In a world where screens have become the dominant feature of our lives The appeal of tangible printed items hasn't gone away. It doesn't matter if it's for educational reasons project ideas, artistic or simply adding some personal flair to your area, Income Tax Rebate On Home Loan Principal Before Possession are now a vital resource. We'll take a dive through the vast world of "Income Tax Rebate On Home Loan Principal Before Possession," exploring what they are, where they can be found, and the ways that they can benefit different aspects of your daily life.

Get Latest Income Tax Rebate On Home Loan Principal Before Possession Below

Income Tax Rebate On Home Loan Principal Before Possession

Income Tax Rebate On Home Loan Principal Before Possession -

Web 28 janv 2014 nbsp 0183 32 3 Answers Sorted by 1 The rebate is available from the financial year in which you have taken the possession of the property All the interest paid in that

Web 16 mai 2013 nbsp 0183 32 Principal component Section 80C provides that the principal component of the home loan is entitled to exemption up to Rs 100 000 along with all other permissible

Printables for free cover a broad range of downloadable, printable documents that can be downloaded online at no cost. They come in many forms, including worksheets, templates, coloring pages, and many more. One of the advantages of Income Tax Rebate On Home Loan Principal Before Possession is their versatility and accessibility.

More of Income Tax Rebate On Home Loan Principal Before Possession

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Web 12 janv 2022 nbsp 0183 32 Combined with tax exemptions on the principal amount a home loan for under construction property makes your dream house more affordable Yes you can

Web 5 f 233 vr 2023 nbsp 0183 32 If the loan is taken jointly each loan holder can claim a deduction for home loan interest up to Rs 2 lakh each and principal repayment under Section 80C up to

Print-friendly freebies have gained tremendous popularity due to several compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or costly software.

-

Flexible: This allows you to modify print-ready templates to your specific requirements be it designing invitations and schedules, or even decorating your home.

-

Educational Impact: Printables for education that are free can be used by students of all ages, which makes them a useful resource for educators and parents.

-

The convenience of immediate access various designs and templates, which saves time as well as effort.

Where to Find more Income Tax Rebate On Home Loan Principal Before Possession

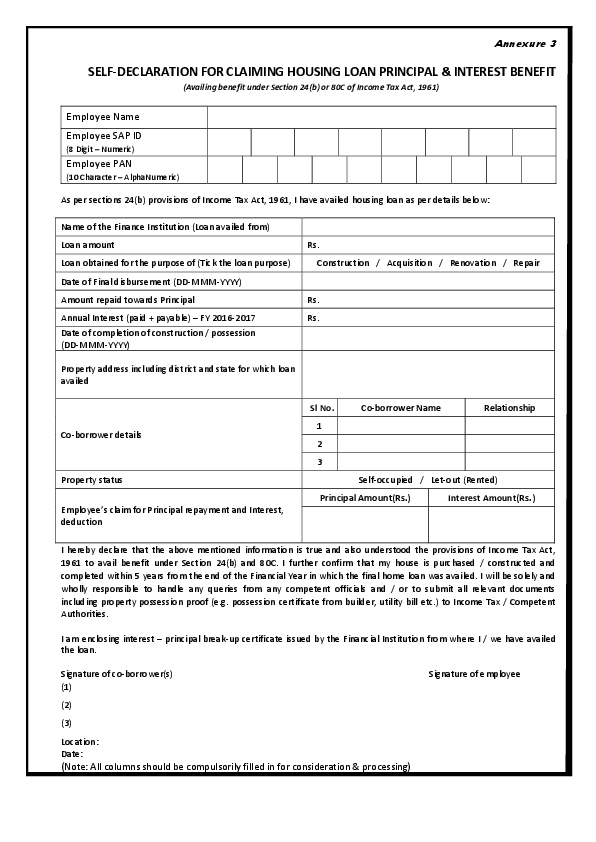

PDF SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST

PDF SELF DECLARATION FOR CLAIMING HOUSING LOAN PRINCIPAL INTEREST

Web 31 janv 2023 nbsp 0183 32 A home buyer can claim an income tax rebate under Section 24 B on home loan interest payments made before taking possession of the unit in the

Web 9 sept 2023 nbsp 0183 32 In case of delayed possession over the stipulated period considering that the tax deduction limit over the first 5 years in Rs 2 lakh and the tax deductible limit after

In the event that we've stirred your curiosity about Income Tax Rebate On Home Loan Principal Before Possession, let's explore where the hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of Income Tax Rebate On Home Loan Principal Before Possession suitable for many goals.

- Explore categories such as the home, decor, crafting, and organization.

2. Educational Platforms

- Educational websites and forums typically provide worksheets that can be printed for free along with flashcards, as well as other learning materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers are willing to share their original designs and templates free of charge.

- The blogs covered cover a wide selection of subjects, from DIY projects to party planning.

Maximizing Income Tax Rebate On Home Loan Principal Before Possession

Here are some new ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations to adorn your living spaces.

2. Education

- Use printable worksheets for free to help reinforce your learning at home also in the classes.

3. Event Planning

- Make invitations, banners and decorations for special events such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

Income Tax Rebate On Home Loan Principal Before Possession are a treasure trove of useful and creative resources which cater to a wide range of needs and passions. Their accessibility and versatility make them an essential part of both professional and personal lives. Explore the many options of Income Tax Rebate On Home Loan Principal Before Possession now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes you can! You can print and download these files for free.

-

Are there any free printables for commercial use?

- It's determined by the specific terms of use. Always verify the guidelines provided by the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright issues when you download Income Tax Rebate On Home Loan Principal Before Possession?

- Certain printables could be restricted in their usage. Be sure to review the terms and conditions set forth by the designer.

-

How can I print Income Tax Rebate On Home Loan Principal Before Possession?

- Print them at home using the printer, or go to a print shop in your area for high-quality prints.

-

What program do I require to open printables at no cost?

- A majority of printed materials are in PDF format. These can be opened using free software, such as Adobe Reader.

Home Loan Tax Benefit What Is The Income Tax Rebate On Home Loan

ITR Filing You Can Claim Interest Paid Before Possession Even If You

Check more sample of Income Tax Rebate On Home Loan Principal Before Possession below

Maximize Your Tax Savings On Home Loan Principal Repayments

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate For Housing Loan Form No 12C Pallikalvi Teachers News

Mortgage Why Is The Breakdown Of A Loan Repayment Into Principal And

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

What Does Rebate Lost Mean On Student Loans

https://taxmantra.com/tax-benefit-on-home-loan-in-case-of-pre-and-post...

Web 16 mai 2013 nbsp 0183 32 Principal component Section 80C provides that the principal component of the home loan is entitled to exemption up to Rs 100 000 along with all other permissible

https://www.livemint.com/money/personal-fina…

Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to

Web 16 mai 2013 nbsp 0183 32 Principal component Section 80C provides that the principal component of the home loan is entitled to exemption up to Rs 100 000 along with all other permissible

Web 22 juin 2023 nbsp 0183 32 Tax benefits on home loans can only be claimed once possession of the property is obtained Interest paid prior to

Mortgage Why Is The Breakdown Of A Loan Repayment Into Principal And

Income Tax Rebate On Personal Loan Claim Tax Rebate For Personal Loan

Income Tax Rebate On Investment In Insurance Premium 2020 Tariq Mahmood

What Does Rebate Lost Mean On Student Loans

What To Know About Montana s New Income And Property Tax Rebates

INCOME TAX REBATE ON HOME LOAN

INCOME TAX REBATE ON HOME LOAN

Income Tax Rebate Under Section 87A