In this age of technology, when screens dominate our lives The appeal of tangible printed materials hasn't faded away. Be it for educational use project ideas, artistic or simply to add the personal touch to your area, Is Roth Ira Dividend Income Taxable have become an invaluable resource. The following article is a take a dive deep into the realm of "Is Roth Ira Dividend Income Taxable," exploring what they are, how they are available, and how they can enrich various aspects of your lives.

Get Latest Is Roth Ira Dividend Income Taxable Below

Is Roth Ira Dividend Income Taxable

Is Roth Ira Dividend Income Taxable -

Key Takeaways One advantage of a Roth IRA over a traditional IRA is that qualified distributions are tax free and penalty free To be qualified distributions have to meet certain

Dividends received from stocks in your Roth IRA are not reportable on your income taxes due to the tax sheltered nature of the account You will need to report distributions from your IRA when

Printables for free include a vast range of printable, free material that is available online at no cost. They are available in numerous designs, including worksheets coloring pages, templates and more. The benefit of Is Roth Ira Dividend Income Taxable is their flexibility and accessibility.

More of Is Roth Ira Dividend Income Taxable

Are Roth Contributions Right For Me

Are Roth Contributions Right For Me

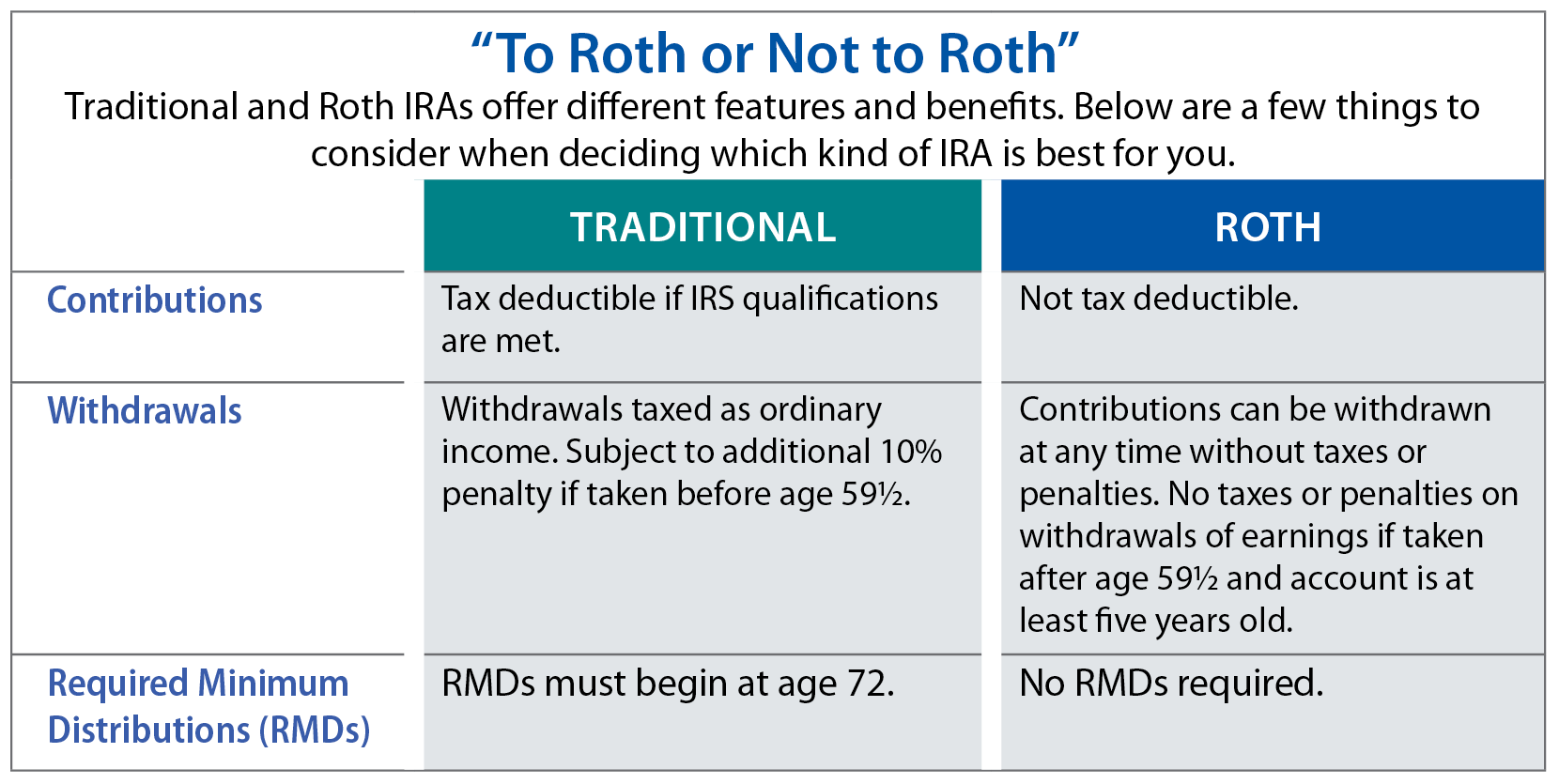

While there s no deduction for Roth IRA contributions qualified distributions from a Roth account are tax free Savers can also withdraw their original contributions on a tax free basis

Money you put into a Roth IRA is not tax deductible meaning you don t report Roth IRA contributions on your tax return and you can t deduct the contributions from your taxable income You pay

Is Roth Ira Dividend Income Taxable have risen to immense recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Modifications: We can customize printables to your specific needs in designing invitations and schedules, or decorating your home.

-

Educational Impact: Downloads of educational content for free offer a wide range of educational content for learners of all ages, which makes the perfect resource for educators and parents.

-

The convenience of immediate access various designs and templates, which saves time as well as effort.

Where to Find more Is Roth Ira Dividend Income Taxable

Savings Account Vs Roth IRA What s The Difference

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth IRA What s The Difference

Key Points A Roth IRA gives you the flexibility to buy individual stocks and other assets offered by your account custodian If you buy dividend stocks in your Roth IRA you can earn a

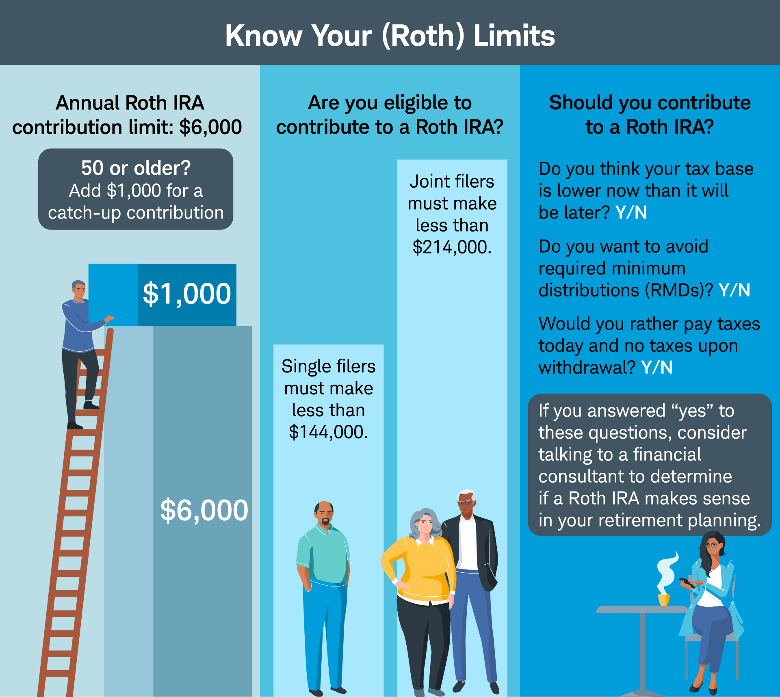

2022 Roth IRA Contribution Income Limits Single Tax Filers If your modified adjusted gross income MAGI is You can Less than 129 000 Contribute up to the maximum 129 000 or more but less than 144 000 Make a partial contribution 144 000 or more No longer contribute for the given year

We hope we've stimulated your curiosity about Is Roth Ira Dividend Income Taxable we'll explore the places you can find these treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of purposes.

- Explore categories such as decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free with flashcards and other teaching tools.

- It is ideal for teachers, parents and students looking for extra resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates free of charge.

- These blogs cover a broad variety of topics, everything from DIY projects to planning a party.

Maximizing Is Roth Ira Dividend Income Taxable

Here are some unique ways in order to maximize the use of Is Roth Ira Dividend Income Taxable:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Print free worksheets to build your knowledge at home also in the classes.

3. Event Planning

- Design invitations, banners, and decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Is Roth Ira Dividend Income Taxable are a treasure trove with useful and creative ideas that meet a variety of needs and desires. Their access and versatility makes them an essential part of each day life. Explore the plethora of Is Roth Ira Dividend Income Taxable now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can print and download these materials for free.

-

Can I use the free templates for commercial use?

- It is contingent on the specific terms of use. Always review the terms of use for the creator before using printables for commercial projects.

-

Are there any copyright violations with printables that are free?

- Certain printables might have limitations concerning their use. Check the terms and conditions provided by the designer.

-

How do I print Is Roth Ira Dividend Income Taxable?

- Print them at home using either a printer or go to any local print store for superior prints.

-

What program do I require to open Is Roth Ira Dividend Income Taxable?

- Most PDF-based printables are available in PDF format. These can be opened using free programs like Adobe Reader.

Should You Invest In An IRA Or A Roth IRA SmartZone Finance

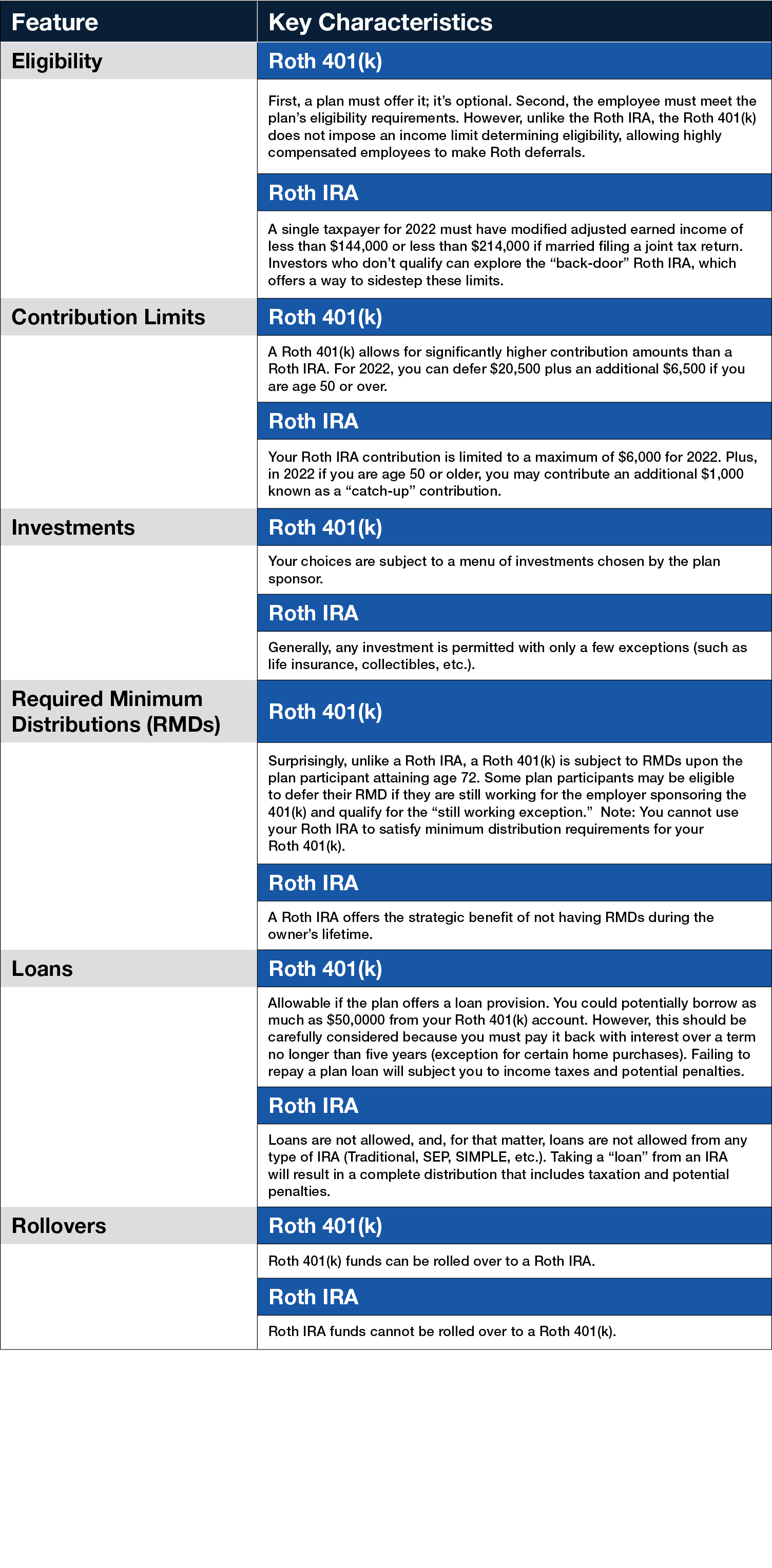

Roth 401 k Versus Roth IRA Essential Info For Retirement Investors

Check more sample of Is Roth Ira Dividend Income Taxable below

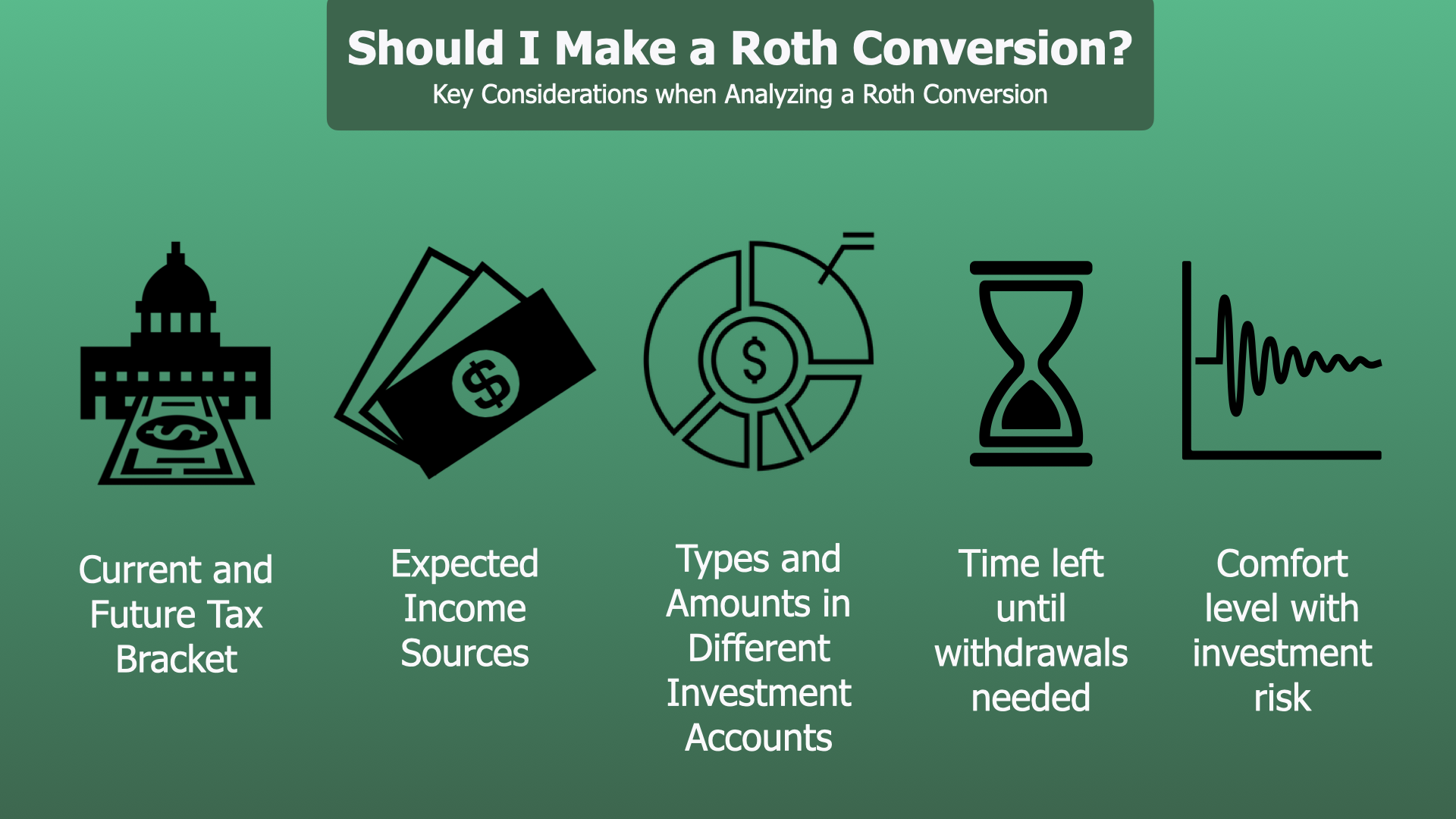

Should I Make A Roth IRA Conversion Financial Symmetry Inc

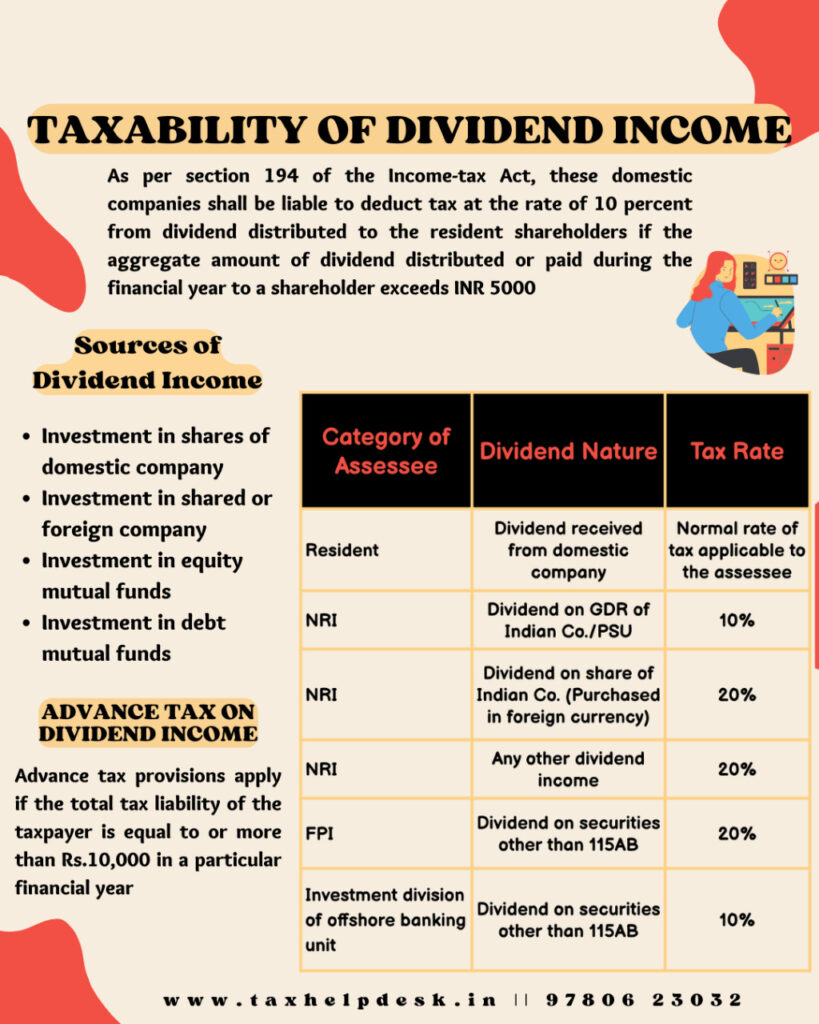

Tax On Dividend Income In India How Is Your Dividend Taxed

2022 Roth Ira Income Limits Choosing Your Gold IRA

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Is A Savings Account Worth It Anymore Leia Aqui Do You Actually Lose

Roth Investment Calculator KhushabWisam

https://finance.zacks.com/need-report-dividend...

Dividends received from stocks in your Roth IRA are not reportable on your income taxes due to the tax sheltered nature of the account You will need to report distributions from your IRA when

https://www.investopedia.com/articles/personal...

How Are Dividends Within a Roth IRA Taxed They aren t taxed at all All earnings in a Roth IRA including dividends issued by companies the Roth IRA invests in grow tax free and

Dividends received from stocks in your Roth IRA are not reportable on your income taxes due to the tax sheltered nature of the account You will need to report distributions from your IRA when

How Are Dividends Within a Roth IRA Taxed They aren t taxed at all All earnings in a Roth IRA including dividends issued by companies the Roth IRA invests in grow tax free and

Traditional Vs Roth IRAs What s The Difference Fi3 Advisors

Tax On Dividend Income In India How Is Your Dividend Taxed

Is A Savings Account Worth It Anymore Leia Aqui Do You Actually Lose

Roth Investment Calculator KhushabWisam

Taxability Of Dividend Income Everything You Need To Know

The IRS Announced Its Roth IRA Income Limits For 2022 Personal

The IRS Announced Its Roth IRA Income Limits For 2022 Personal

Do You Pay Taxes On Stocks Sold In Roth Ira Choosing Your Gold IRA