

Medical Bills Income Tax Rebate - Medical Bills Income Tax Exemption, Medical Bills Income Tax Deductions India, Medical Expense Income Tax Deduction, Medical Bills For Tax Deduction, Medical Expenses Income Tax Return, Medical Bills For Tax Return, Medical Bills In Income Tax Return, Fake Medical Bills For Tax Exemption, Medical Bills Limit For Tax Exemption, Minimum Medical Bills For Tax Deduction

Web If you have spent less than Rs 15 000 then only the incurred expense is tax free E g if your medical expense in a year with supporting bills was Rs 9 000 you will get a tax exemption of Rs 9 000 only out of the

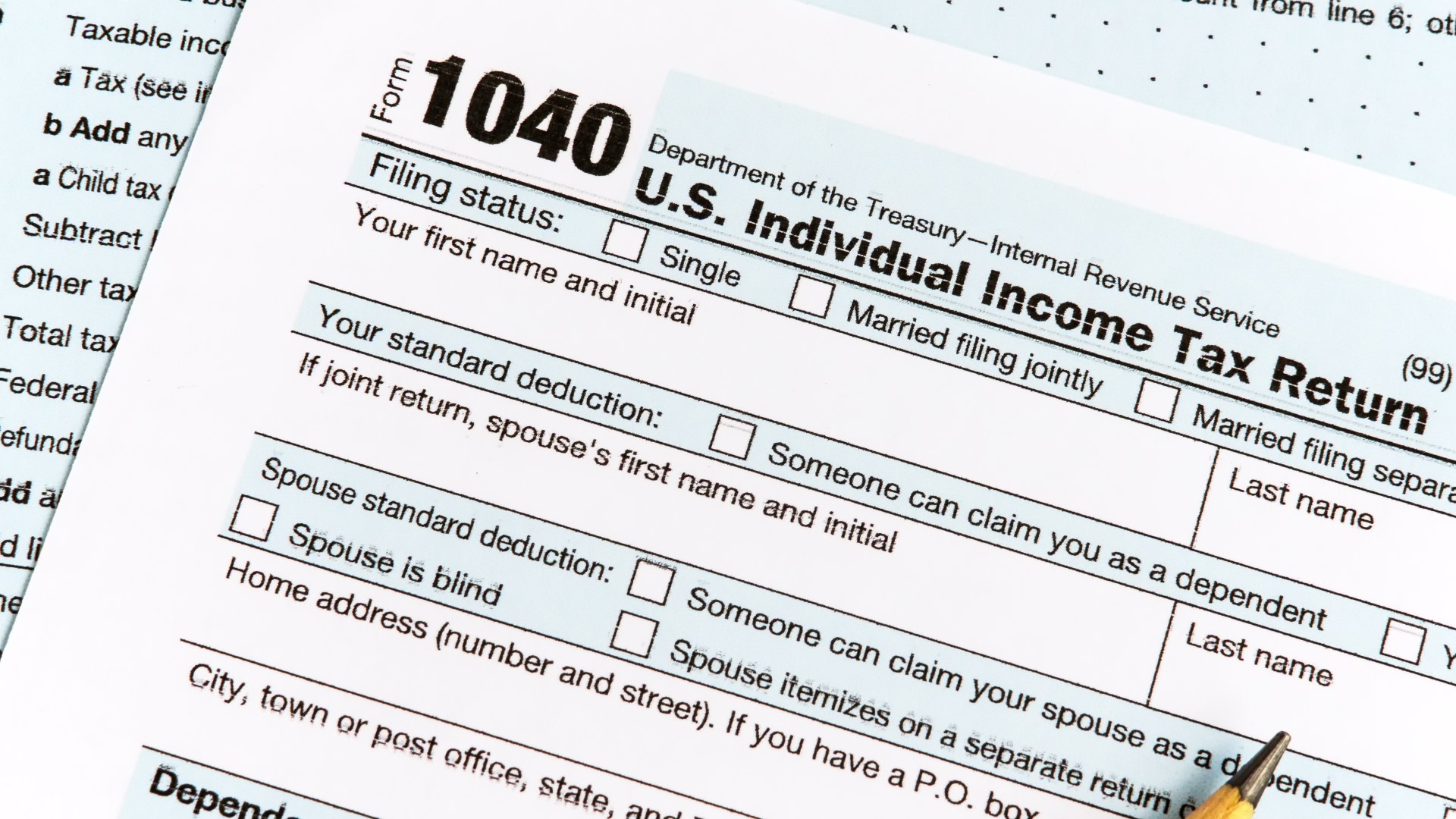

Web 26 sept 2017 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is

Medical Bills Income Tax Rebate encompass a wide range of downloadable, printable content that can be downloaded from the internet at no cost. The resources are offered in a variety formats, such as worksheets, coloring pages, templates and more. The value of Medical Bills Income Tax Rebate lies in their versatility and accessibility.

More of Medical Bills Income Tax Rebate

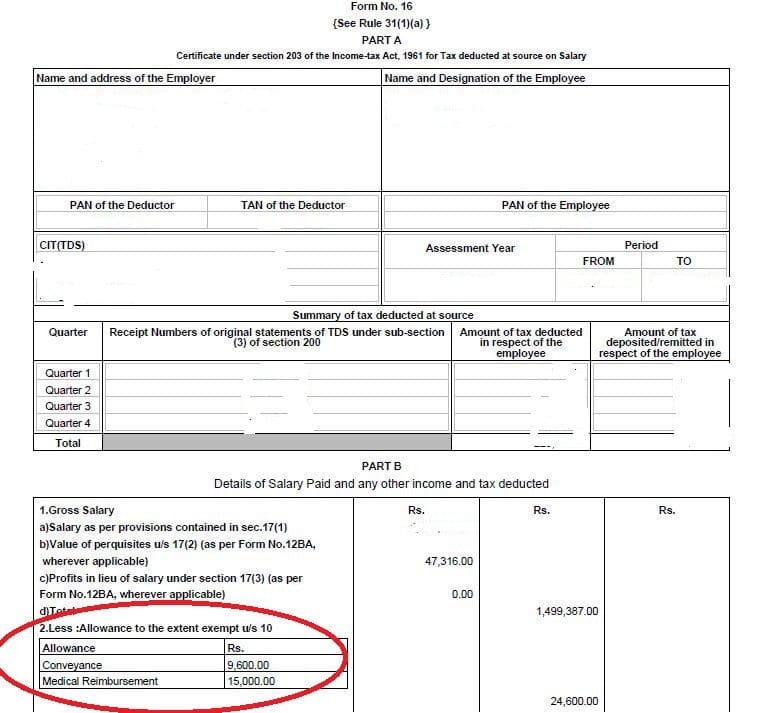

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Web What is Section 80D Every individual or HUF can claim a deduction from their total income for medical insurance premiums paid in any given year under Section 80D This

Web 1 Exemption from regular medical expenses It comes under section 10A of the Income Tax Act 196 The tax exemption limit is of up to Rs 15 000 If your employer provides

Printables for free have gained immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the need to purchase physical copies of the software or expensive hardware.

-

customization: They can make printables to fit your particular needs when it comes to designing invitations to organize your schedule or even decorating your house.

-

Educational Worth: Printables for education that are free are designed to appeal to students of all ages, which makes these printables a powerful aid for parents as well as educators.

-

Convenience: Quick access to a variety of designs and templates will save you time and effort.

Where to Find more Medical Bills Income Tax Rebate

10 Pay Stub Format Sampletemplatess Sampletemplatess C83

10 Pay Stub Format Sampletemplatess Sampletemplatess C83

Web 18 mai 2021 nbsp 0183 32 IR 2021 115 May 18 2021 The Internal Revenue Service today provided guidance on tax breaks under the American Rescue Plan Act of 2021 for continuation

Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If you are making payment of

Since we've got your interest in printables for free Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection with Medical Bills Income Tax Rebate for all goals.

- Explore categories like decorations for the home, education and the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing including flashcards, learning materials.

- This is a great resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates free of charge.

- These blogs cover a wide spectrum of interests, including DIY projects to party planning.

Maximizing Medical Bills Income Tax Rebate

Here are some inventive ways that you can make use of Medical Bills Income Tax Rebate:

1. Home Decor

- Print and frame stunning images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets from the internet to enhance learning at home and in class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Medical Bills Income Tax Rebate are an abundance of creative and practical resources for a variety of needs and interest. Their accessibility and flexibility make them an essential part of each day life. Explore the endless world of Medical Bills Income Tax Rebate and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly gratis?

- Yes you can! You can print and download these tools for free.

-

Does it allow me to use free templates for commercial use?

- It's dependent on the particular rules of usage. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright violations with printables that are free?

- Some printables may have restrictions regarding usage. Be sure to review the terms and condition of use as provided by the author.

-

How can I print Medical Bills Income Tax Rebate?

- You can print them at home with an printer, or go to an area print shop for premium prints.

-

What software will I need to access printables that are free?

- The majority of PDF documents are provided in PDF format. They can be opened with free software, such as Adobe Reader.

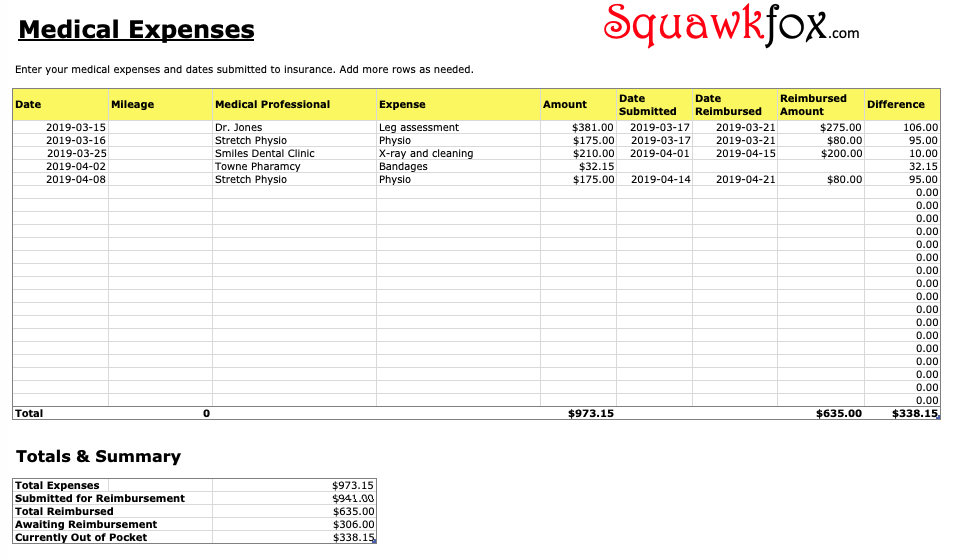

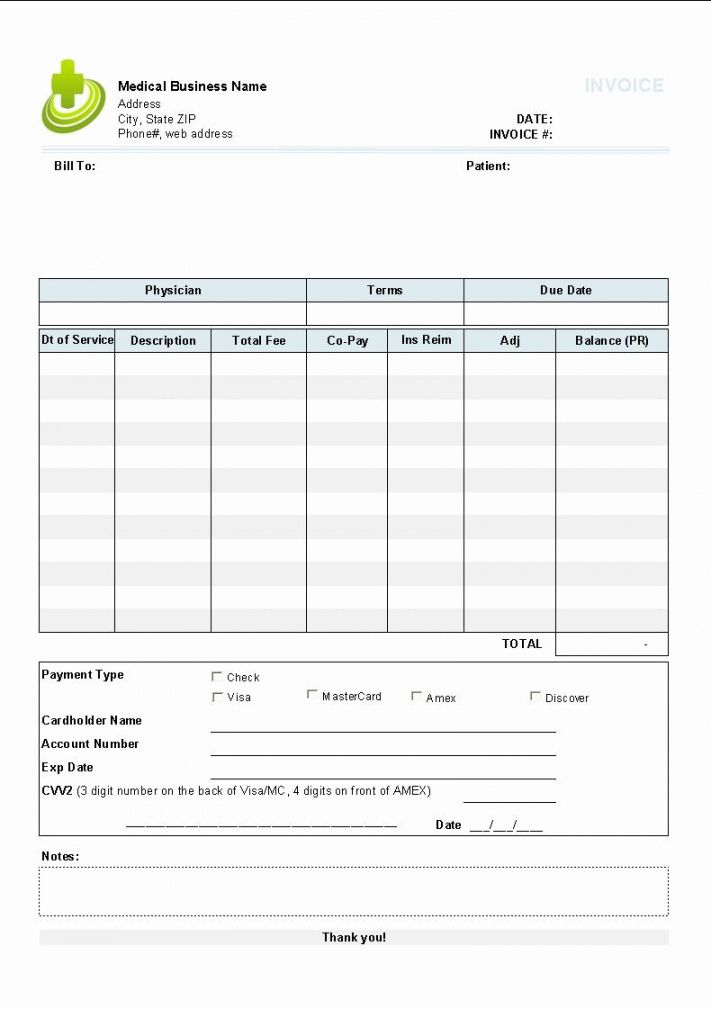

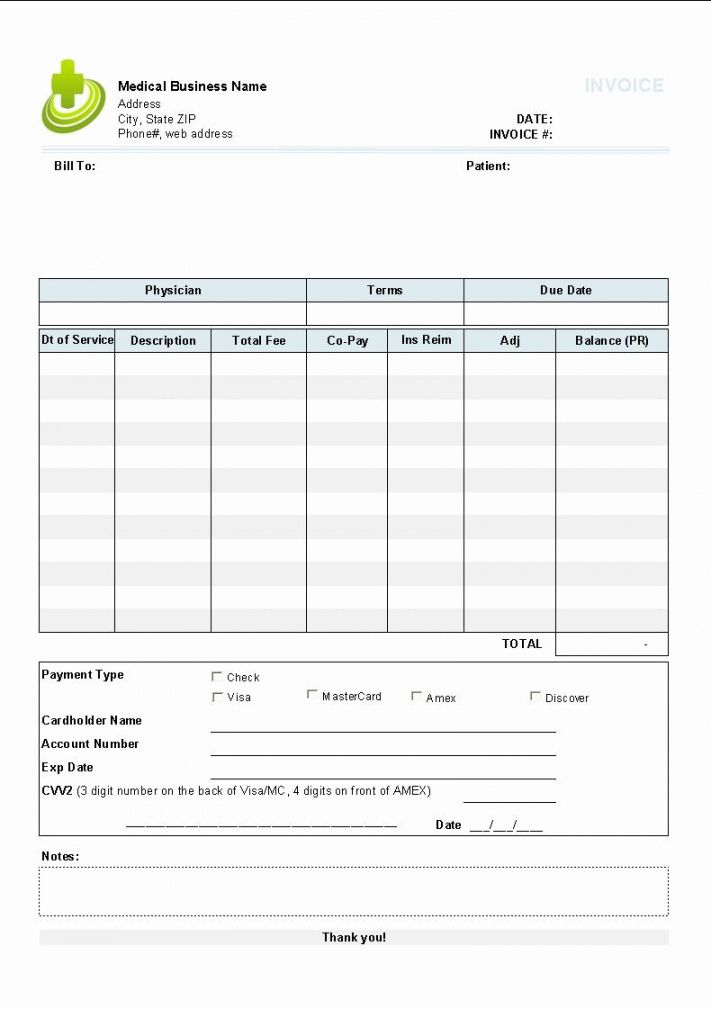

Medical Bill Format In Excel Sample Templates

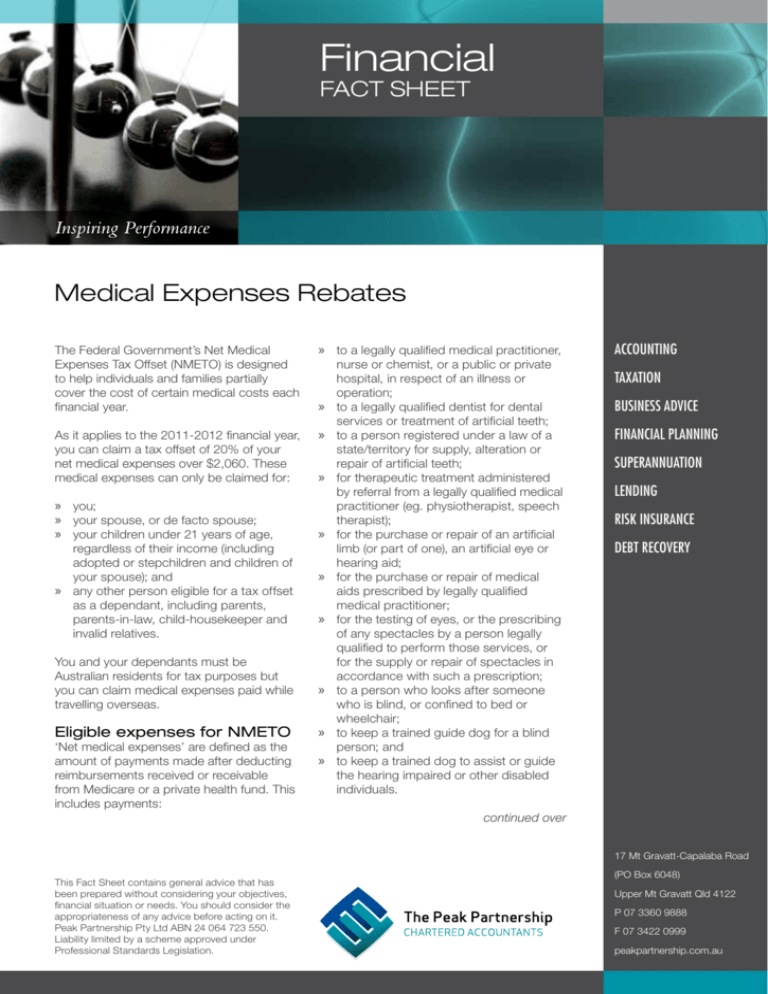

Medical Expenses Rebates

Check more sample of Medical Bills Income Tax Rebate below

Section 80d Preventive Health Check Up Tax Deduction The Gray Tower

Medical Insurance Receipt Format INSURANCE DAY

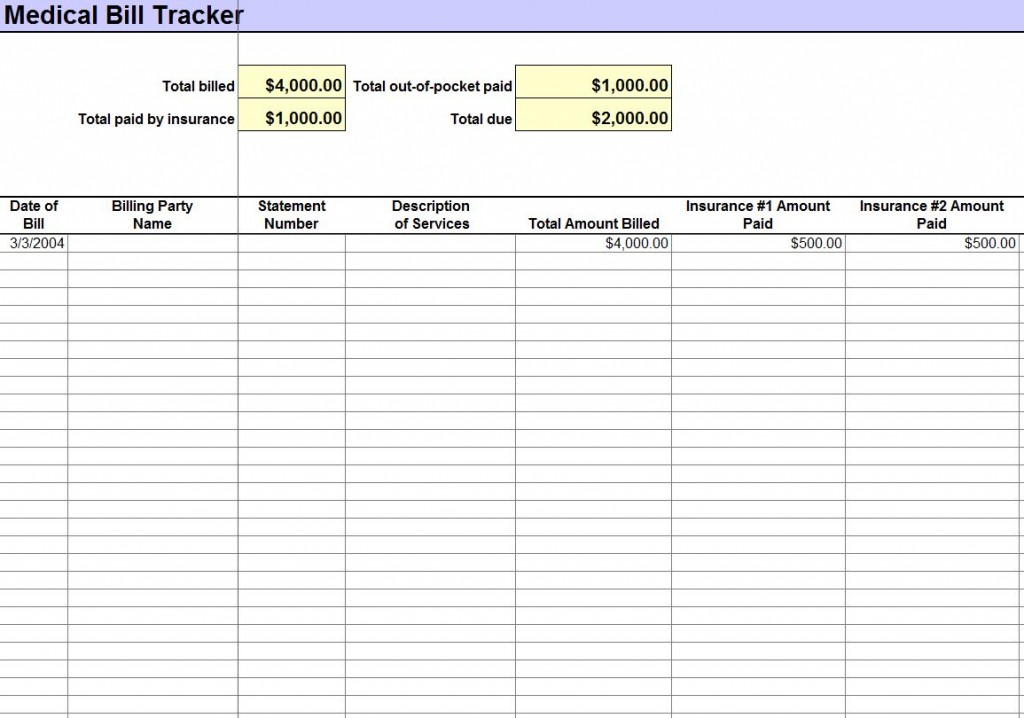

Hospital Patient Medical Bill Tracker Template Word Excel Templates

![]()

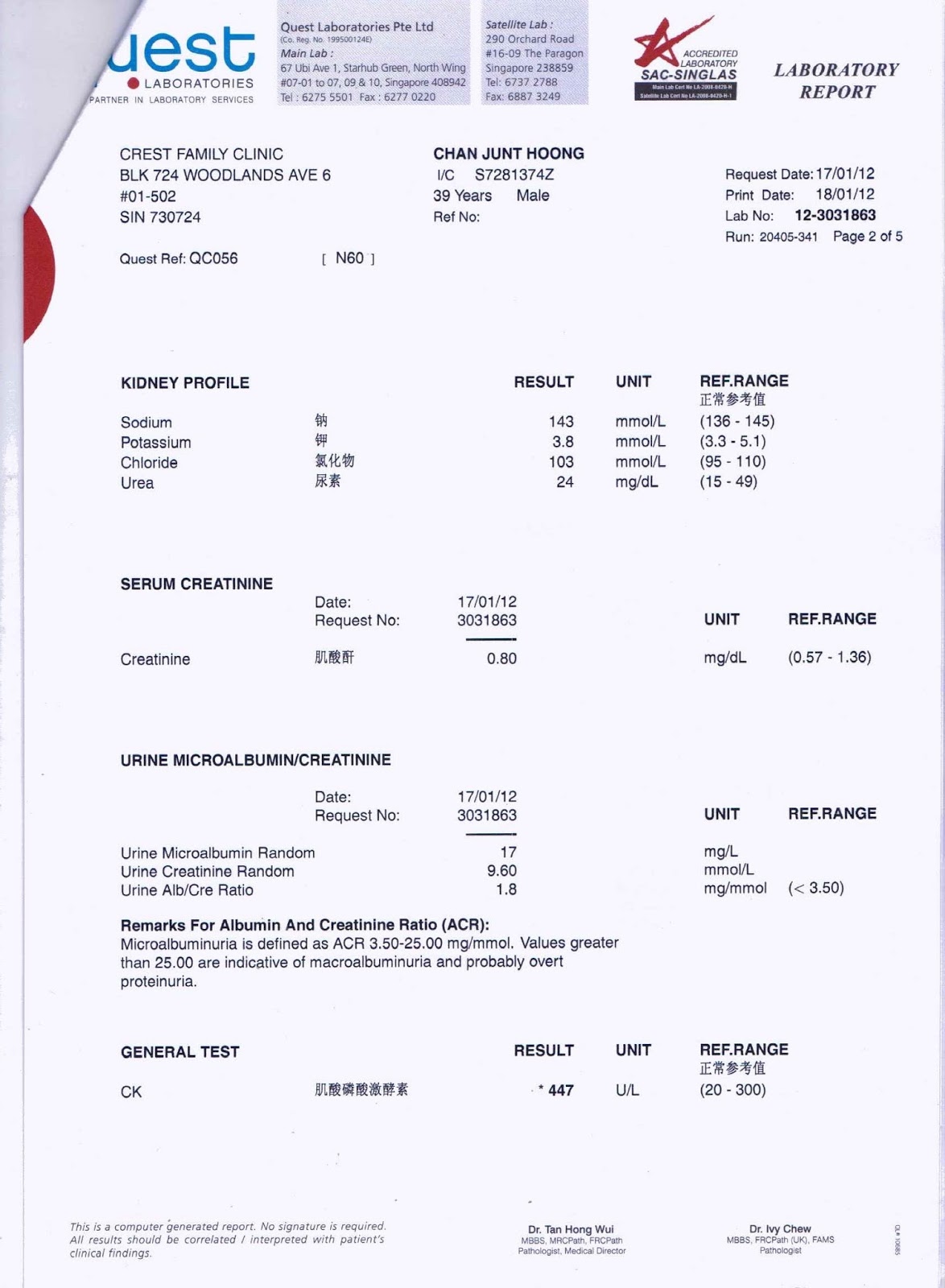

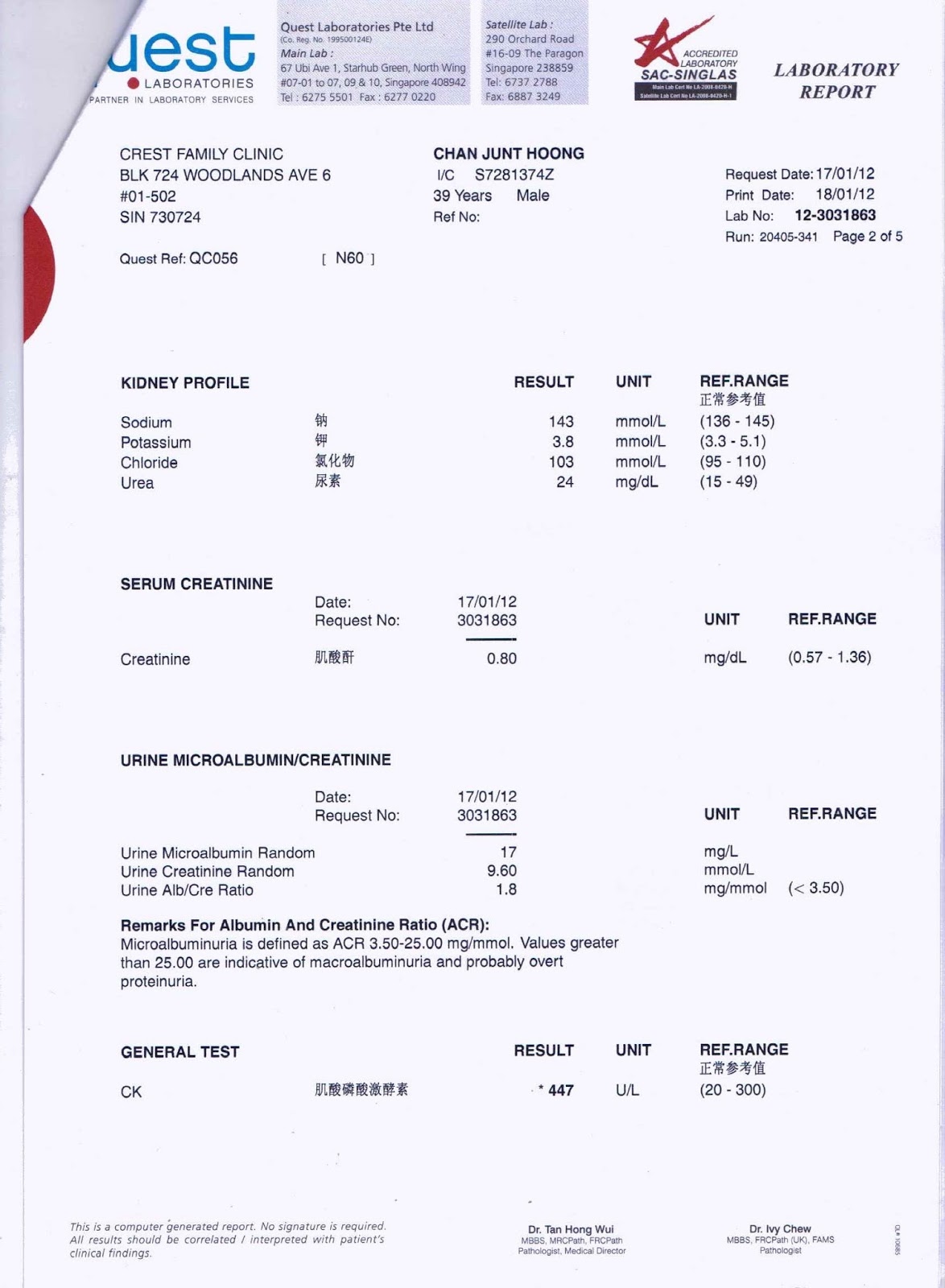

Chan Junt Hoong s Blog Continuation From Chan Junt Hoong s Mobile Blog

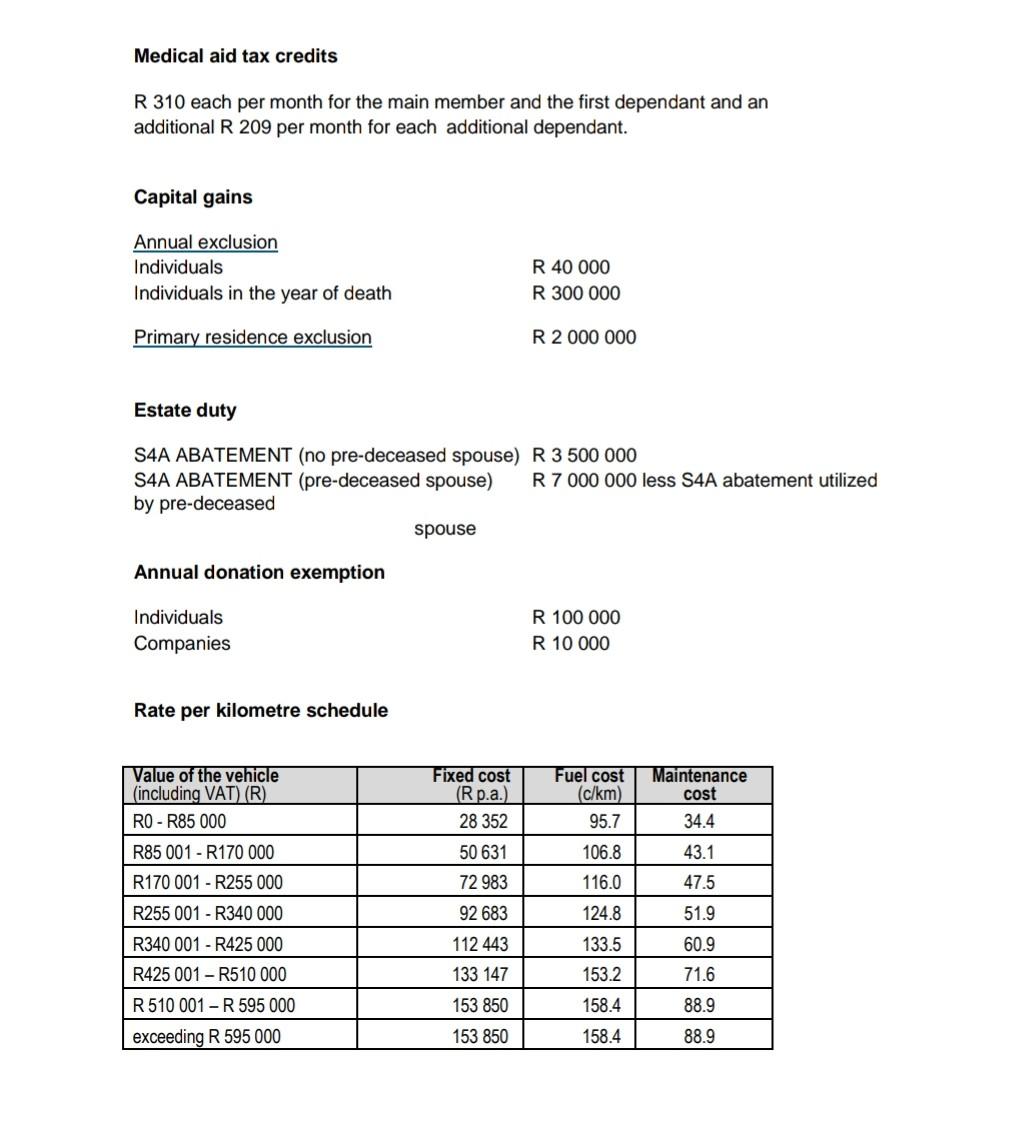

Solved QUESTION TWO 30 MARKS The Following Information Is Chegg

Printable 25 Fake Medical Bills Format In 2020 With Images Invoice

https://www.nerdwallet.com/article/taxes/medi…

Web 26 sept 2017 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is

https://www.thebalancemoney.com/medical-e…

Web 12 janv 2023 nbsp 0183 32 The Deduction and Your AGI Threshold You can calculate the 7 5 rule by tallying up all your medical expenses for the year then subtracting the amount equal to 7 5 of your AGI For example if your

Web 26 sept 2017 nbsp 0183 32 For tax returns filed in 2023 taxpayers can deduct qualified unreimbursed medical expenses that are more than 7 5 of their 2022 adjusted gross income So if your adjusted gross income is

Web 12 janv 2023 nbsp 0183 32 The Deduction and Your AGI Threshold You can calculate the 7 5 rule by tallying up all your medical expenses for the year then subtracting the amount equal to 7 5 of your AGI For example if your

Chan Junt Hoong s Blog Continuation From Chan Junt Hoong s Mobile Blog

Medical Insurance Receipt Format INSURANCE DAY

Solved QUESTION TWO 30 MARKS The Following Information Is Chegg

Printable 25 Fake Medical Bills Format In 2020 With Images Invoice

In SA Tax Credits For Medical Aid Contributions eBiz Money

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

Section 80 Deduction Deduction U s 80DD 80DDB 80U Tax2win Blog

South Carolina Taxpayers Could Soon Be Eligible For 100 Rebate Wcnc