In the digital age, with screens dominating our lives however, the attraction of tangible printed materials hasn't faded away. In the case of educational materials and creative work, or just adding an element of personalization to your space, Is Fuel A Taxable Benefit have become an invaluable source. This article will take a dive into the sphere of "Is Fuel A Taxable Benefit," exploring the different types of printables, where you can find them, and how they can enhance various aspects of your daily life.

Get Latest Is Fuel A Taxable Benefit Below

Is Fuel A Taxable Benefit

Is Fuel A Taxable Benefit -

A company car fuel benefit is a tax that s charged to you for using the fuel that s paid for by your employer which is why HMRC regards it as free fuel It will therefore still cost you to receive the fuel as this tax still needs to be paid

From the 2017 to 2018 tax year onwards payment or reinstatement as outlined in a and b must be made by 6 July following the tax year in which the fuel is provided to count

Is Fuel A Taxable Benefit provide a diverse variety of printable, downloadable items that are available online at no cost. They come in many kinds, including worksheets coloring pages, templates and more. One of the advantages of Is Fuel A Taxable Benefit is in their variety and accessibility.

More of Is Fuel A Taxable Benefit

North Carolina Taxable Fuel Bond Surety Bond Authority

North Carolina Taxable Fuel Bond Surety Bond Authority

Fuel benefit occurs when an employer pays for private fuel such as for travelling to and from work for an employee The value of the benefit and the amount of tax an employee pays on private fuel depends on the emissions of the car

If the recipient of a taxable fringe benefit is your employee the benefit is generally subject to employment taxes and must be reported on Form W 2 Wage and Tax Statement

Is Fuel A Taxable Benefit have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

Customization: There is the possibility of tailoring printables to your specific needs, whether it's designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Value Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, making them a great resource for educators and parents.

-

Easy to use: Instant access to an array of designs and templates is time-saving and saves effort.

Where to Find more Is Fuel A Taxable Benefit

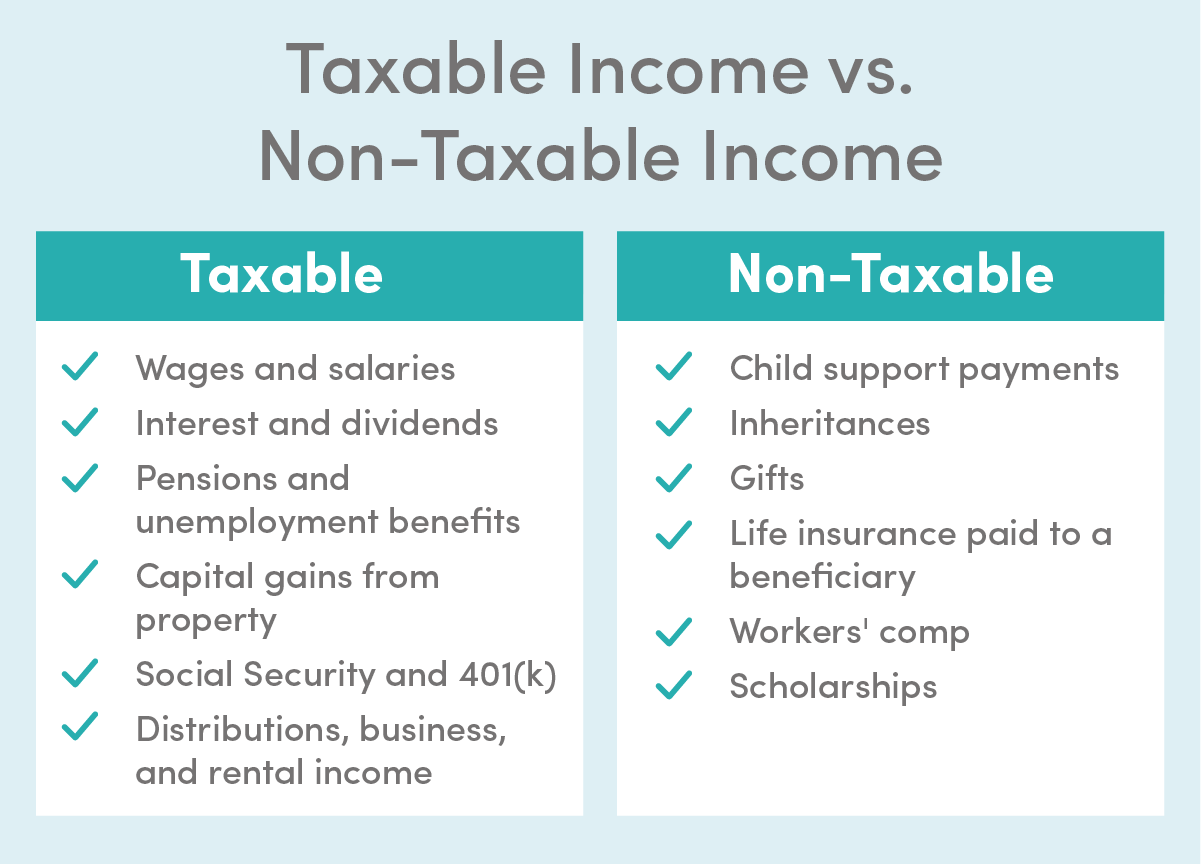

What is taxable income Financial Wellness Starts Here

What is taxable income Financial Wellness Starts Here

Taxable benefit is considered a supply for GST HST purposes

When an employer provides fuel for a company car a taxable benefit is likely to arise The taxable benefit is specifically known as the fuel benefit charge The fuel benefit

If we've already piqued your interest in Is Fuel A Taxable Benefit and other printables, let's discover where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of Is Fuel A Taxable Benefit designed for a variety reasons.

- Explore categories such as design, home decor, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for no cost.

- These blogs cover a wide array of topics, ranging including DIY projects to party planning.

Maximizing Is Fuel A Taxable Benefit

Here are some innovative ways in order to maximize the use of Is Fuel A Taxable Benefit:

1. Home Decor

- Print and frame gorgeous images, quotes, as well as seasonal decorations, to embellish your living spaces.

2. Education

- Use printable worksheets for free to aid in learning at your home or in the classroom.

3. Event Planning

- Invitations, banners and decorations for special events like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Is Fuel A Taxable Benefit are a treasure trove of creative and practical resources which cater to a wide range of needs and interest. Their access and versatility makes them a great addition to every aspect of your life, both professional and personal. Explore the vast array of Is Fuel A Taxable Benefit today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes you can! You can print and download these documents for free.

-

Are there any free printables for commercial use?

- It's based on the rules of usage. Always verify the guidelines provided by the creator prior to printing printables for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may come with restrictions on their use. Always read the terms of service and conditions provided by the designer.

-

How do I print Is Fuel A Taxable Benefit?

- Print them at home using the printer, or go to the local print shop for premium prints.

-

What program is required to open printables free of charge?

- The majority of printables are in the PDF format, and is open with no cost software such as Adobe Reader.

New York Taxable Fuel Bond Surety Bond Authority

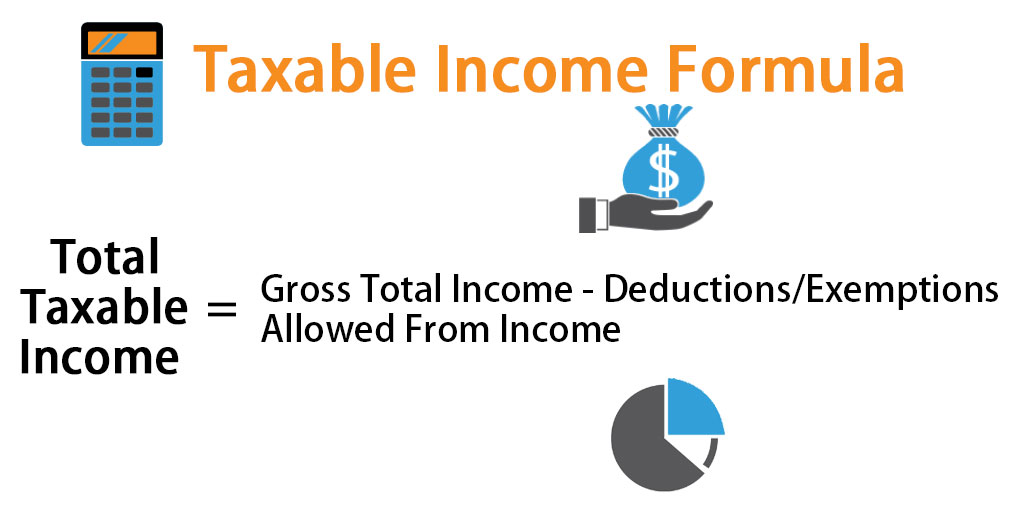

Taxable Income Formula Financepal

Check more sample of Is Fuel A Taxable Benefit below

Mississippi Taxable Fuel Bond Surety Bond Authority

Missouri Taxable Fuel Bond Surety Bond Authority

Montana Taxable Fuel Bond Surety Bond Authority

Is Fuel An Investment 4refuel

Nebraska Taxable Fuel Bond Surety Bond Authority

Iowa Taxable Fuel Bond Surety Bond Authority

https://www.gov.uk/guidance/taxable-fuel-provided...

From the 2017 to 2018 tax year onwards payment or reinstatement as outlined in a and b must be made by 6 July following the tax year in which the fuel is provided to count

https://www.gov.uk/expenses-and-benefits-company-cars

As an employer providing company cars and fuel to your employees you have certain National Insurance and reporting obligations

From the 2017 to 2018 tax year onwards payment or reinstatement as outlined in a and b must be made by 6 July following the tax year in which the fuel is provided to count

As an employer providing company cars and fuel to your employees you have certain National Insurance and reporting obligations

Is Fuel An Investment 4refuel

Missouri Taxable Fuel Bond Surety Bond Authority

Nebraska Taxable Fuel Bond Surety Bond Authority

Iowa Taxable Fuel Bond Surety Bond Authority

Oklahoma Taxable Fuel Bond Surety Bond Authority

Helpful Resources For Calculating Canadian Employee Taxable Benefits

Helpful Resources For Calculating Canadian Employee Taxable Benefits

Taxable Income Formula Calculator Examples With Excel Template