In the age of digital, where screens dominate our lives it's no wonder that the appeal of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons and creative work, or simply to add an individual touch to the area, Is There Tax On Inherited Roth Ira have proven to be a valuable resource. For this piece, we'll take a dive in the world of "Is There Tax On Inherited Roth Ira," exploring what they are, how to find them and how they can enrich various aspects of your daily life.

Get Latest Is There Tax On Inherited Roth Ira Below

Is There Tax On Inherited Roth Ira

Is There Tax On Inherited Roth Ira -

Roth IRA contributions are made with money that s already been taxed and withdrawals are generally tax free Contrast this with a traditional IRA where contributions are tax free and

When you inherit a Roth IRA the money you receive gets the same tax advantaged treatment as the original account Because the money was contributed on an after tax basis you can withdraw

Is There Tax On Inherited Roth Ira encompass a wide collection of printable items that are available online at no cost. They are available in a variety of designs, including worksheets coloring pages, templates and much more. One of the advantages of Is There Tax On Inherited Roth Ira is their versatility and accessibility.

More of Is There Tax On Inherited Roth Ira

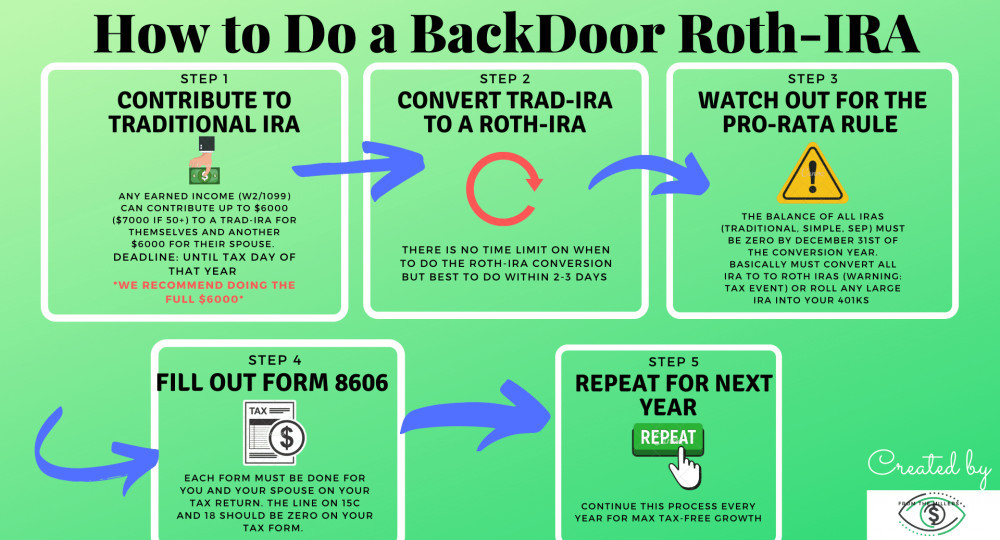

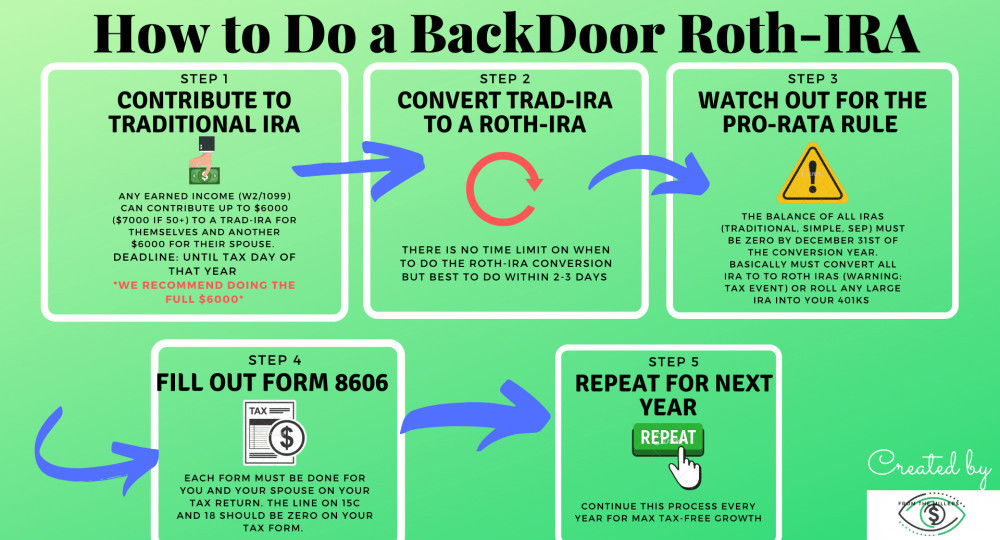

What Is A Backdoor Roth IRA How Does It Work In 2021 Personal

What Is A Backdoor Roth IRA How Does It Work In 2021 Personal

As an owner all distributions that you take in retirement are tax free Additionally you can keep your money in a Roth IRA to grow and pass it on to your heirs Unlike a traditional IRA

Most of the time yes It would be unusual for any taxes to be due on an RMD from an inherited Roth IRA The only portion of an inherited IRA that could be subject to tax is earnings

Is There Tax On Inherited Roth Ira have garnered immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

customization The Customization feature lets you tailor the templates to meet your individual needs, whether it's designing invitations planning your schedule or decorating your home.

-

Educational Benefits: Free educational printables are designed to appeal to students of all ages, making these printables a powerful tool for parents and teachers.

-

It's easy: Quick access to numerous designs and templates cuts down on time and efforts.

Where to Find more Is There Tax On Inherited Roth Ira

Rules For Inherited Roth IRAs Fee Only Fiduciary Financial Planning

Rules For Inherited Roth IRAs Fee Only Fiduciary Financial Planning

IRAs and inherited IRAs are tax deferred accounts That means that tax is paid when the holder of an IRA account or the beneficiary takes distributions in the case of an inherited

An Inherited Roth IRA is a retirement account created when a deceased individual s Roth IRA is passed on to their beneficiary The beneficiary can be anybody the decedent has chosen including a spouse relative unrelated party or corporation The rules governing an inherited Roth IRA vary for spouses and

If we've already piqued your curiosity about Is There Tax On Inherited Roth Ira Let's look into where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection of Is There Tax On Inherited Roth Ira to suit a variety of reasons.

- Explore categories like design, home decor, craft, and organization.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing or flashcards as well as learning tools.

- It is ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- These blogs cover a broad array of topics, ranging from DIY projects to planning a party.

Maximizing Is There Tax On Inherited Roth Ira

Here are some ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame beautiful images, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like birthdays and weddings.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Is There Tax On Inherited Roth Ira are a treasure trove filled with creative and practical information that satisfy a wide range of requirements and hobbies. Their accessibility and versatility make these printables a useful addition to your professional and personal life. Explore the vast world of Is There Tax On Inherited Roth Ira and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly cost-free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I make use of free printouts for commercial usage?

- It's based on specific usage guidelines. Always verify the guidelines of the creator before using their printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Certain printables may be subject to restrictions on their use. Make sure you read the terms and condition of use as provided by the creator.

-

How can I print printables for free?

- You can print them at home using the printer, or go to an in-store print shop to get high-quality prints.

-

What program do I require to view printables that are free?

- The majority of printables are in PDF format. These is open with no cost software like Adobe Reader.

What Can I Do With An Inherited Roth IRA YouTube

Does A Roth IRA Account Make Sense For You Gorfine Schiller Gardyn

Check more sample of Is There Tax On Inherited Roth Ira below

Roth IRA Rules What You Need To Know In 2019 Roth Ira Rules Roth

How Am I Taxed If I Convert My Inherited IRA To A Roth Nj

5 Things To Know About Required Minimum Distributions AZ IRA Real Estate

The New Inherited I R A Rules 6 Meridian

INHERITED IRA RULES How To Minimize Inheritance Taxes With Stretch

Inherited Roth IRA Definition Rules Tax Consequences Tax Strategies

https://www.fool.com/retirement/plans/roth-ira/inherited

When you inherit a Roth IRA the money you receive gets the same tax advantaged treatment as the original account Because the money was contributed on an after tax basis you can withdraw

https://www.thebalancemoney.com/inherited-roth-ira...

One of the biggest Roth IRA benefits is that your withdrawals are tax free whether you re the original owner or you inherited the account But if you inherit a Roth IRA you could owe taxes on the earnings portion if you withdraw the money less than five years after the original owner opened it

When you inherit a Roth IRA the money you receive gets the same tax advantaged treatment as the original account Because the money was contributed on an after tax basis you can withdraw

One of the biggest Roth IRA benefits is that your withdrawals are tax free whether you re the original owner or you inherited the account But if you inherit a Roth IRA you could owe taxes on the earnings portion if you withdraw the money less than five years after the original owner opened it

The New Inherited I R A Rules 6 Meridian

How Am I Taxed If I Convert My Inherited IRA To A Roth Nj

INHERITED IRA RULES How To Minimize Inheritance Taxes With Stretch

Inherited Roth IRA Definition Rules Tax Consequences Tax Strategies

Irs Life Expectancy Table Ira Distributions Tutorial Pics

What Is A Roth IRA The Fancy Accountant

What Is A Roth IRA The Fancy Accountant

+1000px.jpg)

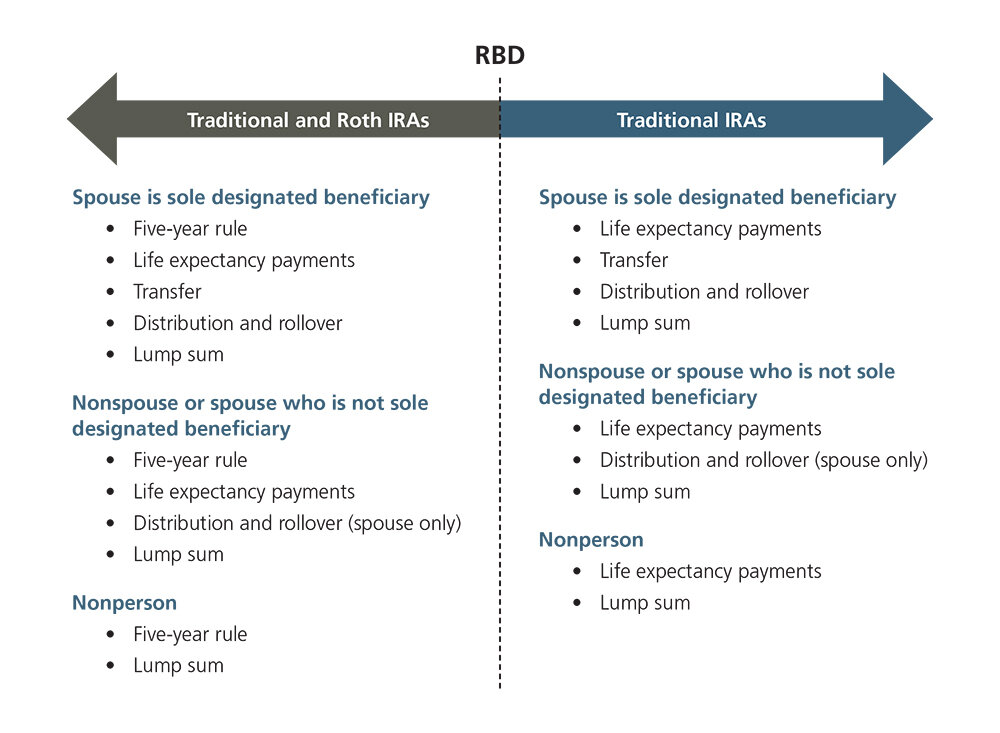

IRA Beneficiary Options For Deaths Before January 1 2020 Ascensus