In this digital age, where screens rule our lives however, the attraction of tangible printed materials isn't diminishing. If it's to aid in education as well as creative projects or just adding the personal touch to your area, Is 80ccf Part Of 80c are now an essential source. The following article is a take a dive into the sphere of "Is 80ccf Part Of 80c," exploring the different types of printables, where to locate them, and what they can do to improve different aspects of your lives.

What Are Is 80ccf Part Of 80c?

Printables for free cover a broad collection of printable resources available online for download at no cost. These resources come in various kinds, including worksheets templates, coloring pages and many more. The great thing about Is 80ccf Part Of 80c is in their versatility and accessibility.

Is 80ccf Part Of 80c

Is 80ccf Part Of 80c

Is 80ccf Part Of 80c -

[desc-5]

[desc-1]

Deductions Under Sections 80C 80CCC 80CCD 80CCF 80CCG Times Of India

Deductions Under Sections 80C 80CCC 80CCD 80CCF 80CCG Times Of India

[desc-4]

[desc-6]

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

Section 80C Of Income Tax Act Tax Deduction AY 2023 24

[desc-9]

[desc-7]

Income Tax Deduction Under Section 80C To 80U FY 2022 23

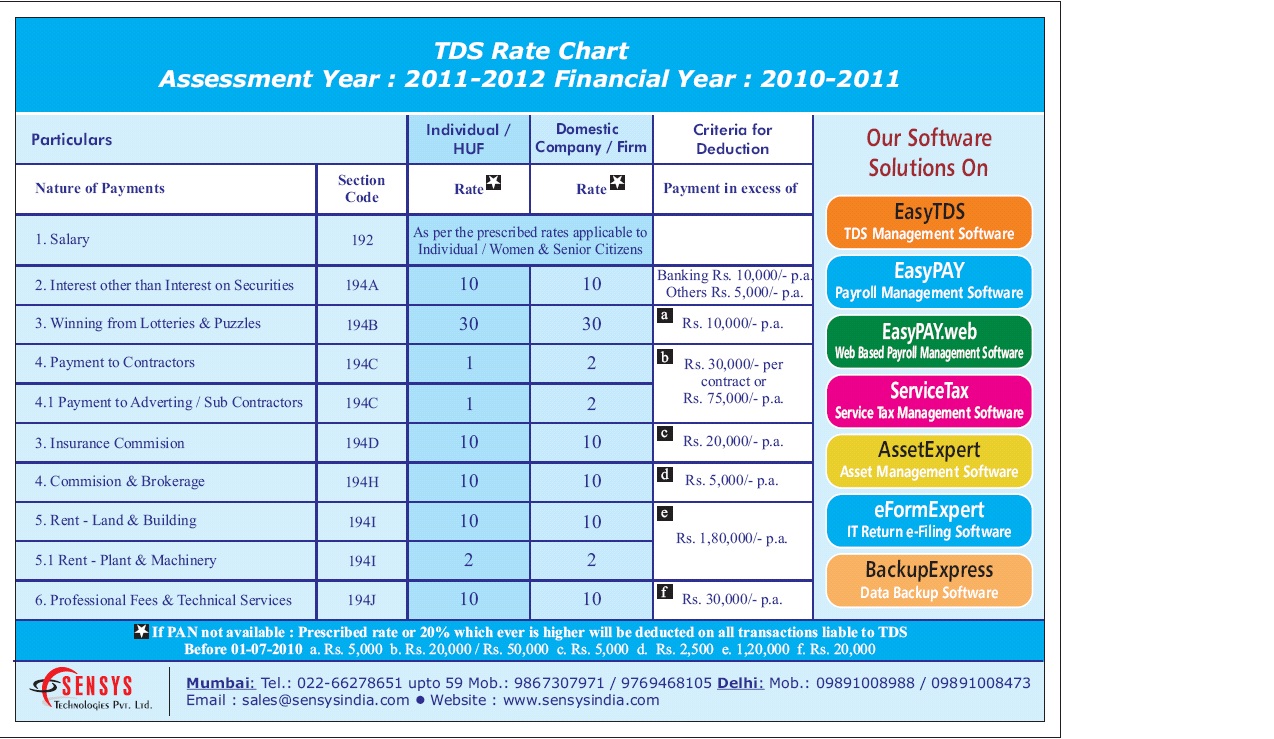

TDS Rate Chart AY 2011 2012 Sensys Blog

ATT 80C Jantes Alu Oponeo be

80c YouTube

Section 80 C Best Tax Saving Investment Option Under Sec 80C

Deduction Under Section 80C A Complete List BasuNivesh

Deduction Under Section 80C A Complete List BasuNivesh

Investment Options To Avail Tax Deduction Under Section 80C