In this day and age where screens rule our lives The appeal of tangible printed objects isn't diminished. Whatever the reason, whether for education in creative or artistic projects, or just adding the personal touch to your area, Income Tax House Loan Interest Exemption India have become an invaluable resource. With this guide, you'll take a dive to the depths of "Income Tax House Loan Interest Exemption India," exploring the benefits of them, where they can be found, and how they can improve various aspects of your life.

Get Latest Income Tax House Loan Interest Exemption India Below

Income Tax House Loan Interest Exemption India

Income Tax House Loan Interest Exemption India -

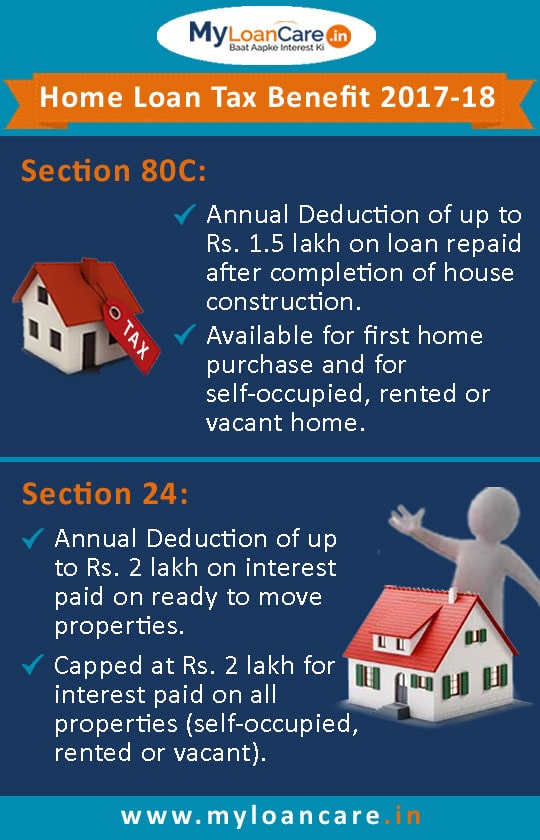

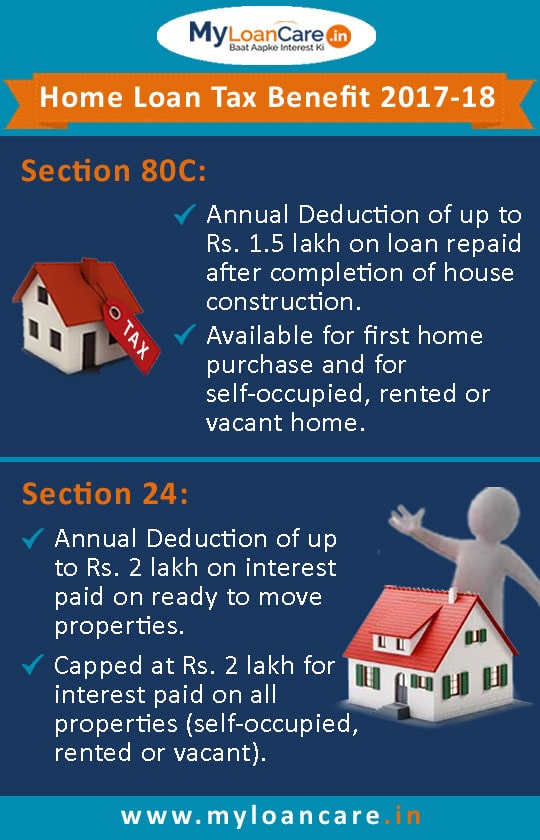

Deduction of Interest on Home Loan for the property Homeowners can claim a deduction of up to Rs 2 lakh on their home loan interest if the owner or his family reside in the

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is

Income Tax House Loan Interest Exemption India offer a wide collection of printable content that can be downloaded from the internet at no cost. The resources are offered in a variety forms, including worksheets, coloring pages, templates and much more. The beauty of Income Tax House Loan Interest Exemption India is their flexibility and accessibility.

More of Income Tax House Loan Interest Exemption India

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution You can claim a home loan interest

If a home loan is taken jointly each borrower can claim deduction on home loan interest up to Rs 2 lakh under Section 24 b and tax deduction on the principal repayment up to Rs 1 5 lakh under Section 80C This doubles

Income Tax House Loan Interest Exemption India have risen to immense popularity due to a variety of compelling reasons:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

Personalization The Customization feature lets you tailor printables to fit your particular needs whether you're designing invitations and schedules, or even decorating your house.

-

Educational Value Downloads of educational content for free are designed to appeal to students from all ages, making these printables a powerful instrument for parents and teachers.

-

Simple: The instant accessibility to an array of designs and templates, which saves time as well as effort.

Where to Find more Income Tax House Loan Interest Exemption India

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

Is A Plot Loan Eligible For Tax Exemption HDFC Sales Blog

If you re using the Loan Against Property amount to fund your new residential house then you are eligible for tax deductions up to Rs 2 lakh The tax deductions are applicable on

Currently homebuyers can claim an income tax deduction on the interest paid on their home loan under Section 24 b of the Income tax Act 1961 The maximum

We've now piqued your interest in printables for free Let's find out where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection in Income Tax House Loan Interest Exemption India for different uses.

- Explore categories such as interior decor, education, crafting, and organization.

2. Educational Platforms

- Educational websites and forums often offer free worksheets and worksheets for printing, flashcards, and learning tools.

- Ideal for teachers, parents, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers post their original designs and templates for free.

- These blogs cover a broad array of topics, ranging ranging from DIY projects to party planning.

Maximizing Income Tax House Loan Interest Exemption India

Here are some creative ways for you to get the best of Income Tax House Loan Interest Exemption India:

1. Home Decor

- Print and frame stunning artwork, quotes and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Print out free worksheets and activities for reinforcement of learning at home, or even in the classroom.

3. Event Planning

- Create invitations, banners, and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Keep track of your schedule with printable calendars, to-do lists, and meal planners.

Conclusion

Income Tax House Loan Interest Exemption India are a treasure trove with useful and creative ideas that satisfy a wide range of requirements and needs and. Their availability and versatility make them a fantastic addition to both professional and personal lives. Explore the plethora of Income Tax House Loan Interest Exemption India now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes you can! You can download and print these free resources for no cost.

-

Are there any free printouts for commercial usage?

- It's based on the usage guidelines. Always consult the author's guidelines before using any printables on commercial projects.

-

Do you have any copyright problems with printables that are free?

- Some printables could have limitations in their usage. Always read the terms and condition of use as provided by the author.

-

How can I print Income Tax House Loan Interest Exemption India?

- Print them at home using either a printer or go to a print shop in your area for better quality prints.

-

What software is required to open Income Tax House Loan Interest Exemption India?

- The majority of printed documents are in PDF format. These can be opened with free software, such as Adobe Reader.

Home Loan Deductions And Tax Benefits AY 2022 23 Home Loan Tax

Discover Your Favorite Brand Free Shipping Stainless Steel Flat Collar

Check more sample of Income Tax House Loan Interest Exemption India below

CNN News18 News Anchor Journalist Columnist Blogger Page5231

Solved Please Note That This Is Based On Philippine Tax System Please

Joint Home Loan Declaration Form For Income Tax Savings And Non

Can I Claim Both Home Loan And HRA Tax Benefits

Income Tax Benefits On Housing Loan In India

2022 Tax Brackets Lashell Ahern

https://cleartax.in/s/section-80ee-income-tax...

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is

https://tax2win.in/guide/income-tax-benefit-on-housing-loan-interest

Q How much housing loan interest can be exempt from income tax The maximum interest deduction under Section 24 b is limited to Rs 2 lakh encompassing

Section 80EE allows income tax benefits on the interest portion of the residential house property loan availed from any financial institution The deduction is

Q How much housing loan interest can be exempt from income tax The maximum interest deduction under Section 24 b is limited to Rs 2 lakh encompassing

Can I Claim Both Home Loan And HRA Tax Benefits

Solved Please Note That This Is Based On Philippine Tax System Please

Income Tax Benefits On Housing Loan In India

2022 Tax Brackets Lashell Ahern

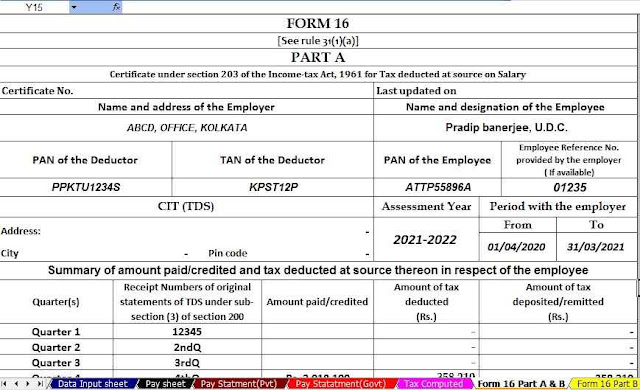

Exemption U s 80C As Per Income Tax Act With Automated Income Tax

Home Loan Benefits For Income Tax Home Sweet Home Modern Livingroom

Home Loan Benefits For Income Tax Home Sweet Home Modern Livingroom

Hra House Rent Allowance Meaning Hra Exemption Tax Deductions How To