In this digital age, with screens dominating our lives The appeal of tangible printed materials hasn't faded away. No matter whether it's for educational uses as well as creative projects or simply to add an individual touch to the home, printables for free are a great source. With this guide, you'll dive through the vast world of "Is Fuel Reimbursement Taxable Income," exploring the benefits of them, where to get them, as well as the ways that they can benefit different aspects of your lives.

Get Latest Is Fuel Reimbursement Taxable Income Below

Is Fuel Reimbursement Taxable Income

Is Fuel Reimbursement Taxable Income -

Generally your employer must include the value of the use or availability of the vehicle in your income However there are exceptions if the use of the vehicle qualifies as a working

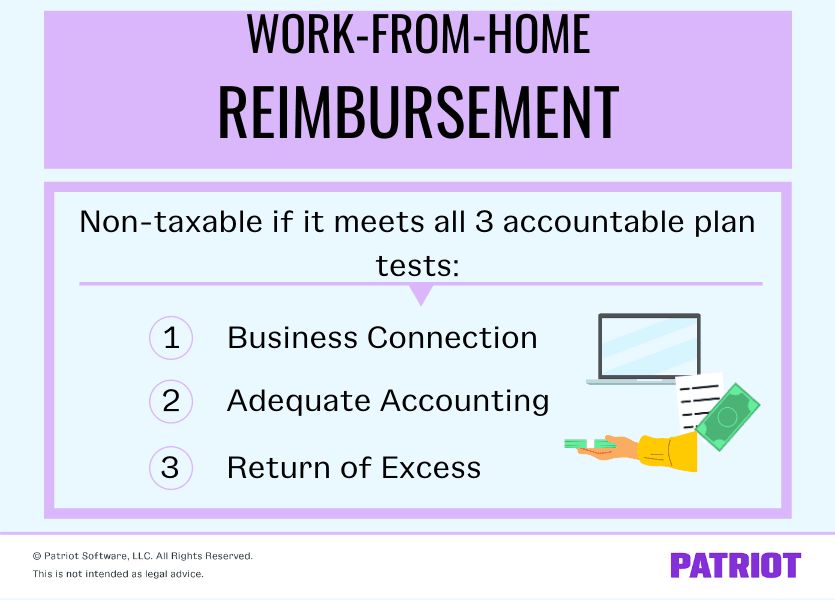

Generally mileage reimbursements aren t included in your taxable income if they re paid under an accountable plan established by your employer To qualify as an accountable plan your employer s reimbursement

Is Fuel Reimbursement Taxable Income provide a diverse collection of printable content that can be downloaded from the internet at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages, and many more. The appealingness of Is Fuel Reimbursement Taxable Income is their flexibility and accessibility.

More of Is Fuel Reimbursement Taxable Income

4 Ways To Keep Track Of Fuel Use WikiHow

4 Ways To Keep Track Of Fuel Use WikiHow

Up to specified dollar limits cash contributions to the HSA of a qualified individual determined monthly are exempt from federal income tax withholding social security tax Medicare tax

Taxable Includible in gross income not excluded under any IRC section If the recipient is an employee this amount is includible as wages and reported by the employer on Form W 2 and

Is Fuel Reimbursement Taxable Income have garnered immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Customization: We can customize the templates to meet your individual needs whether it's making invitations to organize your schedule or even decorating your home.

-

Educational Impact: Education-related printables at no charge offer a wide range of educational content for learners of all ages, making them a useful source for educators and parents.

-

The convenience of Fast access a variety of designs and templates is time-saving and saves effort.

Where to Find more Is Fuel Reimbursement Taxable Income

Fuel Management System Fuel Card Management IntelliShift

Fuel Management System Fuel Card Management IntelliShift

You can give gas cards as fuel stipends But unless employees track record and submit their exact vehicle mileage gas cards are considered taxable and ensuring tax

You re not required to reimburse employees using the IRS s mileage reimbursement rate you can choose a higher or lower amount if you prefer But if you reimburse your employees at a higher rate the additional

Since we've got your interest in Is Fuel Reimbursement Taxable Income Let's take a look at where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy offer a huge selection of Is Fuel Reimbursement Taxable Income to suit a variety of uses.

- Explore categories like decoration for your home, education, crafting, and organization.

2. Educational Platforms

- Forums and websites for education often offer worksheets with printables that are free Flashcards, worksheets, and other educational tools.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs covered cover a wide variety of topics, that range from DIY projects to planning a party.

Maximizing Is Fuel Reimbursement Taxable Income

Here are some ways of making the most of Is Fuel Reimbursement Taxable Income:

1. Home Decor

- Print and frame beautiful artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations and decorations for special events such as weddings, birthdays, and other special occasions.

4. Organization

- Be organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

Is Fuel Reimbursement Taxable Income are a treasure trove of creative and practical resources that can meet the needs of a variety of people and hobbies. Their access and versatility makes them an essential part of each day life. Explore the world of Is Fuel Reimbursement Taxable Income today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really completely free?

- Yes they are! You can print and download these free resources for no cost.

-

Can I make use of free templates for commercial use?

- It depends on the specific conditions of use. Always review the terms of use for the creator before using their printables for commercial projects.

-

Do you have any copyright rights issues with Is Fuel Reimbursement Taxable Income?

- Some printables may contain restrictions concerning their use. Be sure to review the terms and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home using printing equipment or visit a local print shop to purchase higher quality prints.

-

What program do I require to view printables free of charge?

- The majority of printed documents are in the format PDF. This can be opened using free programs like Adobe Reader.

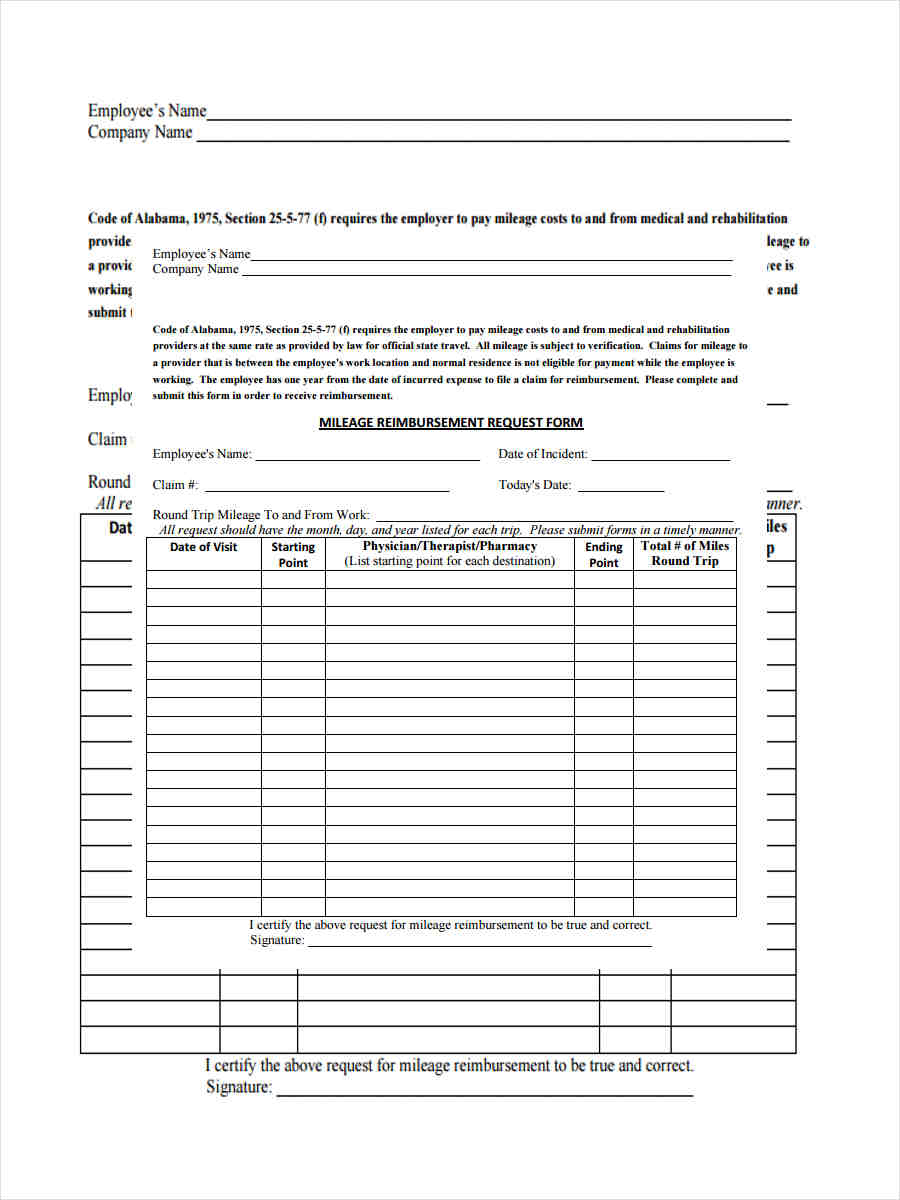

Gas Mileage Reimbursement Form Excel Templates

Employee Gifts Are They Taxable Income Tax Deductible For The Company

Check more sample of Is Fuel Reimbursement Taxable Income below

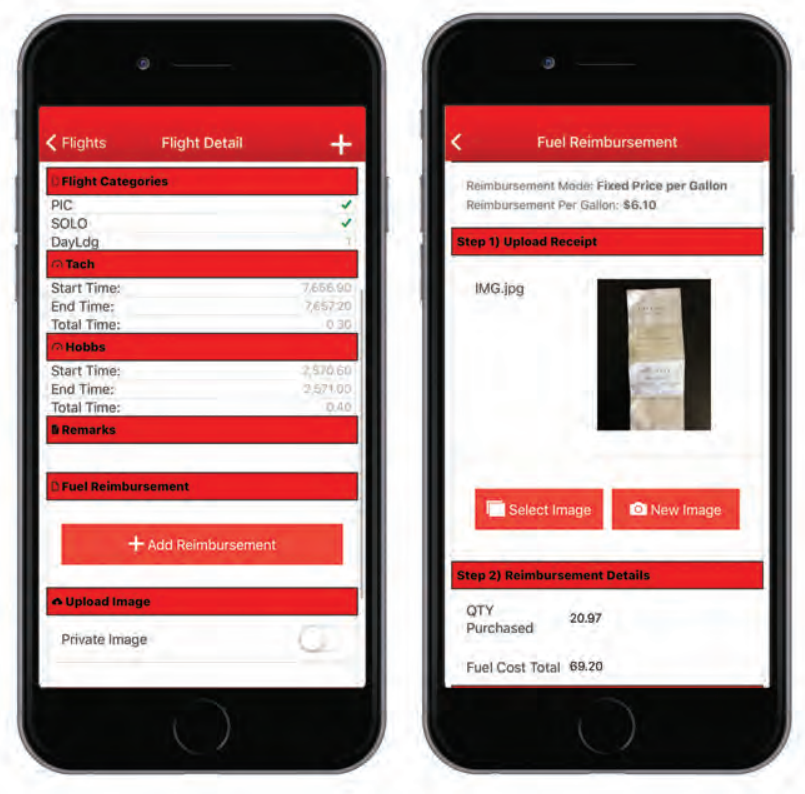

Fleet Member How To Submit Fuel Reimbursement Pilot Partner

Fuel Cycle Pricing Alternatives More 2024 Capterra

Filling Tax Form Tax Payment Financial Management Corporate Tax

Fuel EPayCard

Mileage Reimbursement For Remote Employees IRS Mileage Rate 2021

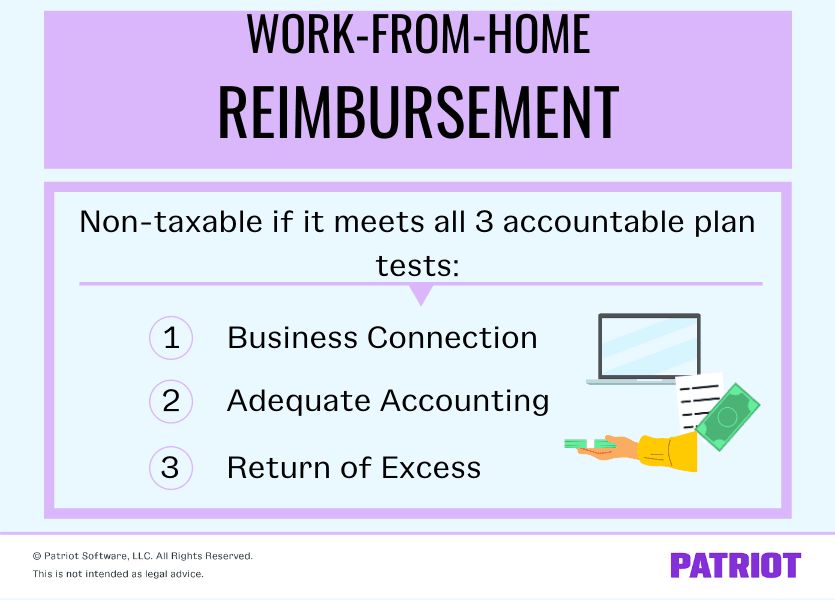

Work from home Reimbursement Definition Taxes Policy

https://turbotax.intuit.com/tax-tips/jobs …

Generally mileage reimbursements aren t included in your taxable income if they re paid under an accountable plan established by your employer To qualify as an accountable plan your employer s reimbursement

https://taxsharkinc.com/car-allowance-taxed

In 2022 a set monthly car allowance to pay for a lease maintenance or gas is taxable but the mileage reimbursement is not as long as it stays below the requirements of the IRS

Generally mileage reimbursements aren t included in your taxable income if they re paid under an accountable plan established by your employer To qualify as an accountable plan your employer s reimbursement

In 2022 a set monthly car allowance to pay for a lease maintenance or gas is taxable but the mileage reimbursement is not as long as it stays below the requirements of the IRS

Fuel EPayCard

Fuel Cycle Pricing Alternatives More 2024 Capterra

Mileage Reimbursement For Remote Employees IRS Mileage Rate 2021

Work from home Reimbursement Definition Taxes Policy

USDA Announces SY2023 24 Reimbursement Rates School Nutrition Association

What Is Pre Tax Commuter Benefit

What Is Pre Tax Commuter Benefit

Budget 2023 Malaysia Income Tax Rate