In the age of digital, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects isn't diminished. Whether it's for educational purposes in creative or artistic projects, or simply adding an element of personalization to your home, printables for free are now an essential resource. In this article, we'll take a dive into the sphere of "How Much Tax Should I Deduct From My Social Security Check," exploring what they are, how they are, and the ways that they can benefit different aspects of your daily life.

Get Latest How Much Tax Should I Deduct From My Social Security Check Below

How Much Tax Should I Deduct From My Social Security Check

How Much Tax Should I Deduct From My Social Security Check -

So someone with an AGI of 25 000 with 2 000 in nontaxable interest and 14 000 in annual Social Security benefits would have a combined income of 34 000 25 000 2 000 7 000 34 000

The 2022 tax brackets for single filers 10 tax rate for incomes less than 10 275 12 tax rate for incomes over 10 275 but not over 41 775 22 tax rate for incomes over 41 775 but not over 89 075 24 tax

How Much Tax Should I Deduct From My Social Security Check offer a wide collection of printable documents that can be downloaded online at no cost. These resources come in many types, like worksheets, coloring pages, templates and more. The beauty of How Much Tax Should I Deduct From My Social Security Check lies in their versatility and accessibility.

More of How Much Tax Should I Deduct From My Social Security Check

Claim Medical Expenses On Your Taxes Health For CA

Claim Medical Expenses On Your Taxes Health For CA

A retiree can use the Tax Withholding Estimator to enter any pension income or Social Security benefits they or their spouse receive The tool then automatically calculates the taxable portion and incorporates it into an overall estimate of their projected tax liability and withholding for the year

You will pay tax on your Social Security benefits based on Internal Revenue Service IRS rules if you File a federal tax return as an individual and your combined income is Between 25 000 and 34 000 you may have to pay income tax on up to 50 of your benefits More than 34 000 up to 85 of your benefits may be taxable

How Much Tax Should I Deduct From My Social Security Check have gained immense popularity due to a variety of compelling reasons:

-

Cost-Effective: They eliminate the requirement of buying physical copies or costly software.

-

Customization: This allows you to modify printables to your specific needs such as designing invitations making your schedule, or even decorating your house.

-

Education Value Printing educational materials for no cost provide for students of all ages. This makes them a valuable tool for parents and teachers.

-

Easy to use: Quick access to a variety of designs and templates will save you time and effort.

Where to Find more How Much Tax Should I Deduct From My Social Security Check

You Need To Deduct Social Security Tax From Wages On Workers In Your

You Need To Deduct Social Security Tax From Wages On Workers In Your

Keep in mind Your Social Security benefits are taxable only if your overall income exceeds 25 000 for an individual or 32 000 for a married couple filing jointly If the income you report is above that threshold you could pay taxes on up to 85 percent of your benefits AARP NEWSLETTERS

Generally if your combined income 50 of your benefit plus any other earned income exceeds 25 000 year filing individually or 32 000 year filing jointly you may have to pay federal

Now that we've ignited your curiosity about How Much Tax Should I Deduct From My Social Security Check and other printables, let's discover where you can get these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a variety of How Much Tax Should I Deduct From My Social Security Check suitable for many motives.

- Explore categories such as home decor, education, organization, and crafts.

2. Educational Platforms

- Educational websites and forums usually provide worksheets that can be printed for free, flashcards, and learning materials.

- This is a great resource for parents, teachers, and students seeking supplemental resources.

3. Creative Blogs

- Many bloggers share their creative designs as well as templates for free.

- These blogs cover a broad selection of subjects, all the way from DIY projects to planning a party.

Maximizing How Much Tax Should I Deduct From My Social Security Check

Here are some fresh ways how you could make the most of printables for free:

1. Home Decor

- Print and frame stunning images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Print free worksheets to aid in learning at your home either in the schoolroom or at home.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions like weddings and birthdays.

4. Organization

- Be organized by using printable calendars checklists for tasks, as well as meal planners.

Conclusion

How Much Tax Should I Deduct From My Social Security Check are an abundance of innovative and useful resources catering to different needs and interests. Their accessibility and versatility make them a wonderful addition to the professional and personal lives of both. Explore the vast array of How Much Tax Should I Deduct From My Social Security Check and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are How Much Tax Should I Deduct From My Social Security Check really free?

- Yes, they are! You can print and download these materials for free.

-

Can I use free printables for commercial purposes?

- It's based on the rules of usage. Make sure you read the guidelines for the creator prior to printing printables for commercial projects.

-

Are there any copyright issues in printables that are free?

- Certain printables may be subject to restrictions on use. Always read the terms and conditions offered by the creator.

-

How can I print printables for free?

- Print them at home using an printer, or go to an area print shop for superior prints.

-

What software do I need in order to open How Much Tax Should I Deduct From My Social Security Check?

- Many printables are offered in the format of PDF, which can be opened using free software such as Adobe Reader.

How Is Social Security Income Taxed

Check For Errors In Your Social Security Statements

Check more sample of How Much Tax Should I Deduct From My Social Security Check below

What Can I Deduct From My Taxes Bookkeeping Accounting Tax

Solved How Much Can She Deduct Were You Being A Tax Professional

Can I Deduct My Tax prep Fees Fox Business

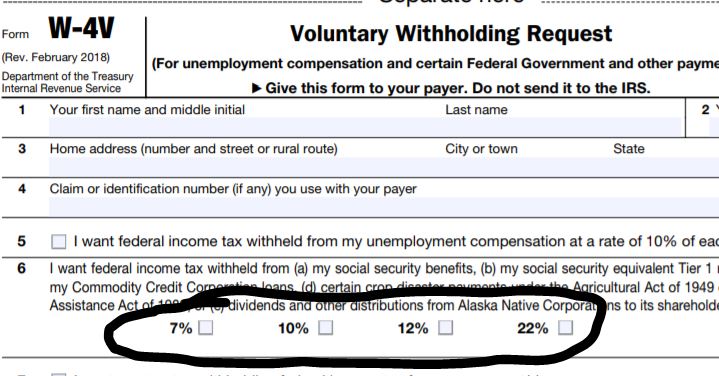

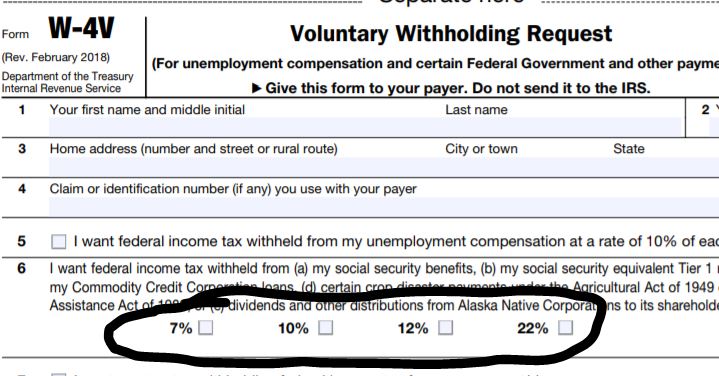

Social Security Form W4v 2023 Printable Forms Free Online

24 Amazing Tax Deductions For Therapists Nicole Arzt

How To Deduct Your Car And Rent On Your Tax Return YouTube

https://www.terrysavage.com/ask-terry/social...

The 2022 tax brackets for single filers 10 tax rate for incomes less than 10 275 12 tax rate for incomes over 10 275 but not over 41 775 22 tax rate for incomes over 41 775 but not over 89 075 24 tax

https://marketrealist.com/p/should-i-have-taxes...

You can have 7 percent 10 percent 12 percent or 22 percent of your monthly benefit withheld for taxes and only these percentages are allowed to be withheld Flat dollar

The 2022 tax brackets for single filers 10 tax rate for incomes less than 10 275 12 tax rate for incomes over 10 275 but not over 41 775 22 tax rate for incomes over 41 775 but not over 89 075 24 tax

You can have 7 percent 10 percent 12 percent or 22 percent of your monthly benefit withheld for taxes and only these percentages are allowed to be withheld Flat dollar

Social Security Form W4v 2023 Printable Forms Free Online

Solved How Much Can She Deduct Were You Being A Tax Professional

24 Amazing Tax Deductions For Therapists Nicole Arzt

How To Deduct Your Car And Rent On Your Tax Return YouTube

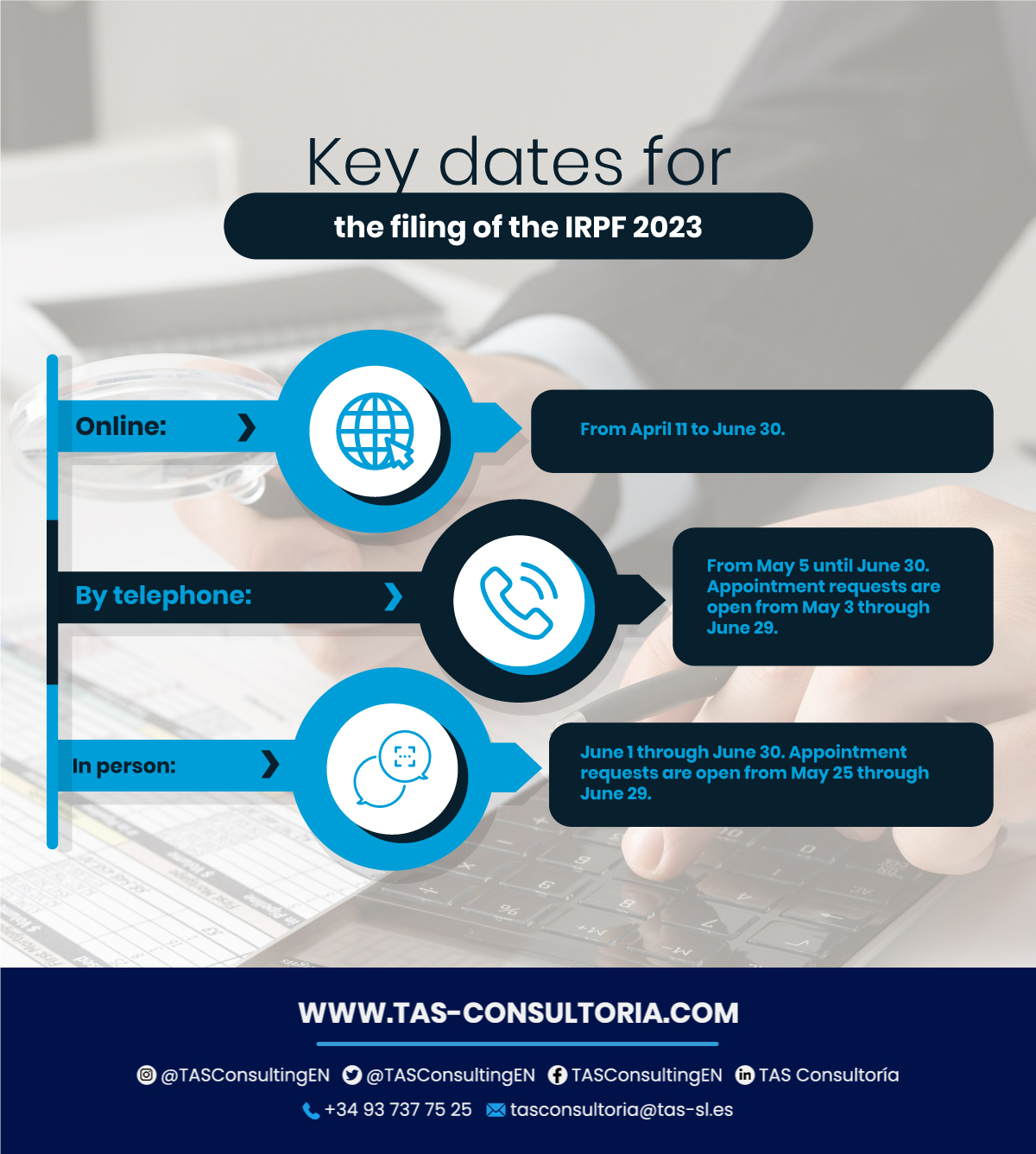

What Is New In The 2023 Income Tax Return

Is Social Security Taxable Income 2021 Savvy Senior Is Social

Is Social Security Taxable Income 2021 Savvy Senior Is Social

Tax Deductions You Can Deduct What Napkin Finance