In a world where screens have become the dominant feature of our lives The appeal of tangible printed materials isn't diminishing. For educational purposes or creative projects, or simply to add an individual touch to the home, printables for free have become a valuable resource. For this piece, we'll dive into the world "Income Tax Deduction Act," exploring the benefits of them, where they are available, and how they can enhance various aspects of your daily life.

Get Latest Income Tax Deduction Act Below

Income Tax Deduction Act

Income Tax Deduction Act -

Individuals and HUFs can opt for the Old Tax Regime or the New Tax Regime with lower rate of taxation u s 115 BAC of the Income Tax Act The taxpayer opting for concessional rates in the New Tax Regime will not be allowed certain Exemptions and Deductions like 80C 80D 80TTB HRA available in the Old Tax Regime

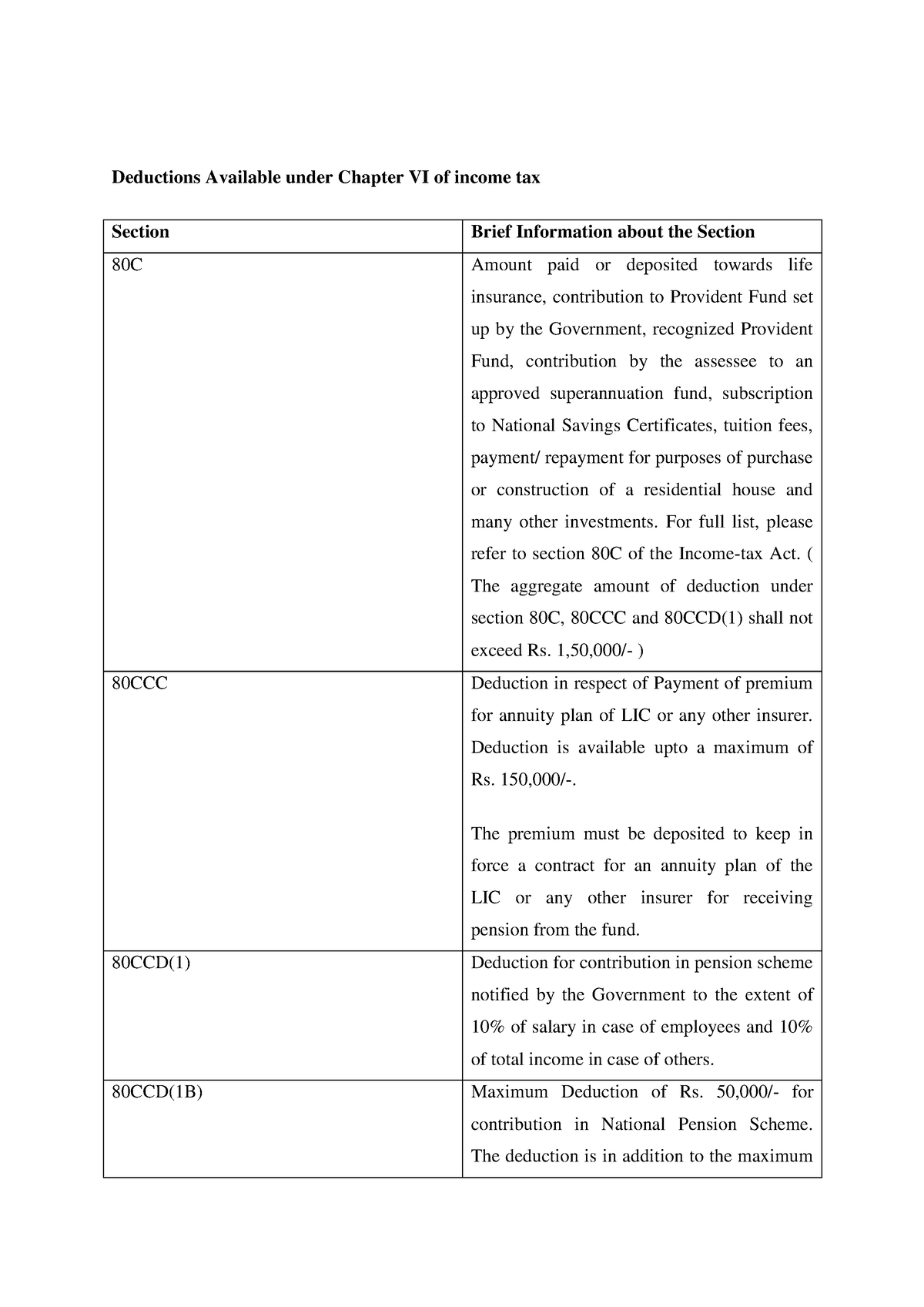

What is Income Tax Deduction under Chapter VI A of Income Tax Act Section 80 Deduction List Who can Claim Income Tax Deductions Investments that Qualify for Deductions under Section 80C Expenses that Qualify for Tax Deductions under Section 80C Features of Income Tax Deduction u s 80 Frequently Asked Questions

Income Tax Deduction Act cover a large array of printable documents that can be downloaded online at no cost. They come in many formats, such as worksheets, templates, coloring pages and more. The appeal of printables for free lies in their versatility and accessibility.

More of Income Tax Deduction Act

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

Updated on Mar 24th 2024 20 min read CONTENTS Show Salaried employees form the major chunk of the overall taxpayers in the country and the contribution they make to the tax collection is quite significant Income tax deductions offer a gamut of opportunities for saving tax for the salaried class

These are Eligibility of Deduction Under 80C of Income Tax Act Individuals and HUFs are both eligible for Section 80C deductions This section also applies to both Indian residents and non resident Indians Companies partnerships and other corporate bodies are not eligible for the deduction

Income Tax Deduction Act have gained immense popularity because of a number of compelling causes:

-

Cost-Effective: They eliminate the necessity to purchase physical copies of the software or expensive hardware.

-

Modifications: This allows you to modify the templates to meet your individual needs when it comes to designing invitations to organize your schedule or even decorating your house.

-

Educational value: These Income Tax Deduction Act offer a wide range of educational content for learners of all ages. This makes them a vital source for educators and parents.

-

Easy to use: Instant access to various designs and templates helps save time and effort.

Where to Find more Income Tax Deduction Act

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

Summary Of Income Tax Deduction Under Chapter VI A CA Rajput

What is Section 80D Section 80D of the Income tax act allows you to take tax deductions for the expenses incurred towards healthcare

Standard Deduction in New Tax regime Budget 2020 introduced the Under this new regime the taxpayers have the option to pay concessional tax rates However major deductions and exemptions are not allowed under this new regime Budget 2023 was amended allowing to claim a standard deduction of Rs 50 000 in the new

We've now piqued your curiosity about Income Tax Deduction Act and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy have a large selection of Income Tax Deduction Act suitable for many purposes.

- Explore categories such as furniture, education, management, and craft.

2. Educational Platforms

- Educational websites and forums usually provide free printable worksheets Flashcards, worksheets, and other educational materials.

- Great for parents, teachers as well as students searching for supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs or templates for download.

- The blogs are a vast selection of subjects, all the way from DIY projects to party planning.

Maximizing Income Tax Deduction Act

Here are some creative ways to make the most of printables that are free:

1. Home Decor

- Print and frame beautiful artwork, quotes, and seasonal decorations, to add a touch of elegance to your living spaces.

2. Education

- Print free worksheets to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized with printable calendars with to-do lists, planners, and meal planners.

Conclusion

Income Tax Deduction Act are an abundance of creative and practical resources designed to meet a range of needs and interest. Their access and versatility makes them a valuable addition to your professional and personal life. Explore the vast array of Income Tax Deduction Act right now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes they are! You can print and download these tools for free.

-

Can I download free printouts for commercial usage?

- It depends on the specific usage guidelines. Always review the terms of use for the creator prior to utilizing the templates for commercial projects.

-

Are there any copyright concerns when using Income Tax Deduction Act?

- Certain printables may be subject to restrictions on use. Be sure to check the terms and conditions provided by the creator.

-

How can I print Income Tax Deduction Act?

- Print them at home with printing equipment or visit a local print shop to purchase higher quality prints.

-

What software do I require to view printables at no cost?

- A majority of printed materials are in the format PDF. This can be opened with free programs like Adobe Reader.

What Will My Tax Deduction Savings Look Like The Motley Fool

Deduction From Salary Under Section 16 Of Income Tax Act How To Earn

Check more sample of Income Tax Deduction Act below

Section 80gg Of Income Tax Act Deduction 80gg 80gg 2020 YouTube

Tax Savings Deductions Under Chapter VI A Learn By Quicko

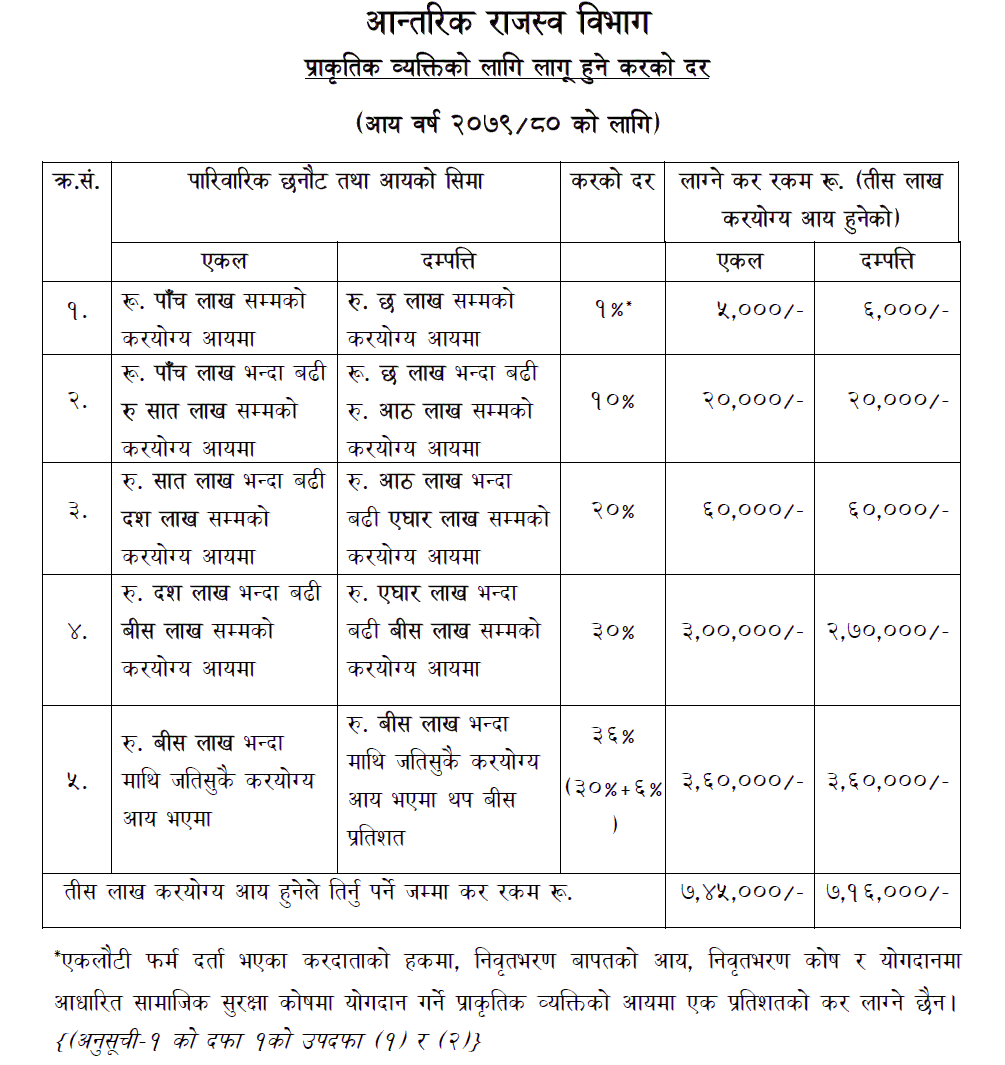

Income Tax Rate In Nepal For Fiscal Year 2079 80 For Natural Person

Deduction In Income Tax Section 80ccc Section 80ccc Of Income Tax

Deductions Allowed Under The New Income Tax Regime Paisabazaar

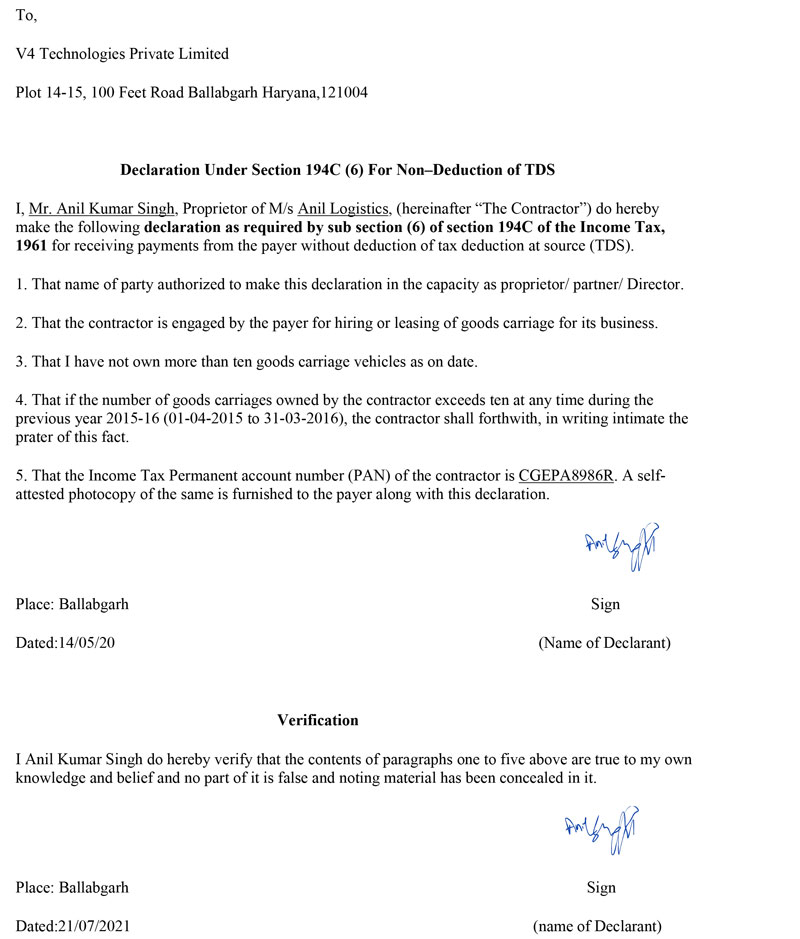

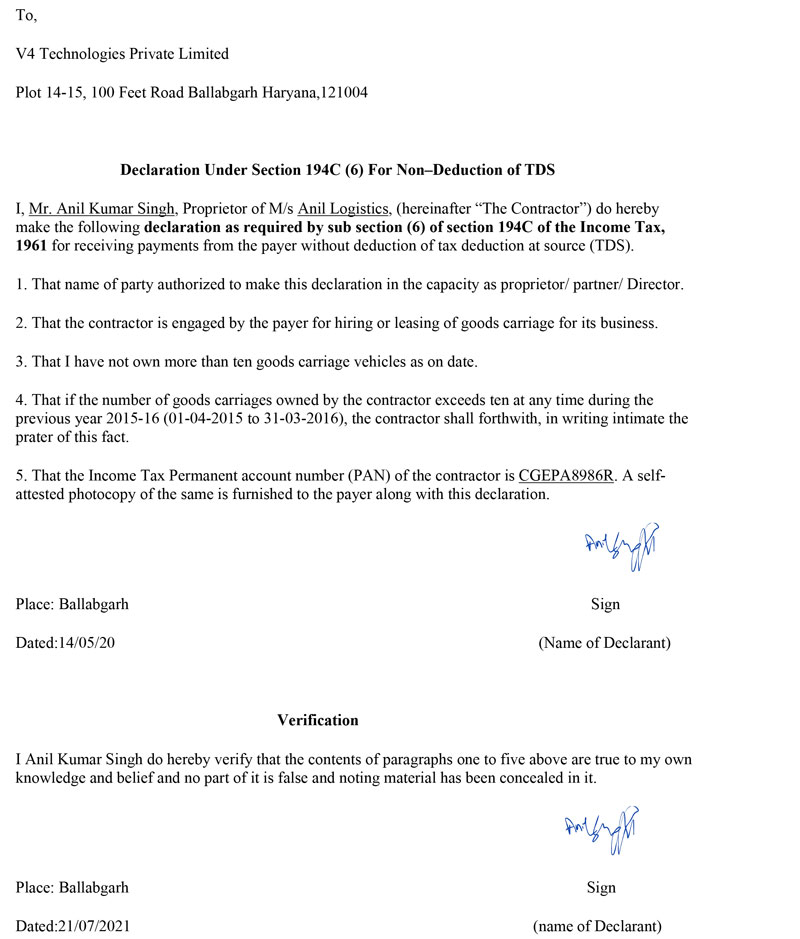

Transporter s Declaration For Non Deduction Of TDS U s 194C Drafting

https://tax2win.in/guide/deductions

What is Income Tax Deduction under Chapter VI A of Income Tax Act Section 80 Deduction List Who can Claim Income Tax Deductions Investments that Qualify for Deductions under Section 80C Expenses that Qualify for Tax Deductions under Section 80C Features of Income Tax Deduction u s 80 Frequently Asked Questions

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg?w=186)

https://incometaxindia.gov.in/pages/acts/income...

Section 110 Determination of tax where total income includes income on which no tax is payable Section 115VF Tonnage income Section 14A Expenditure incurred in relation to income not includible in total income Section 115BBI Specified income of certain institutions Section 4

What is Income Tax Deduction under Chapter VI A of Income Tax Act Section 80 Deduction List Who can Claim Income Tax Deductions Investments that Qualify for Deductions under Section 80C Expenses that Qualify for Tax Deductions under Section 80C Features of Income Tax Deduction u s 80 Frequently Asked Questions

Section 110 Determination of tax where total income includes income on which no tax is payable Section 115VF Tonnage income Section 14A Expenditure incurred in relation to income not includible in total income Section 115BBI Specified income of certain institutions Section 4

Deduction In Income Tax Section 80ccc Section 80ccc Of Income Tax

Tax Savings Deductions Under Chapter VI A Learn By Quicko

Deductions Allowed Under The New Income Tax Regime Paisabazaar

Transporter s Declaration For Non Deduction Of TDS U s 194C Drafting

Deductions Available Under Chapter VI Of Income Tax Taxation KSLU

Information On Section 80G Of Income Tax Act Ebizfiling

Information On Section 80G Of Income Tax Act Ebizfiling

8 Tax Itemized Deduction Worksheet Worksheeto