In this age of electronic devices, where screens dominate our lives, the charm of tangible printed material hasn't diminished. If it's to aid in education and creative work, or simply adding an element of personalization to your home, printables for free are now a vital resource. For this piece, we'll dive deeper into "Is An Early Roth Distribution Taxable," exploring the benefits of them, where to find them, and ways they can help you improve many aspects of your daily life.

Get Latest Is An Early Roth Distribution Taxable Below

Is An Early Roth Distribution Taxable

Is An Early Roth Distribution Taxable -

To discourage the use of IRA distributions for purposes other than retirement you ll be assessed a 10 additional tax on early distributions from traditional and Roth IRAs unless an exception applies Generally early distributions are those you receive from an IRA before reaching age 59

Distributions of earnings that are part of a non qualified distribution are taxable and may be subject to an additional 10 early distribution penalty There is a distinction regarding which

Is An Early Roth Distribution Taxable offer a wide range of downloadable, printable material that is available online at no cost. The resources are offered in a variety kinds, including worksheets templates, coloring pages and more. The beauty of Is An Early Roth Distribution Taxable is their flexibility and accessibility.

More of Is An Early Roth Distribution Taxable

Roth IRA Withdrawals Read This First

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg)

Roth IRA Withdrawals Read This First

Can I take an early distribution from my Roth IRA Because you contribute to a Roth IRA with after tax dollars you can withdraw your contributed funds at any time However you will be

Nerdy takeaways Contributions can be withdrawn from a Roth IRA at any time without tax implications or withdrawal penalties Unless it s a qualified distribution withdrawing earnings

Is An Early Roth Distribution Taxable have gained immense appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Modifications: Your HTML0 customization options allow you to customize printables to your specific needs when it comes to designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Value Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages, which makes them a vital source for educators and parents.

-

Accessibility: The instant accessibility to a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more Is An Early Roth Distribution Taxable

Roth IRA

Roth IRA

If the money you withdraw from a Roth IRA isn t a qualified distribution part of it might be taxable Your money comes out of a Roth IRA in this order File with H R Block to

You can withdraw Roth IRA contributions tax and penalty free at any time because you paid taxes on these funds in the year you contributed them There are no age restrictions and no limits

We've now piqued your interest in printables for free we'll explore the places you can discover these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of needs.

- Explore categories like decorating your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets for flashcards, lessons, and worksheets. tools.

- Ideal for parents, teachers and students looking for additional sources.

3. Creative Blogs

- Many bloggers post their original designs and templates free of charge.

- The blogs are a vast selection of subjects, everything from DIY projects to planning a party.

Maximizing Is An Early Roth Distribution Taxable

Here are some creative ways for you to get the best use of Is An Early Roth Distribution Taxable:

1. Home Decor

- Print and frame gorgeous art, quotes, as well as seasonal decorations, to embellish your living areas.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home also in the classes.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars, to-do lists, and meal planners.

Conclusion

Is An Early Roth Distribution Taxable are a treasure trove of fun and practical tools designed to meet a range of needs and pursuits. Their availability and versatility make them an invaluable addition to both professional and personal life. Explore the endless world of Is An Early Roth Distribution Taxable today to unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really free?

- Yes, they are! You can download and print these free resources for no cost.

-

Does it allow me to use free printables for commercial purposes?

- It's determined by the specific conditions of use. Always check the creator's guidelines prior to utilizing the templates for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Some printables could have limitations in use. Check the terms of service and conditions provided by the author.

-

How do I print Is An Early Roth Distribution Taxable?

- You can print them at home with a printer or visit the local print shops for top quality prints.

-

What program do I require to view printables at no cost?

- A majority of printed materials are in the format PDF. This is open with no cost software, such as Adobe Reader.

Roth IRA Early Withdrawal Penalities YouTube

Adler Roth Distribution Center Technician Cabela s LinkedIn

Check more sample of Is An Early Roth Distribution Taxable below

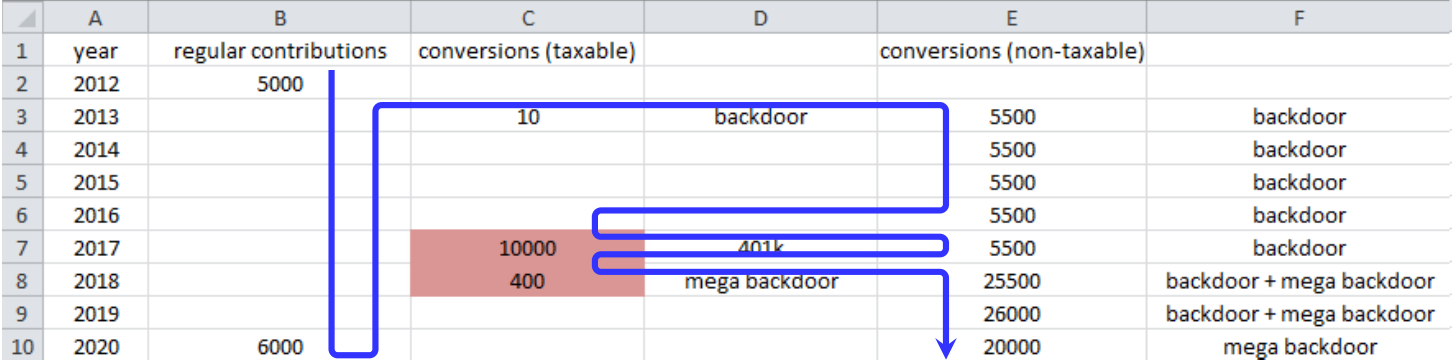

Population Distribution By Taxable Income Range 2012 Download

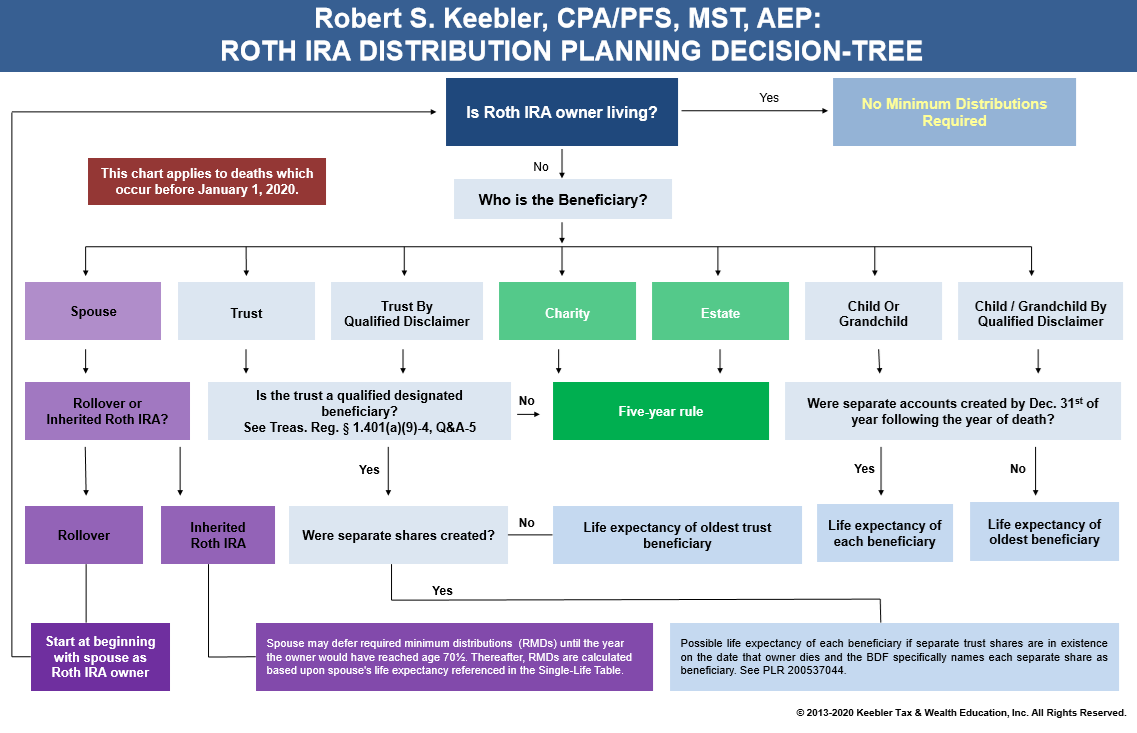

Figure 2 1 Is The Distribution From Your Roth IRA A Qualified

What Are The New Ira Distribution Rules Tutorial Pics

Roth Ira Rules Choosing Your Gold IRA

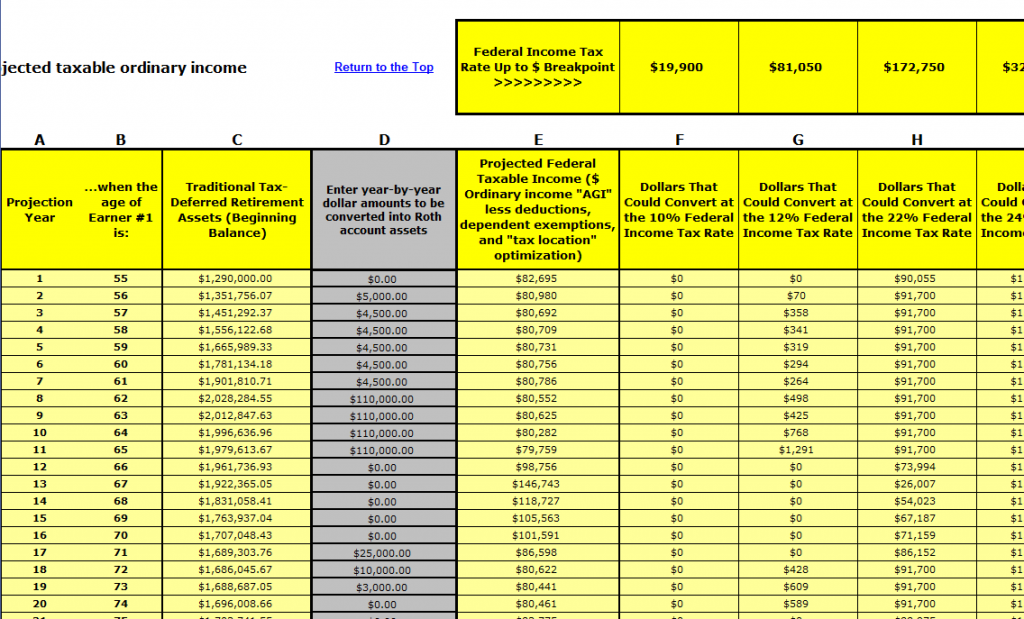

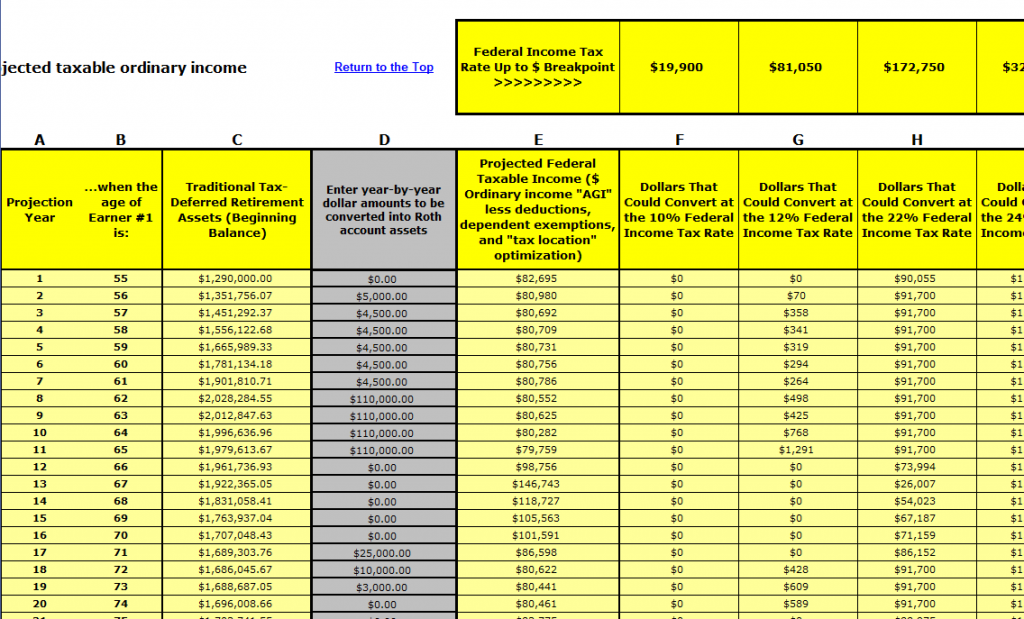

Roth Conversion Analysis Software And Optimal Strategy

When You Contribute To A Roth 401 k The Contribution Won t Lower Your

https://www.investopedia.com/.../tax-treatment-roth-ira-distributions

Distributions of earnings that are part of a non qualified distribution are taxable and may be subject to an additional 10 early distribution penalty There is a distinction regarding which

:max_bytes(150000):strip_icc()/RothIRAwithdrawalconsequences-5c4a16cd46e0fb0001b8c43b.jpg?w=186)

https://www.investopedia.com/the-pros-and-cons-of-an-early...

Withdrawing gains from a Roth IRA before you are 59 can result in potential taxes and penalties Funds in a Roth IRA account can provide emergency savings and avoid the need for a loan

Distributions of earnings that are part of a non qualified distribution are taxable and may be subject to an additional 10 early distribution penalty There is a distinction regarding which

Withdrawing gains from a Roth IRA before you are 59 can result in potential taxes and penalties Funds in a Roth IRA account can provide emergency savings and avoid the need for a loan

Roth Ira Rules Choosing Your Gold IRA

Figure 2 1 Is The Distribution From Your Roth IRA A Qualified

Roth Conversion Analysis Software And Optimal Strategy

When You Contribute To A Roth 401 k The Contribution Won t Lower Your

1099 r Distribution Code 4 Taxable Fill Online Printable Fillable Blank

Deactivated Early Roth Steyr M1907 Pistol With Regimental Markings

Deactivated Early Roth Steyr M1907 Pistol With Regimental Markings

Roth IRA Distribution Rules Taxation Tax Diversification