In a world with screens dominating our lives however, the attraction of tangible, printed materials hasn't diminished. For educational purposes in creative or artistic projects, or just adding some personal flair to your home, printables for free are now a vital source. The following article is a take a dive deeper into "Is Clean Vehicle Rebate Taxable," exploring what they are, how they are, and what they can do to improve different aspects of your lives.

Get Latest Is Clean Vehicle Rebate Taxable Below

Is Clean Vehicle Rebate Taxable

Is Clean Vehicle Rebate Taxable -

The Department of Energy hosts a purchaser friendly version of IRS s list of eligible clean vehicles including battery electric plug in hybrid and fuel cell vehicles that qualified manufacturers have indicated to the IRS meet the requirements to claim the New Clean Vehicle Credit on FuelEconomy gov including the applicable MSRP limitation Q4

Clean Air Vehicle OR Clean Vehicle Rebate Project new owner has 60 days from date of purchase to choose between the two programs Between 135 000 150 000 for single filers 175 000 204 000 for head of household 200 000 300 000 for joint filers Clean Air Vehicle Program ONLY Clean Air Vehicle Program AND

Is Clean Vehicle Rebate Taxable offer a wide assortment of printable resources available online for download at no cost. These resources come in many types, such as worksheets templates, coloring pages, and more. The value of Is Clean Vehicle Rebate Taxable is their flexibility and accessibility.

More of Is Clean Vehicle Rebate Taxable

Plug In Hybrid EV And Incentives California Clean Vehicle Rebate

Plug In Hybrid EV And Incentives California Clean Vehicle Rebate

Only vehicles purchased under the consumer clean vehicle credits are eligible for this benefit Today s guidance provides additional information on registration requirements and how the mechanics of this transfer will work for car dealers

The Inflation Reduction Act of 2022 IRA makes several changes to the tax credit provided in 30D of the Internal Revenue Code Code for qualified plug in electric drive motor vehicles including adding fuel cell vehicles to the 30D tax credit

The Is Clean Vehicle Rebate Taxable have gained huge recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the need to purchase physical copies or expensive software.

-

Individualization You can tailor printing templates to your own specific requirements, whether it's designing invitations to organize your schedule or even decorating your home.

-

Educational Benefits: Education-related printables at no charge can be used by students from all ages, making them a valuable tool for teachers and parents.

-

The convenience of Fast access a myriad of designs as well as templates, which saves time as well as effort.

Where to Find more Is Clean Vehicle Rebate Taxable

CVRP Overview Clean Vehicle Rebate Project

CVRP Overview Clean Vehicle Rebate Project

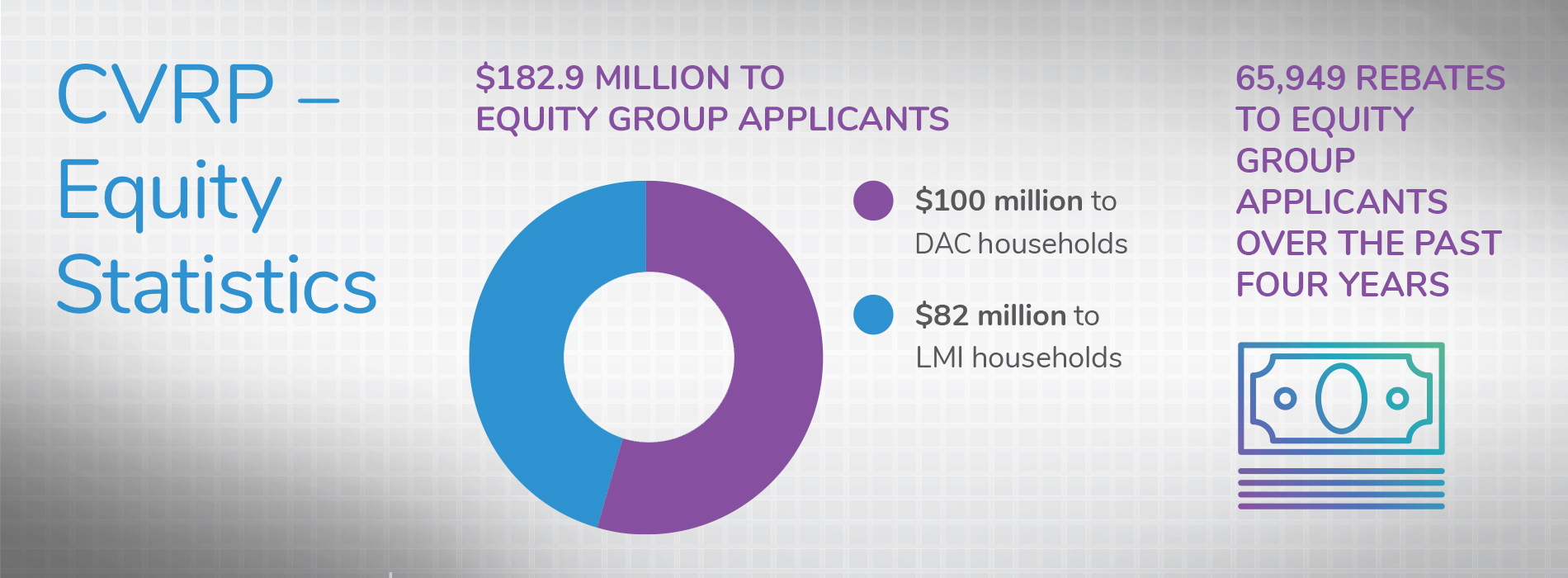

Project Statistics CARB s Incentive Program Insights data dashboard allows for an interactive visualization of the overarching data on CVRP as well as CARB s other light duty incentive programs Through December 2023 CVRP has provided rebates for over 587 000 vehicles totaling over 1 46 billion since the project s launch in 2010

Eligibility for the California Clean Vehicle Rebate Project CVRP is determined by various factors As an applicant you must Be based in California as an individual business nonprofit or government entity at the time of the vehicle s purchase or lease Ensure your income meets the set eligibility requirements when your application is received

We hope we've stimulated your interest in Is Clean Vehicle Rebate Taxable, let's explore where you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of goals.

- Explore categories like home decor, education, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers provide their inventive designs and templates for no cost.

- These blogs cover a wide variety of topics, including DIY projects to party planning.

Maximizing Is Clean Vehicle Rebate Taxable

Here are some fresh ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Print worksheets that are free to help reinforce your learning at home for the classroom.

3. Event Planning

- Invitations, banners and decorations for special occasions like birthdays and weddings.

4. Organization

- Keep track of your schedule with printable calendars as well as to-do lists and meal planners.

Conclusion

Is Clean Vehicle Rebate Taxable are an abundance of practical and imaginative resources which cater to a wide range of needs and desires. Their availability and versatility make these printables a useful addition to your professional and personal life. Explore the many options that is Is Clean Vehicle Rebate Taxable today, and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really for free?

- Yes they are! You can download and print the resources for free.

-

Do I have the right to use free printables in commercial projects?

- It is contingent on the specific rules of usage. Always verify the guidelines provided by the creator before utilizing printables for commercial projects.

-

Do you have any copyright issues when you download printables that are free?

- Some printables could have limitations regarding usage. Make sure you read the terms and regulations provided by the creator.

-

How do I print Is Clean Vehicle Rebate Taxable?

- You can print them at home using any printer or head to the local print shops for high-quality prints.

-

What software do I require to view printables for free?

- The majority are printed with PDF formats, which is open with no cost software, such as Adobe Reader.

The 200 Energy Bills Rebate Everything You Need To Know TechRadar

California Directs More Clean Vehicle Rebates To Lower Income Families

Check more sample of Is Clean Vehicle Rebate Taxable below

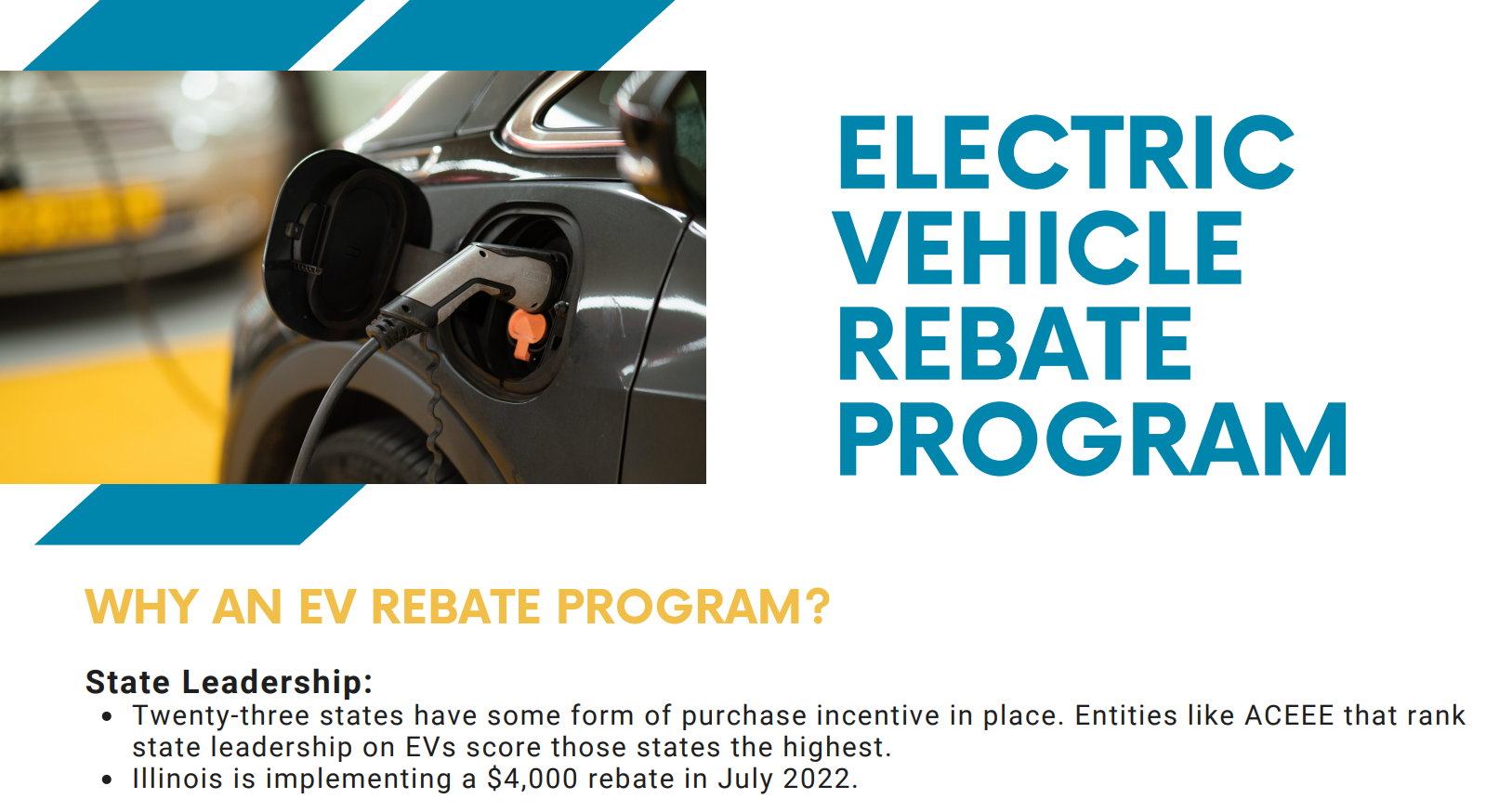

Electric Vehicle Rebate Program Clean Fuels Michigan

Clean Vehicle Rebate Project California Climate Investments

Traderider Rebate Program Verify Trade ID

Clean Vehicle Rebate Login

Clean Vehicle Rebate Project Center For Sustainable Energy

Rebate Statistics Clean Vehicle Rebate Project

https:// cleanvehiclerebate.org /en/faqs

Clean Air Vehicle OR Clean Vehicle Rebate Project new owner has 60 days from date of purchase to choose between the two programs Between 135 000 150 000 for single filers 175 000 204 000 for head of household 200 000 300 000 for joint filers Clean Air Vehicle Program ONLY Clean Air Vehicle Program AND

https:// cleanvehiclerebate.org /en/eligibility-guidelines

Are you eligible for a CVRP rebate Find out here You can also learn about the rebate limit application requirements the CVRP ownership requirement and vehicle eligibility Applicant Eligibility Income Eligibility Rebate Limit Vehicle Eligibility Funding Availability Application Requirements Ownership Requirement Get the Details

Clean Air Vehicle OR Clean Vehicle Rebate Project new owner has 60 days from date of purchase to choose between the two programs Between 135 000 150 000 for single filers 175 000 204 000 for head of household 200 000 300 000 for joint filers Clean Air Vehicle Program ONLY Clean Air Vehicle Program AND

Are you eligible for a CVRP rebate Find out here You can also learn about the rebate limit application requirements the CVRP ownership requirement and vehicle eligibility Applicant Eligibility Income Eligibility Rebate Limit Vehicle Eligibility Funding Availability Application Requirements Ownership Requirement Get the Details

Clean Vehicle Rebate Login

Clean Vehicle Rebate Project California Climate Investments

Clean Vehicle Rebate Project Center For Sustainable Energy

Rebate Statistics Clean Vehicle Rebate Project

FAQs Clean Vehicle Rebate Project

Is Recovery Rebate Taxable Find All Answers

Is Recovery Rebate Taxable Find All Answers

The Recovery Rebate Credit Calculator ShauntelRaya