Today, where screens have become the dominant feature of our lives and the appeal of physical printed products hasn't decreased. No matter whether it's for educational uses such as creative projects or simply to add some personal flair to your home, printables for free have become a valuable resource. Here, we'll dive deep into the realm of "India Income Tax Home Loan Interest Exemption," exploring the benefits of them, where they are available, and the ways that they can benefit different aspects of your life.

Get Latest India Income Tax Home Loan Interest Exemption Below

India Income Tax Home Loan Interest Exemption

India Income Tax Home Loan Interest Exemption -

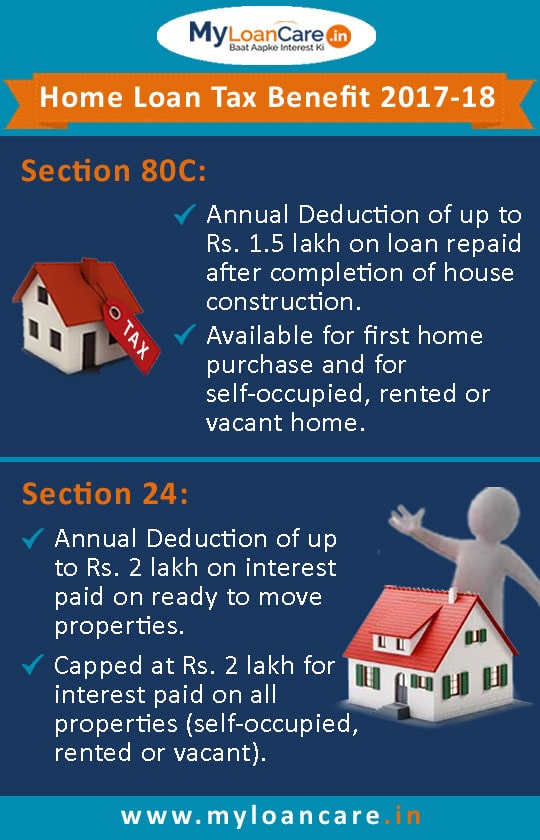

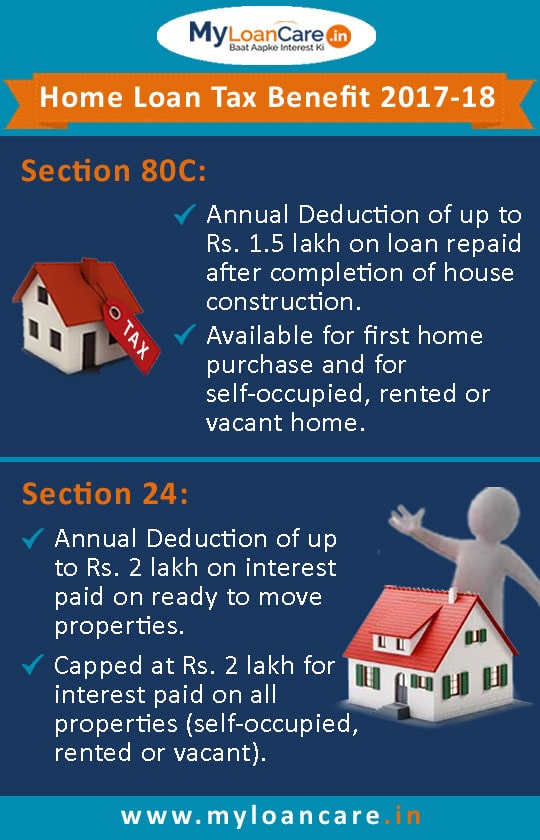

If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C This doubles the amount of deductions available when compared to a home loan taken by a single applicant

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

Printables for free cover a broad selection of printable and downloadable materials online, at no cost. These printables come in different forms, like worksheets templates, coloring pages and much more. The appeal of printables for free lies in their versatility as well as accessibility.

More of India Income Tax Home Loan Interest Exemption

Tax Benefits On Home Loan Know More At Taxhelpdesk

Tax Benefits On Home Loan Know More At Taxhelpdesk

Taxpayers in India can claim both HRA and deduction on home loan interest under specific conditions benefiting those paying rent and having a home loan Requirements include being a salaried individual receiving HRA residing in the same city as work and availing a home loan

Section 80EE allows Income Tax Benefits on Interest on Home Loan to first time buyers in the following events This deduction will be provided only if the cost of the property acquired is not more than Rs 50 Lakhs and the amount of the loan taken is up to Rs 35 Lakhs The loan should be sanctioned between 1st April 2016 and 31st March

India Income Tax Home Loan Interest Exemption have gained a lot of appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Individualization They can make print-ready templates to your specific requirements be it designing invitations for your guests, organizing your schedule or even decorating your house.

-

Educational Value: Printables for education that are free provide for students of all ages, which makes them a vital instrument for parents and teachers.

-

Easy to use: Instant access to a plethora of designs and templates cuts down on time and efforts.

Where to Find more India Income Tax Home Loan Interest Exemption

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Home Loan Tax Exemption Check Tax Benefits On Home Loan

New income tax rules from April 2022 Those first time home buyers who have got home loan sanction letter before 1st April 2022 and their property value is less than 45 lakh can still

Currently homebuyers can claim an income tax deduction on the interest paid on their home loan under Section 24 b of the Income tax Act 1961 The maximum amount of deduction that can be claimed is Rs 2 lakh per financial year for a self occupied property There is an express need for more tax sops for home buyers as well as

Now that we've ignited your interest in printables for free Let's look into where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of printables that are free for a variety of goals.

- Explore categories such as decoration for your home, education, management, and craft.

2. Educational Platforms

- Forums and educational websites often offer free worksheets and worksheets for printing for flashcards, lessons, and worksheets. materials.

- This is a great resource for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs or templates for download.

- These blogs cover a wide spectrum of interests, ranging from DIY projects to party planning.

Maximizing India Income Tax Home Loan Interest Exemption

Here are some ways for you to get the best of printables that are free:

1. Home Decor

- Print and frame stunning artwork, quotes or festive decorations to decorate your living areas.

2. Education

- Utilize free printable worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and decorations for special events like weddings or birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

India Income Tax Home Loan Interest Exemption are an abundance of practical and innovative resources that can meet the needs of a variety of people and desires. Their accessibility and versatility make they a beneficial addition to every aspect of your life, both professional and personal. Explore the vast array of India Income Tax Home Loan Interest Exemption today to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free free?

- Yes you can! You can download and print these documents for free.

-

Can I utilize free printing templates for commercial purposes?

- It's determined by the specific usage guidelines. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables could be restricted on their use. You should read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- Print them at home using a printer or visit an area print shop for top quality prints.

-

What software do I need to open printables for free?

- The majority of PDF documents are provided with PDF formats, which is open with no cost software such as Adobe Reader.

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Check more sample of India Income Tax Home Loan Interest Exemption below

Solved Please Note That This Is Based On Philippine Tax System Please

Home Loan Interest Rate Home Sweet Home

Buy INCOME TAX LAW AND PRACTICE 2018 19 Book Online At Low Prices In

Income Tax Rates Slab For FY 2022 23 Or AY 2023 24 Ebizfiling

Income Tax Benefits On Housing Loan In India

Home Loan Benefits For Income Tax Home Sweet Home Modern Livingroom

https://cleartax.in/s/home-loan-tax-benefit

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is up to Rs 50 000 per financial year Taxpayers can claim 80EE if they had serviced a home loan between 1 April 2016 to 31 March 2017

If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs 1 5 lakh each in their tax returns To claim this deduction they should also be co owners of the property taken on loan

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is up to Rs 50 000 per financial year Taxpayers can claim 80EE if they had serviced a home loan between 1 April 2016 to 31 March 2017

Income Tax Rates Slab For FY 2022 23 Or AY 2023 24 Ebizfiling

Home Loan Interest Rate Home Sweet Home

Income Tax Benefits On Housing Loan In India

Home Loan Benefits For Income Tax Home Sweet Home Modern Livingroom

All You Need To Know On How To Save Income Tax Ebizfiling

Income Tax Rules For Startups And Tax Saving Schemes For Startups

Income Tax Rules For Startups And Tax Saving Schemes For Startups

How To Deduct Property Taxes On IRS Tax Forms Irs Tax Forms Mortgage