In this age of electronic devices, where screens dominate our lives The appeal of tangible, printed materials hasn't diminished. If it's to aid in education in creative or artistic projects, or simply adding some personal flair to your home, printables for free have become a valuable resource. With this guide, you'll take a dive into the world "Irc Tax Deduction," exploring what they are, how you can find them, and how they can enhance various aspects of your lives.

Get Latest Irc Tax Deduction Below

Irc Tax Deduction

Irc Tax Deduction -

10 7 1 Employer s income tax rules for stock based awards As discussed in the preceding section of this chapter regarding employee s taxable income IRC Section 83 provides

a General rule Except as otherwise provided in this section the following taxes shall be allowed as a deduction for the taxable year within which paid or accrued

Printables for free include a vast array of printable content that can be downloaded from the internet at no cost. These resources come in many formats, such as worksheets, templates, coloring pages, and more. One of the advantages of Irc Tax Deduction is in their versatility and accessibility.

More of Irc Tax Deduction

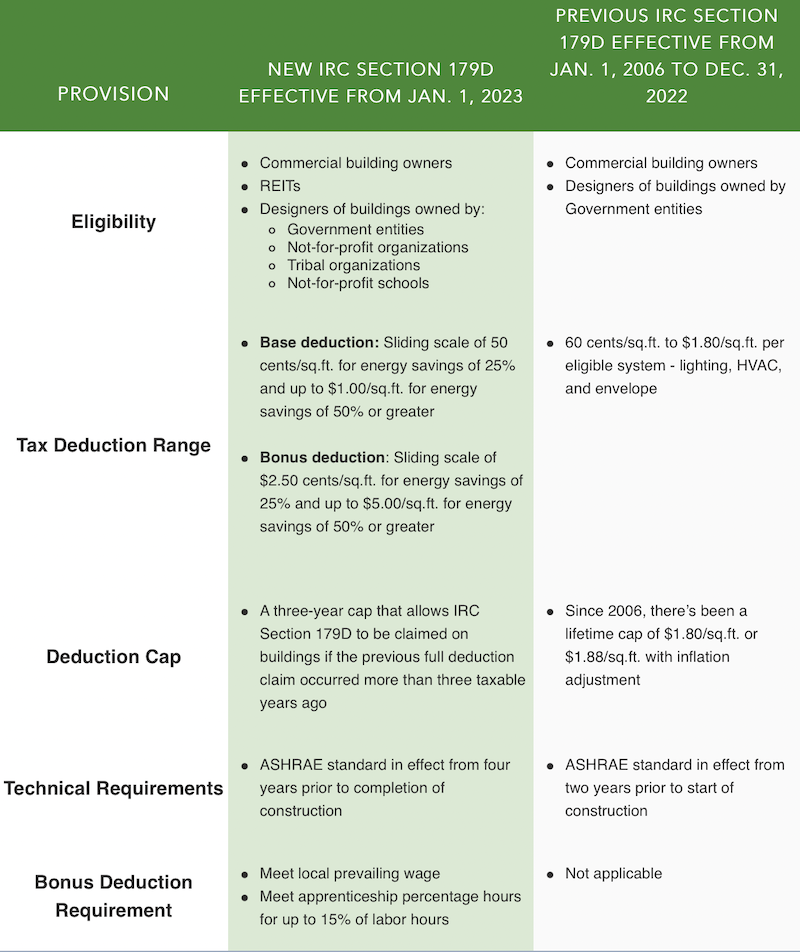

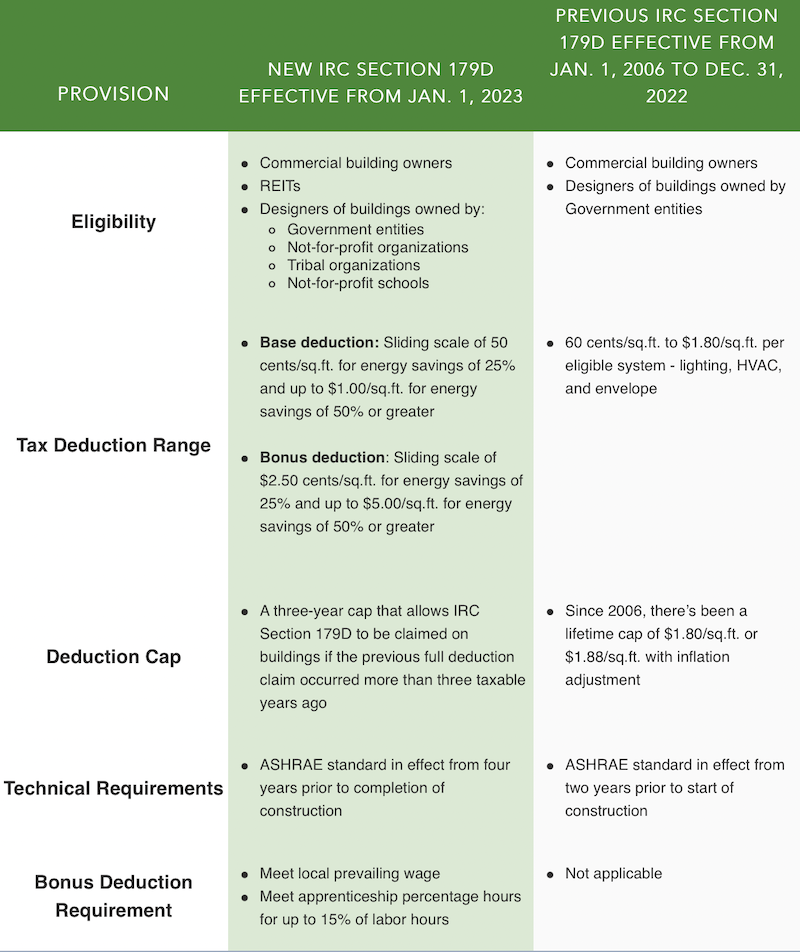

3 Changes To The IRC Sec 179D Deduction In 2023

3 Changes To The IRC Sec 179D Deduction In 2023

Under IRC Section 461 for an accrual basis taxpayer to deduct the bonuses in the year of accrual the following conditions must be met by year end Fixed

L 88 272 Sec 207 a substituted provisions denying the deduction for taxes assessed against local benefits which increase property value except for so much as is properly

Irc Tax Deduction have garnered immense popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

customization They can make printing templates to your own specific requirements whether you're designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Impact: Printables for education that are free cater to learners of all ages, making them a great source for educators and parents.

-

It's easy: instant access many designs and templates, which saves time as well as effort.

Where to Find more Irc Tax Deduction

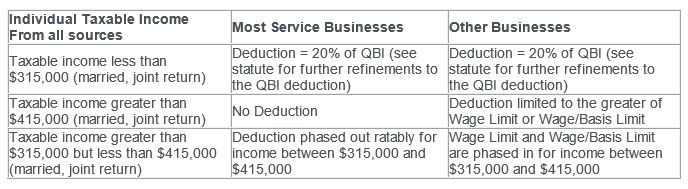

Tax Deduction Limitations Of IRC Sec 199A For Financial Professionals

Tax Deduction Limitations Of IRC Sec 199A For Financial Professionals

Treasury regulations commonly referred to as federal tax regulations provide the official interpretation of the IRC by the U S Department of the

A credit reduces your actual U S income tax on a dollar for dollar basis while a deduction reduces only your income subject to tax You can choose to take the

If we've already piqued your curiosity about Irc Tax Deduction We'll take a look around to see where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Irc Tax Deduction to suit a variety of purposes.

- Explore categories such as decoration for your home, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets including flashcards, learning tools.

- Perfect for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates, which are free.

- The blogs are a vast range of topics, including DIY projects to party planning.

Maximizing Irc Tax Deduction

Here are some new ways that you can make use of printables for free:

1. Home Decor

- Print and frame gorgeous images, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Use free printable worksheets to reinforce learning at home and in class.

3. Event Planning

- Invitations, banners and decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Irc Tax Deduction are an abundance of innovative and useful resources for a variety of needs and needs and. Their accessibility and flexibility make them a fantastic addition to any professional or personal life. Explore the vast world of Irc Tax Deduction right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually for free?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I use the free printing templates for commercial purposes?

- It's dependent on the particular usage guidelines. Be sure to read the rules of the creator before using their printables for commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Some printables may have restrictions in use. Make sure you read the terms and conditions offered by the author.

-

How can I print printables for free?

- Print them at home using the printer, or go to an area print shop for the highest quality prints.

-

What software do I need to open printables for free?

- Most printables come in PDF format, which can be opened with free programs like Adobe Reader.

Tax Deduction Letter Sign Templates Jotform

IRC Codes And Regulations PDF Tax Deduction Gross Income

Check more sample of Irc Tax Deduction below

How To Claim The New IRC 179D Energy Efficient Tax Deduction

Safe Harbor Conditions Of The IRC Section 199A Deduction

IRC Section 179D Deduction Clarified Crowe LLP

How IRC 199A And The New 20 Percent Tax Deduction For Small Businesses

Maximizing The IRC 199A Deduction White Paper Lorman Education

2023 Contribution Limits And Standard Deduction Announced Day Hagan

https://www. law.cornell.edu /uscode/text/26/164

a General rule Except as otherwise provided in this section the following taxes shall be allowed as a deduction for the taxable year within which paid or accrued

https://www. law.cornell.edu /uscode/text/26/162

Prior to amendment text read as follows Any amount paid by a taxpayer for insurance to which paragraph 1 applies shall not be taken into account in computing the amount

a General rule Except as otherwise provided in this section the following taxes shall be allowed as a deduction for the taxable year within which paid or accrued

Prior to amendment text read as follows Any amount paid by a taxpayer for insurance to which paragraph 1 applies shall not be taken into account in computing the amount

How IRC 199A And The New 20 Percent Tax Deduction For Small Businesses

Safe Harbor Conditions Of The IRC Section 199A Deduction

Maximizing The IRC 199A Deduction White Paper Lorman Education

2023 Contribution Limits And Standard Deduction Announced Day Hagan

How The 179D Deduction Will Change Under The Inflation Reduction Act

Inflation Reduction Act 179D Energy Efficient Tax Deduction Explained

Inflation Reduction Act 179D Energy Efficient Tax Deduction Explained

Income Tax Brackets 2022 Us Latest News Update