Today, where screens dominate our lives yet the appeal of tangible printed products hasn't decreased. It doesn't matter if it's for educational reasons project ideas, artistic or simply adding an element of personalization to your area, Is Life Insurance Claim Taxable In India are now a useful resource. For this piece, we'll dive in the world of "Is Life Insurance Claim Taxable In India," exploring the different types of printables, where they are, and how they can enrich various aspects of your lives.

Get Latest Is Life Insurance Claim Taxable In India Below

Is Life Insurance Claim Taxable In India

Is Life Insurance Claim Taxable In India -

India Guidance on taxation of life insurance policy proceeds August 22 2023 The Central Board of Direct Taxes CBDT issued new guidance dated 16 August 2023 regarding the taxation of proceeds from life insurance policies Read an August 2023 report PDF 232 KB prepared by the KPMG member firm in India Print friendly

According to the new rules life insurance policies issued after 1 April 2023 will be eligible for tax exemption on maturity benefits under Section 10 10D of the Income Tax Act as long as the total premium paid annually does not exceed Rs 5 lakh

Is Life Insurance Claim Taxable In India offer a wide array of printable materials that are accessible online for free cost. These materials come in a variety of formats, such as worksheets, coloring pages, templates and many more. One of the advantages of Is Life Insurance Claim Taxable In India lies in their versatility as well as accessibility.

More of Is Life Insurance Claim Taxable In India

The Top Cash Value Life Insurance Tax Benefits For You

The Top Cash Value Life Insurance Tax Benefits For You

As per the Income Tax Act 1961 the provisions of Section10 10D offer tax exemption on the premiums paid to the insurance policy or the actual sum assured when the policy matures along with policy proceeds for nominee adhering to

Starting from the assessment year 2024 25 sums received from life insurance policies excluding unit linked insurance policies issued on or after April 1 2023 will no longer be exempt if the premium payable for any previous year during the policy s term exceeds Rs 5 lakh

Is Life Insurance Claim Taxable In India have gained immense popularity because of a number of compelling causes:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

customization You can tailor printing templates to your own specific requirements such as designing invitations to organize your schedule or even decorating your house.

-

Education Value Education-related printables at no charge can be used by students of all ages, which makes these printables a powerful tool for parents and teachers.

-

Accessibility: Access to a plethora of designs and templates helps save time and effort.

Where to Find more Is Life Insurance Claim Taxable In India

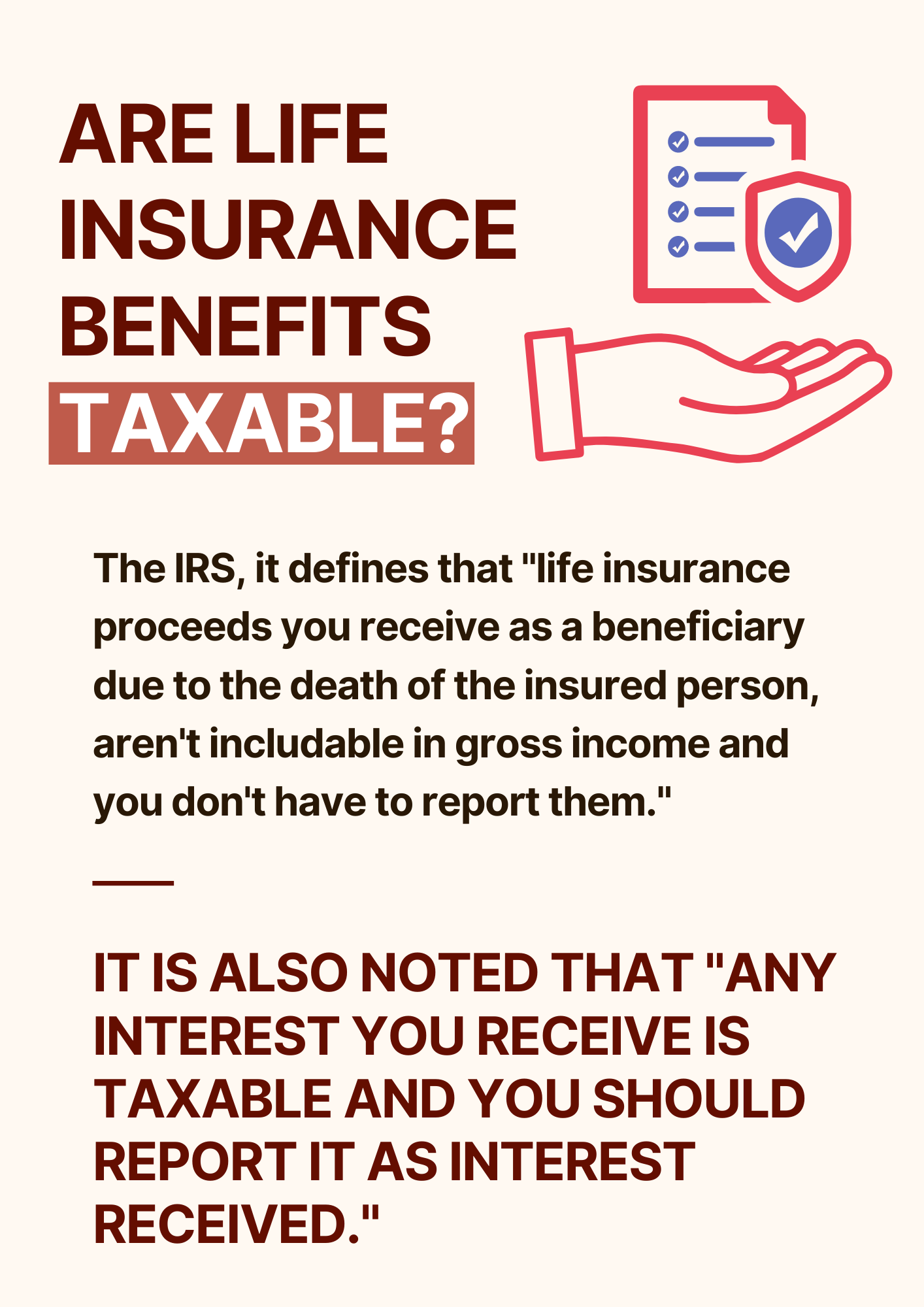

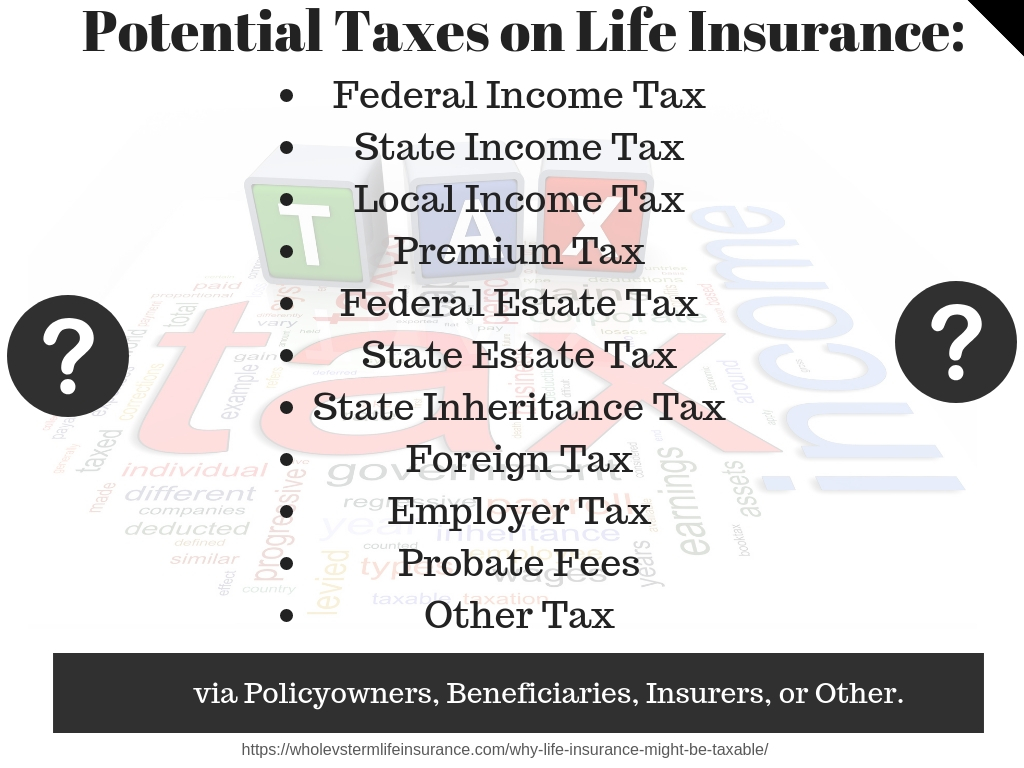

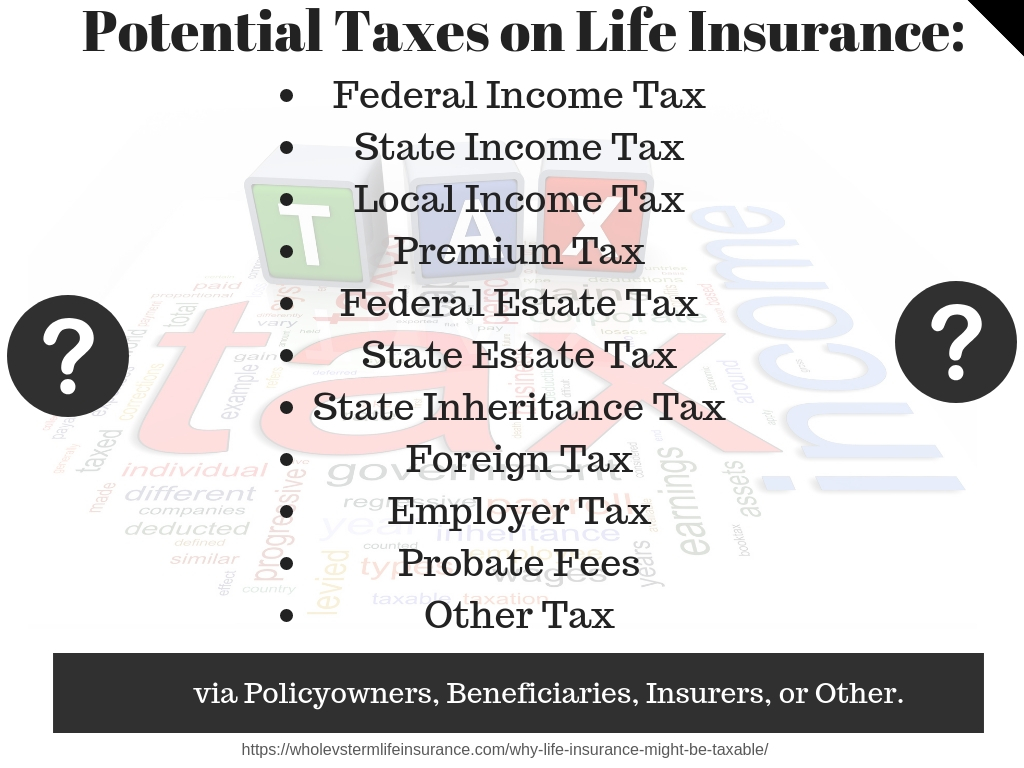

Why Life Insurance Might Be Taxable Whole Vs Term Life

Why Life Insurance Might Be Taxable Whole Vs Term Life

Scenario 1 You purchased a life insurance policy in April 2022 for Rs 10 000 000 cover and the premium payable is Rs 600 000 each year for 10 years The proceeds receivable from such policy would be tax exempt on maturity Scenario 2 Now let s assume you purchased the same policy in July 2023 instead of April 2022

You can claim a maximum of Rs 75 000 tax benefit under this section and Section 10 10D You can get tax exemption on the benefit payout received from life insurance policies as per the new Budget 2023 2024 Note Tax benefits are

We've now piqued your curiosity about Is Life Insurance Claim Taxable In India Let's look into where you can find these gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of printables that are free for a variety of goals.

- Explore categories like decorating your home, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often provide worksheets that can be printed for free Flashcards, worksheets, and other educational tools.

- This is a great resource for parents, teachers as well as students searching for supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs are a vast selection of subjects, that range from DIY projects to party planning.

Maximizing Is Life Insurance Claim Taxable In India

Here are some ideas create the maximum value of Is Life Insurance Claim Taxable In India:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations to adorn your living areas.

2. Education

- Utilize free printable worksheets to enhance learning at home, or even in the classroom.

3. Event Planning

- Design invitations, banners, as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

Is Life Insurance Claim Taxable In India are a treasure trove of practical and imaginative resources which cater to a wide range of needs and hobbies. Their accessibility and flexibility make them a valuable addition to both personal and professional life. Explore the world of Is Life Insurance Claim Taxable In India today and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are Is Life Insurance Claim Taxable In India truly available for download?

- Yes, they are! You can download and print these free resources for no cost.

-

Can I download free templates for commercial use?

- It's determined by the specific terms of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Are there any copyright rights issues with Is Life Insurance Claim Taxable In India?

- Certain printables could be restricted concerning their use. You should read the terms and conditions provided by the designer.

-

How do I print printables for free?

- You can print them at home with your printer or visit an in-store print shop to get the highest quality prints.

-

What software do I require to view printables that are free?

- Many printables are offered as PDF files, which can be opened using free programs like Adobe Reader.

Are Insurance Claim Checks Taxable Income The Oasis Firm Credit

What Is Life Insurance Benefits Of Life Insurance

Check more sample of Is Life Insurance Claim Taxable In India below

Benefits Of Buying A Life Insurance Plan In India

Is Life Insurance Taxable To The Beneficiary YouTube

Are Life Insurance Benefits Taxable Best Philippine Insurance

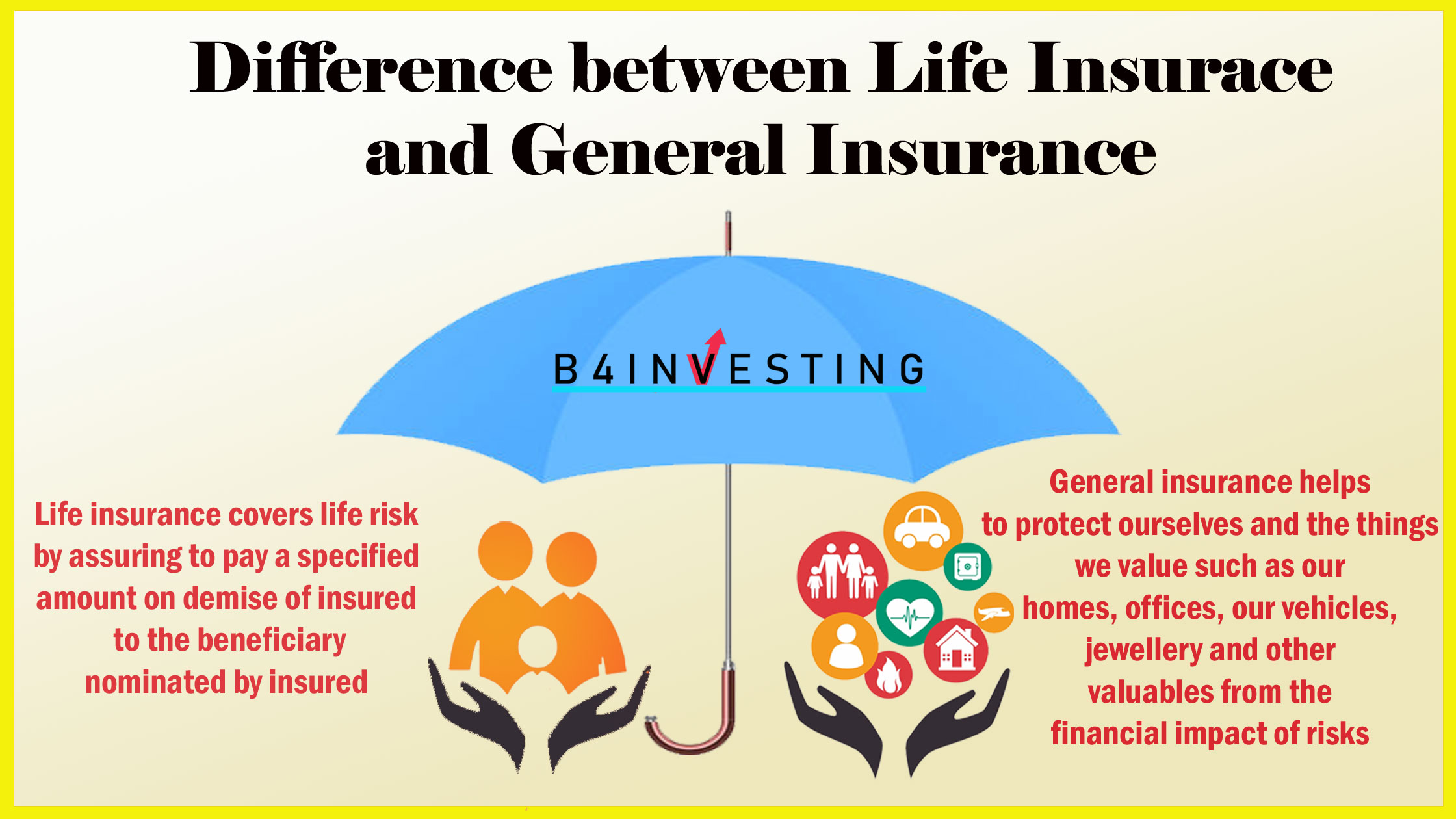

Difference Between Life Insurance And General Insurance B4INVESTING

When Is Life Insurance Taxable Action Economics

Why Life Insurance Might Be Taxable Whole Vs Term Life

https://taxguru.in/income-tax/income-tax-rules...

According to the new rules life insurance policies issued after 1 April 2023 will be eligible for tax exemption on maturity benefits under Section 10 10D of the Income Tax Act as long as the total premium paid annually does not exceed Rs 5 lakh

https://www.businesstoday.in/personal-finance/tax/...

The income tax department has issued a new circular clarifying rules on the taxability of non unit linked life insurance policies This follows the Budget announcement that the maturity amount

According to the new rules life insurance policies issued after 1 April 2023 will be eligible for tax exemption on maturity benefits under Section 10 10D of the Income Tax Act as long as the total premium paid annually does not exceed Rs 5 lakh

The income tax department has issued a new circular clarifying rules on the taxability of non unit linked life insurance policies This follows the Budget announcement that the maturity amount

Difference Between Life Insurance And General Insurance B4INVESTING

Is Life Insurance Taxable To The Beneficiary YouTube

When Is Life Insurance Taxable Action Economics

Why Life Insurance Might Be Taxable Whole Vs Term Life

Is Life Insurance An Asset Life Insurance Insurance Asset

5 Reasons Why Life Insurance Is Important GetInsurance

5 Reasons Why Life Insurance Is Important GetInsurance

Everything You Need To Know About Life Insurance Insurance Industry