In this age of electronic devices, where screens rule our lives it's no wonder that the appeal of tangible printed objects isn't diminished. For educational purposes as well as creative projects or simply to add an individual touch to your home, printables for free can be an excellent resource. In this article, we'll take a dive into the sphere of "Income Tax Rebate On Joint Housing Loan," exploring their purpose, where to find them and how they can enrich various aspects of your lives.

Get Latest Income Tax Rebate On Joint Housing Loan Below

Income Tax Rebate On Joint Housing Loan

Income Tax Rebate On Joint Housing Loan - Income Tax Exemption For Joint Housing Loan, Income Tax Rebate On Second Housing Loan Interest, Joint Home Loan Tax Benefits, Income Tax Rebate On Home Loan Rules

Web 16 mars 2021 nbsp 0183 32 These benefits are available under Section 80C for principal prepayment and under Section 24 b for interest paid But at times there is some confusion about

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

Income Tax Rebate On Joint Housing Loan encompass a wide array of printable content that can be downloaded from the internet at no cost. They are available in numerous kinds, including worksheets templates, coloring pages, and many more. The great thing about Income Tax Rebate On Joint Housing Loan is in their versatility and accessibility.

More of Income Tax Rebate On Joint Housing Loan

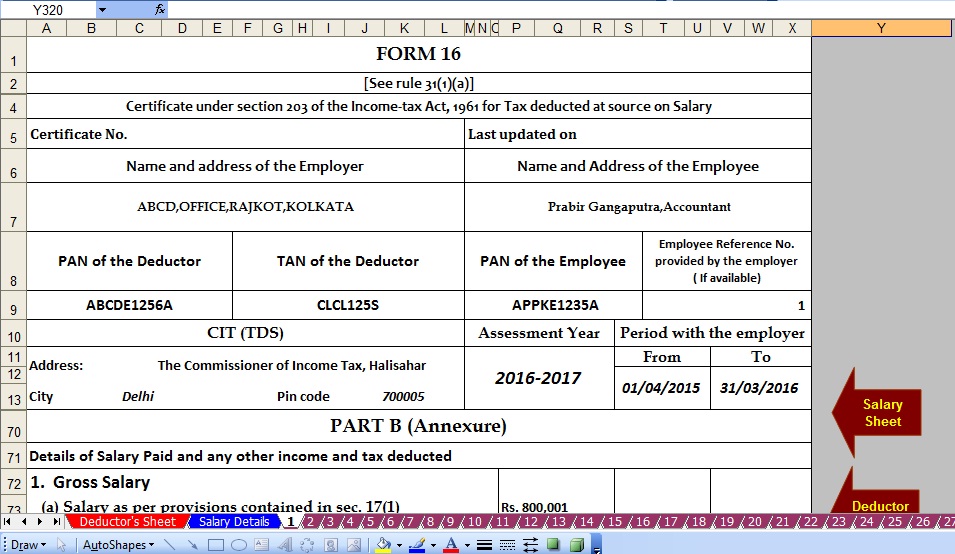

Latest Income Tax Rebate On Home Loan 2023

Latest Income Tax Rebate On Home Loan 2023

Web 28 mars 2017 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to Rs

Web 11 avr 2023 nbsp 0183 32 Deductions per section 24 b of the Income Tax Act Section 24 b of the Income Tax Act allows for a deduction of up to Rs 2 lakh on the interest paid towards a

Print-friendly freebies have gained tremendous popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Flexible: There is the possibility of tailoring the templates to meet your individual needs whether it's making invitations for your guests, organizing your schedule or decorating your home.

-

Educational Impact: The free educational worksheets can be used by students of all ages, which makes them an invaluable tool for parents and educators.

-

Convenience: Instant access to a plethora of designs and templates, which saves time as well as effort.

Where to Find more Income Tax Rebate On Joint Housing Loan

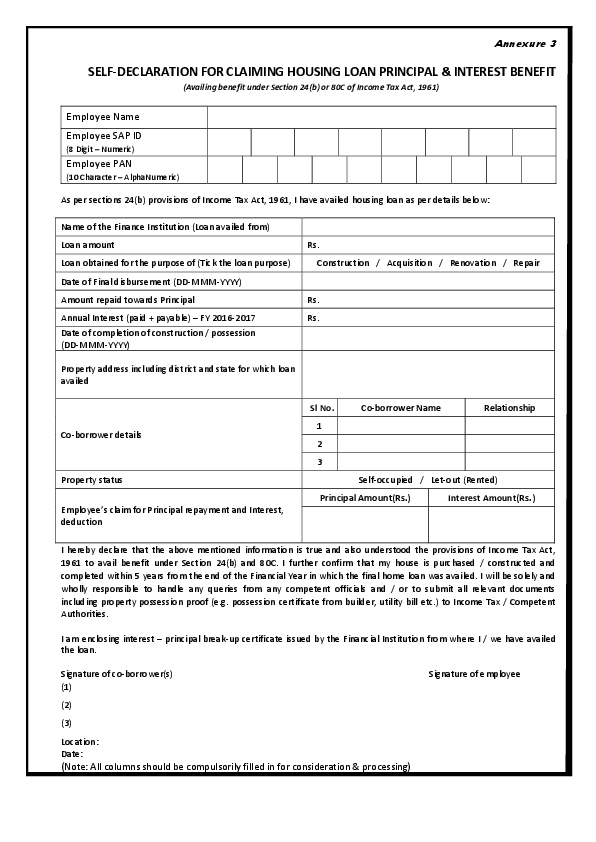

Joint Home Loan Declaration Form For Income Tax Savings And Non

Joint Home Loan Declaration Form For Income Tax Savings And Non

Web 16 oct 2012 nbsp 0183 32 As per the Income Tax Act provisions in case of joint loans all the co borrowers can avail tax benefits The maximum stipulated limit of Rs 150000 is

Web Having a joint home loan is advantageous when both the co borrowers are tax payers But do keep in mind that to claim income tax benefits in joint home loan all the co

Since we've got your curiosity about Income Tax Rebate On Joint Housing Loan Let's find out where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of printables that are free for a variety of objectives.

- Explore categories such as interior decor, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums typically offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- The perfect resource for parents, teachers as well as students who require additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates for free.

- The blogs covered cover a wide range of interests, ranging from DIY projects to planning a party.

Maximizing Income Tax Rebate On Joint Housing Loan

Here are some unique ways that you can make use use of Income Tax Rebate On Joint Housing Loan:

1. Home Decor

- Print and frame beautiful images, quotes, or seasonal decorations to adorn your living areas.

2. Education

- Use free printable worksheets to enhance your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax Rebate On Joint Housing Loan are a treasure trove filled with creative and practical information designed to meet a range of needs and interests. Their accessibility and versatility make them a fantastic addition to both personal and professional life. Explore the many options that is Income Tax Rebate On Joint Housing Loan today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes, they are! You can download and print these documents for free.

-

Can I make use of free printables to make commercial products?

- It's dependent on the particular conditions of use. Always review the terms of use for the creator before using their printables for commercial projects.

-

Do you have any copyright issues with printables that are free?

- Certain printables may be subject to restrictions on usage. Check these terms and conditions as set out by the designer.

-

How can I print Income Tax Rebate On Joint Housing Loan?

- You can print them at home using your printer or visit an area print shop for better quality prints.

-

What program do I need to open printables free of charge?

- Most printables come in PDF format, which is open with no cost software such as Adobe Reader.

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Housing Loans Joint Declaration Form For Housing Loan

Check more sample of Income Tax Rebate On Joint Housing Loan below

How To Calculate Tax Rebate On Home Loan Grizzbye

Home Loan Tax Benefit Calculator FrankiSoumya

Income Tax Rebate On Home Loan Applicable Sections Under I T Act

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Georgia Income Tax Rebate 2023 Printable Rebate Form

What Are Reuluations About Getting A Home Loan On A Forclosed Home

https://housing.com/news/claim-tax-benefits-joint-home-loans

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

https://www.pnbhousing.com/blog/joint-home-loan-tax-benefits-and-other...

Web 7 avr 2022 nbsp 0183 32 What are the Joint Home Loan Tax Advantages 1 For a Self Contained Dwelling In their Income Tax Return each co owner who is a loan co applicant can

Web For one self occupied property you can claim interest benefits upto a limit of Rs 2 lakhs in case of each of the joint owners For home loan repayment each co borrower can claim

Web 7 avr 2022 nbsp 0183 32 What are the Joint Home Loan Tax Advantages 1 For a Self Contained Dwelling In their Income Tax Return each co owner who is a loan co applicant can

Section 80EE Income Tax Deduction For Interest On Home Loan Housing News

Home Loan Tax Benefit Calculator FrankiSoumya

Georgia Income Tax Rebate 2023 Printable Rebate Form

What Are Reuluations About Getting A Home Loan On A Forclosed Home

PDF SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST

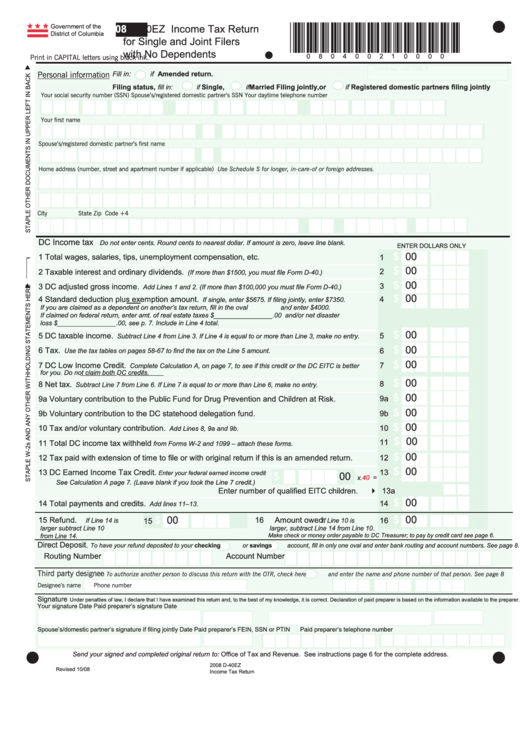

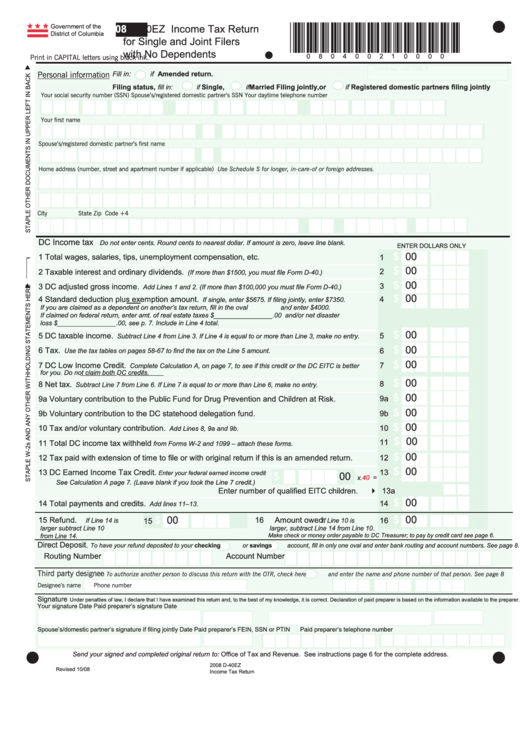

Form D 40ez Income Tax Return For Single And Joint Filers With No

Form D 40ez Income Tax Return For Single And Joint Filers With No

Latest Income Tax Rebate On Home Loan 2023