In a world where screens rule our lives and the appeal of physical printed objects isn't diminished. Whether it's for educational purposes project ideas, artistic or simply adding an individual touch to the area, Input Tax Credit What It Means have proven to be a valuable resource. Here, we'll take a dive through the vast world of "Input Tax Credit What It Means," exploring what they are, how they are available, and how they can enhance various aspects of your life.

Get Latest Input Tax Credit What It Means Below

Input Tax Credit What It Means

Input Tax Credit What It Means -

Input tax credit or ITC enables businesses to reduce the tax liability as it makes a sale by claiming the credit depending on how much GST was paid on the business s

Input tax credit refers to the mechanism of claiming a reduction of tax paid on the inputs of a business or profession In India under the Goods and Service Tax GST law a business

Printables for free include a vast assortment of printable, downloadable documents that can be downloaded online at no cost. The resources are offered in a variety designs, including worksheets templates, coloring pages, and much more. The attraction of printables that are free is in their variety and accessibility.

More of Input Tax Credit What It Means

What Is Input Tax Credit And How To Claim It YouTube

What Is Input Tax Credit And How To Claim It YouTube

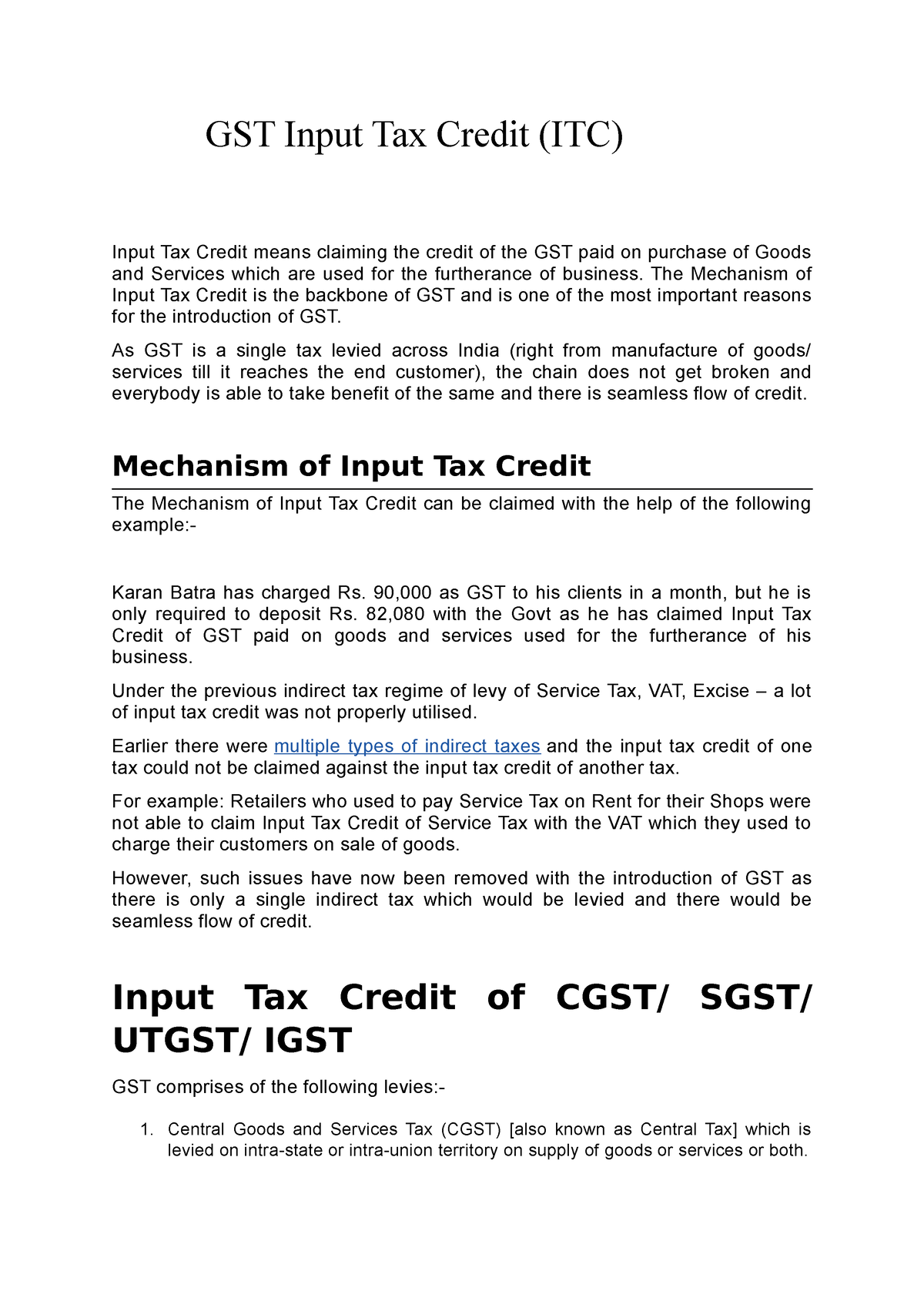

Input Tax Credit means claiming the credit of the GST paid on purchase of Goods and Services which are used for the furtherance of business The Mechanism of Input Tax Credit

What is an input tax credit Also known as a GST credit this is a form of credit that a business may claim for the GST included in the price of goods and services that it purchases When to Claim Input Tax Credits To

The Input Tax Credit What It Means have gained huge appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

The ability to customize: They can make printing templates to your own specific requirements, whether it's designing invitations and schedules, or even decorating your house.

-

Educational Value These Input Tax Credit What It Means can be used by students of all ages. This makes them a useful tool for parents and educators.

-

The convenience of The instant accessibility to a plethora of designs and templates saves time and effort.

Where to Find more Input Tax Credit What It Means

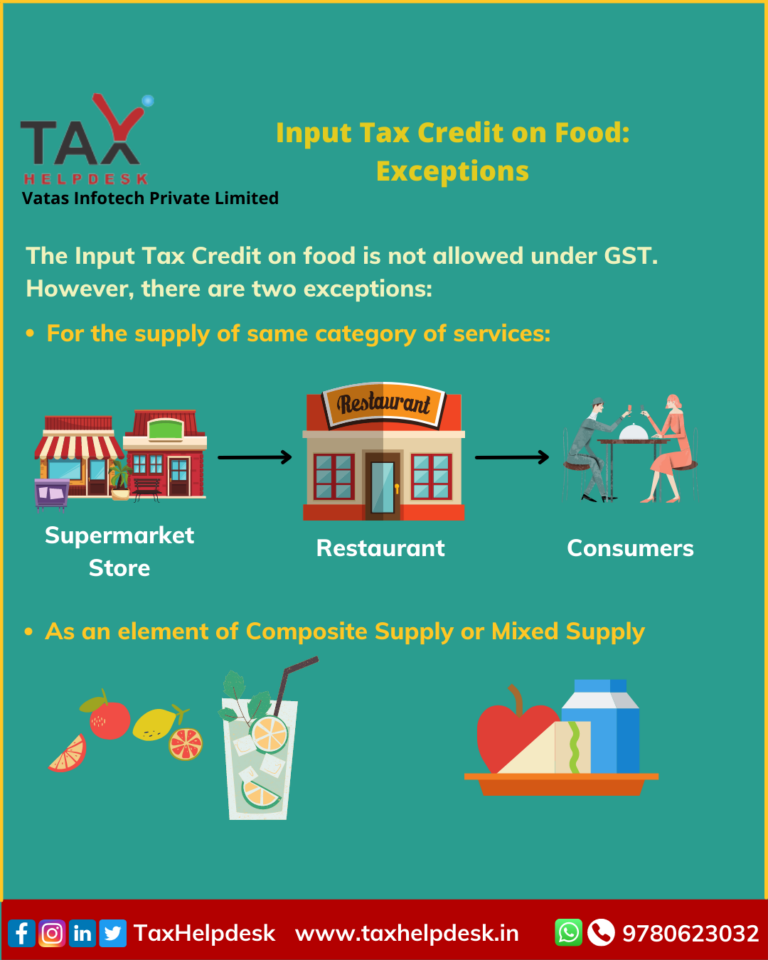

Know Whether You Can Claim Input Tax Credit On Food

Know Whether You Can Claim Input Tax Credit On Food

An input tax credit means that while paying tax on the sale output of goods and services you can avail yourself of the tax you have already paid on the purchase input

Input Tax Credit ITC means claiming the credit of the GST paid on the purchase of Goods and Services which are used for the furtherance of business The Mechanism of Input Tax Credit is the backbone of GST and is

We've now piqued your curiosity about Input Tax Credit What It Means and other printables, let's discover where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a wide selection of Input Tax Credit What It Means suitable for many objectives.

- Explore categories such as design, home decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets for flashcards, lessons, and worksheets. tools.

- Ideal for teachers, parents as well as students who require additional resources.

3. Creative Blogs

- Many bloggers post their original designs as well as templates for free.

- The blogs are a vast range of topics, starting from DIY projects to party planning.

Maximizing Input Tax Credit What It Means

Here are some fresh ways create the maximum value use of printables for free:

1. Home Decor

- Print and frame gorgeous artwork, quotes, or even seasonal decorations to decorate your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance learning at home and in class.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable planners, to-do lists, and meal planners.

Conclusion

Input Tax Credit What It Means are an abundance with useful and creative ideas that satisfy a wide range of requirements and interest. Their accessibility and flexibility make them a great addition to the professional and personal lives of both. Explore the world of Input Tax Credit What It Means today to uncover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really are they free?

- Yes you can! You can print and download these files for free.

-

Can I download free printables in commercial projects?

- It is contingent on the specific rules of usage. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Are there any copyright concerns when using printables that are free?

- Certain printables could be restricted on their use. Check the terms and conditions set forth by the designer.

-

How can I print Input Tax Credit What It Means?

- Print them at home with your printer or visit any local print store for superior prints.

-

What program do I need to run printables free of charge?

- The majority of printed documents are with PDF formats, which can be opened with free software like Adobe Reader.

Itc No Input Tax Credit On Festive Offers To Retailers GST AAR

Understanding Input Tax Credits Blueprint Accounting

Check more sample of Input Tax Credit What It Means below

What Is Input Credit ITC Under GST

Conditions Made To Claim Input Tax Credit Authoritative Blog

GST Input Tax Credit Very Important GST Input Tax Credit ITC

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

![]()

Input Tax Credit Under GST With Examples Unlimited Guide

https://cleartax.in/glossary/input-tax-credit

Input tax credit refers to the mechanism of claiming a reduction of tax paid on the inputs of a business or profession In India under the Goods and Service Tax GST law a business

https://cleartax.in/s/gst-input-tax-credit

Input tax credit refers to the amount of GST paid on purchases available for credit against tax liability What is input tax credit in gst with example Input Tax Credit ITC in GST lets businesses reduce their tax

Input tax credit refers to the mechanism of claiming a reduction of tax paid on the inputs of a business or profession In India under the Goods and Service Tax GST law a business

Input tax credit refers to the amount of GST paid on purchases available for credit against tax liability What is input tax credit in gst with example Input Tax Credit ITC in GST lets businesses reduce their tax

Conditions Made To Claim Input Tax Credit Authoritative Blog

Input Tax Credit Or ITC Guide On Meaning Eligibility And How To

Input Tax Credit Under GST With Examples Unlimited Guide

Input Tax Credit Utilisation Changes Through GST Amendment 2019

Guide To Maximizing The Utilization Of GST Input Tax Credit

Guide To Maximizing The Utilization Of GST Input Tax Credit

PDF Goods And Services Tax INPUT TAX CREDIT Input Tax Credit Key