Today, with screens dominating our lives The appeal of tangible printed materials hasn't faded away. In the case of educational materials and creative work, or just adding an individual touch to the space, How Much Tax Exemption For House Loan have become an invaluable source. Here, we'll dive deep into the realm of "How Much Tax Exemption For House Loan," exploring what they are, how to locate them, and how they can add value to various aspects of your lives.

Get Latest How Much Tax Exemption For House Loan Below

How Much Tax Exemption For House Loan

How Much Tax Exemption For House Loan -

If you own two houses and one of them is empty or inhabited by your parents section 24 will pay the interest on any home loans obtained for the other

You can enjoy home loan tax exemptions of up to Rs 2 lakh on the interest payment component This is useful during the initial repayments of your home loan when the interest payments are the

Printables for free include a vast variety of printable, downloadable documents that can be downloaded online at no cost. The resources are offered in a variety types, like worksheets, templates, coloring pages, and much more. The value of How Much Tax Exemption For House Loan is their flexibility and accessibility.

More of How Much Tax Exemption For House Loan

How Much Tax Do You Pay On Debt related Investments Mint

How Much Tax Do You Pay On Debt related Investments Mint

Tax benefit on Home loan FY 2023 24 Home loan tax benefit is among the most important features of a home loan Tax saving on home loan increases the affordability of your

What is the maximum tax benefit on home loan The maximum tax deduction for a housing loan as per different sections in Income Tax Acts is listed below Up to Rs 2 lakh under Section 24 b for self occupied

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to buy physical copies or expensive software.

-

Individualization This allows you to modify printing templates to your own specific requirements whether you're designing invitations to organize your schedule or even decorating your house.

-

Educational Value Printables for education that are free offer a wide range of educational content for learners of all ages. This makes the perfect instrument for parents and teachers.

-

It's easy: Quick access to a plethora of designs and templates, which saves time as well as effort.

Where to Find more How Much Tax Exemption For House Loan

Can You Take A Home Loan And Also Claim LTCG Tax Exemption

Can You Take A Home Loan And Also Claim LTCG Tax Exemption

The maximum exemption on home loan interest is up to Rs 2 lakh per year for purchasing or constructing a house from scratch under Section 24 of the Income Tax

Additional Tax Deduction under Section 80EEA 2023 There is an additional deduction of up to Rs 1 5 lakh available under the Section 80EEA on the home loan

Now that we've piqued your interest in How Much Tax Exemption For House Loan Let's see where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a large collection of How Much Tax Exemption For House Loan for various needs.

- Explore categories like home decor, education, organizing, and crafts.

2. Educational Platforms

- Educational websites and forums frequently provide free printable worksheets as well as flashcards and other learning tools.

- This is a great resource for parents, teachers and students who are in need of supplementary resources.

3. Creative Blogs

- Many bloggers post their original designs and templates at no cost.

- The blogs covered cover a wide range of topics, starting from DIY projects to planning a party.

Maximizing How Much Tax Exemption For House Loan

Here are some unique ways how you could make the most use of printables that are free:

1. Home Decor

- Print and frame stunning images, quotes, or festive decorations to decorate your living areas.

2. Education

- Use free printable worksheets for teaching at-home as well as in the class.

3. Event Planning

- Design invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars or to-do lists. meal planners.

Conclusion

How Much Tax Exemption For House Loan are a treasure trove of creative and practical resources for a variety of needs and preferences. Their availability and versatility make them an essential part of both professional and personal life. Explore the many options that is How Much Tax Exemption For House Loan today, and unlock new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables available for download really are they free?

- Yes you can! You can print and download these free resources for no cost.

-

Can I make use of free printing templates for commercial purposes?

- It's contingent upon the specific rules of usage. Always read the guidelines of the creator before utilizing printables for commercial projects.

-

Are there any copyright issues when you download How Much Tax Exemption For House Loan?

- Certain printables could be restricted in their usage. Make sure you read these terms and conditions as set out by the designer.

-

How do I print How Much Tax Exemption For House Loan?

- You can print them at home using printing equipment or visit an area print shop for better quality prints.

-

What program will I need to access printables at no cost?

- The majority of printed documents are in the PDF format, and is open with no cost software such as Adobe Reader.

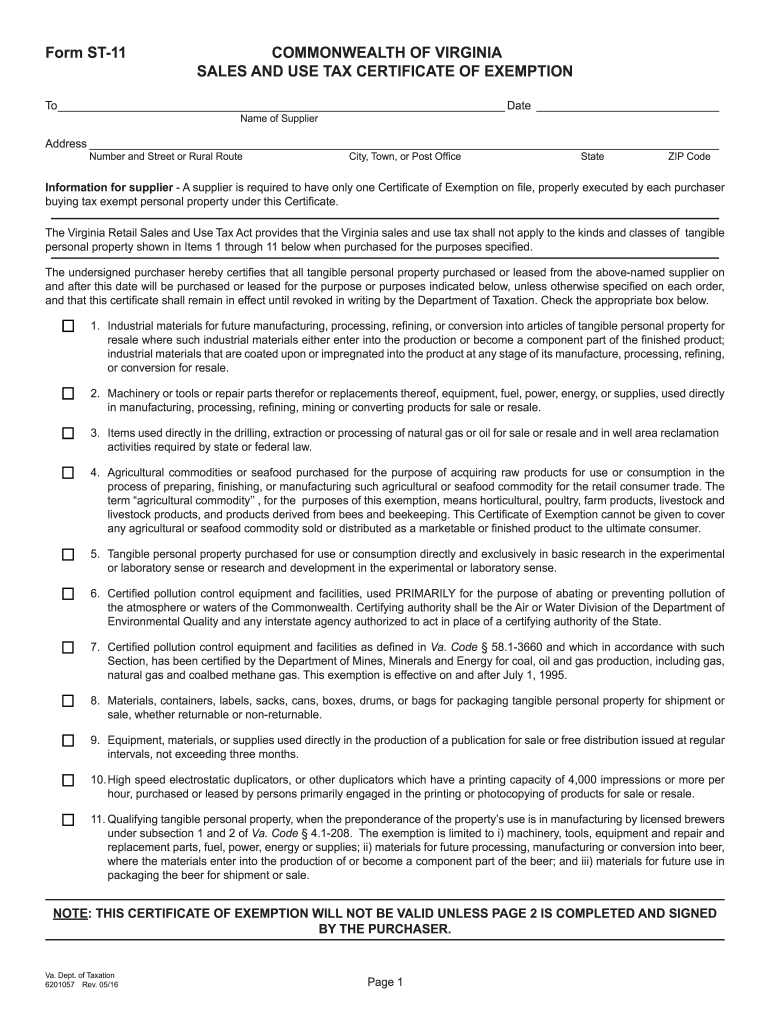

Housing Loan Interest Tax Exemption Under Section MUNIR2

Use Tax Exemption Form Fill Out And Sign Printable PDF Template SignNow

Check more sample of How Much Tax Exemption For House Loan below

Ncua Letter Exemption Form Fill Out And Sign Printable PDF Template

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Tax File Number Declaration Form Pdf Withholding Tax Payments Vrogue

Tax Exemptions For Startups In India Bizzopedia

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

80EEA Tax Exemption On Loan For Purchase Of Affordable House

https://navi.com/blog/tax-benefit-on-home-loan

You can enjoy home loan tax exemptions of up to Rs 2 lakh on the interest payment component This is useful during the initial repayments of your home loan when the interest payments are the

https://www.paisabazaar.com/home-loan/home-loan-tax-benefits

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

You can enjoy home loan tax exemptions of up to Rs 2 lakh on the interest payment component This is useful during the initial repayments of your home loan when the interest payments are the

Income Tax Act allows home loan borrowers to save on their taxes under two sections deduction of up to Rs 1 5 lakh on principal repayment under Section 80C

Tax Exemptions For Startups In India Bizzopedia

Home Loan Tax Exemption Check Tax Benefits On Home Loan

Know The Tax Amount You Can Save On Your Home Loan Under Section 24 And

80EEA Tax Exemption On Loan For Purchase Of Affordable House

How Is Tax Exemption On Home Loan Calculated TESATEW

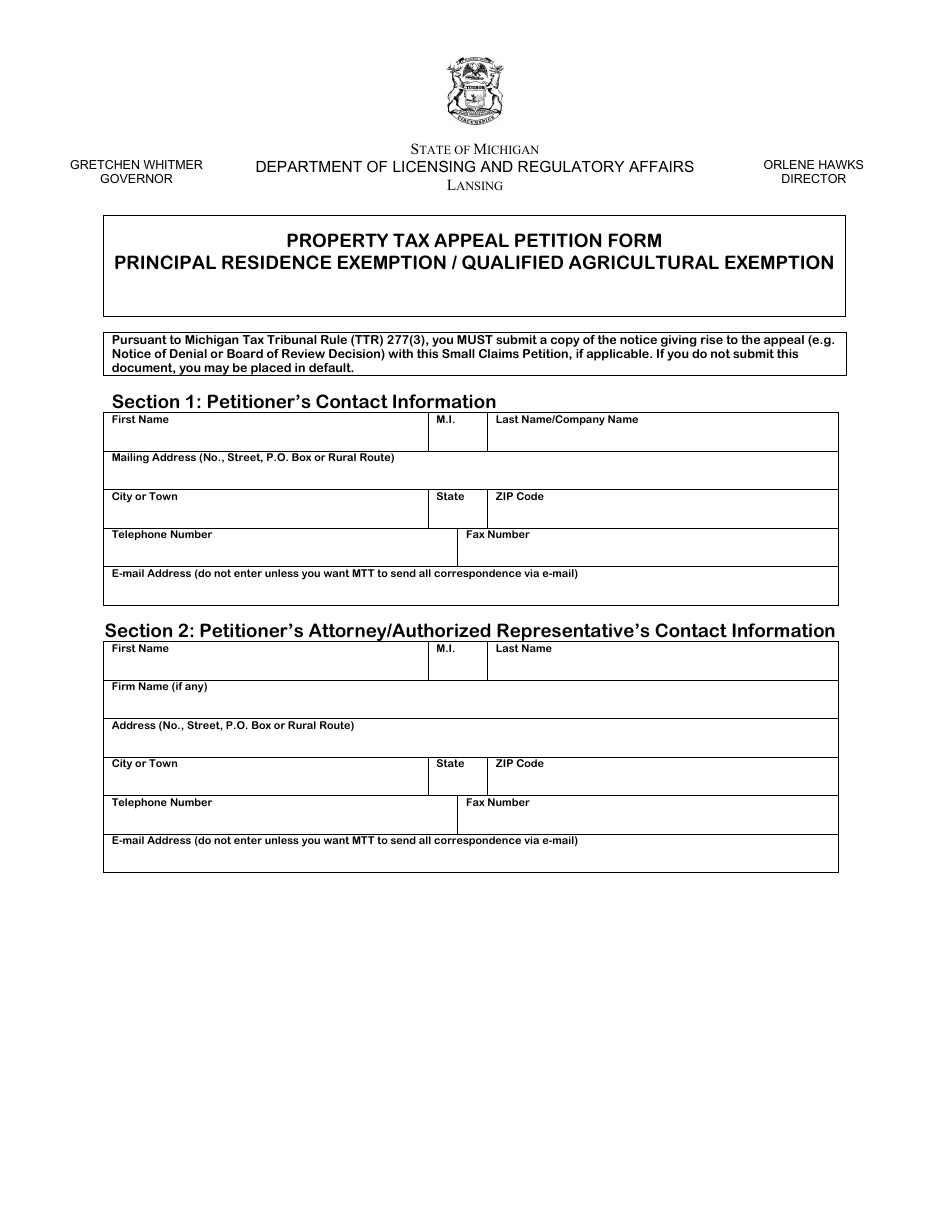

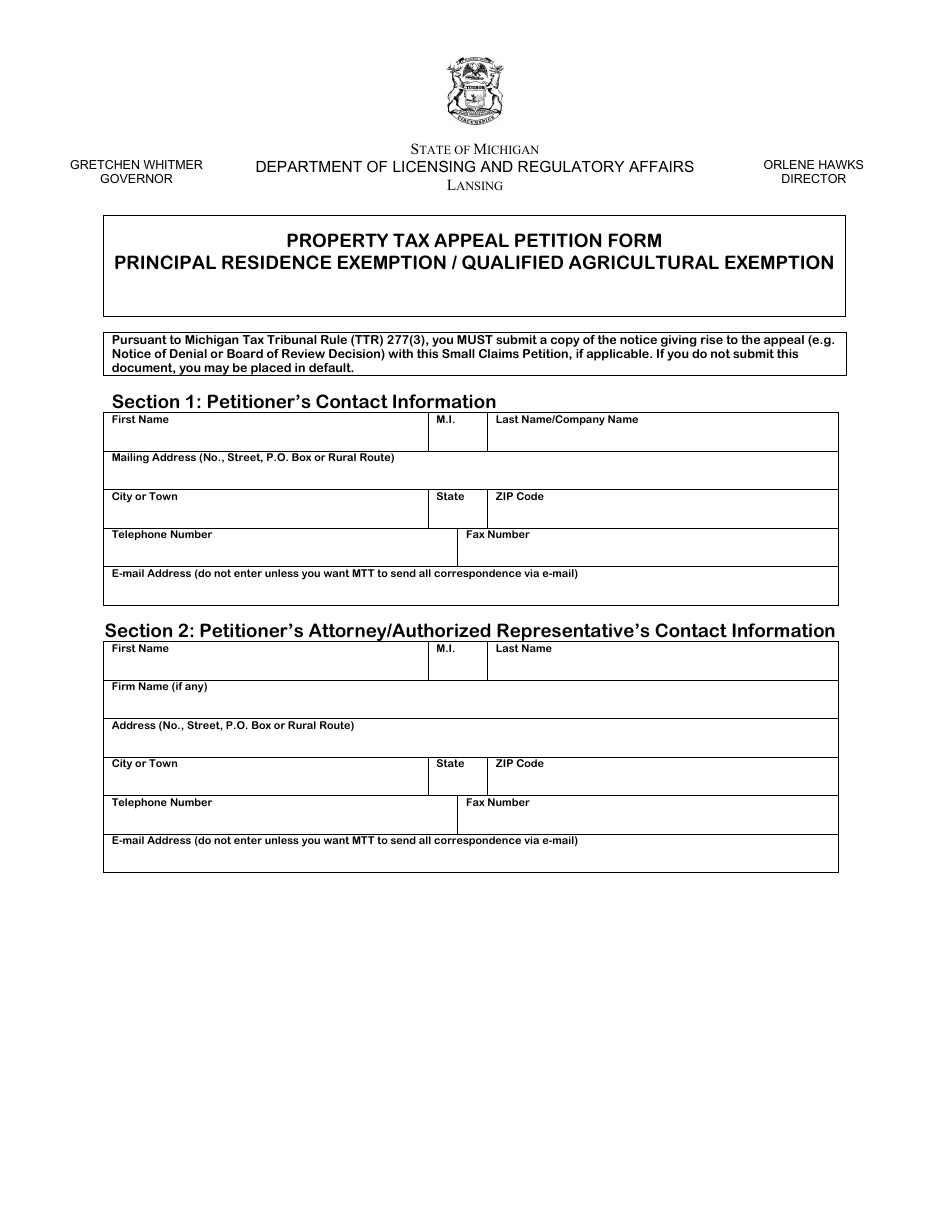

Michigan Property Tax Appeal Petition Form Principal Residence

Michigan Property Tax Appeal Petition Form Principal Residence

Applicability Of Tax Exemption For Online Coaching