In the age of digital, where screens rule our lives and the appeal of physical, printed materials hasn't diminished. In the case of educational materials as well as creative projects or simply adding an individual touch to your area, Is House Rent Taxable In India have become an invaluable source. Through this post, we'll dive into the world "Is House Rent Taxable In India," exploring what they are, how they are available, and how they can add value to various aspects of your daily life.

Get Latest Is House Rent Taxable In India Below

Is House Rent Taxable In India

Is House Rent Taxable In India -

Learn what is house rent allowance HRA including eligibility criteria documents required Check out HRA taxation rules in India HRA calculator FAQs

Any amount received from renting a residential property a shop a building or a factory building is taxable The tax on rental income is determined after deducting municipal taxes standard deduction and

Printables for free cover a broad variety of printable, downloadable resources available online for download at no cost. They come in many kinds, including worksheets coloring pages, templates and more. The benefit of Is House Rent Taxable In India is in their variety and accessibility.

More of Is House Rent Taxable In India

Reasons You Should Rent Out Your Home And Not Sell Ankor Management

Reasons You Should Rent Out Your Home And Not Sell Ankor Management

Frequently Asked Questions What is HRA House Rent Allowance In Income Tax HRA is defined as a house rent allowance It is the amount paid by the employer to the employees to help them meet living costs in rented accommodation

HRA is not entirely taxable even though it is a part of your salary A portion of HRA is excluded from taxation under Section 10 13A of the Income Tax Act of 1961 subject to some provisions Until calculating taxable income the sum of HRA exemption is deducted from the overall income which allows an individual to save money on taxes

Printables for free have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

customization: You can tailor printables to your specific needs such as designing invitations, organizing your schedule, or decorating your home.

-

Educational Worth: Printing educational materials for no cost offer a wide range of educational content for learners from all ages, making them a great tool for teachers and parents.

-

Easy to use: Fast access the vast array of design and templates saves time and effort.

Where to Find more Is House Rent Taxable In India

Solved Please Note That This Is Based On Philippine Tax System Please

Solved Please Note That This Is Based On Philippine Tax System Please

In India rental income is taxed at a rate of 30 per cent under the income category from house property To qualify for tax exemptions and standard deductions under the Income Tax Act the individual must be the legal owner of the property What Are The Tax Implications On Rental Income

Rental income from the property situated in India is taxable in the hands of the owner of the house property whether it is for an NRI or a resident Indian Taxation rules are the same for both

After we've peaked your curiosity about Is House Rent Taxable In India Let's see where you can discover these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Is House Rent Taxable In India to suit a variety of uses.

- Explore categories such as decorating your home, education, crafting, and organization.

2. Educational Platforms

- Forums and educational websites often offer worksheets with printables that are free or flashcards as well as learning tools.

- The perfect resource for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a broad array of topics, ranging all the way from DIY projects to planning a party.

Maximizing Is House Rent Taxable In India

Here are some ideas to make the most use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes or festive decorations to decorate your living spaces.

2. Education

- Use printable worksheets for free to build your knowledge at home, or even in the classroom.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Is House Rent Taxable In India are an abundance of practical and innovative resources which cater to a wide range of needs and preferences. Their availability and versatility make them a fantastic addition to both professional and personal lives. Explore the endless world of Is House Rent Taxable In India right now and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes you can! You can print and download the resources for free.

-

Can I use the free printables for commercial use?

- It's all dependent on the usage guidelines. Always check the creator's guidelines before using printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables may come with restrictions concerning their use. Be sure to review the terms of service and conditions provided by the designer.

-

How do I print Is House Rent Taxable In India?

- Print them at home with an printer, or go to an in-store print shop to get premium prints.

-

What software do I need to open Is House Rent Taxable In India?

- The majority of printables are in PDF format, which is open with no cost software, such as Adobe Reader.

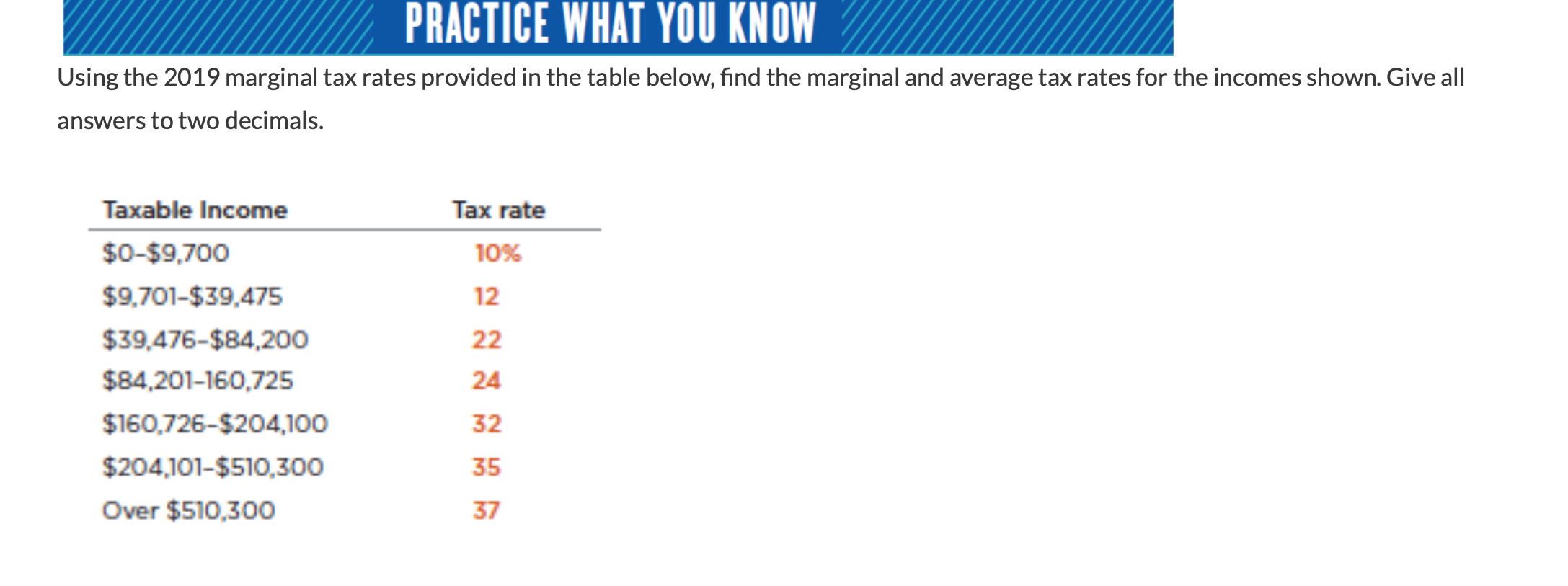

Solved What Would Be Your Federal Income Tax If Your Taxable Chegg

Whether Gratuity Taxable Or Not Income Tax Calculation On Gratuity

Check more sample of Is House Rent Taxable In India below

All You Need To Know About The Taxable Nontaxable And Partially

The Second Biggest Expense For Homeowners After The Mortgage Is

Budget 2022 Different Types Of Taxable Incomes Income Tax Slab Rates

Taxable Income Calculator India

Income Taxable Only If An Individual Is A Resident Indian Mint

Solved Problem 3 27 LO 1 Compute The Taxable Income For Chegg

https://www.99acres.com/articles/how-is-rental-income-taxed.html

Any amount received from renting a residential property a shop a building or a factory building is taxable The tax on rental income is determined after deducting municipal taxes standard deduction and

https://taxguru.in/income-tax/house-rent-allowance...

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

Any amount received from renting a residential property a shop a building or a factory building is taxable The tax on rental income is determined after deducting municipal taxes standard deduction and

HRA is covered under Section 10 13A of Income Tax Act 1961 Salaried Employees who live in a Rented house can claim HRA to lower their taxes partially or wholly The decision of how much HRA needs to be paid is made by employer Part of Salary is apportioned to HRA 1 CONDITIONS FOR CLAIMING HRA EXEMPTION

Taxable Income Calculator India

The Second Biggest Expense For Homeowners After The Mortgage Is

Income Taxable Only If An Individual Is A Resident Indian Mint

Solved Problem 3 27 LO 1 Compute The Taxable Income For Chegg

Cherish Childhood Memories Quotes

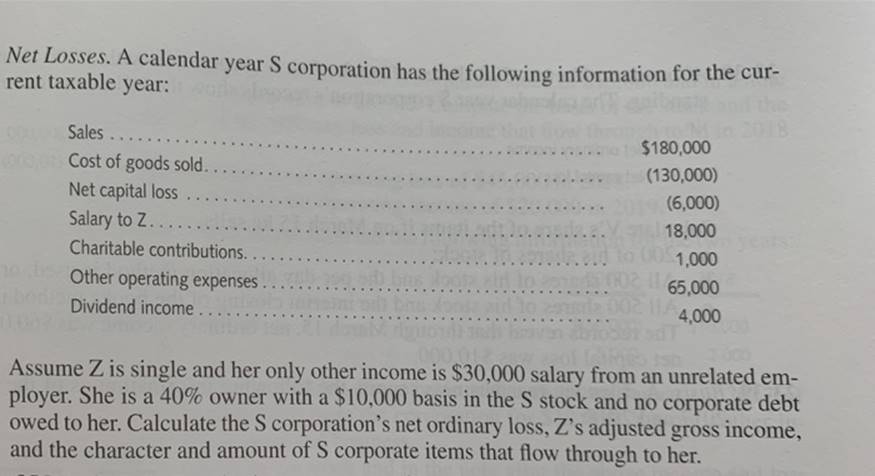

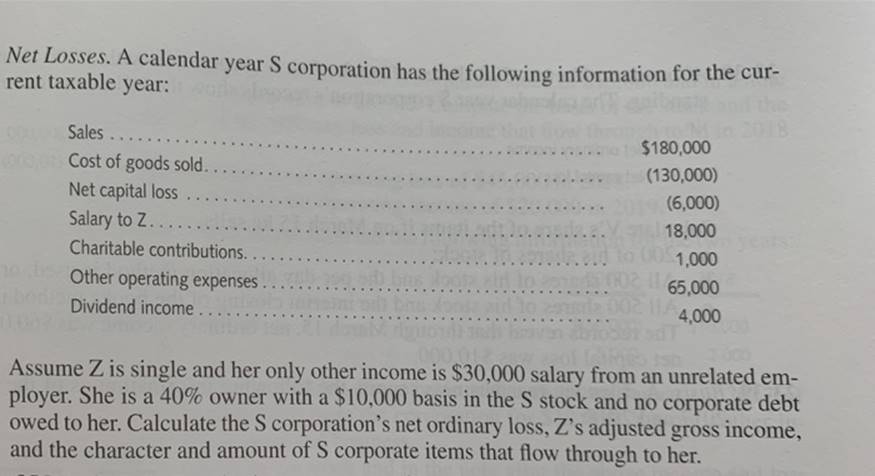

Get Answer Net Losses A Calendar Year S Corporation Has The

Get Answer Net Losses A Calendar Year S Corporation Has The

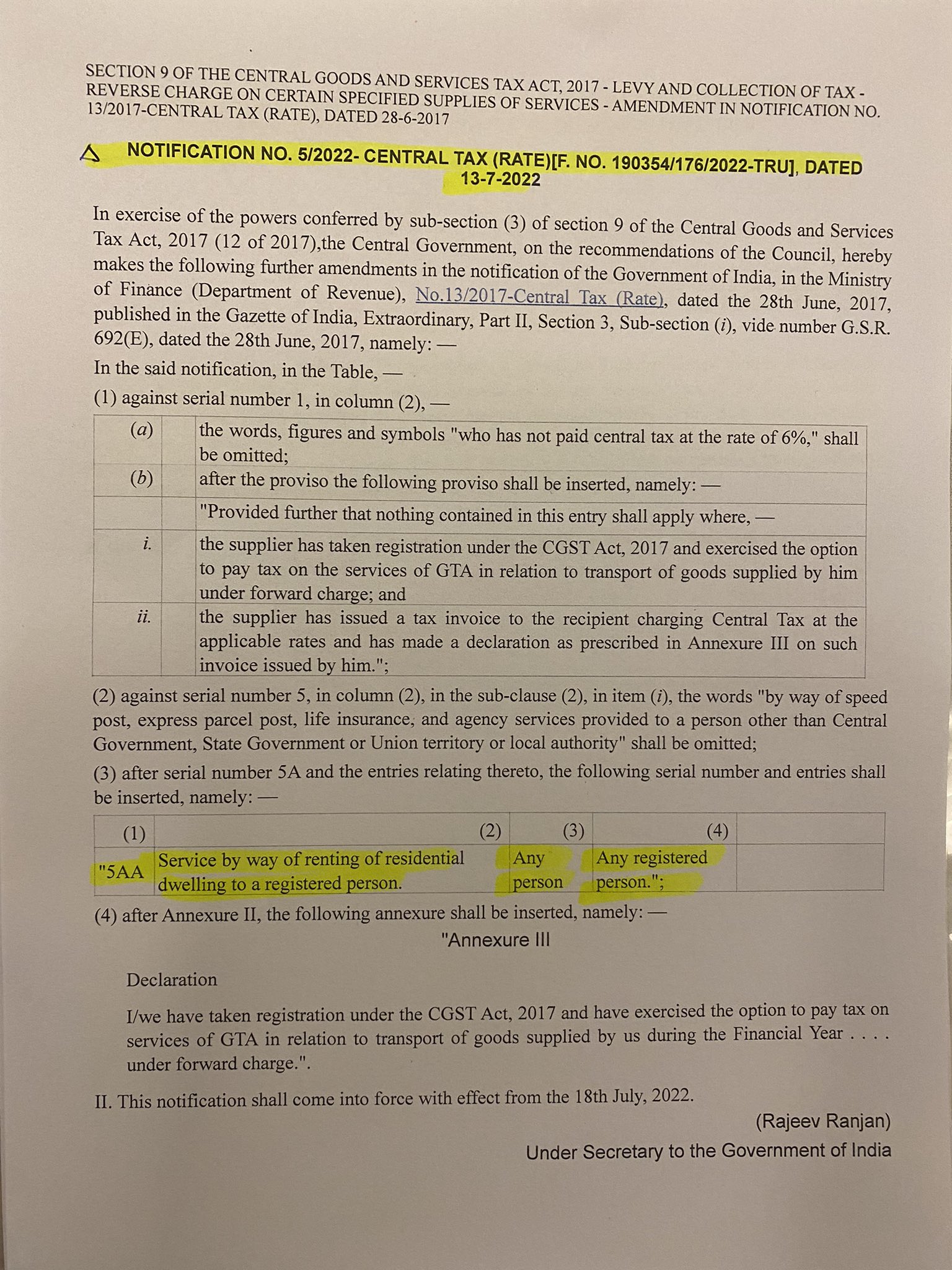

PIB Fact Check On Twitter Claim 18 GST On House Rent For Tenants N