In this age of technology, in which screens are the norm and the appeal of physical printed items hasn't gone away. No matter whether it's for educational uses as well as creative projects or simply to add an extra personal touch to your area, Interest On Home Loan Deduction Taxguru can be an excellent resource. For this piece, we'll take a dive in the world of "Interest On Home Loan Deduction Taxguru," exploring what they are, where to find them and how they can improve various aspects of your lives.

Get Latest Interest On Home Loan Deduction Taxguru Below

Interest On Home Loan Deduction Taxguru

Interest On Home Loan Deduction Taxguru -

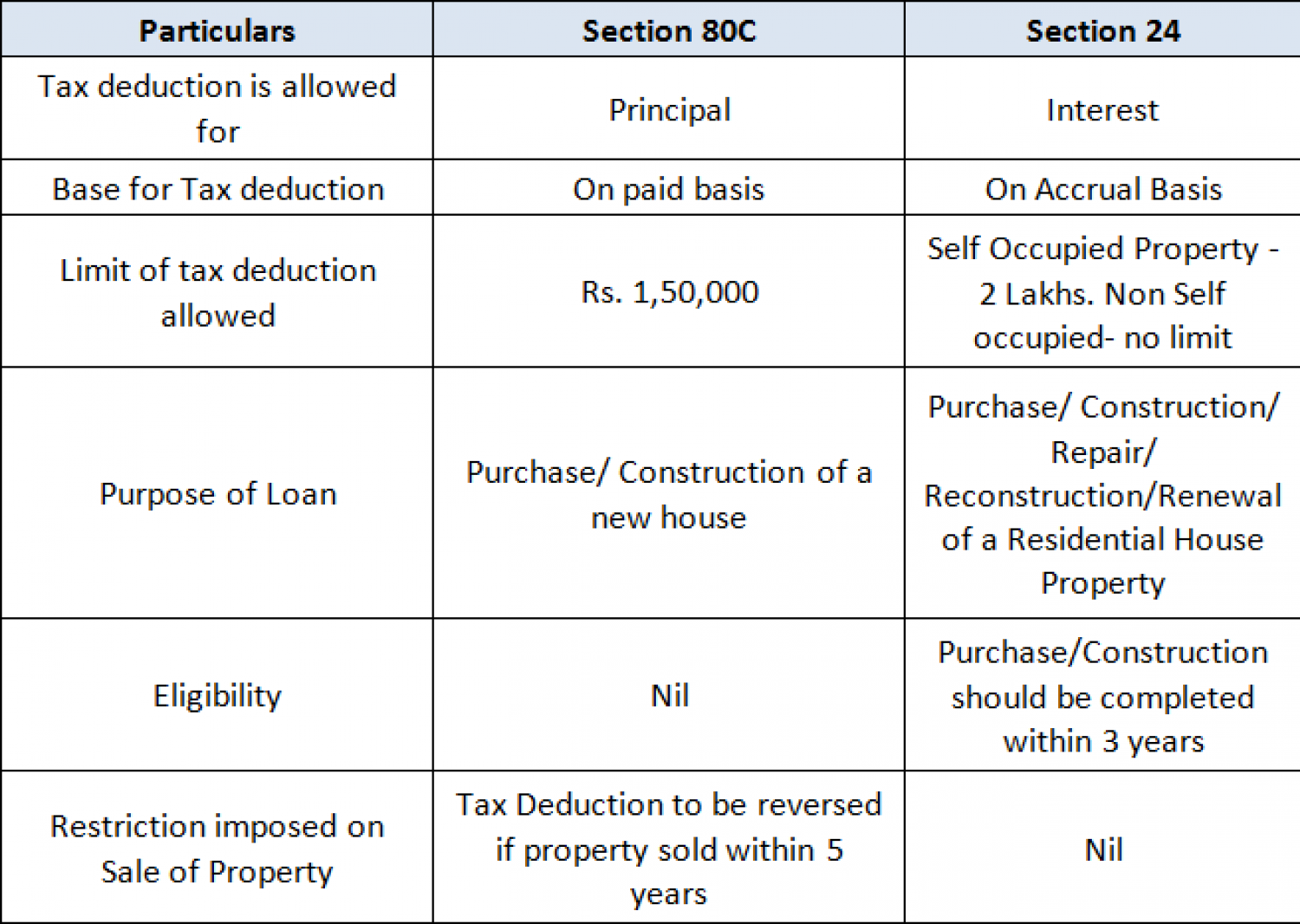

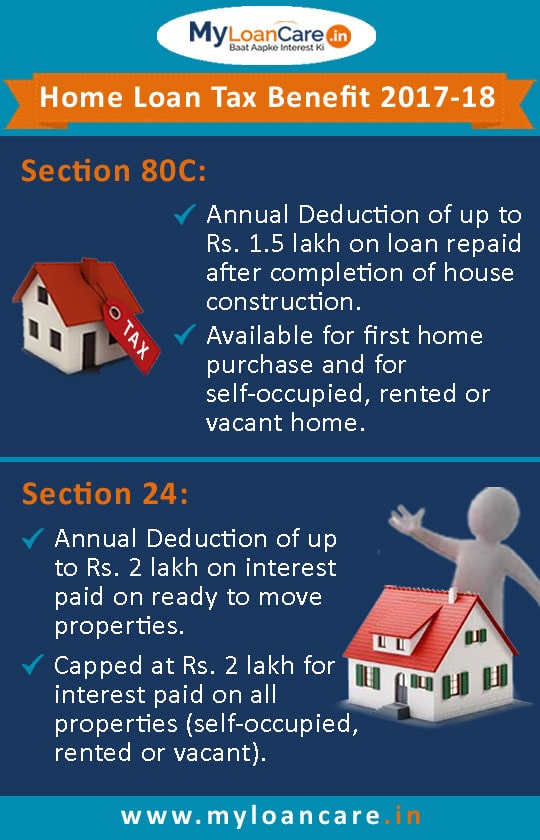

The interest paid on the home loan EMI for the year can be claimed as a deduction from your total income up to a maximum of Rs 2 lakh under Section 24

If you have a home loan you can no longer be given tax deductions for its interest expenses The change in tax rules came into force on 1 January 2023 No more

Interest On Home Loan Deduction Taxguru provide a diverse variety of printable, downloadable materials that are accessible online for free cost. They are available in numerous designs, including worksheets templates, coloring pages, and much more. The value of Interest On Home Loan Deduction Taxguru is in their variety and accessibility.

More of Interest On Home Loan Deduction Taxguru

How To Calculate Interest Using Apr Haiper

How To Calculate Interest Using Apr Haiper

Section 24 provides for deduction for interest on a home loan of up to Rs 2 00 000 in a financial year The assessee can claim a deduction up to Rs 2 lakh while

Introduction This publication discusses the rules for deducting home mortgage interest Part I contains general information on home mortgage interest including points It also

Interest On Home Loan Deduction Taxguru have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Individualization This allows you to modify the design to meet your needs when it comes to designing invitations planning your schedule or even decorating your home.

-

Educational Benefits: Free educational printables provide for students of all ages. This makes them a great source for educators and parents.

-

Convenience: The instant accessibility to a myriad of designs as well as templates helps save time and effort.

Where to Find more Interest On Home Loan Deduction Taxguru

Interest On Home Loan Deduction In Income Tax Home Loan Deduction In

Interest On Home Loan Deduction In Income Tax Home Loan Deduction In

Various Tax Deductions Available for Interest on Home Loans In India there are two main sections under the Income Tax Act 1961 that allow deductions for the

In general yes You can deduct the mortgage interest you paid during the tax year on the first 750 000 of your mortgage debt for your primary home or a second

We've now piqued your curiosity about Interest On Home Loan Deduction Taxguru We'll take a look around to see where you can find these elusive gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy have a large selection of Interest On Home Loan Deduction Taxguru designed for a variety goals.

- Explore categories like decoration for your home, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums typically offer worksheets with printables that are free, flashcards, and learning tools.

- Great for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers post their original designs or templates for download.

- These blogs cover a broad range of topics, everything from DIY projects to party planning.

Maximizing Interest On Home Loan Deduction Taxguru

Here are some creative ways how you could make the most use of printables for free:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets to reinforce learning at home or in the classroom.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Interest On Home Loan Deduction Taxguru are a treasure trove of innovative and useful resources that cater to various needs and preferences. Their accessibility and flexibility make them an invaluable addition to every aspect of your life, both professional and personal. Explore the vast array of Interest On Home Loan Deduction Taxguru today and uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Interest On Home Loan Deduction Taxguru truly for free?

- Yes you can! You can download and print these materials for free.

-

Are there any free printables in commercial projects?

- It's based on specific terms of use. Always review the terms of use for the creator prior to printing printables for commercial projects.

-

Are there any copyright violations with Interest On Home Loan Deduction Taxguru?

- Some printables may have restrictions on their use. Make sure you read the terms and condition of use as provided by the designer.

-

How can I print printables for free?

- You can print them at home using the printer, or go to a local print shop to purchase higher quality prints.

-

What program must I use to open Interest On Home Loan Deduction Taxguru?

- Many printables are offered in PDF format. These can be opened with free software, such as Adobe Reader.

Can HRA Home Loan Benefits Be Claimed When ITR Is Filing

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Check more sample of Interest On Home Loan Deduction Taxguru below

HOME LOAN INTEREST CERTIFICATE For FY 2021 22 PDF Loans Interest

Home Loan Interest Rates Compare Rates Of Top Banks Loanfasttrack

RBI REPO Rate 2022 23 4loanapp

Claiming The Student Loan Interest Deduction

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Deduction Of Principal Component And Interest Paid On Housing Loan

https://www.vero.fi/.../deductions/tax_credit_on_interest_payments

If you have a home loan you can no longer be given tax deductions for its interest expenses The change in tax rules came into force on 1 January 2023 No more

https://taxguru.in/income-tax/home-loa…

1 Home purchase loan This is the loan used to buy a house 2 Home extension loan Obtaining a loan to extend one s home allows say to add a floor room garage bathroom kitchen etc 3 Home loan

If you have a home loan you can no longer be given tax deductions for its interest expenses The change in tax rules came into force on 1 January 2023 No more

1 Home purchase loan This is the loan used to buy a house 2 Home extension loan Obtaining a loan to extend one s home allows say to add a floor room garage bathroom kitchen etc 3 Home loan

Claiming The Student Loan Interest Deduction

Home Loan Interest Rates Compare Rates Of Top Banks Loanfasttrack

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Deduction Of Principal Component And Interest Paid On Housing Loan

Home Loan Benefits For Income Tax Home Sweet Home Modern Livingroom

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Section 80EE Income Tax Deduction For Interest On Home Loan Tax2win

Home Loan Tax Benefit Smart Guide To Tax Benefit On Home Loan 2015