Today, when screens dominate our lives and the appeal of physical printed materials hasn't faded away. Whether it's for educational purposes for creative projects, just adding some personal flair to your space, Is Petrol Reimbursement Taxable are now a vital source. We'll take a dive into the world "Is Petrol Reimbursement Taxable," exploring their purpose, where to find them, and how they can be used to enhance different aspects of your life.

Get Latest Is Petrol Reimbursement Taxable Below

Is Petrol Reimbursement Taxable

Is Petrol Reimbursement Taxable -

What if my employer just reimburses my petrol receipts or pays me a fixed sum each month towards fuel The only tax free way to receive reimbursement for business miles is using the

But unless employees track record and submit their exact vehicle mileage gas cards are considered taxable and ensuring tax compliance when distributing third party gift

Is Petrol Reimbursement Taxable cover a large range of printable, free items that are available online at no cost. They are available in a variety of designs, including worksheets templates, coloring pages, and many more. The appealingness of Is Petrol Reimbursement Taxable lies in their versatility as well as accessibility.

More of Is Petrol Reimbursement Taxable

What Is Petrol Reimbursement For Grade 26 In Optum Fishbowl

What Is Petrol Reimbursement For Grade 26 In Optum Fishbowl

Learn how mileage reimbursement can be taxable or non taxable depending on the rules and rates applied by your employer Find out the difference between accountable and non accountable plans standard and

Learn how to reimburse employees for business expenses and whether they are taxable Find out the difference between accountable and nonaccountable plans per diem rates and how to report reimbursements on

Is Petrol Reimbursement Taxable have gained a lot of appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies or expensive software.

-

Personalization The Customization feature lets you tailor print-ready templates to your specific requirements for invitations, whether that's creating them or arranging your schedule or decorating your home.

-

Educational Value The free educational worksheets cater to learners of all ages, which makes them a useful resource for educators and parents.

-

Affordability: Fast access an array of designs and templates cuts down on time and efforts.

Where to Find more Is Petrol Reimbursement Taxable

Vehicle Programs Is Mileage Reimbursement Taxable Motus

Vehicle Programs Is Mileage Reimbursement Taxable Motus

Such perquisites can be taxable or non taxable in nature These include simple benefits like fuel reimbursement a company provided car or accommodation etc Perquisites may also include

Learn how mileage reimbursements from your employer are taxed depending on whether they are paid under an accountable or a nonaccountable plan Find out the requirements rates and exceptions for each plan and how

Since we've got your curiosity about Is Petrol Reimbursement Taxable Let's find out where you can find these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Is Petrol Reimbursement Taxable to suit a variety of objectives.

- Explore categories such as decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets along with flashcards, as well as other learning materials.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs as well as templates for free.

- The blogs covered cover a wide variety of topics, everything from DIY projects to planning a party.

Maximizing Is Petrol Reimbursement Taxable

Here are some innovative ways in order to maximize the use use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use printable worksheets for free to aid in learning at your home (or in the learning environment).

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings or birthdays.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

Is Petrol Reimbursement Taxable are an abundance of practical and innovative resources for a variety of needs and interest. Their access and versatility makes them a valuable addition to every aspect of your life, both professional and personal. Explore the wide world that is Is Petrol Reimbursement Taxable today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is Petrol Reimbursement Taxable truly completely free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I utilize free printables in commercial projects?

- It's all dependent on the conditions of use. Be sure to read the rules of the creator prior to printing printables for commercial projects.

-

Do you have any copyright issues with Is Petrol Reimbursement Taxable?

- Certain printables might have limitations in use. Check the terms and conditions offered by the designer.

-

How do I print printables for free?

- Print them at home with either a printer at home or in a local print shop to purchase higher quality prints.

-

What software do I need to run printables free of charge?

- Most printables come as PDF files, which is open with no cost software such as Adobe Reader.

Petrol Prices OGRA Suggests Another Increase Of Rs12 PakWheels Blog

PETROL PRICES FOR JUNE 2016 EXPECTING ANOTHER HUGE PRICE HIKE AS FROM

Check more sample of Is Petrol Reimbursement Taxable below

Gas Mileage Reimbursement Form Excel Templates

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

Is Tuition Reimbursement Taxable For FICA Purposes CollegeReaction

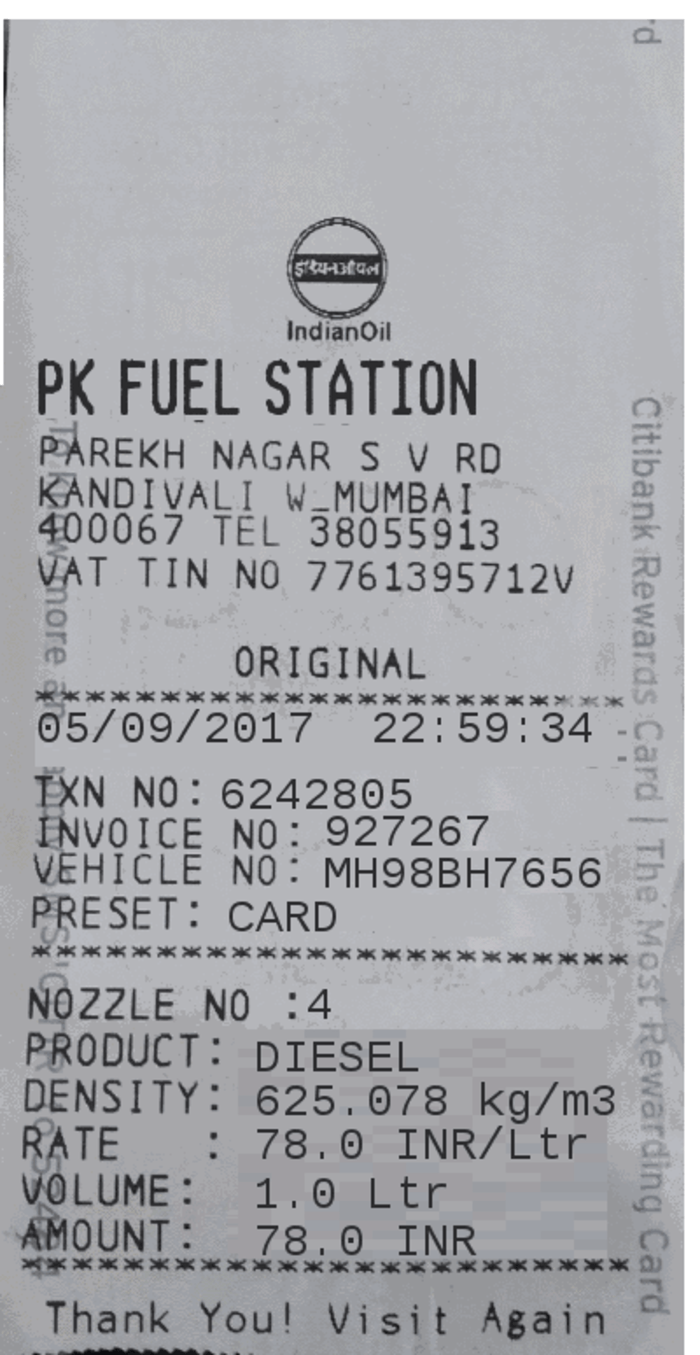

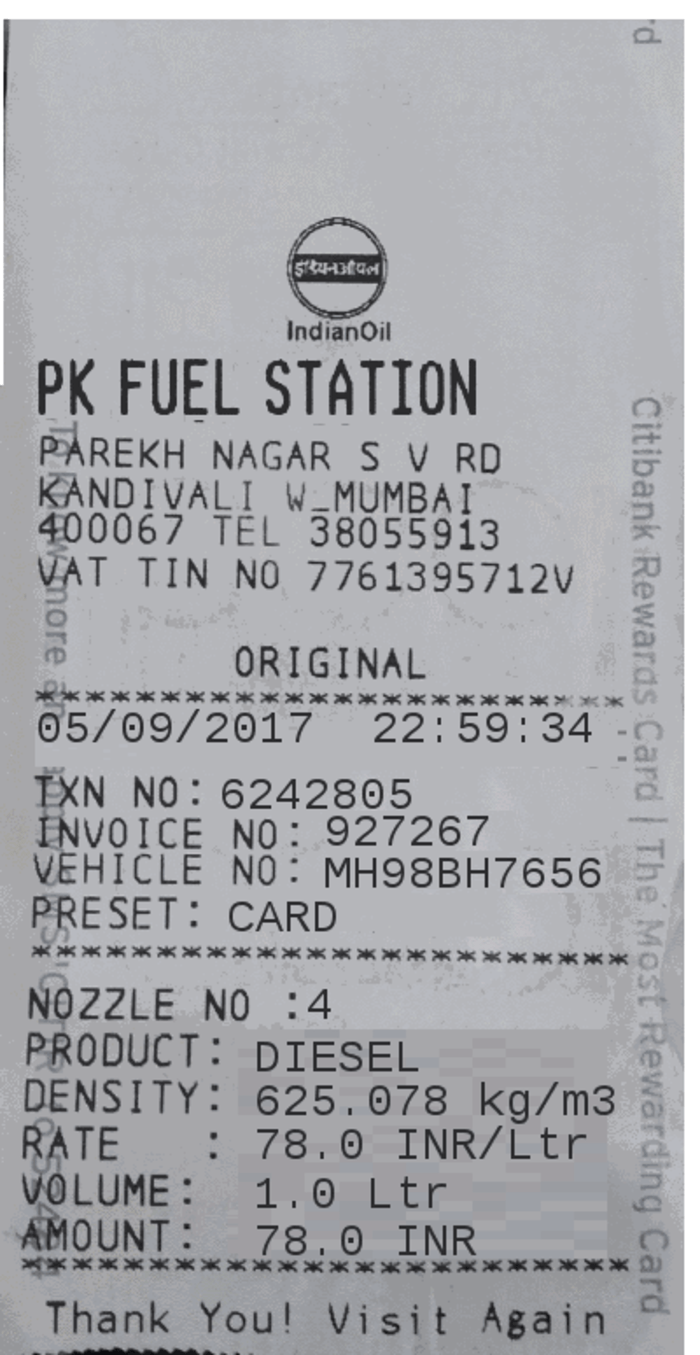

Gas Receipt Template

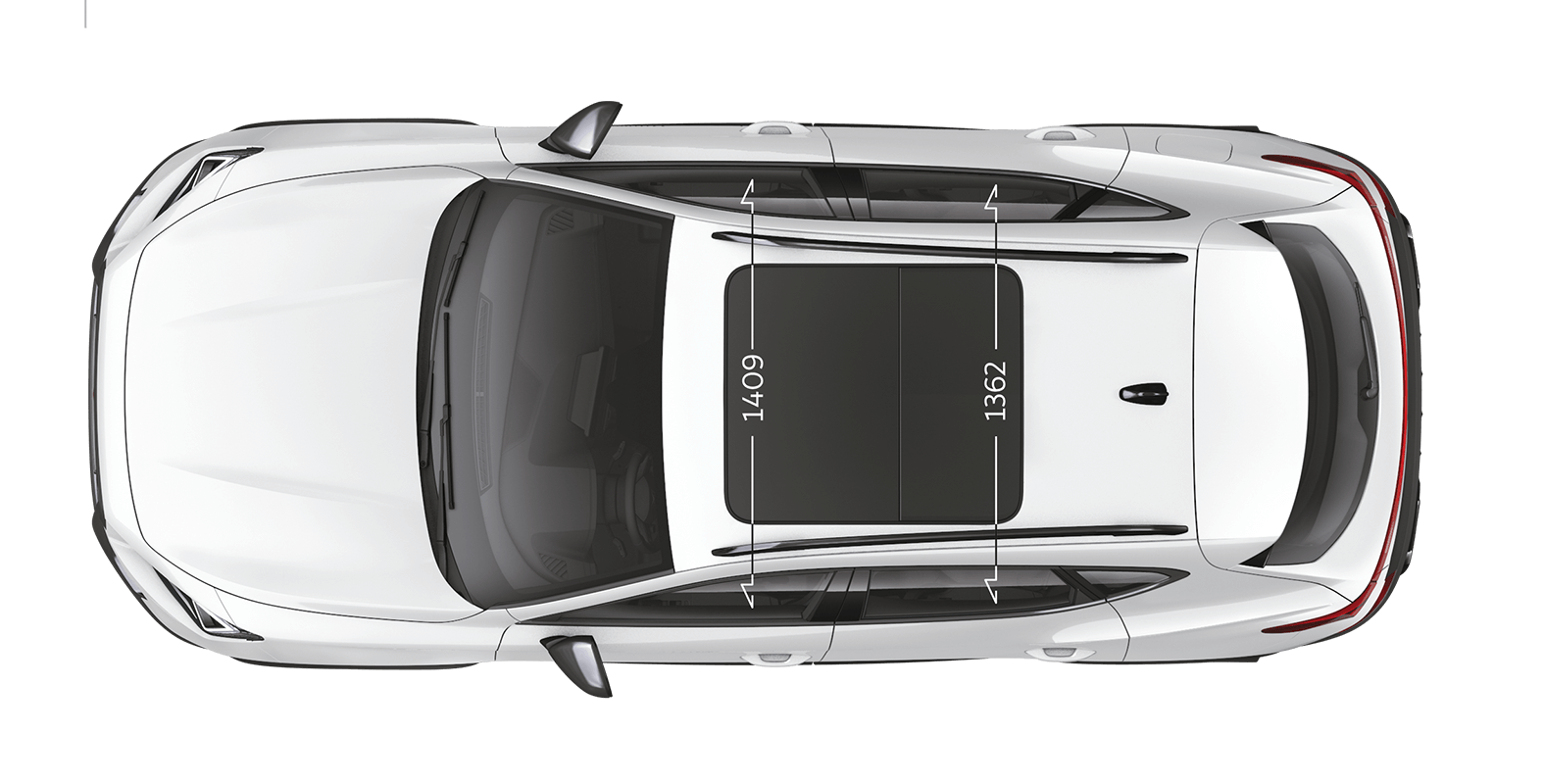

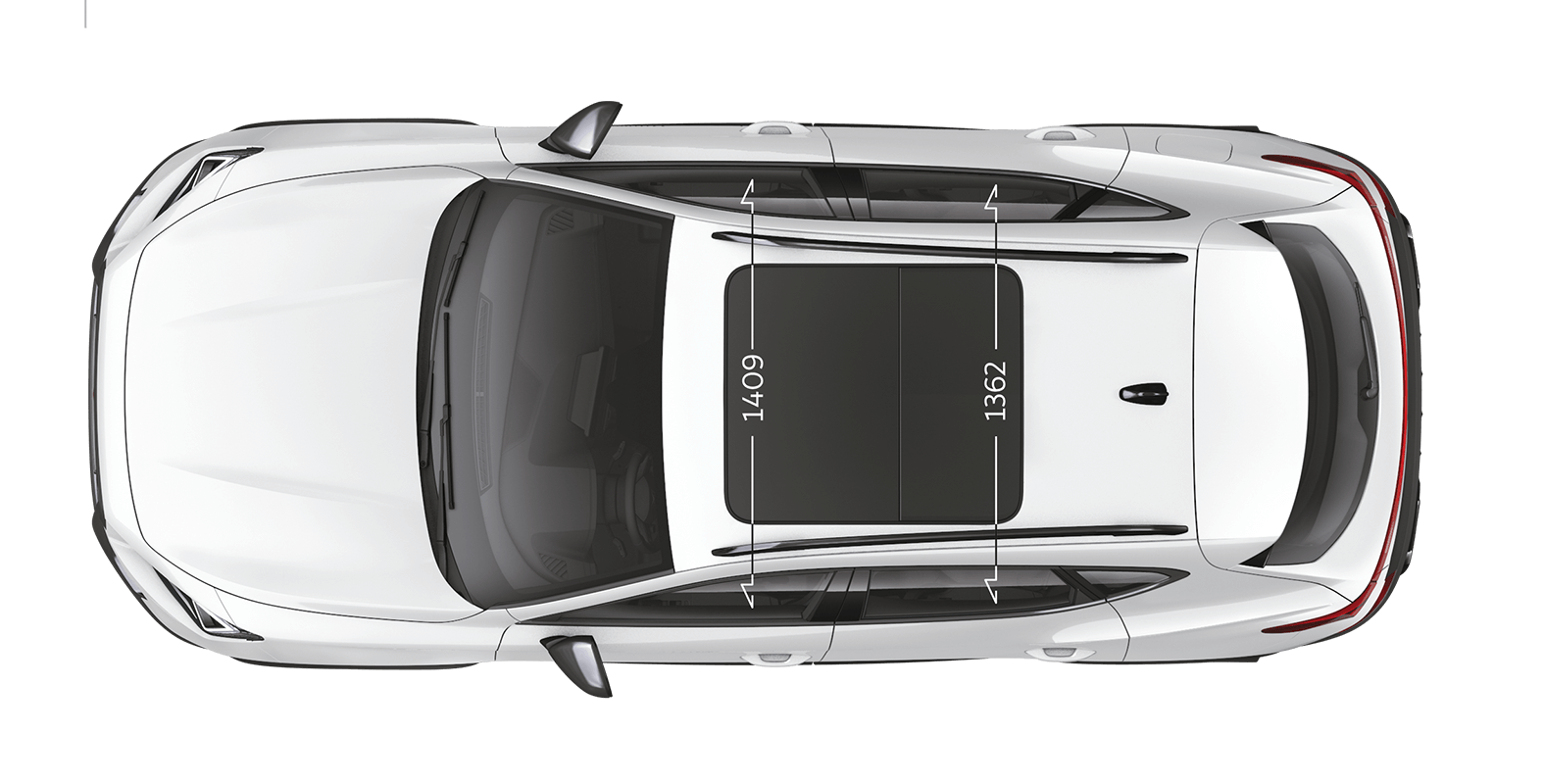

Petrol

Is Tuition Reimbursement Taxable A Guide ClearDegree

https://compt.io › blog › gas-stipends-common-questions

But unless employees track record and submit their exact vehicle mileage gas cards are considered taxable and ensuring tax compliance when distributing third party gift

https://www.irs.gov › pub › irs-pdf

The IRC may provide that a fringe benefit is taxable nontaxable partially taxable or tax deferred These terms are defined below Taxable Includible in gross income not excluded under any

But unless employees track record and submit their exact vehicle mileage gas cards are considered taxable and ensuring tax compliance when distributing third party gift

The IRC may provide that a fringe benefit is taxable nontaxable partially taxable or tax deferred These terms are defined below Taxable Includible in gross income not excluded under any

Gas Receipt Template

2023 Mileage Reimbursement Calculator Internal Revenue Code Simplified

Petrol

Is Tuition Reimbursement Taxable A Guide ClearDegree

What Is Healthcare Reimbursement Insurance Noon

File Petrol Pump Mp3h0355 jpg Wikipedia

File Petrol Pump Mp3h0355 jpg Wikipedia

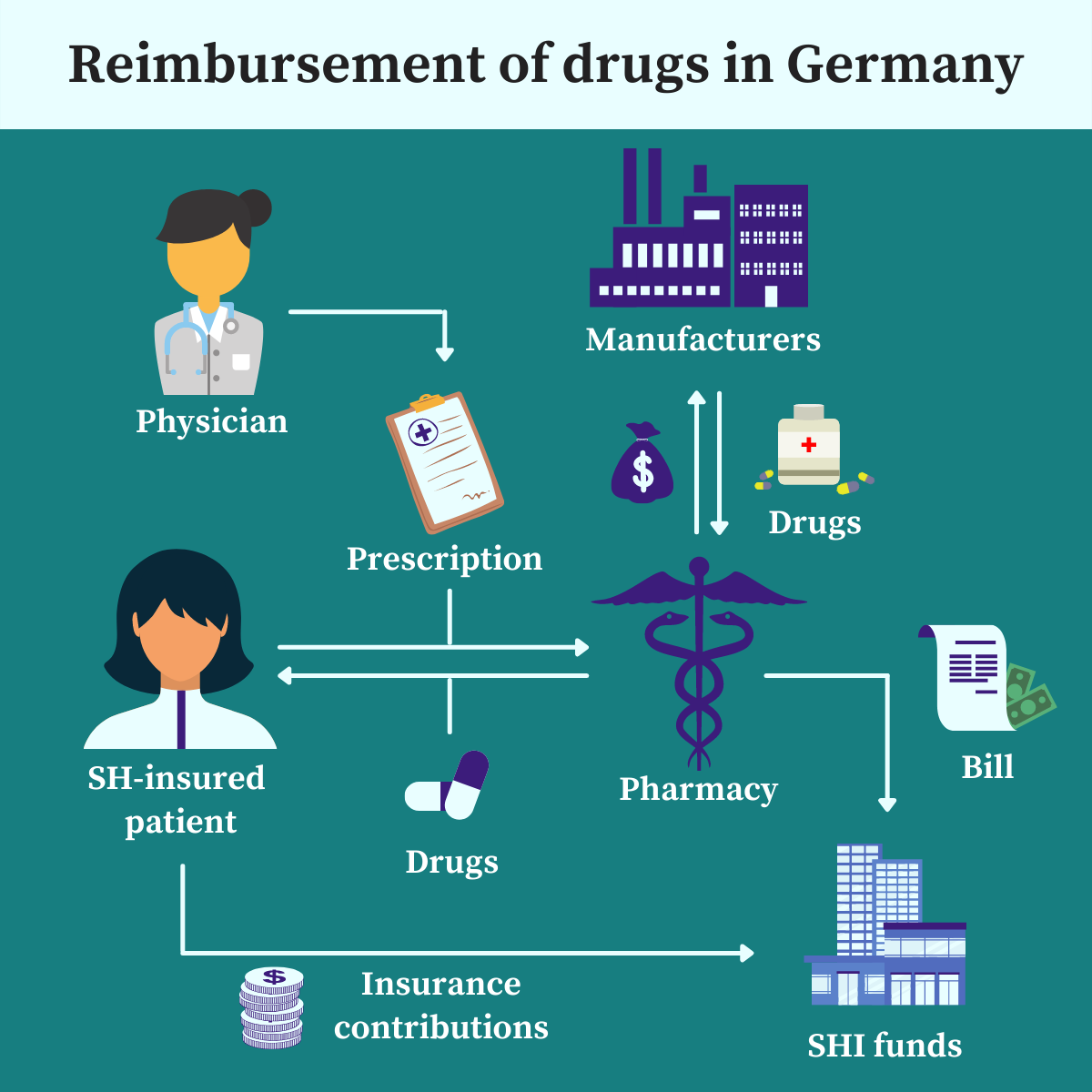

Are You Interested In Drug Reimbursement In Germany