Today, when screens dominate our lives and the appeal of physical printed products hasn't decreased. No matter whether it's for educational uses as well as creative projects or simply adding an extra personal touch to your area, How Much Tax Do You Pay On 401k Withdrawal At 62 have become an invaluable source. The following article is a take a dive to the depths of "How Much Tax Do You Pay On 401k Withdrawal At 62," exploring the different types of printables, where to find them, and how they can add value to various aspects of your lives.

Get Latest How Much Tax Do You Pay On 401k Withdrawal At 62 Below

How Much Tax Do You Pay On 401k Withdrawal At 62

How Much Tax Do You Pay On 401k Withdrawal At 62 -

Learn how 401 k contributions withdrawals and rollovers are taxed and how to plan for your retirement income and taxes Find out the differences between traditional and Roth 401 k s

Learn how 401 k plans offer tax advantages for retirement savings but also have rules and penalties for early withdrawals Find

How Much Tax Do You Pay On 401k Withdrawal At 62 offer a wide variety of printable, downloadable material that is available online at no cost. The resources are offered in a variety forms, like worksheets templates, coloring pages, and much more. The beauty of How Much Tax Do You Pay On 401k Withdrawal At 62 lies in their versatility and accessibility.

More of How Much Tax Do You Pay On 401k Withdrawal At 62

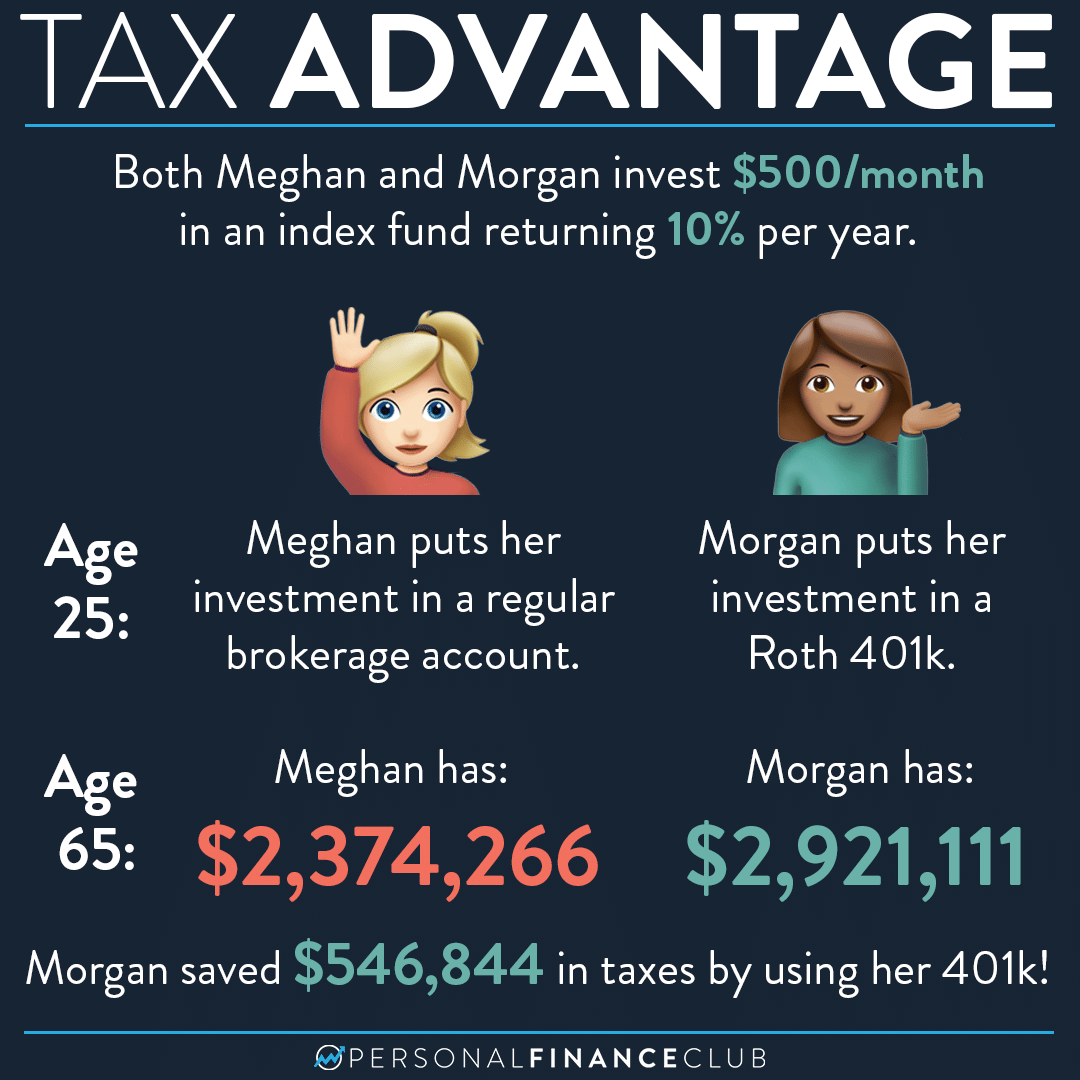

Here s How Much Money You Can Save On Taxes With A Roth 401k Personal

Here s How Much Money You Can Save On Taxes With A Roth 401k Personal

Learn how to report and pay taxes on your 401 k withdrawal whether you re rolling over retiring or taking an early distribution Find out the tax

Learn how to lower your tax bill on 401 k withdrawals by converting to a Roth account withdrawing early or adjusting your income bracket Find out the rules benefits and drawbacks of

The How Much Tax Do You Pay On 401k Withdrawal At 62 have gained huge recognition for a variety of compelling motives:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies of the software or expensive hardware.

-

Customization: We can customize printables to fit your particular needs be it designing invitations to organize your schedule or even decorating your home.

-

Educational Impact: The free educational worksheets offer a wide range of educational content for learners from all ages, making them a useful source for educators and parents.

-

Affordability: Fast access a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more How Much Tax Do You Pay On 401k Withdrawal At 62

How Much Tax Do I Pay On 401k Withdrawal YouTube

How Much Tax Do I Pay On 401k Withdrawal YouTube

Learn when you can withdraw money from your 401 k without paying a 10 penalty or taxes Find out the exceptions requirements and alternatives for qualified early and hardship

Learn when you can withdraw from your 401 k without paying a 10 penalty and how to take qualified distributions after age 59 Find out the exceptions hardship withdrawals and tax

After we've peaked your interest in How Much Tax Do You Pay On 401k Withdrawal At 62 We'll take a look around to see where you can get these hidden treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of printables that are free for a variety of objectives.

- Explore categories like design, home decor, organizational, and arts and crafts.

2. Educational Platforms

- Forums and educational websites often provide free printable worksheets along with flashcards, as well as other learning materials.

- This is a great resource for parents, teachers, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers are willing to share their original designs as well as templates for free.

- The blogs are a vast array of topics, ranging ranging from DIY projects to party planning.

Maximizing How Much Tax Do You Pay On 401k Withdrawal At 62

Here are some innovative ways create the maximum value of printables for free:

1. Home Decor

- Print and frame stunning artwork, quotes or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets for teaching at-home either in the schoolroom or at home.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable planners as well as to-do lists and meal planners.

Conclusion

How Much Tax Do You Pay On 401k Withdrawal At 62 are an abundance of practical and imaginative resources that meet a variety of needs and preferences. Their accessibility and versatility make them a great addition to both professional and personal lives. Explore the endless world that is How Much Tax Do You Pay On 401k Withdrawal At 62 today, and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables actually gratis?

- Yes you can! You can download and print these materials for free.

-

Can I use free printables for commercial purposes?

- It's dependent on the particular conditions of use. Always read the guidelines of the creator before using printables for commercial projects.

-

Do you have any copyright issues in printables that are free?

- Certain printables might have limitations concerning their use. Be sure to review the terms of service and conditions provided by the creator.

-

How do I print How Much Tax Do You Pay On 401k Withdrawal At 62?

- Print them at home with an printer, or go to a local print shop for higher quality prints.

-

What software do I require to view printables free of charge?

- Most PDF-based printables are available in the PDF format, and can be opened using free software such as Adobe Reader.

Cu nto Paga Un Empleador En Impuestos Sobre La N mina Tasa De

How To Pay Less Taxes On 401k Withdrawal shorts YouTube

Check more sample of How Much Tax Do You Pay On 401k Withdrawal At 62 below

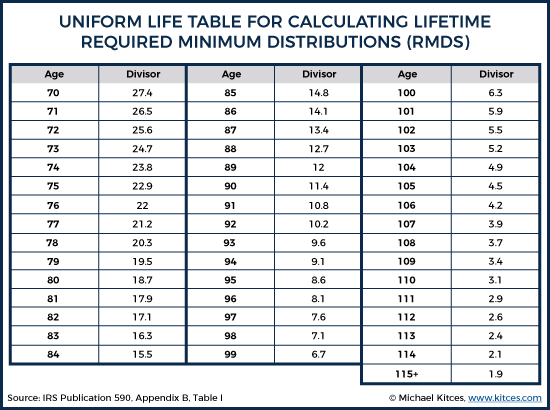

401k Rmd Distribution Table Elcho Table

401k Early Withdrawal Tax Calculator AndrenaCarla

401 K Cash Distributions Understanding The Taxes Penalties

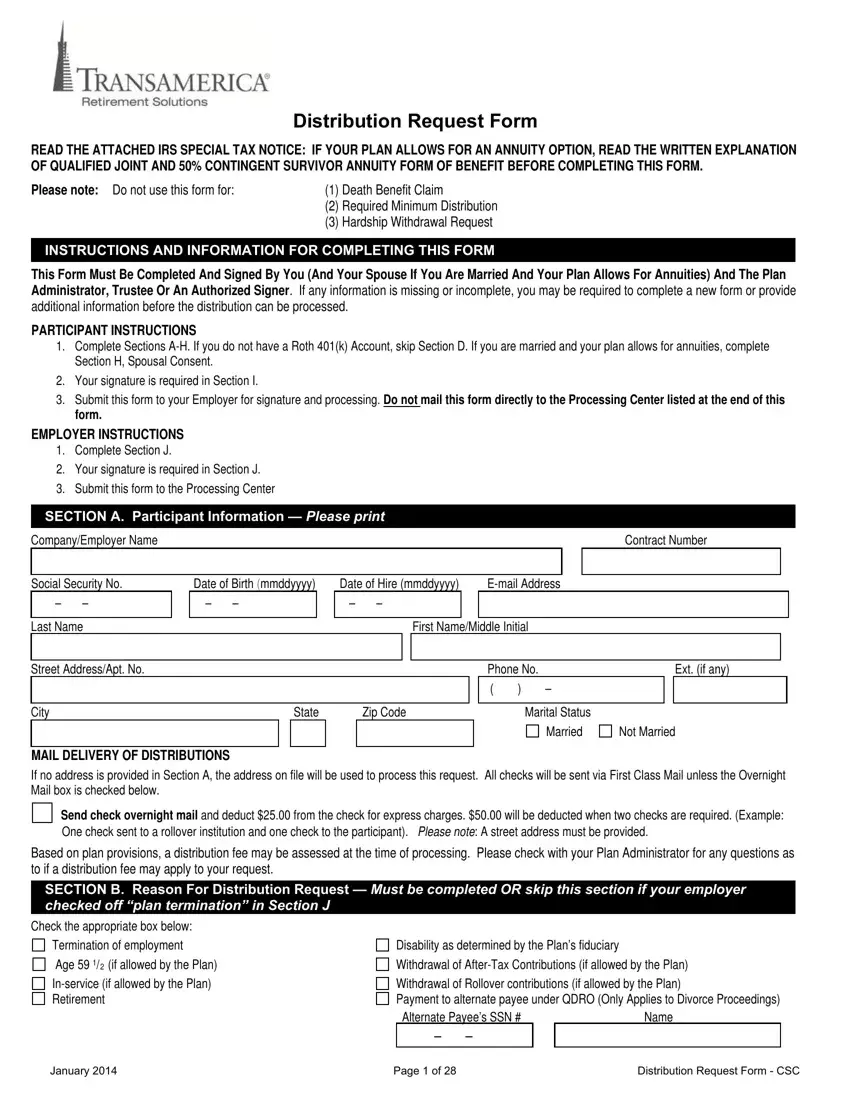

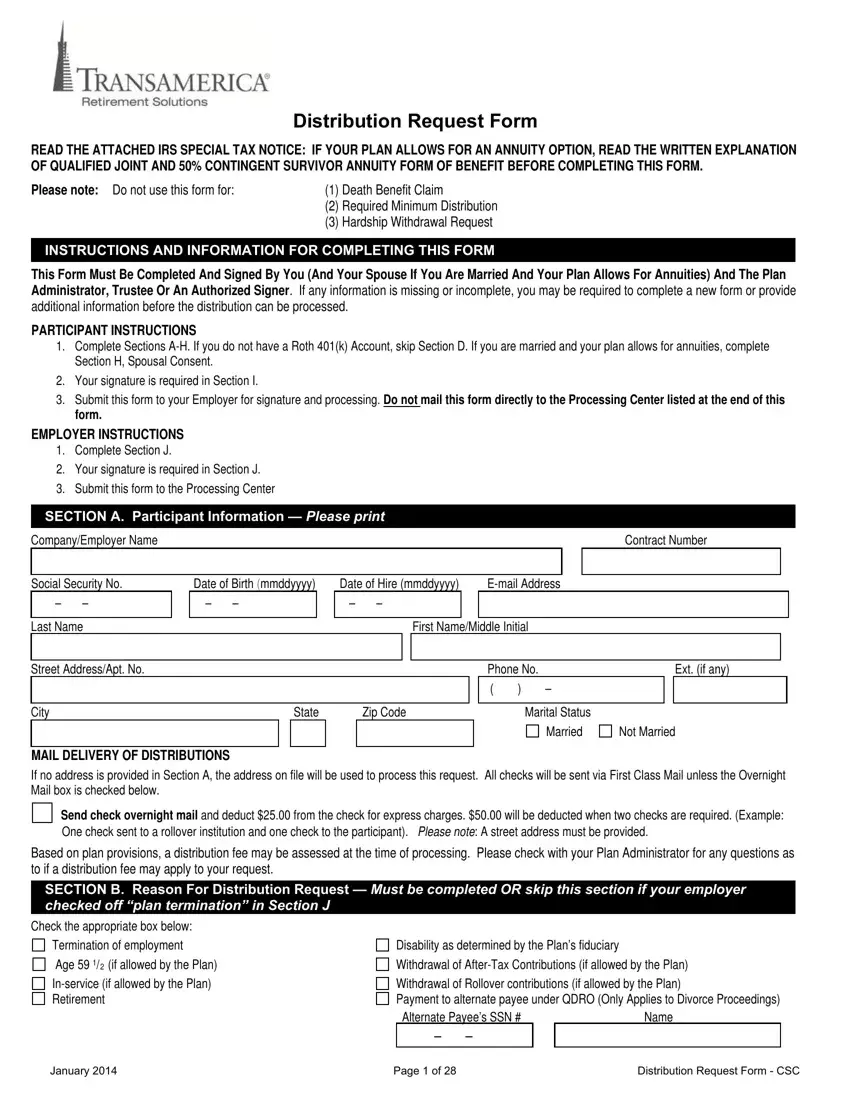

Transamerica 401K Withdrawal Fill Out Printable PDF Forms Online

401k Withdrawal Strategy For Early Retirement Early Retirement

/what-age-can-funds-be-withdrawn-from-401k-2388807_FINAL-5b632ba64cedfd0050ac345a.png)

How Much Tax Do You Pay On Bond Investments Mint

https://www.nerdwallet.com/article/tax…

Learn how 401 k plans offer tax advantages for retirement savings but also have rules and penalties for early withdrawals Find

https://www.sdretirementplans.com/with…

If your 401 k contributions were traditional personal deferrals the answer is yes you will pay income tax on your withdrawals If you take withdrawals before reaching the age of 59 the IRS may also impose a ten percent

Learn how 401 k plans offer tax advantages for retirement savings but also have rules and penalties for early withdrawals Find

If your 401 k contributions were traditional personal deferrals the answer is yes you will pay income tax on your withdrawals If you take withdrawals before reaching the age of 59 the IRS may also impose a ten percent

Transamerica 401K Withdrawal Fill Out Printable PDF Forms Online

401k Early Withdrawal Tax Calculator AndrenaCarla

/what-age-can-funds-be-withdrawn-from-401k-2388807_FINAL-5b632ba64cedfd0050ac345a.png)

401k Withdrawal Strategy For Early Retirement Early Retirement

How Much Tax Do You Pay On Bond Investments Mint

Social Security Cost Of Living Adjustments 2023

Understanding Your Forms W 2 Wage Tax Statement Tax Tax Refund

Understanding Your Forms W 2 Wage Tax Statement Tax Tax Refund

How To Calculate 401k Required Minimum Distribution Free Download