In this age of electronic devices, in which screens are the norm however, the attraction of tangible printed objects hasn't waned. No matter whether it's for educational uses and creative work, or just adding an individual touch to your home, printables for free are now a vital resource. For this piece, we'll take a dive into the world of "Is Retirement Income Taxable In New York State," exploring the benefits of them, where to find them, and what they can do to improve different aspects of your lives.

Get Latest Is Retirement Income Taxable In New York State Below

Is Retirement Income Taxable In New York State

Is Retirement Income Taxable In New York State -

The state of New York has a state income tax but residents benefit from an exemption on some of their retirement income that offers more favorable tax treatment than federal law

New York is moderately tax friendly for retirees It does not tax Social Security benefits and provides seniors a sizable deduction of 20 000 on other types of retirement income Retirees in New York should have relatively low income tax bills

Is Retirement Income Taxable In New York State provide a diverse range of downloadable, printable resources available online for download at no cost. They are available in numerous types, such as worksheets coloring pages, templates and much more. The great thing about Is Retirement Income Taxable In New York State is in their variety and accessibility.

More of Is Retirement Income Taxable In New York State

Solved Please Note That This Is Based On Philippine Tax System Please

Solved Please Note That This Is Based On Philippine Tax System Please

As a NYSLRS retiree your pension will not be subject to New York State or local income tax New York doesn t tax Social Security benefits either You may also get a tax break on any distributions from retirement savings such as deferred compensation and benefits from a private sector pension

Taxes on Retirement Income New York gives every resident who is age 59 5 or older a break on taxes against retirement income from pensions and or retirement account distributions The first 20 000 of retirement income is exempt from tax

Printables for free have gained immense popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

customization: The Customization feature lets you tailor printed materials to meet your requirements whether it's making invitations for your guests, organizing your schedule or decorating your home.

-

Educational Impact: Printing educational materials for no cost are designed to appeal to students of all ages. This makes these printables a powerful device for teachers and parents.

-

Convenience: The instant accessibility to various designs and templates cuts down on time and efforts.

Where to Find more Is Retirement Income Taxable In New York State

Federal Income Tax Calculator Tax Withholding Estimator 2021 Gambaran

Federal Income Tax Calculator Tax Withholding Estimator 2021 Gambaran

Under Internal Revenue Code Section 414 h as of July 1 1989 your required contributions are tax deferred until they are distributed to you These contributions are reportable for federal income tax only when you withdraw or retire from the Retirement System Therefore your contributions are

Use our income tax calculator to estimate how much tax you might pay on your taxable income Your tax is 0 if your income is less than the 2023 2024 standard deduction determined by your

In the event that we've stirred your interest in printables for free Let's look into where you can find these gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection with Is Retirement Income Taxable In New York State for all reasons.

- Explore categories like decorating your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide worksheets that can be printed for free along with flashcards, as well as other learning tools.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their creative designs and templates for no cost.

- These blogs cover a broad selection of subjects, ranging from DIY projects to planning a party.

Maximizing Is Retirement Income Taxable In New York State

Here are some new ways create the maximum value of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets for reinforcement of learning at home as well as in the class.

3. Event Planning

- Design invitations, banners and decorations for special occasions like weddings and birthdays.

4. Organization

- Make sure you are organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Is Retirement Income Taxable In New York State are an abundance of fun and practical tools that can meet the needs of a variety of people and preferences. Their accessibility and versatility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the endless world of Is Retirement Income Taxable In New York State now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really are they free?

- Yes, they are! You can download and print these free resources for no cost.

-

Do I have the right to use free printables for commercial purposes?

- It's based on specific conditions of use. Always verify the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright issues with Is Retirement Income Taxable In New York State?

- Certain printables could be restricted on their use. Be sure to read the terms and regulations provided by the author.

-

How do I print Is Retirement Income Taxable In New York State?

- Print them at home with printing equipment or visit the local print shops for the highest quality prints.

-

What software do I require to view printables for free?

- Most PDF-based printables are available in the format of PDF, which is open with no cost software like Adobe Reader.

Nys Withholding Tax Forms 2022 WithholdingForm

Is Repair Labor Taxable In New Jersey Best Reviews

Check more sample of Is Retirement Income Taxable In New York State below

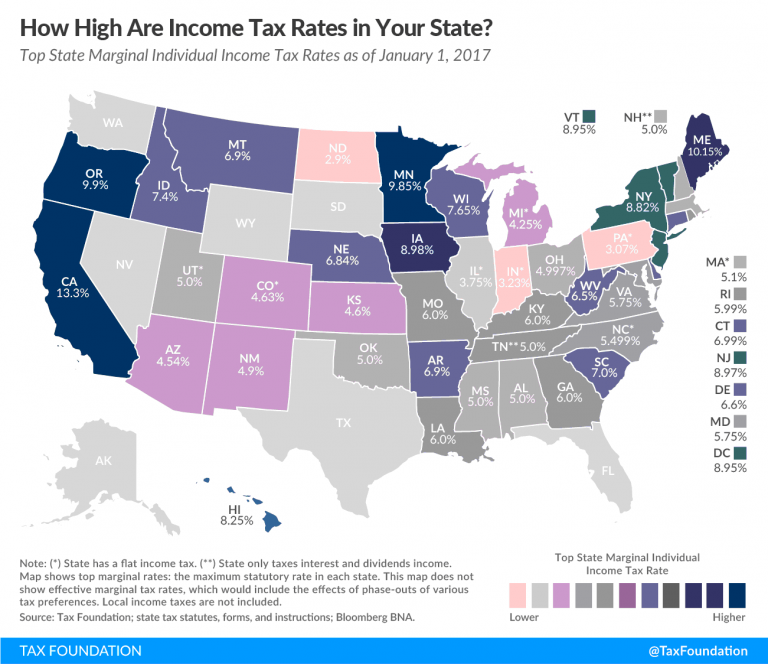

7 States That Do Not Tax Retirement Income

Every State With A Progressive Tax Also Taxes Retirement Income

Pay Less Retirement Taxes

Is Labor Taxable In New Jersey Best Reviews

Maximize Your Paycheck Understanding FICA Tax In 2023

Where Do Americans Take Their Retirement Income Tax Foundation

https://smartasset.com/retirement/new-york-retirement-taxes

New York is moderately tax friendly for retirees It does not tax Social Security benefits and provides seniors a sizable deduction of 20 000 on other types of retirement income Retirees in New York should have relatively low income tax bills

https://www.osc.ny.gov/retirement/retirees/taxes-and-your-pension

NYSLRS pensions are not subject to New York State or local income tax but if you move to another state that state may tax your pension Visit the Retired Public Employees Association website to see which states tax pensions

New York is moderately tax friendly for retirees It does not tax Social Security benefits and provides seniors a sizable deduction of 20 000 on other types of retirement income Retirees in New York should have relatively low income tax bills

NYSLRS pensions are not subject to New York State or local income tax but if you move to another state that state may tax your pension Visit the Retired Public Employees Association website to see which states tax pensions

Is Labor Taxable In New Jersey Best Reviews

Every State With A Progressive Tax Also Taxes Retirement Income

Maximize Your Paycheck Understanding FICA Tax In 2023

Where Do Americans Take Their Retirement Income Tax Foundation

Don t Dread The IRS Three Part Guide To Tackle Your Taxes Financial

The Most Common Sources Of Retirement Income SmartZone Finance

The Most Common Sources Of Retirement Income SmartZone Finance

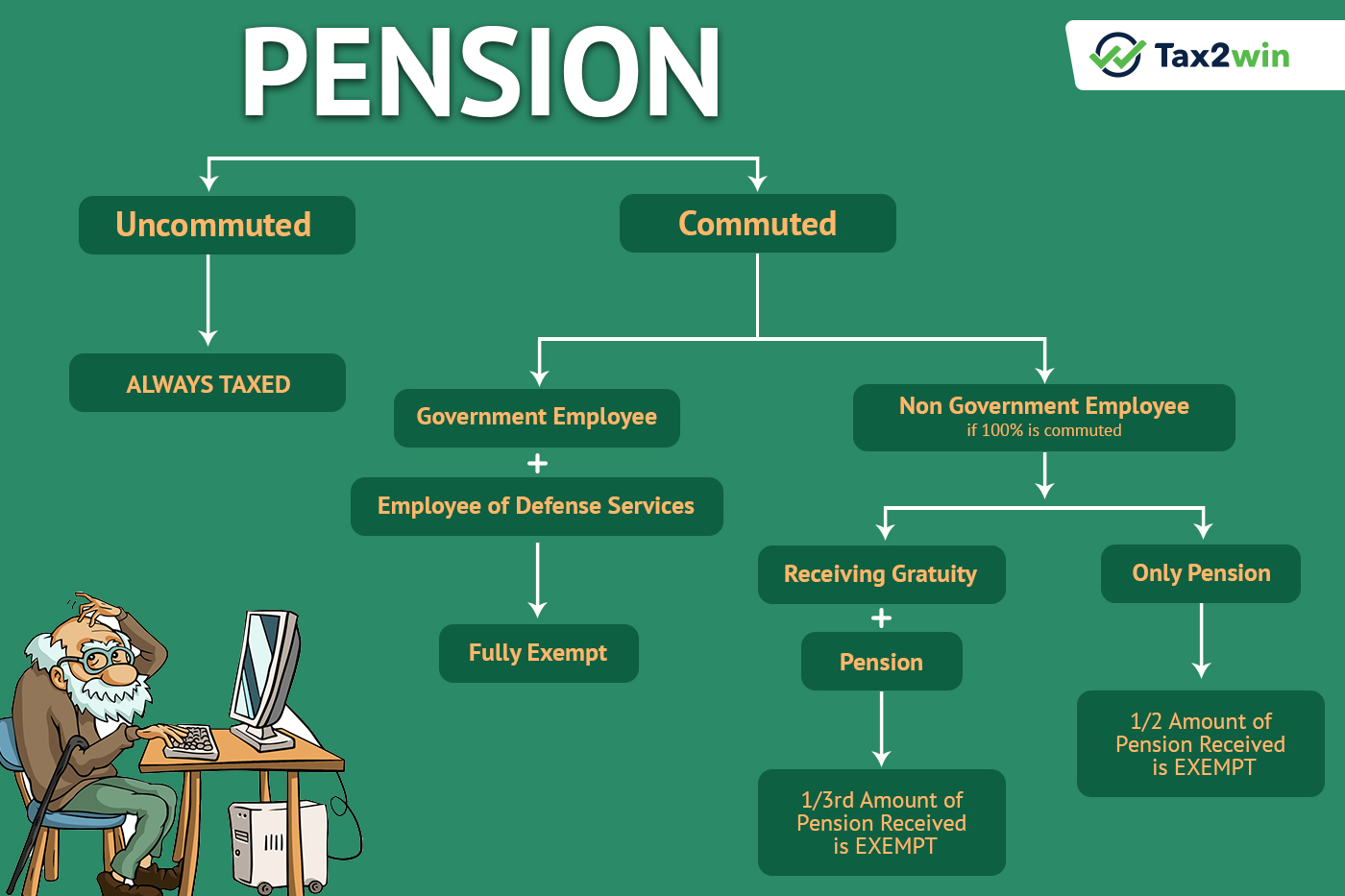

Income Tax Return For Pension Earners No More A Tedious Task Tax2win Blog