In this age of electronic devices, where screens have become the dominant feature of our lives The appeal of tangible printed products hasn't decreased. Be it for educational use as well as creative projects or simply adding personal touches to your home, printables for free are a great resource. We'll dive into the sphere of "Income Tax Rebate On Self Education In India," exploring what they are, how to find them and how they can be used to enhance different aspects of your life.

Get Latest Income Tax Rebate On Self Education In India Below

Income Tax Rebate On Self Education In India

Income Tax Rebate On Self Education In India -

Web 22 juil 2019 nbsp 0183 32 Deduction for Children Education amp Tuition Fees Tax Benefits Under Section 80C India s literacy rate is 77 70 2021 and 2022 To further promote

Web 14 avr 2017 nbsp 0183 32 In a financial year individuals can claim a maximum deduction of Rs 1 5 lakh for payments made towards tuition fees along with deductions for items such as

Income Tax Rebate On Self Education In India offer a wide range of downloadable, printable content that can be downloaded from the internet at no cost. These printables come in different formats, such as worksheets, templates, coloring pages and more. The appeal of printables for free is their flexibility and accessibility.

More of Income Tax Rebate On Self Education In India

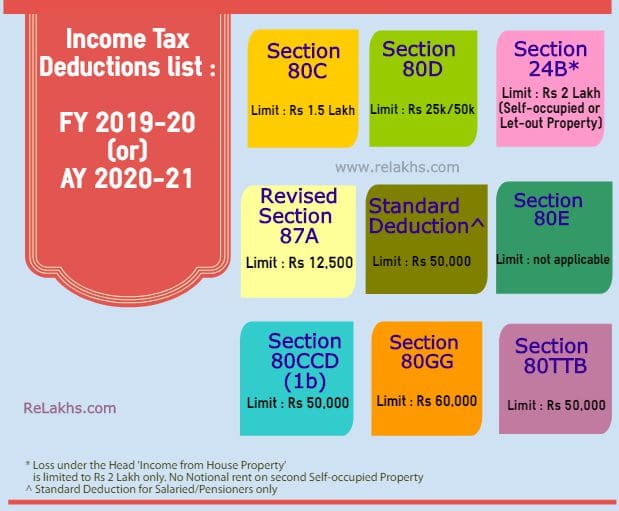

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Income Tax Deductions List FY 2019 20 How To Save Tax For AY 20 21

Web To promote the importance of education amongst the citizen the Income Tax Department introduced various tax benefits or education fees deduction in income tax This helps

Web 10 sept 2018 nbsp 0183 32 Rs 80 000 under Section 80C of the ITA sums paid towards PPF LIP Balance Rs 70 000 for tuition fees 150 000 80 000 or vice versa In other words the

Income Tax Rebate On Self Education In India have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity to purchase physical copies or expensive software.

-

The ability to customize: The Customization feature lets you tailor printed materials to meet your requirements be it designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Worth: Downloads of educational content for free are designed to appeal to students of all ages, which makes the perfect resource for educators and parents.

-

Accessibility: You have instant access numerous designs and templates cuts down on time and efforts.

Where to Find more Income Tax Rebate On Self Education In India

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

How To Celebrate With Rebate Planning For Incomes PRACTICAL TAX

Web 25 f 233 vr 2021 nbsp 0183 32 Self Education Expenses The provisions of this Section 80C are only applicable when you are spending your income specifically on tuition fees of your child This means that as a parent you are not

Web 17 f 233 vr 2017 nbsp 0183 32 Synopsis When you pay your kids tuition fees it qualifies for income deduction and also helps in reducing your tax liability Here is how you can claim this tax

We've now piqued your interest in printables for free, let's explore where they are hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of Income Tax Rebate On Self Education In India designed for a variety uses.

- Explore categories like decorating your home, education, the arts, and more.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing including flashcards, learning tools.

- The perfect resource for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- These blogs cover a wide array of topics, ranging that includes DIY projects to party planning.

Maximizing Income Tax Rebate On Self Education In India

Here are some innovative ways that you can make use use of Income Tax Rebate On Self Education In India:

1. Home Decor

- Print and frame gorgeous art, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Print out free worksheets and activities to reinforce learning at home or in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Rebate On Self Education In India are an abundance with useful and creative ideas for a variety of needs and needs and. Their accessibility and versatility make they a beneficial addition to each day life. Explore the plethora of Income Tax Rebate On Self Education In India to open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly free?

- Yes you can! You can print and download the resources for free.

-

Can I download free templates for commercial use?

- It's dependent on the particular rules of usage. Be sure to read the rules of the creator before using printables for commercial projects.

-

Do you have any copyright issues with Income Tax Rebate On Self Education In India?

- Certain printables could be restricted in their usage. Always read the conditions and terms of use provided by the author.

-

How do I print printables for free?

- You can print them at home with any printer or head to any local print store for premium prints.

-

What software do I need to open Income Tax Rebate On Self Education In India?

- The majority of printables are in the format of PDF, which is open with no cost programs like Adobe Reader.

Education Tax Credit 2020 Income Limits TIEDUN

Indian Budget 2023 Income Tax Rebate Limit Increased No Tax On Income

Check more sample of Income Tax Rebate On Self Education In India below

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Income Tax IT Benefits Rebates For Senior Citizens Website For Andhra

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Fortune India Business News Strategy Finance And Corporate Insight

INCOME TAX REBATE ON INVESTMENT

https://cleartax.in/s/tuition-fees-deduction-under-section-80c

Web 14 avr 2017 nbsp 0183 32 In a financial year individuals can claim a maximum deduction of Rs 1 5 lakh for payments made towards tuition fees along with deductions for items such as

https://www.livemint.com/money/personal-fina…

Web 3 oct 2021 nbsp 0183 32 Let us discuss the benefits available under the income tax laws in India in connection with education Deduction under Section 80

Web 14 avr 2017 nbsp 0183 32 In a financial year individuals can claim a maximum deduction of Rs 1 5 lakh for payments made towards tuition fees along with deductions for items such as

Web 3 oct 2021 nbsp 0183 32 Let us discuss the benefits available under the income tax laws in India in connection with education Deduction under Section 80

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Fortune India Business News Strategy Finance And Corporate Insight

INCOME TAX REBATE ON INVESTMENT

Tax Rebate On Income Upto 5 Lakh Under Section 87A

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Revised Tax Rebate Under Sec 87A After Budget 2019 BasuNivesh

Interim Budget 2019 20 The Talk Of The Town Trade Brains