In the age of digital, where screens dominate our lives however, the attraction of tangible printed material hasn't diminished. No matter whether it's for educational uses, creative projects, or simply to add a personal touch to your space, Income Tax Rebate On Medical Expenses Of Parents can be an excellent resource. We'll dive into the world "Income Tax Rebate On Medical Expenses Of Parents," exploring the benefits of them, where you can find them, and what they can do to improve different aspects of your daily life.

Get Latest Income Tax Rebate On Medical Expenses Of Parents Below

Income Tax Rebate On Medical Expenses Of Parents

Income Tax Rebate On Medical Expenses Of Parents -

Web 24 oct 2022 nbsp 0183 32 Medical Tax Relief Types Amount Medical treatment special needs and carer expenses for parents Medical condition certified by medical practitioner

Web 17 juil 2019 nbsp 0183 32 Section 80DDB provides a deduction for the expenditure actually incurred on the treatment of specified diseases for self spouse children parents and siblings

Income Tax Rebate On Medical Expenses Of Parents cover a large array of printable items that are available online at no cost. These resources come in various forms, like worksheets coloring pages, templates and many more. The value of Income Tax Rebate On Medical Expenses Of Parents lies in their versatility as well as accessibility.

More of Income Tax Rebate On Medical Expenses Of Parents

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Solved Janice Morgan Age 24 Is Single And Has No Dependents She Is

Web 29 juin 2018 nbsp 0183 32 Deduction under section 80DDB can be claimed by an individual or a HUF who is resident in India Deduction is available in

Web 15 mars 2019 nbsp 0183 32 Section 80D of the Income tax Act allows you to save tax by claiming medical expenditures incurred as a deduction from income before levy of tax You can claim this deduction if these two conditions

Income Tax Rebate On Medical Expenses Of Parents have gained immense popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

The ability to customize: They can make print-ready templates to your specific requirements in designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Worth: Printables for education that are free can be used by students of all ages, making them a valuable tool for parents and educators.

-

An easy way to access HTML0: Access to numerous designs and templates cuts down on time and efforts.

Where to Find more Income Tax Rebate On Medical Expenses Of Parents

Medical Expenses Rebate YouTube

Medical Expenses Rebate YouTube

Web The tax deduction limit increases to Rs 50 000 per fiscal year for senior citizens aged 60 years and above Individuals can claim tax deductions under Section 80D on a health

Web 21 f 233 vr 2022 nbsp 0183 32 Section 80D of Income Tax Act allows deduction of up to Rs 50 000 for medical expenses incurred for senior citizens self spouses or dependent children If you are making payment of

After we've peaked your interest in printables for free Let's find out where they are hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection with Income Tax Rebate On Medical Expenses Of Parents for all needs.

- Explore categories like the home, decor, organizational, and arts and crafts.

2. Educational Platforms

- Educational websites and forums frequently offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- It is ideal for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers share their imaginative designs and templates for no cost.

- The blogs covered cover a wide variety of topics, that includes DIY projects to planning a party.

Maximizing Income Tax Rebate On Medical Expenses Of Parents

Here are some ideas to make the most of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Print out free worksheets and activities to enhance learning at home or in the classroom.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

Income Tax Rebate On Medical Expenses Of Parents are a treasure trove of practical and imaginative resources which cater to a wide range of needs and desires. Their availability and versatility make them a fantastic addition to any professional or personal life. Explore the many options of Income Tax Rebate On Medical Expenses Of Parents today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really free?

- Yes you can! You can print and download these resources at no cost.

-

Can I use the free printables for commercial uses?

- It's contingent upon the specific rules of usage. Always verify the guidelines of the creator prior to using the printables in commercial projects.

-

Are there any copyright issues in Income Tax Rebate On Medical Expenses Of Parents?

- Some printables could have limitations on use. Be sure to check the terms and conditions provided by the creator.

-

How do I print printables for free?

- You can print them at home with any printer or head to a local print shop to purchase top quality prints.

-

What program is required to open printables free of charge?

- Most PDF-based printables are available in the format PDF. This can be opened using free software like Adobe Reader.

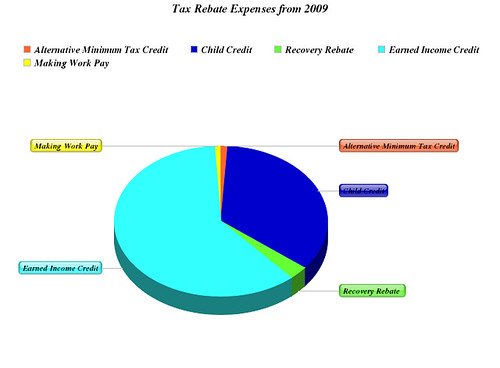

Tax Rebate Expenses From 2009 Maddogg41283 Flickr

SCE OFFERS REBATES TO CUSTOMERS WHO ARE MEDICAL BASELINE BASED ON LOWER

Check more sample of Income Tax Rebate On Medical Expenses Of Parents below

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

Solved Janice Morgan Age 24 Is Single And Has No Chegg

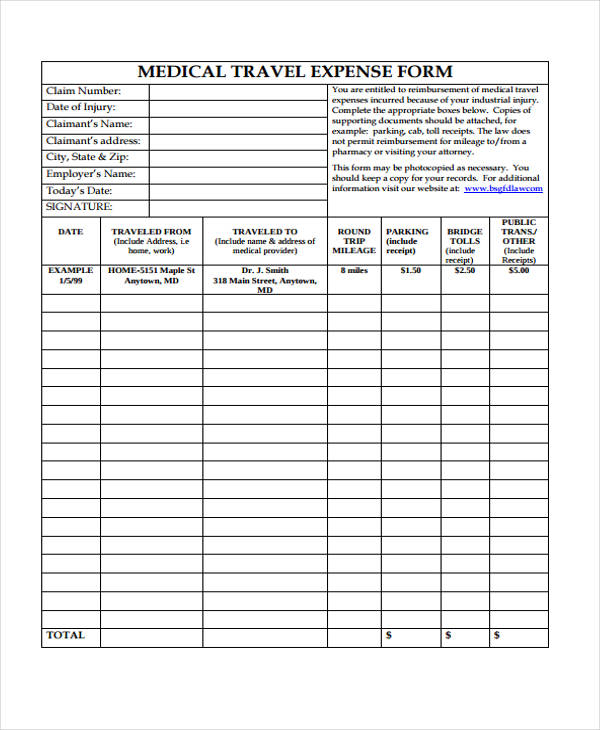

FREE 11 Medical Expense Forms In PDF MS Word

Http www anchor tax service financial tools deductions medical

Deferred Tax And Temporary Differences The Footnotes Analyst

Income Tax Rebate Under Section 87A

https://tax2win.in/guide/section-80ddb

Web 17 juil 2019 nbsp 0183 32 Section 80DDB provides a deduction for the expenditure actually incurred on the treatment of specified diseases for self spouse children parents and siblings

https://economictimes.indiatimes.com/wealth/t…

Web 28 f 233 vr 2019 nbsp 0183 32 Can medical bills help me save tax under section 80D Yes medical bills of your senior citizen parents or of yourself if you are

Web 17 juil 2019 nbsp 0183 32 Section 80DDB provides a deduction for the expenditure actually incurred on the treatment of specified diseases for self spouse children parents and siblings

Web 28 f 233 vr 2019 nbsp 0183 32 Can medical bills help me save tax under section 80D Yes medical bills of your senior citizen parents or of yourself if you are

Http www anchor tax service financial tools deductions medical

Solved Janice Morgan Age 24 Is Single And Has No Chegg

Deferred Tax And Temporary Differences The Footnotes Analyst

Income Tax Rebate Under Section 87A

Is It Possible To Stop Paying Property Taxes By Removing Your Property

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

2022 1040 Schedule A

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

2022 1040 Schedule A

Tax Rebate For Individual Deductions For Individuals reliefs