In this day and age where screens have become the dominant feature of our lives The appeal of tangible printed products hasn't decreased. In the case of educational materials, creative projects, or simply adding an extra personal touch to your home, printables for free are now a useful source. In this article, we'll take a dive deeper into "Is Fuel Reimbursement Taxable In India," exploring their purpose, where to locate them, and how they can be used to enhance different aspects of your lives.

Get Latest Is Fuel Reimbursement Taxable In India Below

Is Fuel Reimbursement Taxable In India

Is Fuel Reimbursement Taxable In India -

Exclusively for personal purpose the entire reimbursements is taxable in the hands of the employee Partly for official purpose and partly for personal purpose reimbursement up to Rs 900 is tax free and the balance

Such perquisites can be taxable or non taxable in nature These include simple benefits like fuel reimbursement a company provided car or accommodation etc Perquisites

Printables for free include a vast assortment of printable documents that can be downloaded online at no cost. They are available in numerous types, such as worksheets templates, coloring pages, and more. The great thing about Is Fuel Reimbursement Taxable In India is in their versatility and accessibility.

More of Is Fuel Reimbursement Taxable In India

Is Mileage Reimbursement Taxable

Is Mileage Reimbursement Taxable

On the total billed amount for fuel purchase employees can save up to 30 in taxes GoodReturns in Reimbursements and allowances are provided to salaried class so as to reduce their tax

If the bike is used exclusively for personal purpose the entire reimbursements is taxable in the hands of the employee If the bike is used partly for official purpose and partly

Is Fuel Reimbursement Taxable In India have gained a lot of popularity for several compelling reasons:

-

Cost-Effective: They eliminate the necessity to purchase physical copies or costly software.

-

Flexible: The Customization feature lets you tailor printed materials to meet your requirements when it comes to designing invitations and schedules, or decorating your home.

-

Educational Use: Education-related printables at no charge can be used by students from all ages, making them a great tool for parents and teachers.

-

Affordability: instant access a plethora of designs and templates saves time and effort.

Where to Find more Is Fuel Reimbursement Taxable In India

Vehicle Programs Is Mileage Reimbursement Taxable Motus

Vehicle Programs Is Mileage Reimbursement Taxable Motus

For determining taxability of reimbursement it has to be found whether reimbursement is of actual amount incurred on the salary of the employees by the NREP If

The fuel allowance received by employees is subject to certain tax exemptions under section 10 The government has set a maximum limit of 2400 per month It means for an employee who

We hope we've stimulated your curiosity about Is Fuel Reimbursement Taxable In India Let's look into where you can discover these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety and Is Fuel Reimbursement Taxable In India for a variety uses.

- Explore categories such as decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets Flashcards, worksheets, and other educational tools.

- Perfect for teachers, parents or students in search of additional sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for free.

- These blogs cover a broad array of topics, ranging that includes DIY projects to party planning.

Maximizing Is Fuel Reimbursement Taxable In India

Here are some new ways of making the most use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living areas.

2. Education

- Use printable worksheets for free to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable calendars along with lists of tasks, and meal planners.

Conclusion

Is Fuel Reimbursement Taxable In India are an abundance of innovative and useful resources that meet a variety of needs and desires. Their accessibility and versatility make them a fantastic addition to both personal and professional life. Explore the vast array of Is Fuel Reimbursement Taxable In India to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes, they are! You can download and print these materials for free.

-

Does it allow me to use free printables for commercial use?

- It's based on specific terms of use. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright concerns when using printables that are free?

- Some printables may contain restrictions on their use. Make sure you read the terms and regulations provided by the creator.

-

How do I print printables for free?

- You can print them at home using the printer, or go to an area print shop for the highest quality prints.

-

What software must I use to open printables at no cost?

- The majority of printed documents are in the format PDF. This is open with no cost software such as Adobe Reader.

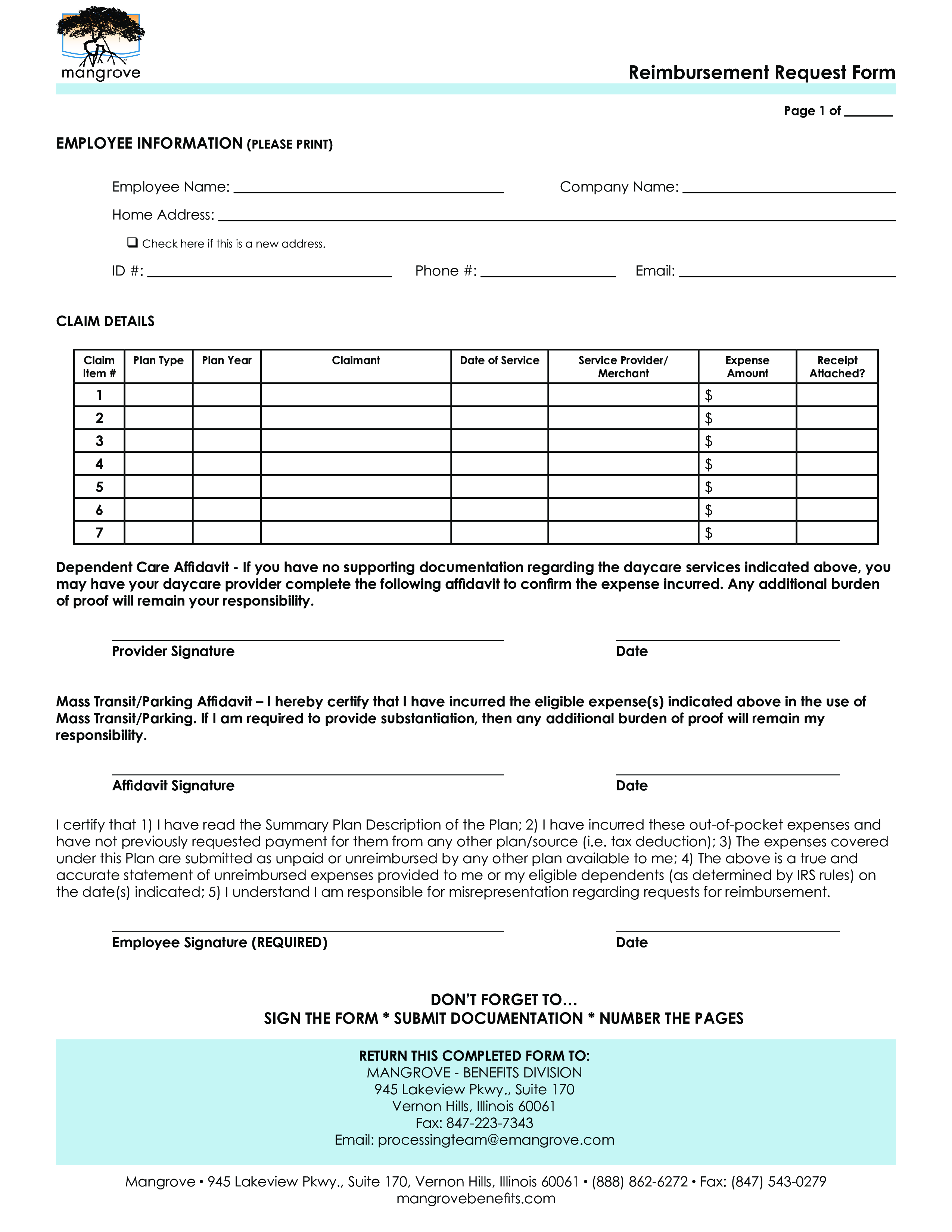

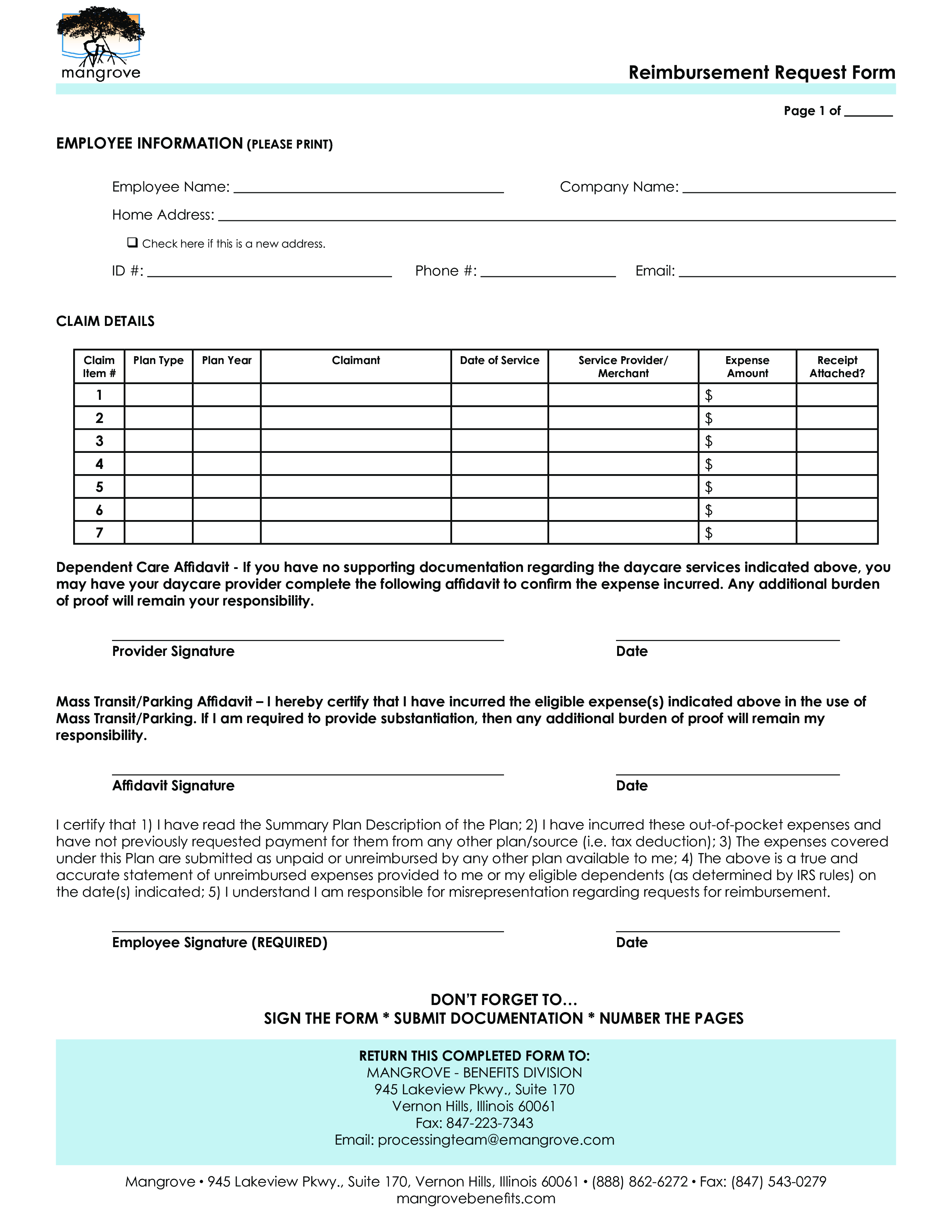

Reimbursement Expense Receipt How To Create A Reimbursement Expense

Gas Mileage Reimbursement Form Excel Templates

Check more sample of Is Fuel Reimbursement Taxable In India below

Can My Work related Phone Bills And WiFi Bills Help Me Reduce Taxes

Solved Please Note That This Is Based On Philippine Tax System Please

Example Mileage Reimbursement Form Printable Form Templates And Letter

Is Mileage Reimbursement Considered Taxable Income TripLog

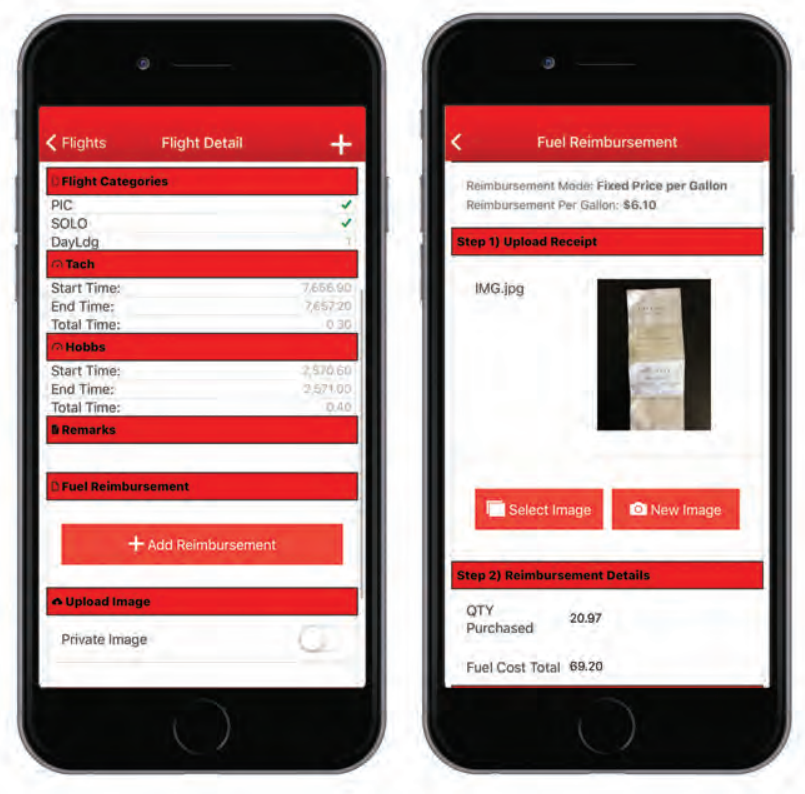

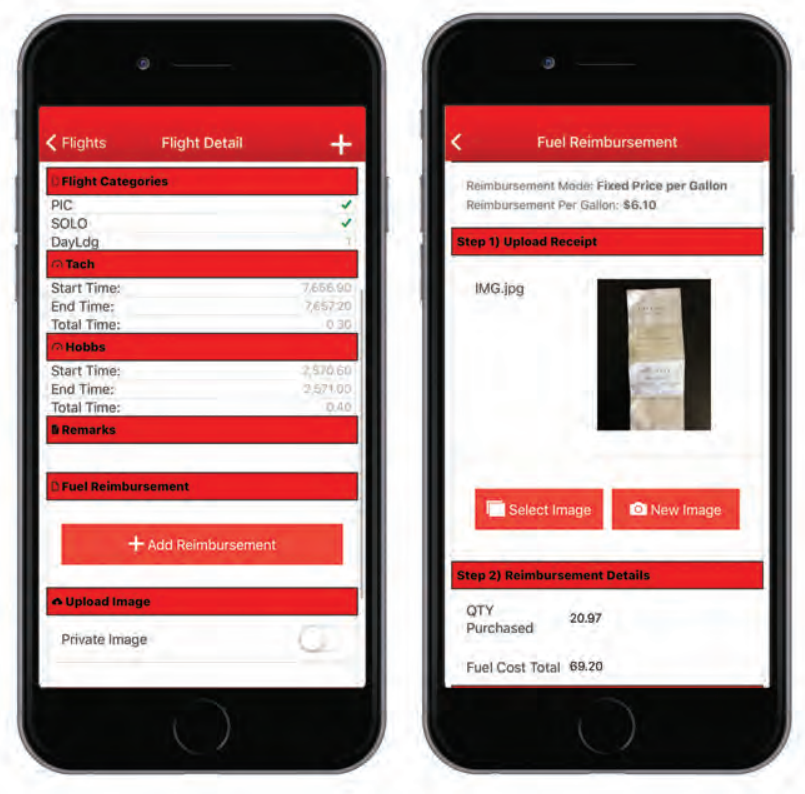

Fleet Member How To Submit Fuel Reimbursement Pilot Partner

Is Tuition Reimbursement Taxable A Guide ClearDegree

https://cleartax.in › perquisites-in-income-tax

Such perquisites can be taxable or non taxable in nature These include simple benefits like fuel reimbursement a company provided car or accommodation etc Perquisites

https://www.pwc.in › assets › pdfs › publications › ...

Taxability of reimbursement has been a matter of considerable debate in India from the perspectives of both Direct Tax and Indirect Tax In addition Transfer Pricing rules may also

Such perquisites can be taxable or non taxable in nature These include simple benefits like fuel reimbursement a company provided car or accommodation etc Perquisites

Taxability of reimbursement has been a matter of considerable debate in India from the perspectives of both Direct Tax and Indirect Tax In addition Transfer Pricing rules may also

Is Mileage Reimbursement Considered Taxable Income TripLog

Solved Please Note That This Is Based On Philippine Tax System Please

Fleet Member How To Submit Fuel Reimbursement Pilot Partner

Is Tuition Reimbursement Taxable A Guide ClearDegree

Mileage Reimbursement 2023 Form Printable Forms Free Online

Mileage Reimbursement Form In PDF Basic Mileage Reimbursement Form

Mileage Reimbursement Form In PDF Basic Mileage Reimbursement Form

2023 Mileage Form Printable Forms Free Online