In a world with screens dominating our lives and the appeal of physical printed items hasn't gone away. No matter whether it's for educational uses project ideas, artistic or just adding some personal flair to your home, printables for free have proven to be a valuable source. In this article, we'll dive into the world of "Is Uniform Cleaning Tax Deductible," exploring what they are, where they are, and how they can enrich various aspects of your life.

Get Latest Is Uniform Cleaning Tax Deductible Below

Is Uniform Cleaning Tax Deductible

Is Uniform Cleaning Tax Deductible -

Uniforms Costumes A new suit or dress wouldn t be tax deductible because you could wear the attire outside of work Is dry cleaning tax deductible The cost of dry cleaning is tax deductible as long as the clothes are deductible too only used for work Are you currently doing your own books for your Cosmetic surgery

In regard to uniforms you can deduct the cost of the uniforms and their upkeep dry cleaning if both of the following apply Your job requires that you wear special clothing such as a uniform The clothes are not suitable for everyday wear

Is Uniform Cleaning Tax Deductible provide a diverse assortment of printable content that can be downloaded from the internet at no cost. The resources are offered in a variety styles, from worksheets to templates, coloring pages and many more. The beauty of Is Uniform Cleaning Tax Deductible lies in their versatility as well as accessibility.

More of Is Uniform Cleaning Tax Deductible

5 Easy Tax Deductions For A Higher Tax Return AUSTRALIA Part 1

5 Easy Tax Deductions For A Higher Tax Return AUSTRALIA Part 1

Check how much tax relief you can claim for uniforms work clothing and tools Use this list to check if you can claim a fixed amount of tax relief also known as flat rate expenses for your

If your uniform is considered a necessary expense then the cost of maintaining that uniform becomes deductible When your uniform costume or safety gear needs to be cleaned altered or dry cleaned retain your receipt for your tax records

Is Uniform Cleaning Tax Deductible have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies or expensive software.

-

Personalization The Customization feature lets you tailor the templates to meet your individual needs whether you're designing invitations and schedules, or even decorating your house.

-

Educational value: The free educational worksheets cater to learners from all ages, making them an invaluable aid for parents as well as educators.

-

It's easy: Fast access a plethora of designs and templates cuts down on time and efforts.

Where to Find more Is Uniform Cleaning Tax Deductible

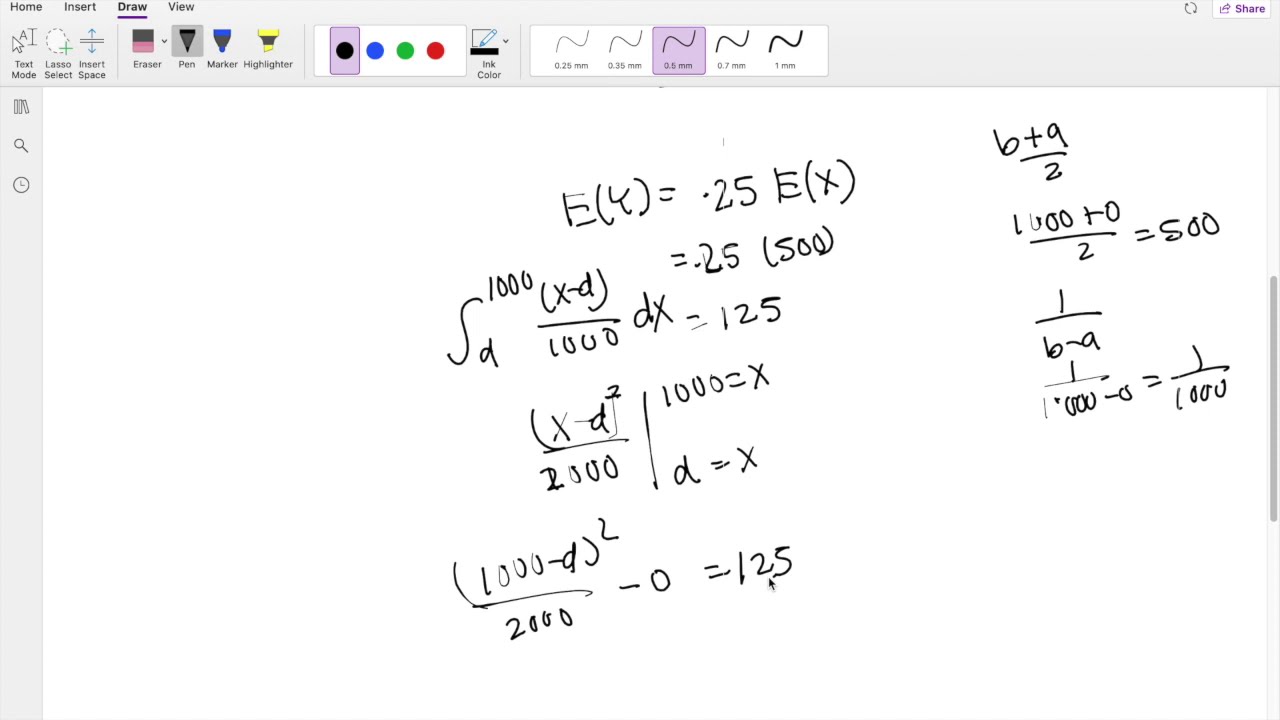

Mixed Random Variable Payment Random Variable W Deductible Loss

Mixed Random Variable Payment Random Variable W Deductible Loss

Uniform expenses are generally not tax deductible for most employees under the Tax Cuts and Jobs Act TCJA of 2017 Exceptions include armed forces reservists professional performers and certain state and local government officials Proper documentation and record keeping are important for those eligible to claim uniform

In the event your employer doesn t reimburse you for the expense of purchasing these uniforms and doesn t provide an allowance for their cleaning you can include all uniform related expenses in

Now that we've piqued your interest in Is Uniform Cleaning Tax Deductible, let's explore where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection in Is Uniform Cleaning Tax Deductible for different uses.

- Explore categories like interior decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates at no cost.

- These blogs cover a wide selection of subjects, everything from DIY projects to planning a party.

Maximizing Is Uniform Cleaning Tax Deductible

Here are some fresh ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Utilize free printable worksheets to enhance your learning at home, or even in the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Is Uniform Cleaning Tax Deductible are a treasure trove with useful and creative ideas that cater to various needs and desires. Their accessibility and flexibility make them a great addition to any professional or personal life. Explore the vast collection of Is Uniform Cleaning Tax Deductible and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly completely free?

- Yes, they are! You can print and download these resources at no cost.

-

Can I download free printing templates for commercial purposes?

- It's based on specific conditions of use. Always read the guidelines of the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns when using Is Uniform Cleaning Tax Deductible?

- Certain printables could be restricted on use. Check the terms and conditions provided by the designer.

-

How can I print printables for free?

- Print them at home using the printer, or go to an in-store print shop to get premium prints.

-

What software is required to open printables at no cost?

- The majority of PDF documents are provided in the format PDF. This can be opened with free software like Adobe Reader.

Is Volunteer Work Tax Deductible

Is House Cleaning Tax deductible

Check more sample of Is Uniform Cleaning Tax Deductible below

Is Office Cleaning Tax Deductible

Deductible Uniform Loss Examples SOA Exam P Probability

SOA Exam P Question 56 Deductible Of Uniform Distribution YouTube

Tax Deductible Bricks R Us

Is Food Tax Deductible A Guide For Small Businesses

Solved Due 12 18 17 This Assignment Is Worth 25 Points You Chegg

https://www.hrblock.com/tax-center/filing...

In regard to uniforms you can deduct the cost of the uniforms and their upkeep dry cleaning if both of the following apply Your job requires that you wear special clothing such as a uniform The clothes are not suitable for everyday wear

https://www.bench.co/blog/tax-tips/clothing-tax-deduction

In order to deduct the cost of uniforms or work clothes the item needs to be distinctive and not appropriate for everyday wear For instance a polo branded with your company logo would be deductible while khaki pants wouldn t be even if they are a part of the company uniform since they can easily be worn outside of the business Costumes

In regard to uniforms you can deduct the cost of the uniforms and their upkeep dry cleaning if both of the following apply Your job requires that you wear special clothing such as a uniform The clothes are not suitable for everyday wear

In order to deduct the cost of uniforms or work clothes the item needs to be distinctive and not appropriate for everyday wear For instance a polo branded with your company logo would be deductible while khaki pants wouldn t be even if they are a part of the company uniform since they can easily be worn outside of the business Costumes

Tax Deductible Bricks R Us

Deductible Uniform Loss Examples SOA Exam P Probability

Is Food Tax Deductible A Guide For Small Businesses

Solved Due 12 18 17 This Assignment Is Worth 25 Points You Chegg

How Office Cleaning Expenses Can Be Tax Deductible

Spring Cleaning Tax Records Greenway Shredding

Spring Cleaning Tax Records Greenway Shredding

Printable Itemized Deductions Worksheet