In this day and age where screens have become the dominant feature of our lives however, the attraction of tangible printed material hasn't diminished. It doesn't matter if it's for educational reasons or creative projects, or just adding a personal touch to your area, Is Provident Fund Contributions Tax Deductible are now an essential source. Here, we'll dive deeper into "Is Provident Fund Contributions Tax Deductible," exploring their purpose, where they can be found, and how they can be used to enhance different aspects of your daily life.

Get Latest Is Provident Fund Contributions Tax Deductible Below

Is Provident Fund Contributions Tax Deductible

Is Provident Fund Contributions Tax Deductible -

Note Own contributions that were not permitted as a deduction plus if any a tax free public sector portion previously transferred to the fund by the public sector fund can be

You are entitled to a deduction under section 11F of contributions to any pension fund provident fund or retirement annuity fund The contributions that may be

Is Provident Fund Contributions Tax Deductible cover a large collection of printable items that are available online at no cost. They are available in numerous styles, from worksheets to templates, coloring pages, and much more. The benefit of Is Provident Fund Contributions Tax Deductible is their versatility and accessibility.

More of Is Provident Fund Contributions Tax Deductible

How To Use Provident Fund For Property Purchase Detailed Guide

How To Use Provident Fund For Property Purchase Detailed Guide

This is a well known way to save on tax in 2024 Contributions towards any pension provident fund or retirement annuity RA are tax deductible up to a limit of

Employer s contribution and interest on employer s contribution Employer s contribution and interest on it is fully taxable It is taxed under the head salary in your

Is Provident Fund Contributions Tax Deductible have gained a lot of popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

The ability to customize: This allows you to modify the design to meet your needs, whether it's designing invitations to organize your schedule or even decorating your house.

-

Educational Value: Educational printables that can be downloaded for free are designed to appeal to students of all ages, which makes them a vital tool for teachers and parents.

-

Easy to use: You have instant access the vast array of design and templates can save you time and energy.

Where to Find more Is Provident Fund Contributions Tax Deductible

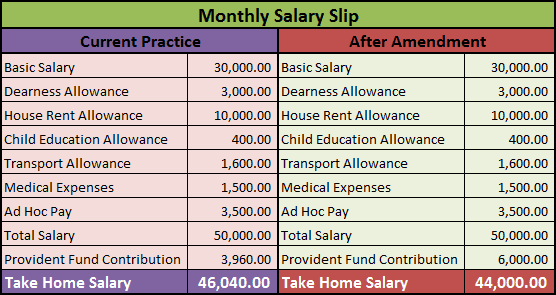

How Is The Employer s Contribution To EPF NPS Over 7 5 Lakh

How Is The Employer s Contribution To EPF NPS Over 7 5 Lakh

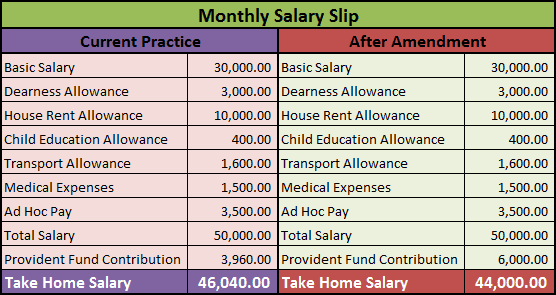

With an amendment in the Finance Act 2021 interest earned on a provident fund PF balance has come under the ambit of tax This has been effective from April

The Voluntary Provident Fund VPF allows additional contributions over 12 with the same interest rate VPF contributions are tax deductible under Section

We hope we've stimulated your curiosity about Is Provident Fund Contributions Tax Deductible Let's take a look at where you can locate these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of needs.

- Explore categories like decoration for your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free as well as flashcards and other learning tools.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs as well as templates for free.

- The blogs are a vast array of topics, ranging all the way from DIY projects to planning a party.

Maximizing Is Provident Fund Contributions Tax Deductible

Here are some ideas how you could make the most use of printables that are free:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use free printable worksheets to build your knowledge at home as well as in the class.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Get organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

Is Provident Fund Contributions Tax Deductible are an abundance of useful and creative resources that meet a variety of needs and desires. Their accessibility and versatility make them a wonderful addition to every aspect of your life, both professional and personal. Explore the vast world that is Is Provident Fund Contributions Tax Deductible today, and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes you can! You can download and print the resources for free.

-

Can I utilize free printables for commercial use?

- It is contingent on the specific rules of usage. Always verify the guidelines provided by the creator before utilizing their templates for commercial projects.

-

Do you have any copyright concerns when using Is Provident Fund Contributions Tax Deductible?

- Certain printables may be subject to restrictions concerning their use. Make sure to read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- Print them at home using any printer or head to the local print shops for the highest quality prints.

-

What software do I need to open printables for free?

- The majority of printed documents are in PDF format. They is open with no cost software like Adobe Reader.

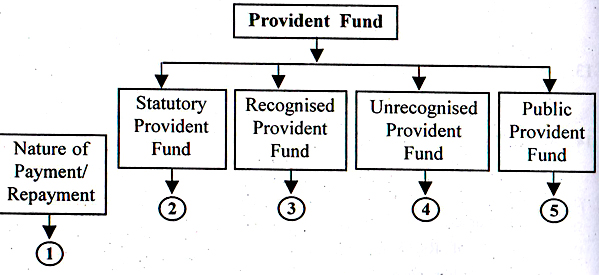

Types Of Provident Funds In India Fi Money

Graphical Chat Presentation Of Provident Fund Tax Treatement

Check more sample of Is Provident Fund Contributions Tax Deductible below

4 Types Of Provident Fund And Tax Treatment Of Provident Fund

4 Types Of Provident Fund And Tax Treatment Of Provident Fund

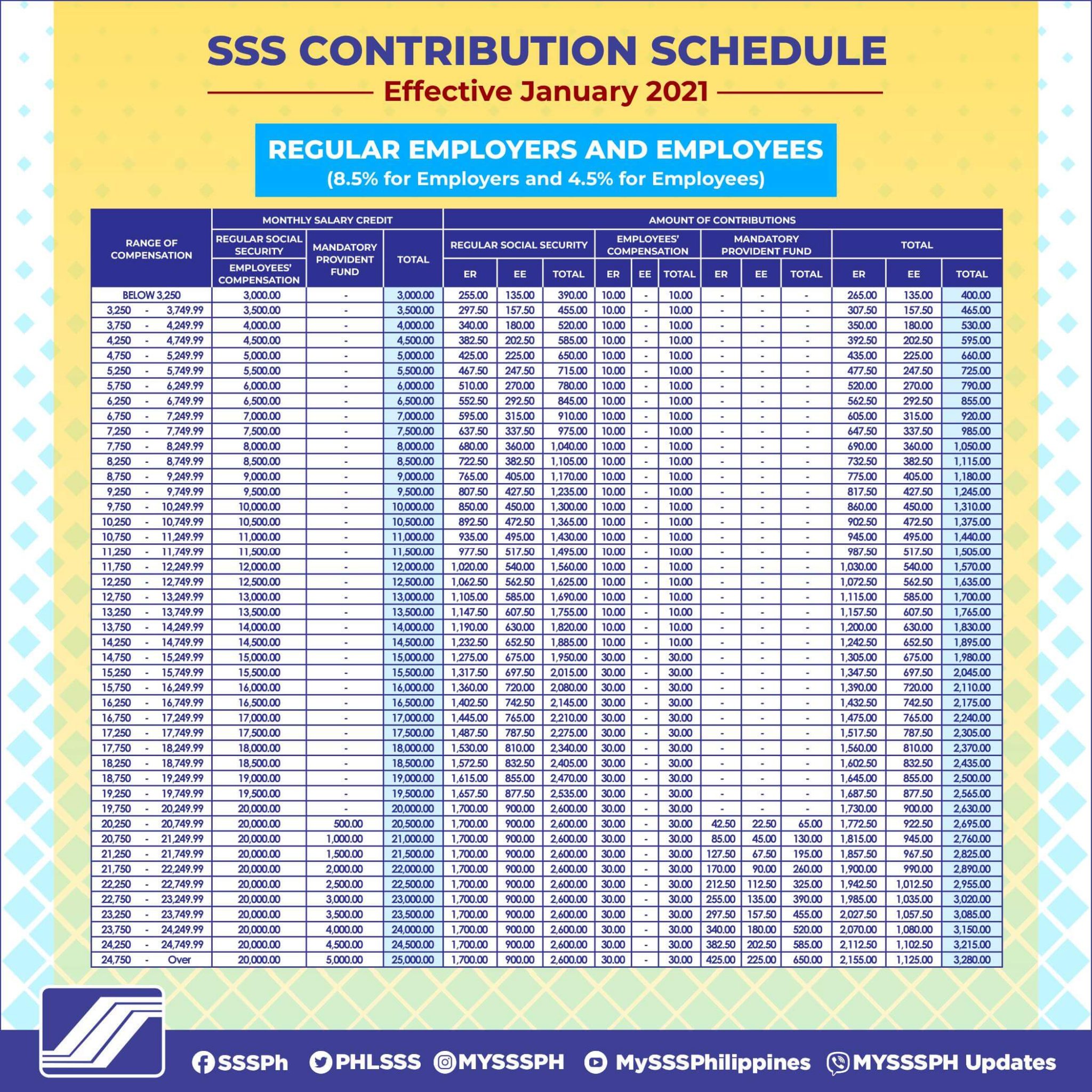

New Sss Contribution Table 2020 CLOUD HOT GIRL

PF

Provident Fund Meaning Types Taxation Example Vs Gratuity

Employees Provident Fund Registration Process Aapka Consultant

https://www.sars.gov.za/faq/faq-what-are-s11f...

You are entitled to a deduction under section 11F of contributions to any pension fund provident fund or retirement annuity fund The contributions that may be

https://incometaxmanagement.com/Pages/Tax-Ready...

Even a salaried employee can simultaneously become member of employees provident fund whether statutory recognised or unrecognised and public provident fund Any

You are entitled to a deduction under section 11F of contributions to any pension fund provident fund or retirement annuity fund The contributions that may be

Even a salaried employee can simultaneously become member of employees provident fund whether statutory recognised or unrecognised and public provident fund Any

PF

4 Types Of Provident Fund And Tax Treatment Of Provident Fund

Provident Fund Meaning Types Taxation Example Vs Gratuity

Employees Provident Fund Registration Process Aapka Consultant

Public Provident Fund PPF India Interest Benefit Withdrawals

What Is Epf And Socso Socso Contribution Table Rates Jadual

What Is Epf And Socso Socso Contribution Table Rates Jadual

What Businesses Should Know About Charitable Contributions Provident