In this day and age where screens have become the dominant feature of our lives and the appeal of physical printed items hasn't gone away. Whatever the reason, whether for education or creative projects, or simply adding some personal flair to your space, How To Qualify For Gst Rebate are now an essential source. In this article, we'll take a dive through the vast world of "How To Qualify For Gst Rebate," exploring what they are, where to find them, and how they can be used to enhance different aspects of your life.

Get Latest How To Qualify For Gst Rebate Below

How To Qualify For Gst Rebate

How To Qualify For Gst Rebate -

You are eligible for the GST HST credit if you are considered a Canadian resident for income tax purposes the month before and at the beginning of the month in which the CRA makes a payment You also need to meet one of the following criteria You are at least 19 years old You have or had a spouse or common law partner

Eligibility 3 Apply 4 How much you can expect to receive 5 Payment dates You are generally eligible for the GST HST credit if you are At least 19 years old If you are under 19 years old you must meet at least one of the following conditions during the same period you have or had a spouse or common law partner

How To Qualify For Gst Rebate provide a diverse assortment of printable material that is available online at no cost. The resources are offered in a variety types, such as worksheets coloring pages, templates and more. The benefit of How To Qualify For Gst Rebate is their versatility and accessibility.

More of How To Qualify For Gst Rebate

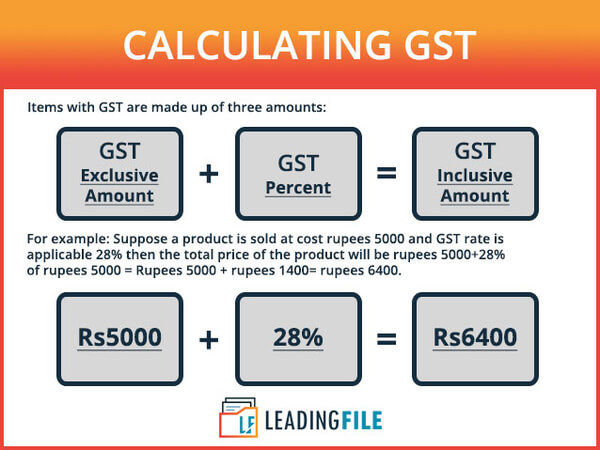

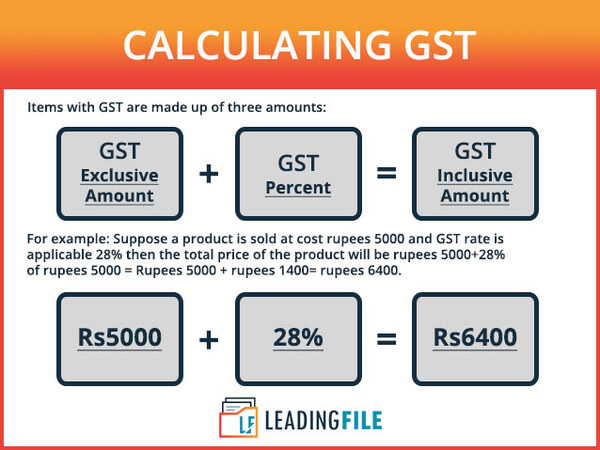

How To Calculate Gst In Excel Aslbuyers

How To Calculate Gst In Excel Aslbuyers

Who is eligible to get the payment If you are already entitled to receive the GST credit in October of this year you will automatically qualify for the one time GST payment top up The tax

The rebate will be issued automatically to those eligible either by cheque or direct deposit through the Canada Revenue Agency It will be delivered alongside the next quarterly GST HST

Printables that are free have gained enormous recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or costly software.

-

Personalization It is possible to tailor the templates to meet your individual needs whether you're designing invitations as well as organizing your calendar, or even decorating your house.

-

Educational Value: Educational printables that can be downloaded for free offer a wide range of educational content for learners of all ages. This makes them an essential aid for parents as well as educators.

-

It's easy: instant access a variety of designs and templates saves time and effort.

Where to Find more How To Qualify For Gst Rebate

Ev Car Tax Rebate Calculator 2024 Carrebate

Ev Car Tax Rebate Calculator 2024 Carrebate

Table of contents What is the GST HST credit What is the difference between GST and HST How is the GST HST credit calculated Can the credit be recalculated Who is eligible for the GST HST credit What is the maximum income for the GST HST credit GST HST Credit Provincial and Territorial Programs How to apply for the GST HST credit

Home News Canada Explainer Eligible Canadians will receive the GST HST credit today Here s how much you can expect The quarterly non taxable payment is meant to offset GST or HST costs

Now that we've piqued your curiosity about How To Qualify For Gst Rebate Let's look into where you can locate these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection of How To Qualify For Gst Rebate for various needs.

- Explore categories such as interior decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually offer free worksheets and worksheets for printing as well as flashcards and other learning tools.

- It is ideal for teachers, parents and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers offer their unique designs and templates for free.

- The blogs covered cover a wide range of interests, all the way from DIY projects to planning a party.

Maximizing How To Qualify For Gst Rebate

Here are some creative ways create the maximum value of How To Qualify For Gst Rebate:

1. Home Decor

- Print and frame stunning artwork, quotes, or even seasonal decorations to decorate your living areas.

2. Education

- Print free worksheets to enhance learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations, banners, and decorations for special events like weddings or birthdays.

4. Organization

- Keep your calendars organized by printing printable calendars along with lists of tasks, and meal planners.

Conclusion

How To Qualify For Gst Rebate are a treasure trove of practical and imaginative resources which cater to a wide range of needs and interest. Their accessibility and flexibility make them an invaluable addition to the professional and personal lives of both. Explore the plethora of How To Qualify For Gst Rebate today to explore new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really gratis?

- Yes you can! You can print and download the resources for free.

-

Can I utilize free printables in commercial projects?

- It is contingent on the specific terms of use. Always verify the guidelines of the creator prior to printing printables for commercial projects.

-

Do you have any copyright problems with How To Qualify For Gst Rebate?

- Some printables may have restrictions on usage. Be sure to read the terms and conditions offered by the creator.

-

How do I print printables for free?

- You can print them at home with your printer or visit an area print shop for top quality prints.

-

What software do I need in order to open printables for free?

- The majority are printed in PDF format. These can be opened with free programs like Adobe Reader.

Key Benefits Of Registering Under GST All About GST Registration

Lead Qualification 101 Definition And How To Qualify Leads

Check more sample of How To Qualify For Gst Rebate below

Relief To Taxpayers Govt Extends GST Return Filing Date To Oct 25

Data And Model Sharing Checklist KFG Notes

The Ultimate 5 Step Lead Qualification Checklist MQL To SQL

Summary Of Changes 37th GST Council Meet SBSandco

GST New Home Rebate Calculation And Examples YouTube

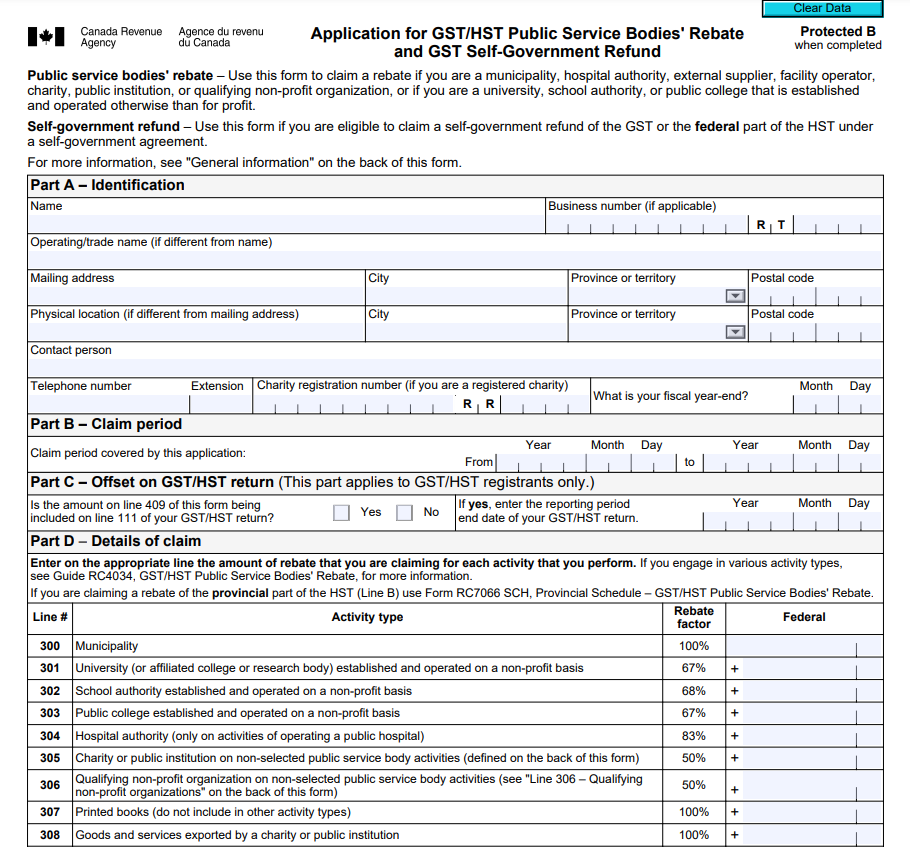

Gst191 Fillable Form Printable Forms Free Online

https://www.canada.ca/.../gsthstc-eligibility.html

Eligibility 3 Apply 4 How much you can expect to receive 5 Payment dates You are generally eligible for the GST HST credit if you are At least 19 years old If you are under 19 years old you must meet at least one of the following conditions during the same period you have or had a spouse or common law partner

https://www.springfinancial.ca/blog/boost-your...

To qualify for the GST HST credit you must be a Canadian resident for income tax purposes in the month prior and at the start of the month in which the CRA makes a payment You also need to meet one of the following criteria You are 19 years of age or older You have or had a spouse or common law partner

Eligibility 3 Apply 4 How much you can expect to receive 5 Payment dates You are generally eligible for the GST HST credit if you are At least 19 years old If you are under 19 years old you must meet at least one of the following conditions during the same period you have or had a spouse or common law partner

To qualify for the GST HST credit you must be a Canadian resident for income tax purposes in the month prior and at the start of the month in which the CRA makes a payment You also need to meet one of the following criteria You are 19 years of age or older You have or had a spouse or common law partner

Summary Of Changes 37th GST Council Meet SBSandco

Data And Model Sharing Checklist KFG Notes

GST New Home Rebate Calculation And Examples YouTube

Gst191 Fillable Form Printable Forms Free Online

GST Rebate Form For Charities PrintableRebateForm

Gst Return Working Form Fill Out And Sign Printable PDF Template

Gst Return Working Form Fill Out And Sign Printable PDF Template

How To Know If You Qualify For Disability Support Entrepreneurs Break