In the digital age, where screens dominate our lives however, the attraction of tangible printed products hasn't decreased. Whether it's for educational purposes such as creative projects or just adding some personal flair to your home, printables for free are now an essential source. Here, we'll dive in the world of "Is Roth Ira Interest Tax Exempt," exploring what they are, where you can find them, and how they can be used to enhance different aspects of your daily life.

Get Latest Is Roth Ira Interest Tax Exempt Below

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Is Roth Ira Interest Tax Exempt

Is Roth Ira Interest Tax Exempt -

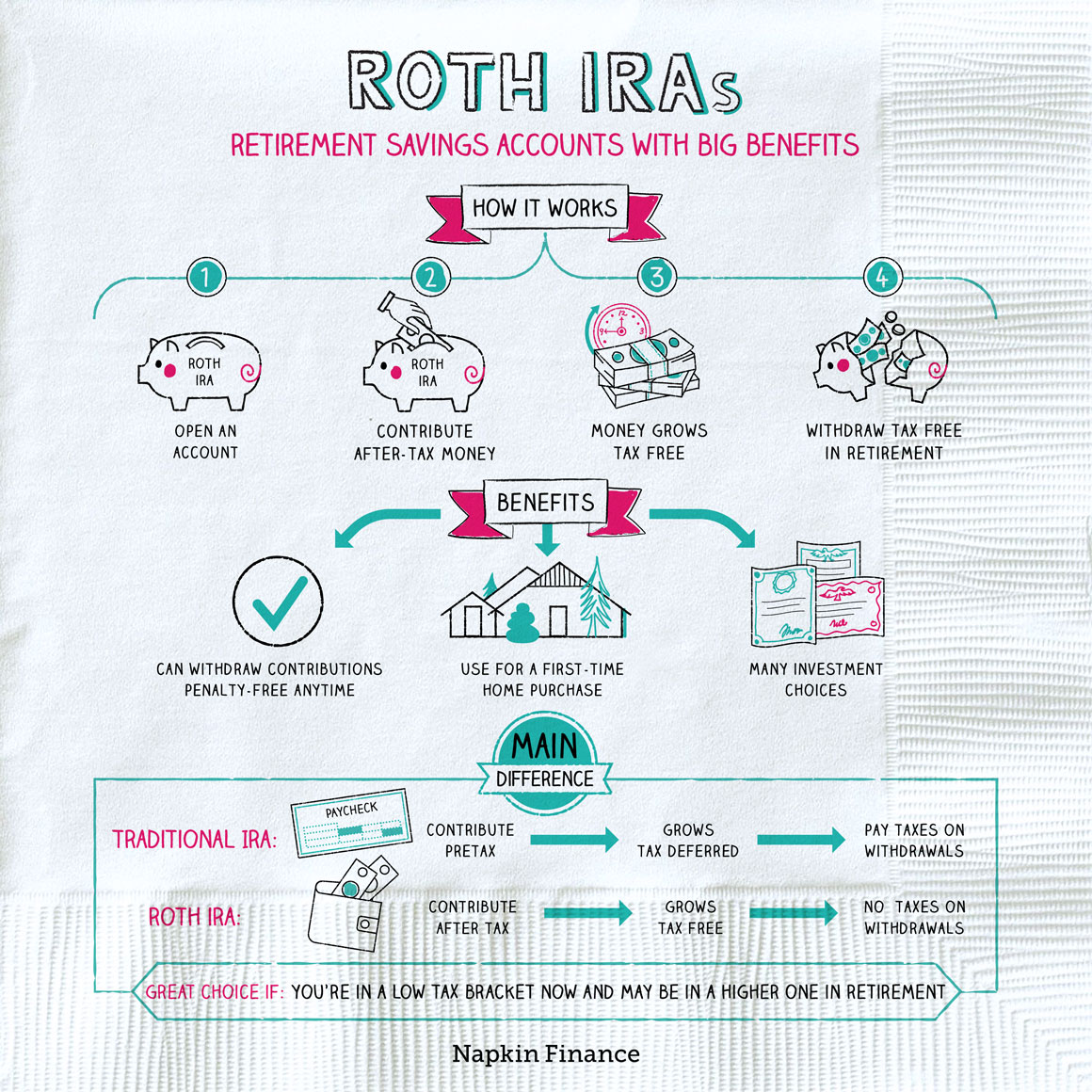

A Roth IRA is an IRA that except as explained below is subject to the rules that apply to a traditional IRA You cannot deduct contributions to a Roth IRA If you satisfy the requirements qualified distributions are tax free You can make contributions to your Roth IRA after you reach age 70

With the Roth IRA the money you contribute isn t tax deductible That means you don t report Roth IRA contributions on your tax return and you can t deduct them from your taxable income

Printables for free cover a broad selection of printable and downloadable resources available online for download at no cost. These materials come in a variety of types, such as worksheets coloring pages, templates and more. The attraction of printables that are free is in their versatility and accessibility.

More of Is Roth Ira Interest Tax Exempt

Roth IRA Vs 401 k Which Is Better For You In 2021 Ira Investment

Roth IRA Vs 401 k Which Is Better For You In 2021 Ira Investment

Roth IRAs offer significant tax exemptions but understanding how the IRS treats distributions is vital for making correct financial decisions

The Internal Revenue Code IRC sets rules for Roth IRAs Here are five things you should know about Roth IRA taxes Contributions Since you contribute to a Roth IRA with money that you ve already paid income tax on your contributions are not tax deductible in the year you make them

Printables that are free have gained enormous popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

customization: The Customization feature lets you tailor the templates to meet your individual needs, whether it's designing invitations or arranging your schedule or even decorating your house.

-

Educational Worth: Free educational printables cater to learners of all ages, making these printables a powerful source for educators and parents.

-

Simple: The instant accessibility to a plethora of designs and templates, which saves time as well as effort.

Where to Find more Is Roth Ira Interest Tax Exempt

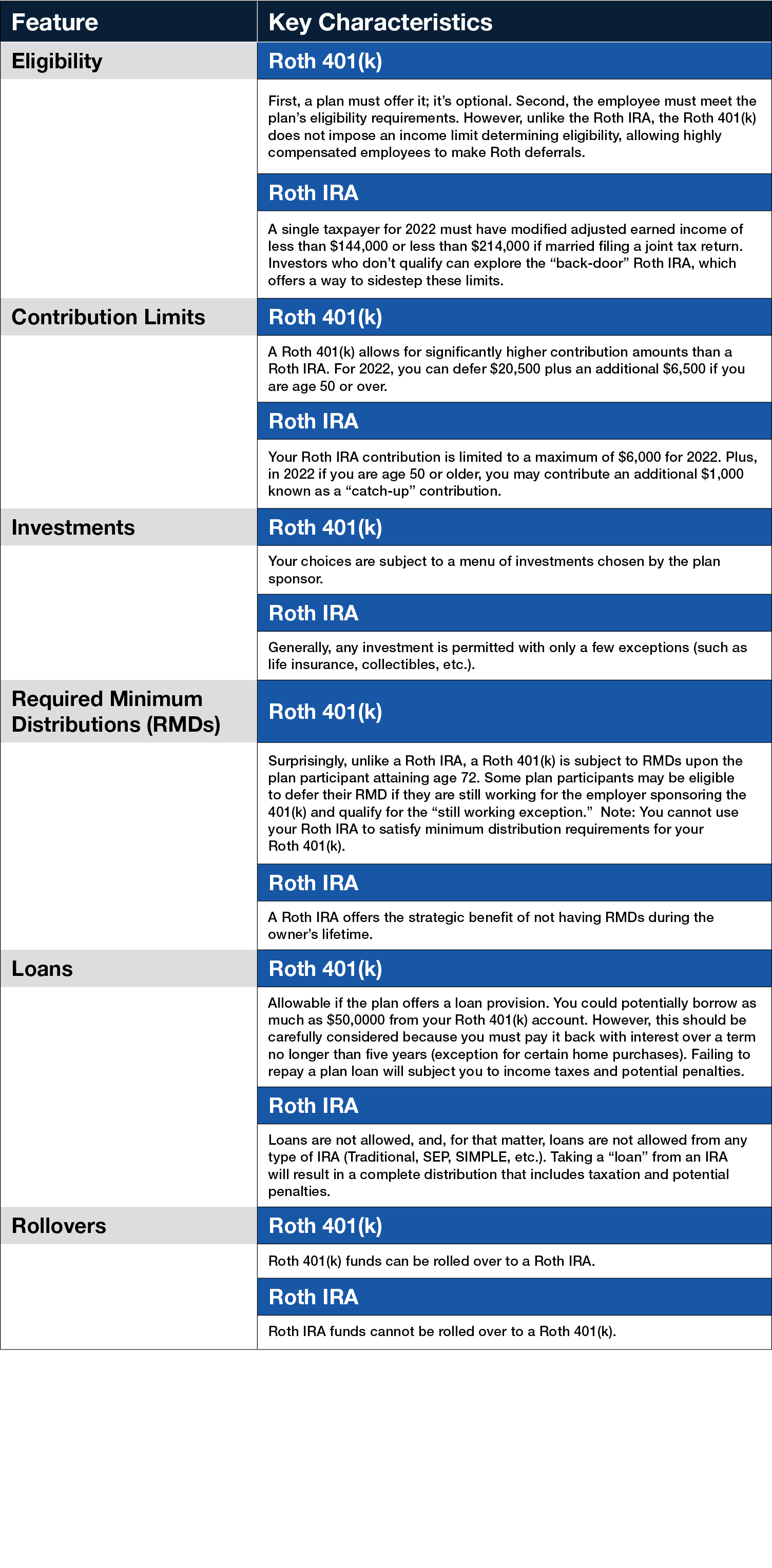

Roth 401 k Versus Roth IRA Essential Info For Retirement Investors

Roth 401 k Versus Roth IRA Essential Info For Retirement Investors

As long as you don t exceed the IRS s income limits you can still contribute the maximum annual amount to a Roth IRA For the 2024 tax year that s 7 000 or 8 000 if you re age 50 or older Get details on IRA contribution limits deadlines

You aren t subject to IRA interest tax on the interest your IRA earns while it remains in your account Instead you ll be responsible for any IRA interest tax when you take distributions from the traditional IRA If you have Roth IRA distributions they re

We've now piqued your curiosity about Is Roth Ira Interest Tax Exempt, let's explore where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection and Is Roth Ira Interest Tax Exempt for a variety motives.

- Explore categories such as home decor, education, organizing, and crafts.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- The blogs are a vast array of topics, ranging starting from DIY projects to party planning.

Maximizing Is Roth Ira Interest Tax Exempt

Here are some new ways of making the most of printables that are free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or other seasonal decorations to fill your living spaces.

2. Education

- Print worksheets that are free to aid in learning at your home for the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

Is Roth Ira Interest Tax Exempt are a treasure trove of fun and practical tools catering to different needs and passions. Their access and versatility makes them an invaluable addition to each day life. Explore the vast collection of Is Roth Ira Interest Tax Exempt right now and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes you can! You can download and print these materials for free.

-

Can I download free printing templates for commercial purposes?

- It's dependent on the particular conditions of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Do you have any copyright concerns with Is Roth Ira Interest Tax Exempt?

- Some printables may contain restrictions in use. Be sure to read these terms and conditions as set out by the creator.

-

How can I print printables for free?

- Print them at home with an printer, or go to an in-store print shop to get superior prints.

-

What software do I need to run printables free of charge?

- The majority are printed in the format PDF. This is open with no cost software, such as Adobe Reader.

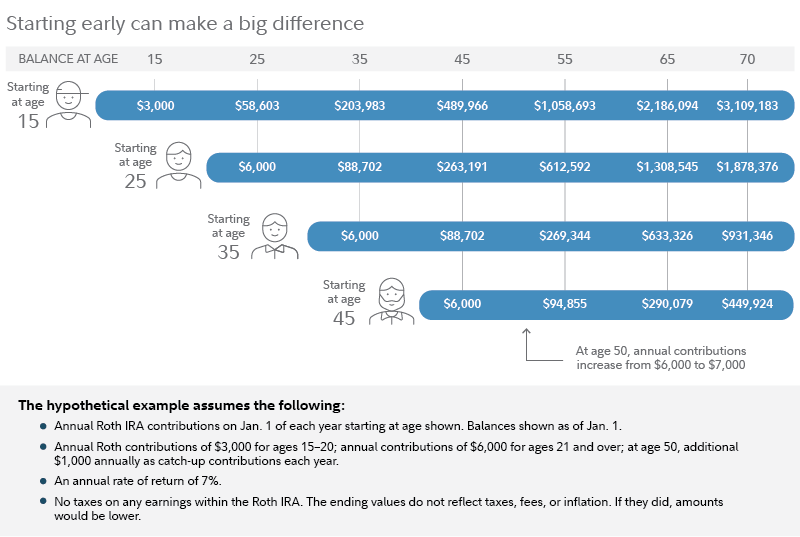

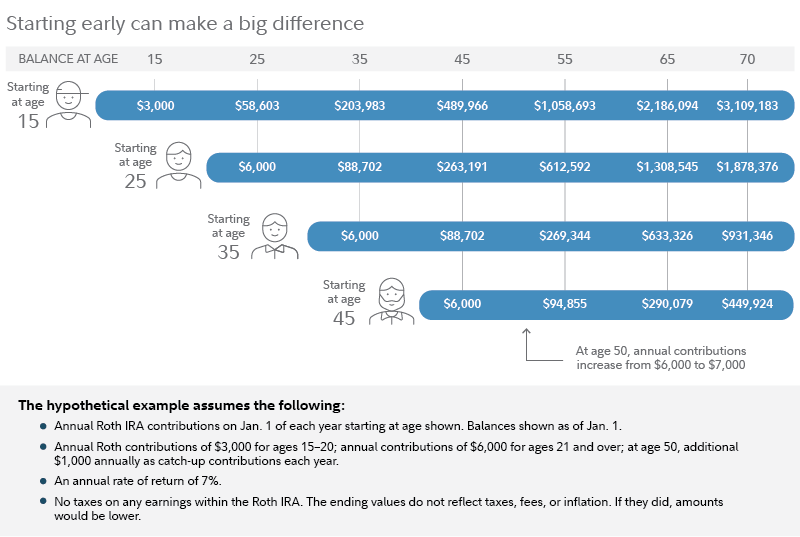

Traditional And Roth IRAs Charles Schwab

What Is A Roth IRA And Do You Really Need One Roth Ira Investing

Check more sample of Is Roth Ira Interest Tax Exempt below

Understanding Capital Gains Tax On Roth IRA What You Need To Know

Roth IRA Strategies For Physicians WealthKeel

Is A Savings Account Worth It Anymore Leia Aqui Do You Actually Lose

Does A Roth IRA Account Make Sense For You Gorfine Schiller Gardyn

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Roth Ira Growth Calculator GarveenIndia

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png?w=186)

https://www.nerdwallet.com/article/investing/roth-ira-taxes

With the Roth IRA the money you contribute isn t tax deductible That means you don t report Roth IRA contributions on your tax return and you can t deduct them from your taxable income

https://www.investopedia.com/ask/answers/05/iraearningsmagi.asp

Traditional IRA earnings are considered tax deferred because you will have to pay taxes eventually when you withdraw the earnings Roth IRA earnings however

With the Roth IRA the money you contribute isn t tax deductible That means you don t report Roth IRA contributions on your tax return and you can t deduct them from your taxable income

Traditional IRA earnings are considered tax deferred because you will have to pay taxes eventually when you withdraw the earnings Roth IRA earnings however

Does A Roth IRA Account Make Sense For You Gorfine Schiller Gardyn

Roth IRA Strategies For Physicians WealthKeel

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Roth Ira Growth Calculator GarveenIndia

Roth IRA Rules What You Need To Know In 2019 Roth Ira Rules Roth

Custodial Roth Ira Calculator ConnellFinnan

Custodial Roth Ira Calculator ConnellFinnan

Roth IRA Pay Now Withdraw Tax Free Later Napkin Finance