In this age of technology, when screens dominate our lives and our lives are dominated by screens, the appeal of tangible printed objects isn't diminished. In the case of educational materials and creative work, or simply adding the personal touch to your space, Kvp Income Tax Rules have become an invaluable resource. Here, we'll take a dive through the vast world of "Kvp Income Tax Rules," exploring what they are, where to get them, as well as the ways that they can benefit different aspects of your life.

What Are Kvp Income Tax Rules?

Kvp Income Tax Rules include a broad variety of printable, downloadable materials that are accessible online for free cost. These materials come in a variety of types, like worksheets, templates, coloring pages and more. The benefit of Kvp Income Tax Rules is their versatility and accessibility.

Kvp Income Tax Rules

Kvp Income Tax Rules

Kvp Income Tax Rules -

[desc-5]

[desc-1]

KVP Interest Rate Maturity Period 2020

KVP Interest Rate Maturity Period 2020

[desc-4]

[desc-6]

Income Tax Diary

Income Tax Diary

[desc-9]

[desc-7]

How Income Tax On KVP Is Calculated Mint

How To Avoid The New Tax Rules On Mortgage Interest Russel Smith

Tax Table Internal Revenue Code Sales Revenue Net Income Tax

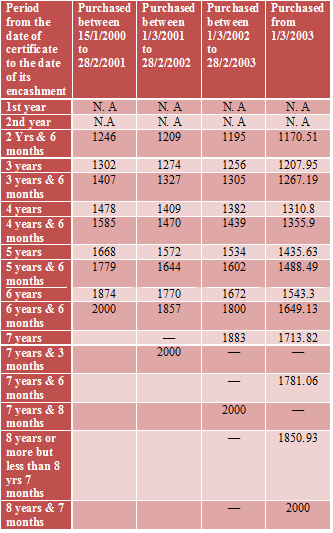

CA SHIV K JINDAL KVP INTEREST RATE CHART

Last minute Income Tax Saving Options Ebizfiling

UK Income Tax Rates 2023 24 Maximising Your Tax free Allowance GCV

UK Income Tax Rates 2023 24 Maximising Your Tax free Allowance GCV

Who Should File A Revised ITR Is There A Penalty