In this digital age, where screens rule our lives and the appeal of physical printed objects isn't diminished. Be it for educational use for creative projects, simply adding the personal touch to your space, Is Social Security Federally Taxed In Ohio have proven to be a valuable source. Through this post, we'll take a dive into the world "Is Social Security Federally Taxed In Ohio," exploring their purpose, where you can find them, and the ways that they can benefit different aspects of your daily life.

Get Latest Is Social Security Federally Taxed In Ohio Below

Is Social Security Federally Taxed In Ohio

Is Social Security Federally Taxed In Ohio -

Social Security is not taxable in Ohio although it may be taxable at the federal level If so though the amount may be tax deductible when you file your federal taxes

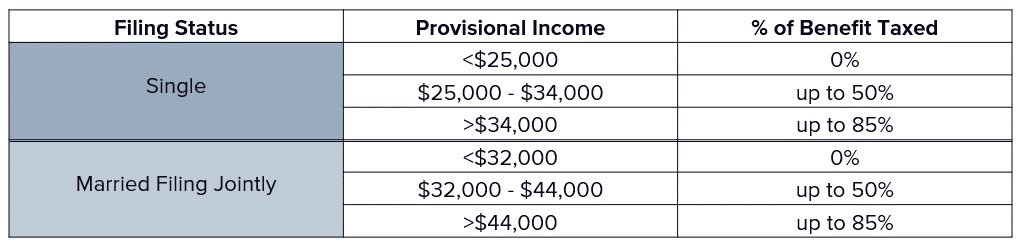

You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is Between 25 000 and 34 000 you may have to pay

Is Social Security Federally Taxed In Ohio encompass a wide assortment of printable, downloadable materials online, at no cost. These resources come in many formats, such as worksheets, templates, coloring pages, and much more. The appeal of printables for free is their versatility and accessibility.

More of Is Social Security Federally Taxed In Ohio

Understanding How Social Security Benefits Are Taxed

Understanding How Social Security Benefits Are Taxed

Views You must pay taxes on up to 85 of your Social Security benefits if you file a Federal tax return as an individual and your combined income exceeds 25 000 Joint return and you and your spouse have combined income of more than 32 000

Published October 10 2018 Updated March 18 2024 If your total income is more than 25 000 for an individual or 32 000 for a married couple filing jointly you must pay federal income taxes on your Social Security benefits Below those thresholds your

Is Social Security Federally Taxed In Ohio have gained immense popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

customization Your HTML0 customization options allow you to customize the design to meet your needs whether it's making invitations, organizing your schedule, or decorating your home.

-

Educational Use: Education-related printables at no charge are designed to appeal to students from all ages, making them a great aid for parents as well as educators.

-

An easy way to access HTML0: immediate access a myriad of designs as well as templates cuts down on time and efforts.

Where to Find more Is Social Security Federally Taxed In Ohio

How Is Social Security Taxed What Pre Retirees Need To Know TFS

How Is Social Security Taxed What Pre Retirees Need To Know TFS

IRS reminds taxpayers their Social Security benefits may be taxable Internal Revenue Service IRS Tax Tip 2022 22 February 9 2022 A new tax season has arrived The IRS reminds taxpayers receiving Social Security benefits that they may have to pay federal income tax on a portion of those benefits

Most states do not tax Social Security income But if you live in Colorado Connecticut Kansas Minnesota Missouri Montana Nebraska New Mexico Rhode Island Utah Vermont or West Virginia some portion of your 2023 benefits may be subject to state income taxes under widely varying rules and formulas

We hope we've stimulated your curiosity about Is Social Security Federally Taxed In Ohio Let's find out where you can find these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Is Social Security Federally Taxed In Ohio for various objectives.

- Explore categories such as interior decor, education, craft, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs with templates and designs for free.

- The blogs covered cover a wide range of interests, all the way from DIY projects to party planning.

Maximizing Is Social Security Federally Taxed In Ohio

Here are some new ways of making the most use of printables for free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets for free to aid in learning at your home as well as in the class.

3. Event Planning

- Invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Is Social Security Federally Taxed In Ohio are a treasure trove with useful and creative ideas that meet a variety of needs and interests. Their accessibility and flexibility make them a great addition to each day life. Explore the many options of Is Social Security Federally Taxed In Ohio today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really available for download?

- Yes they are! You can print and download these tools for free.

-

Are there any free printables for commercial uses?

- It's dependent on the particular usage guidelines. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright violations with Is Social Security Federally Taxed In Ohio?

- Certain printables may be subject to restrictions in use. Always read the terms and regulations provided by the designer.

-

How do I print printables for free?

- You can print them at home with a printer or visit a print shop in your area for high-quality prints.

-

What program do I need in order to open Is Social Security Federally Taxed In Ohio?

- A majority of printed materials are as PDF files, which is open with no cost software, such as Adobe Reader.

Social Security Benefits Are Not Taxed In These 37 States Community

Social Security And Taxes Could There Be A Tax Torpedo In Your Future

Check more sample of Is Social Security Federally Taxed In Ohio below

How Is Social Security Taxed Slate River Financial

How Social Security Is Taxed YouTube

Social Security Benefit Taxes By State 13 States Might Tax Benefits

How Is Social Security Income Taxed Top Videos And News Stories For

Why Is Social Security Taxed Twice

Social Security GuangGurpage

https://www-origin.ssa.gov/benefits/retirement/planner/taxes.html#!

You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is Between 25 000 and 34 000 you may have to pay

https://taxfoundation.org/data/all/state/states...

AL AZ AR CA DE DC GA HI ID IL IN IA KY LA ME MD MA MI MS NH NJ NY NC OH OK OR PA SC VA WI New Mexico includes all Social Security benefits in the taxable income base though the state provides a deduction that reduces the taxability of all retirement income

You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is Between 25 000 and 34 000 you may have to pay

AL AZ AR CA DE DC GA HI ID IL IN IA KY LA ME MD MA MI MS NH NJ NY NC OH OK OR PA SC VA WI New Mexico includes all Social Security benefits in the taxable income base though the state provides a deduction that reduces the taxability of all retirement income

How Is Social Security Income Taxed Top Videos And News Stories For

How Social Security Is Taxed YouTube

Why Is Social Security Taxed Twice

Social Security GuangGurpage

How Is Social Security Income Taxed

At What Age Is Social Security No Longer Taxed Retirement News Daily

At What Age Is Social Security No Longer Taxed Retirement News Daily

37 States That Don t Tax Social Security Benefits