Today, where screens rule our lives, the charm of tangible printed products hasn't decreased. For educational purposes, creative projects, or simply adding some personal flair to your area, Income Tax Exemption Slab In India can be an excellent source. This article will take a dive into the sphere of "Income Tax Exemption Slab In India," exploring what they are, where they are, and how they can add value to various aspects of your lives.

Get Latest Income Tax Exemption Slab In India Below

Income Tax Exemption Slab In India

Income Tax Exemption Slab In India -

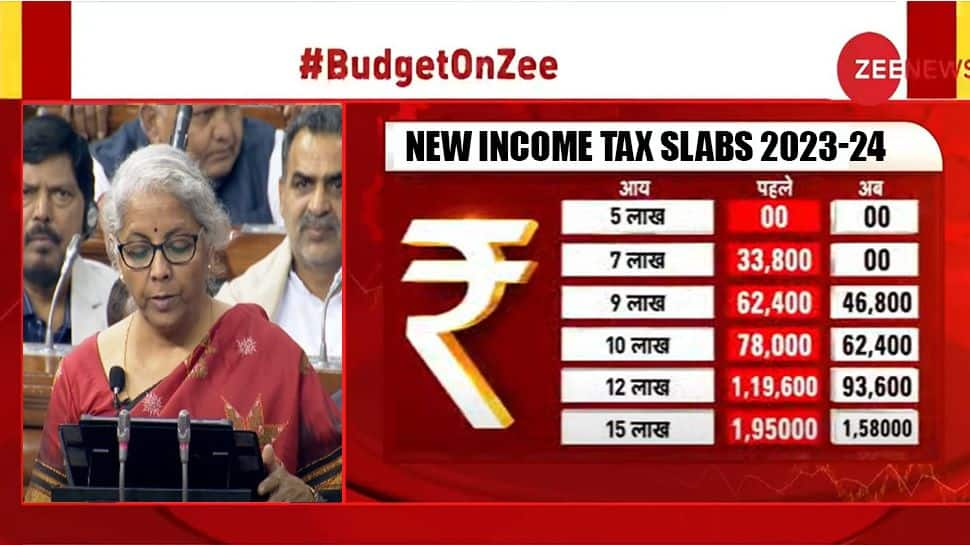

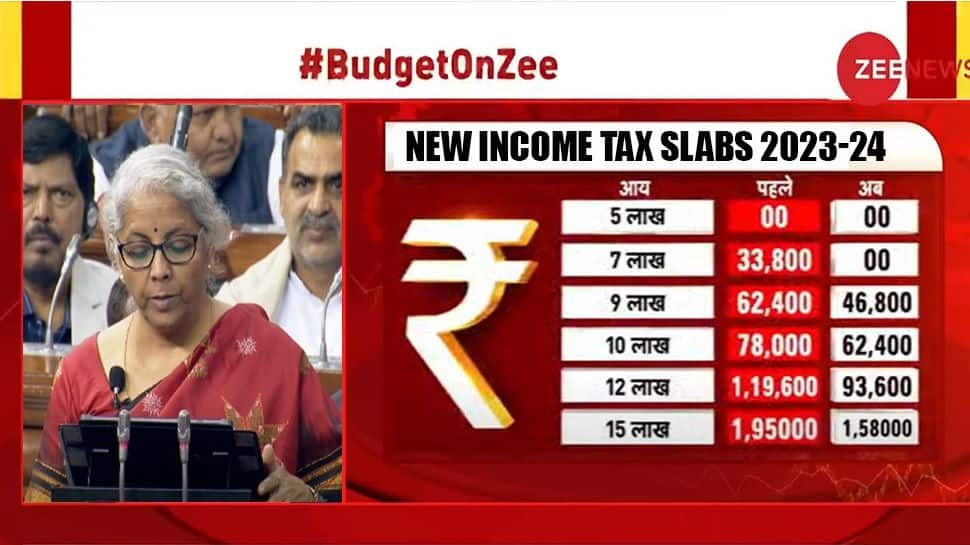

Basic exemption limit hiked to Rs 3 lakh from Rs 2 5 lakh in the new tax regime The number of income tax slabs under the new tax regime reduced to five from six Standard deduction of Rs 50 000 introduced under the new tax regime for salaried and pensioners Family pensioners can also claim standard deduction of Rs 15 000 under the new tax

The Budget 2023 changed the income tax slabs under the new tax regime The government hiked the basic income exemption limit from Rs 2 5 lakh to Rs 3 lakh under the new tax regime Apart from this the government increased the rebate eligibility ceiling through Section 87A under the new tax regime from Rs 5 lakh to Rs 7 lakh taxable income

The Income Tax Exemption Slab In India are a huge selection of printable and downloadable resources available online for download at no cost. They are available in a variety of types, like worksheets, templates, coloring pages, and many more. One of the advantages of Income Tax Exemption Slab In India is their flexibility and accessibility.

More of Income Tax Exemption Slab In India

An Overview Of The Current Income Tax Slab Rates In India Kuvera

An Overview Of The Current Income Tax Slab Rates In India Kuvera

Income tax slabs under the new tax regime have been reduced to five in FY 2023 24 from six Further the basic exemption limit has been hiked to Rs 3 lakh from Rs 2 5 earlier under the new income tax regime The amount of rebate under Section 87A has been enhanced under the new tax regime to taxable income of Rs 7 lakh

An income tax calculator is an online tool that helps individuals calculate the amount of income tax they will owe to the government based on their taxable income It takes into account various factors such as income sources deductions exemptions and tax credits to calculate the final tax liability

Income Tax Exemption Slab In India have garnered immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or costly software.

-

Flexible: They can make designs to suit your personal needs whether it's making invitations making your schedule, or even decorating your home.

-

Educational Benefits: The free educational worksheets can be used by students from all ages, making them a vital aid for parents as well as educators.

-

Convenience: Fast access numerous designs and templates will save you time and effort.

Where to Find more Income Tax Exemption Slab In India

New Tax Regime Definition Advantages And Disadvantages Explained Mint

New Tax Regime Definition Advantages And Disadvantages Explained Mint

Income Tax Slabs in India New Tax Regime Slabs 2023 24 for Individuals Deductions and Exemptions Under the New Tax Regime Slabs Under the new tax regime slabs some

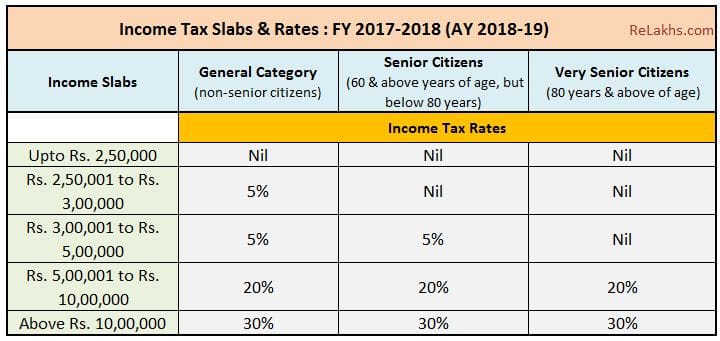

500 001 to 1 000 000 20 Above 1 000 000 30 These income tax slabs and rates apply to individuals residents below 60 years of age NR and NOR for the financial year 2024 25 Resident

If we've already piqued your interest in printables for free Let's take a look at where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Income Tax Exemption Slab In India to suit a variety of applications.

- Explore categories such as the home, decor, the arts, and more.

2. Educational Platforms

- Educational websites and forums often provide free printable worksheets with flashcards and other teaching materials.

- Ideal for parents, teachers and students looking for extra sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- These blogs cover a broad range of interests, including DIY projects to party planning.

Maximizing Income Tax Exemption Slab In India

Here are some ways in order to maximize the use of printables that are free:

1. Home Decor

- Print and frame beautiful art, quotes, or decorations for the holidays to beautify your living areas.

2. Education

- Use printable worksheets for free for teaching at-home also in the classes.

3. Event Planning

- Design invitations and banners and decorations for special occasions such as weddings or birthdays.

4. Organization

- Make sure you are organized with printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

Income Tax Exemption Slab In India are a treasure trove with useful and creative ideas that cater to various needs and interests. Their availability and versatility make they a beneficial addition to the professional and personal lives of both. Explore the vast collection that is Income Tax Exemption Slab In India today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are Income Tax Exemption Slab In India really for free?

- Yes you can! You can print and download these tools for free.

-

Can I download free printables in commercial projects?

- It is contingent on the specific rules of usage. Always check the creator's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright rights issues with printables that are free?

- Some printables may come with restrictions regarding their use. Be sure to read the terms and conditions provided by the author.

-

How can I print Income Tax Exemption Slab In India?

- You can print them at home with either a printer or go to a local print shop to purchase high-quality prints.

-

What software is required to open printables that are free?

- The majority of printed documents are in the PDF format, and can be opened using free programs like Adobe Reader.

Income Tax Slabs For FY 2022 23 AY 2023 24 FinCalC Blog

Budget 2023 Here Are The Fresh New Income Tax Regime Slabs India Today

Check more sample of Income Tax Exemption Slab In India below

Standard Deduction Income Tax Ay 2021 22 Standard Deduction 2021

Budget 2023 Income Tax Slab Change Expectations Salaried Employees

Income Tax Slab For Women Exemption And Rebates

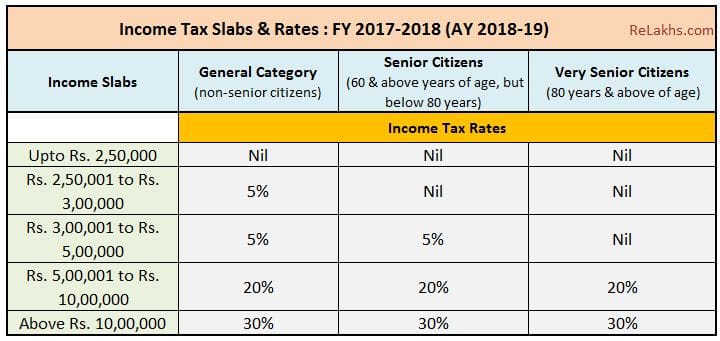

Latest Income Tax Slab Rates For FY 2017 18 AY 2018 19

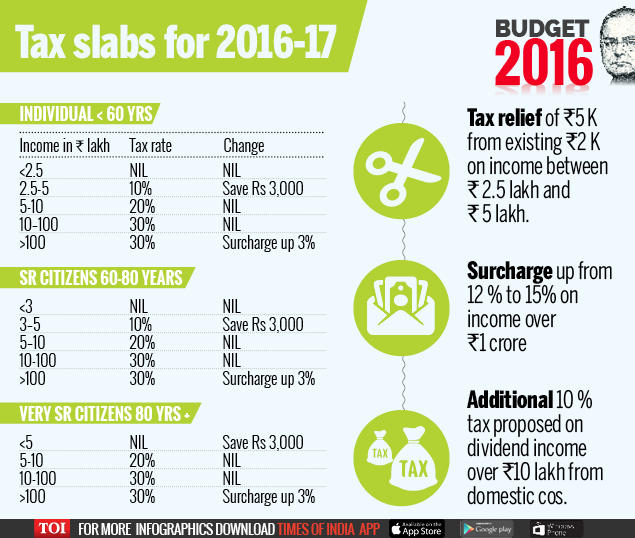

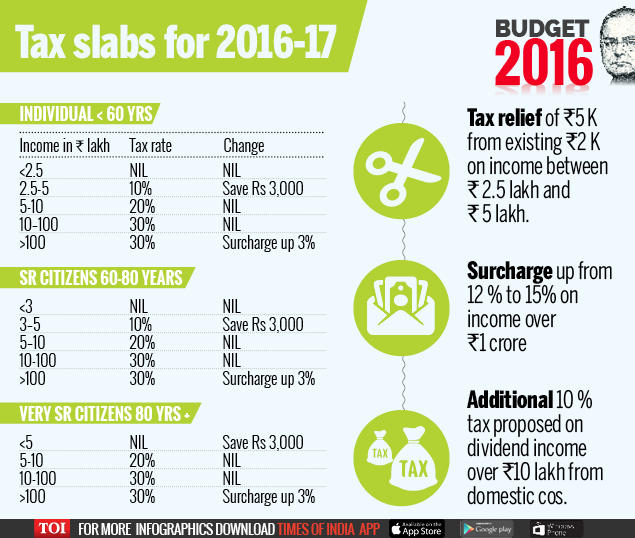

Budget 2016 The Tax Slabs India News Times Of India

Income Tax Clarification Opting For The New Income Tax Regime U s

https://economictimes.indiatimes.com/wealth/tax/...

The Budget 2023 changed the income tax slabs under the new tax regime The government hiked the basic income exemption limit from Rs 2 5 lakh to Rs 3 lakh under the new tax regime Apart from this the government increased the rebate eligibility ceiling through Section 87A under the new tax regime from Rs 5 lakh to Rs 7 lakh taxable income

https://www.incometax.gov.in/iec/foportal/help/individual/return-applicable-1

Tax Slabs for AY 2023 24 Individuals and HUFs can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old Tax Regime

The Budget 2023 changed the income tax slabs under the new tax regime The government hiked the basic income exemption limit from Rs 2 5 lakh to Rs 3 lakh under the new tax regime Apart from this the government increased the rebate eligibility ceiling through Section 87A under the new tax regime from Rs 5 lakh to Rs 7 lakh taxable income

Tax Slabs for AY 2023 24 Individuals and HUFs can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old Tax Regime

Latest Income Tax Slab Rates For FY 2017 18 AY 2018 19

Budget 2023 Income Tax Slab Change Expectations Salaried Employees

Budget 2016 The Tax Slabs India News Times Of India

Income Tax Clarification Opting For The New Income Tax Regime U s

Income Tax 2022 23 Slab Bed Frames Ideas

Government Of India Personal Income Tax Rates And Slabs Finance

Government Of India Personal Income Tax Rates And Slabs Finance

How Much Income Tax Do You Pay Now Under New Tax Regime Quick Guide