In the digital age, in which screens are the norm and the appeal of physical printed items hasn't gone away. In the case of educational materials or creative projects, or just adding a personal touch to your space, Is Ira Contribution Tax Deductible In California are now a vital source. This article will dive into the world "Is Ira Contribution Tax Deductible In California," exploring the benefits of them, where they are available, and the ways that they can benefit different aspects of your life.

Get Latest Is Ira Contribution Tax Deductible In California Below

Is Ira Contribution Tax Deductible In California

Is Ira Contribution Tax Deductible In California -

1 Traditional IRA deduction One of the biggest and most important deductions that Californians can get on state income taxes which is also the same as the federal deduction is

The SECURE Act repealed the maximum age of 70 for traditional IRA contributions California law does not conform to this federal provision FTB Publication 1005

Printables for free cover a broad range of printable, free items that are available online at no cost. The resources are offered in a variety formats, such as worksheets, templates, coloring pages and much more. The appeal of printables for free lies in their versatility and accessibility.

More of Is Ira Contribution Tax Deductible In California

Savings Account Vs Roth IRA What s The Difference

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png)

Savings Account Vs Roth IRA What s The Difference

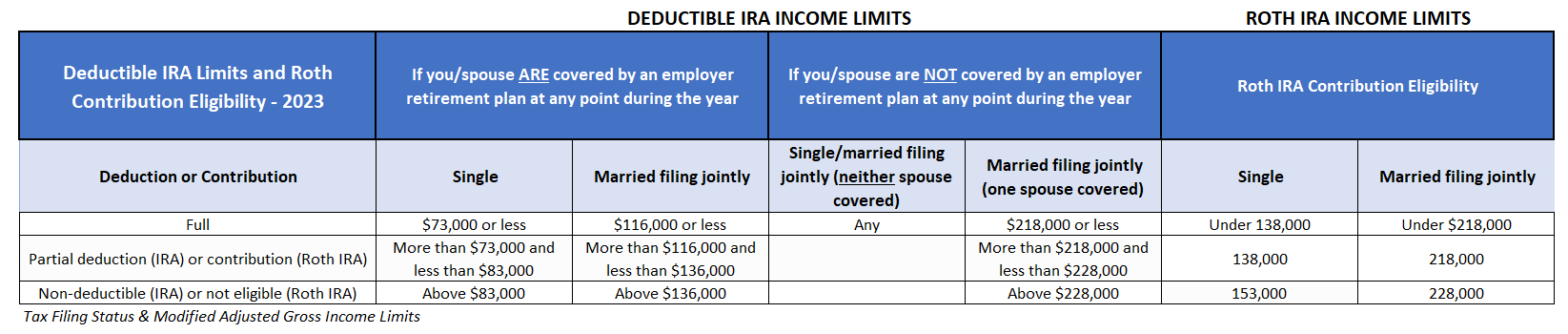

Your IRA contribution may be tax deductible depending on a few things the type of IRA you have whether you re covered by a workplace retirement plan your filing status and your

Withholding from an IRA distribution for California income taxes is not mandatory However most financial firms will automatically withhold 10 percent of the amount withheld for federal

Is Ira Contribution Tax Deductible In California have gained a lot of popularity due to several compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies or costly software.

-

customization There is the possibility of tailoring designs to suit your personal needs, whether it's designing invitations as well as organizing your calendar, or even decorating your home.

-

Educational Benefits: These Is Ira Contribution Tax Deductible In California provide for students from all ages, making them a valuable instrument for parents and teachers.

-

Convenience: Fast access a plethora of designs and templates saves time and effort.

Where to Find more Is Ira Contribution Tax Deductible In California

IRS Announces 2023 HSA Limits Blog Medcom Benefits

IRS Announces 2023 HSA Limits Blog Medcom Benefits

IRA contribution limit increased for 2024 Beginning in 2024 the IRA contribution limit is increased to 7 000 8 000 for individuals age 50 or older from 6 500 7 500 for individuals age 50 or

Is a contribution to an individual retirement account IRA tax deductible For many of us the short answer is You bet That s what IRAs are for however there are rules and limits

If we've already piqued your interest in printables for free Let's take a look at where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Is Ira Contribution Tax Deductible In California designed for a variety motives.

- Explore categories like furniture, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets for flashcards, lessons, and worksheets. materials.

- The perfect resource for parents, teachers and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs covered cover a wide selection of subjects, all the way from DIY projects to party planning.

Maximizing Is Ira Contribution Tax Deductible In California

Here are some creative ways how you could make the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Print free worksheets for teaching at-home for the classroom.

3. Event Planning

- Design invitations and banners and other decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Is Ira Contribution Tax Deductible In California are an abundance of creative and practical resources that meet a variety of needs and preferences. Their accessibility and versatility make them a wonderful addition to both professional and personal lives. Explore the wide world of Is Ira Contribution Tax Deductible In California today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really cost-free?

- Yes you can! You can print and download these files for free.

-

Can I use the free printouts for commercial usage?

- It's dependent on the particular terms of use. Always verify the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Some printables could have limitations regarding their use. Make sure to read the terms and conditions offered by the designer.

-

How do I print printables for free?

- Print them at home using an printer, or go to the local print shops for the highest quality prints.

-

What software do I require to view printables at no cost?

- The majority are printed in the PDF format, and can be opened using free programs like Adobe Reader.

SEP IRA Vs Roth IRA Definition How To Set Up Major Differences

Are IRA Contributions Tax Deductible Alto

Check more sample of Is Ira Contribution Tax Deductible In California below

Max Ira Contribution Choosing Your Gold IRA

Max Ira Contribution 2022 Over 50 Choosing Your Gold IRA

2023 Irs Contribution Limits And Tax Rates By Kristin Mckenna Harvest

Can You Make A Deductible IRA Contribution

Roth Ira Growth Calculator GarveenIndia

2023 Dcfsa Limits 2023 Calendar

https://ttlc.intuit.com/community/state-taxes/...

The SECURE Act repealed the maximum age of 70 for traditional IRA contributions California law does not conform to this federal provision FTB Publication 1005

:max_bytes(150000):strip_icc()/savingsvs.ira_V1-b63b805de8554f589543be193cad9857.png?w=186)

https://pocketsense.com/california-ira-deduction-rules-6736309.html

Are IRA Contributions Tax Deductible in California The maximum California IRA deduction limit is the same thing as the contribution limit That means either 6 000 or 7 000

The SECURE Act repealed the maximum age of 70 for traditional IRA contributions California law does not conform to this federal provision FTB Publication 1005

Are IRA Contributions Tax Deductible in California The maximum California IRA deduction limit is the same thing as the contribution limit That means either 6 000 or 7 000

Can You Make A Deductible IRA Contribution

Max Ira Contribution 2022 Over 50 Choosing Your Gold IRA

Roth Ira Growth Calculator GarveenIndia

2023 Dcfsa Limits 2023 Calendar

2023 IRS Contribution Limits And Tax Rates

Entering IRA Contributions In A 1040 Return In ProSeries

Entering IRA Contributions In A 1040 Return In ProSeries

Investment Expenses What s Tax Deductible Charles Schwab