In a world where screens rule our lives but the value of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons, creative projects, or simply adding an individual touch to the area, How Much Tax Do I Pay On 401k Withdrawal After 60 are now an essential resource. With this guide, you'll take a dive deeper into "How Much Tax Do I Pay On 401k Withdrawal After 60," exploring the benefits of them, where to find them and how they can enhance various aspects of your daily life.

Get Latest How Much Tax Do I Pay On 401k Withdrawal After 60 Below

How Much Tax Do I Pay On 401k Withdrawal After 60

How Much Tax Do I Pay On 401k Withdrawal After 60 -

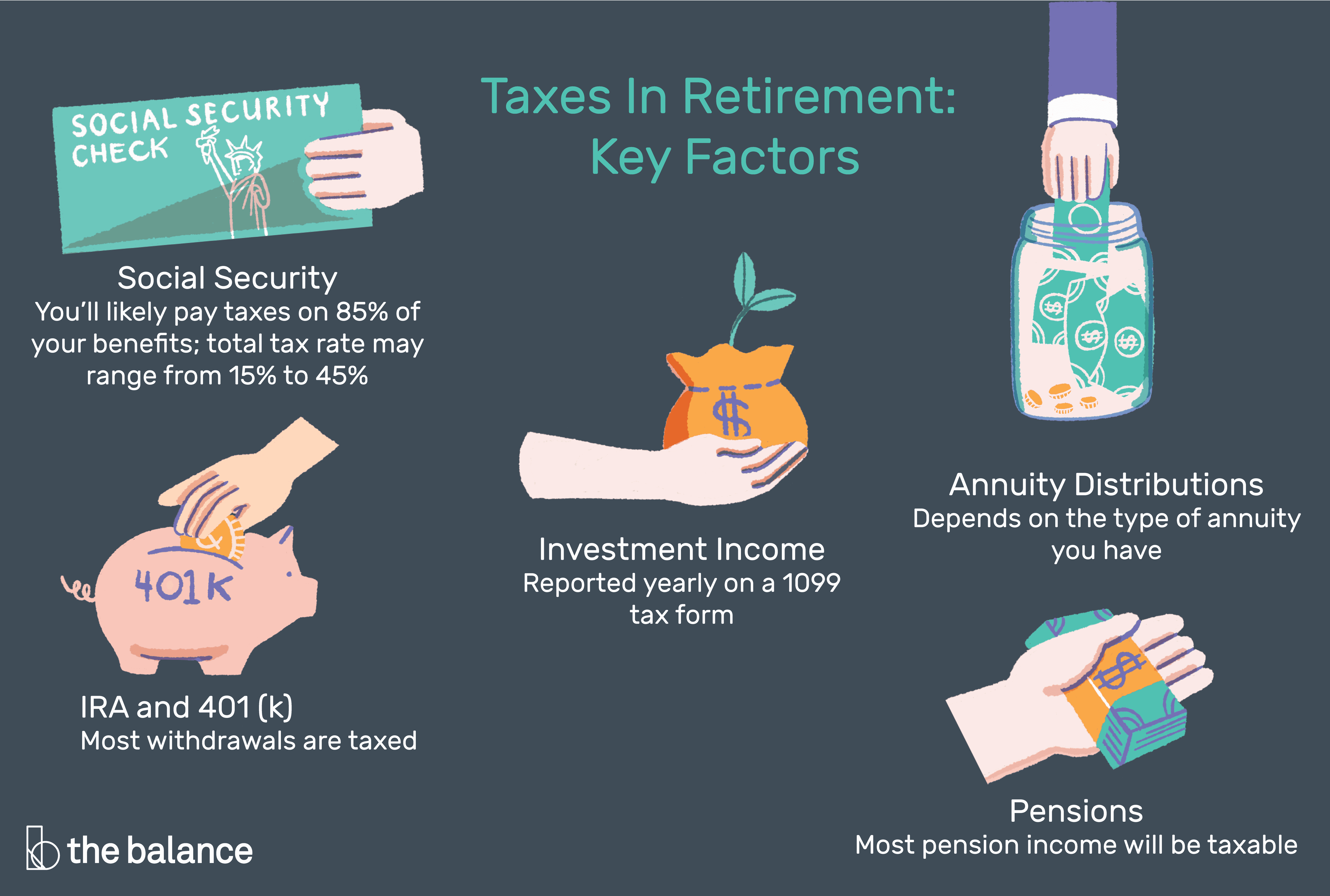

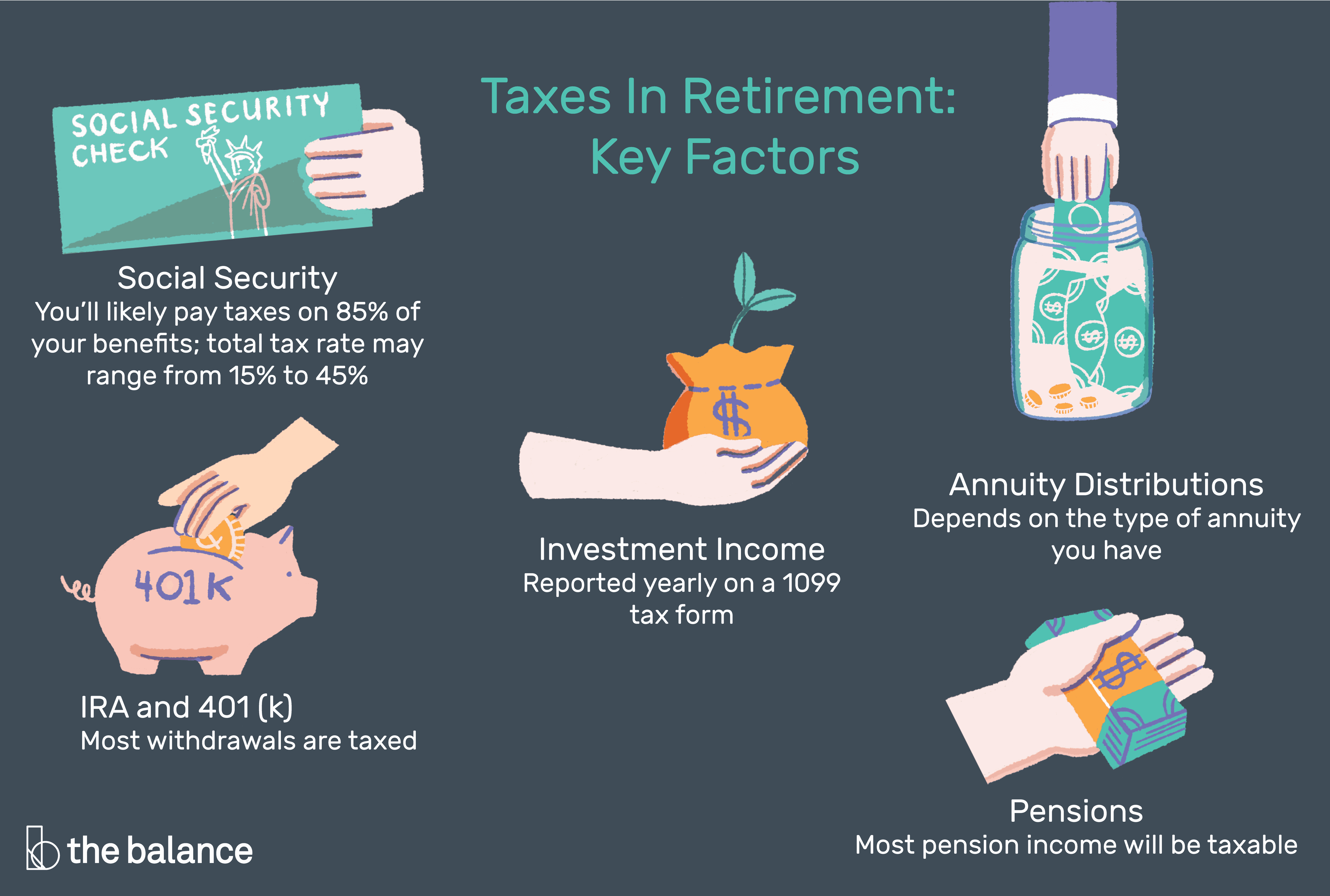

The tax rate for your 401 k distributions will depend on which federal tax bracket you are in at the time of withdrawal You have to pay taxes on the money you withdraw because you didn t pay income taxes on it when you contributed put money into the account

Key Takeaways Most plans allow participants to withdraw funds from their 401 k at age 59 without incurring a 10 early withdrawal tax penalty If you re withdrawing pre tax money you ll still pay taxes on your 401 k withdrawal but if you re withdrawing Roth funds you may not have to pay taxes on your contributions

How Much Tax Do I Pay On 401k Withdrawal After 60 offer a wide variety of printable, downloadable materials online, at no cost. These printables come in different forms, including worksheets, templates, coloring pages, and many more. The benefit of How Much Tax Do I Pay On 401k Withdrawal After 60 lies in their versatility and accessibility.

More of How Much Tax Do I Pay On 401k Withdrawal After 60

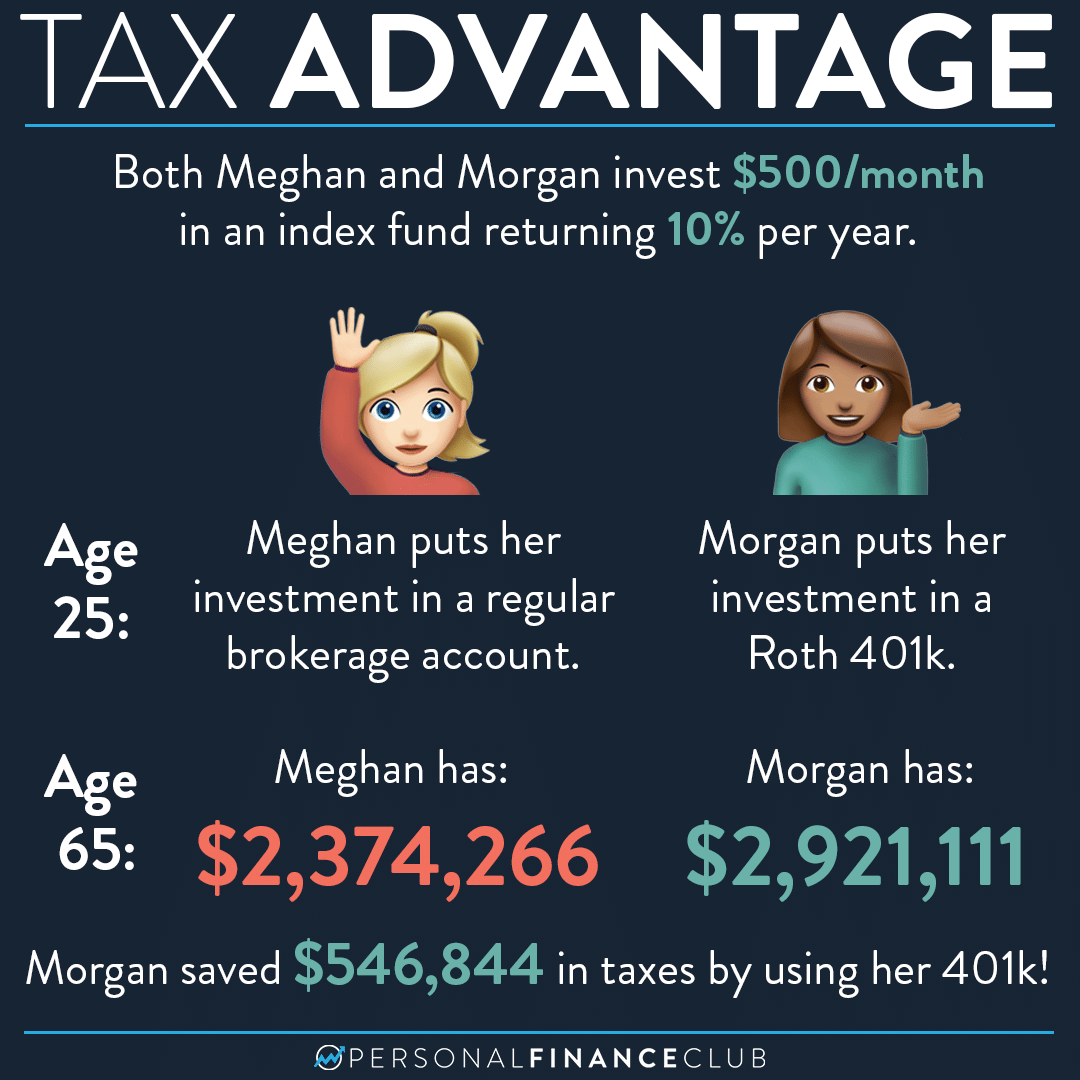

Here s How Much Money You Can Save On Taxes With A Roth 401k Personal

Here s How Much Money You Can Save On Taxes With A Roth 401k Personal

Most Americans retire in their mid 60s and the Internal Revenue Service IRS allows you to begin taking distributions from your 401 k without a 10 early withdrawal penalty as soon as you are

Nerdy takeaways You can make a 401 k withdrawal at any age but doing so before age 59 could trigger a 10 early distribution tax on top of ordinary income taxes Some reasons for taking an

Print-friendly freebies have gained tremendous popularity due to numerous compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies or expensive software.

-

Modifications: This allows you to modify printed materials to meet your requirements, whether it's designing invitations and schedules, or even decorating your house.

-

Educational Worth: Educational printables that can be downloaded for free are designed to appeal to students of all ages, making them an essential instrument for parents and teachers.

-

Simple: instant access a myriad of designs as well as templates is time-saving and saves effort.

Where to Find more How Much Tax Do I Pay On 401k Withdrawal After 60

Cu nto Paga Un Empleador En Impuestos Sobre La N mina Tasa De

Cu nto Paga Un Empleador En Impuestos Sobre La N mina Tasa De

One of the easiest ways to lower the amount of taxes you have to pay on 401 k withdrawals is to convert those funds to a Roth 401 k or a Roth individual retirement account IRA

However if you make a withdrawal before reaching 59 you will pay income taxes on any interests and gains on your retirement savings and a 10 early withdrawal tax unless you need the money due to disability or death 401

Now that we've piqued your interest in How Much Tax Do I Pay On 401k Withdrawal After 60 Let's see where you can get these hidden treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer a vast selection of How Much Tax Do I Pay On 401k Withdrawal After 60 designed for a variety objectives.

- Explore categories such as the home, decor, management, and craft.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing as well as flashcards and other learning materials.

- Great for parents, teachers and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their innovative designs with templates and designs for free.

- The blogs are a vast array of topics, ranging that includes DIY projects to planning a party.

Maximizing How Much Tax Do I Pay On 401k Withdrawal After 60

Here are some fresh ways to make the most use of How Much Tax Do I Pay On 401k Withdrawal After 60:

1. Home Decor

- Print and frame beautiful art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use free printable worksheets to enhance your learning at home and in class.

3. Event Planning

- Invitations, banners and other decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars checklists for tasks, as well as meal planners.

Conclusion

How Much Tax Do I Pay On 401k Withdrawal After 60 are an abundance of fun and practical tools which cater to a wide range of needs and interest. Their accessibility and flexibility make them a great addition to both professional and personal life. Explore the vast world of How Much Tax Do I Pay On 401k Withdrawal After 60 now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free cost-free?

- Yes, they are! You can print and download these files for free.

-

Can I make use of free templates for commercial use?

- It's all dependent on the usage guidelines. Always consult the author's guidelines before using their printables for commercial projects.

-

Are there any copyright problems with printables that are free?

- Some printables could have limitations in their usage. Be sure to check the conditions and terms of use provided by the designer.

-

How can I print printables for free?

- You can print them at home using your printer or visit a local print shop for superior prints.

-

What program do I need to open printables for free?

- The majority of printables are in the format PDF. This can be opened using free software like Adobe Reader.

401k Rmd Distribution Table Elcho Table

401 k Loan What To Know Before Borrowing From Your 401 k

Check more sample of How Much Tax Do I Pay On 401k Withdrawal After 60 below

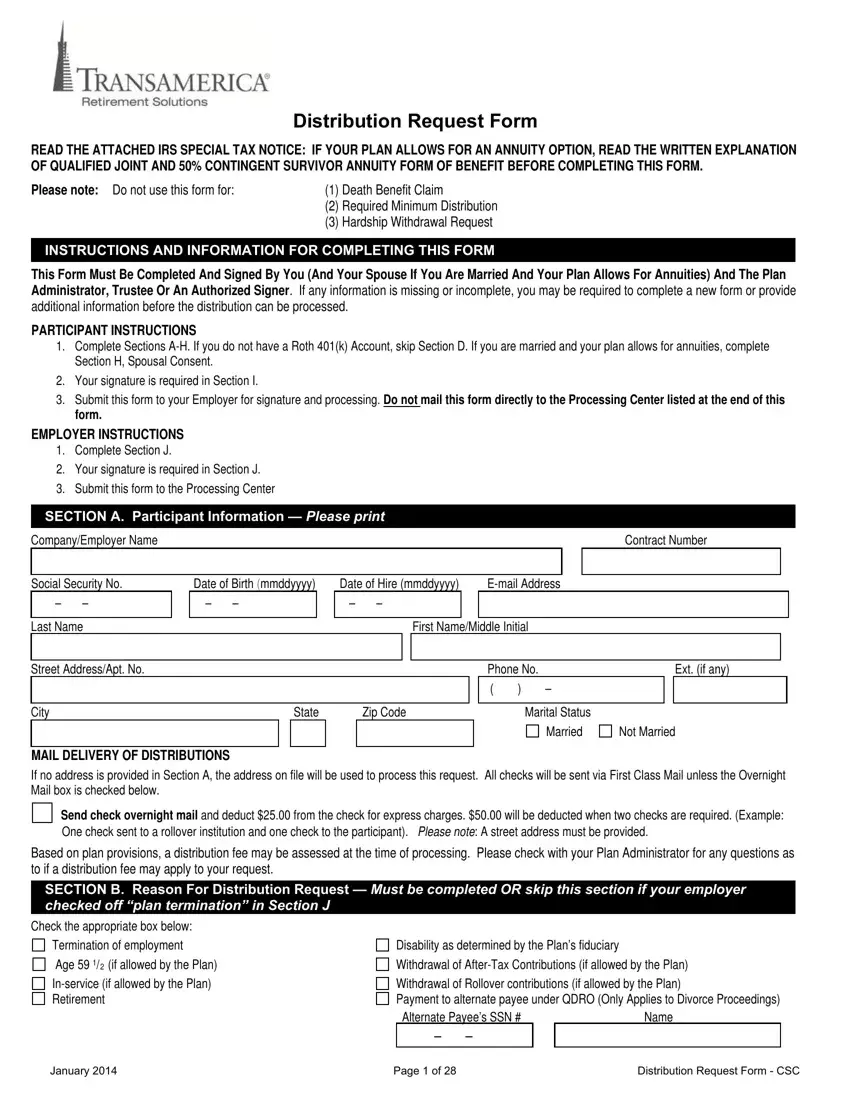

Transamerica 401K Withdrawal Fill Out Printable PDF Forms Online

401 K Cash Distributions Understanding The Taxes Penalties

401k Withdrawal Strategy For Early Retirement Early Retirement

/what-age-can-funds-be-withdrawn-from-401k-2388807_FINAL-5b632ba64cedfd0050ac345a.png)

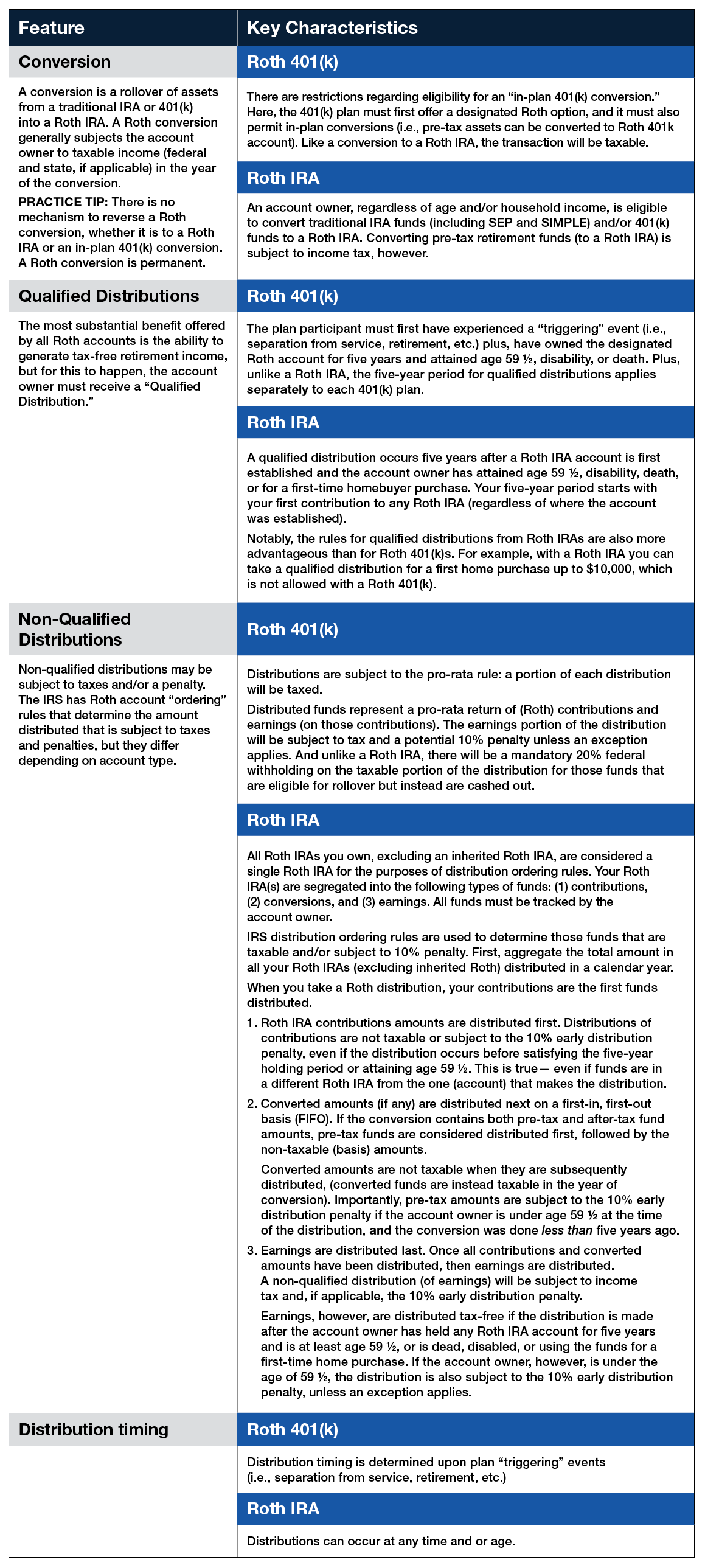

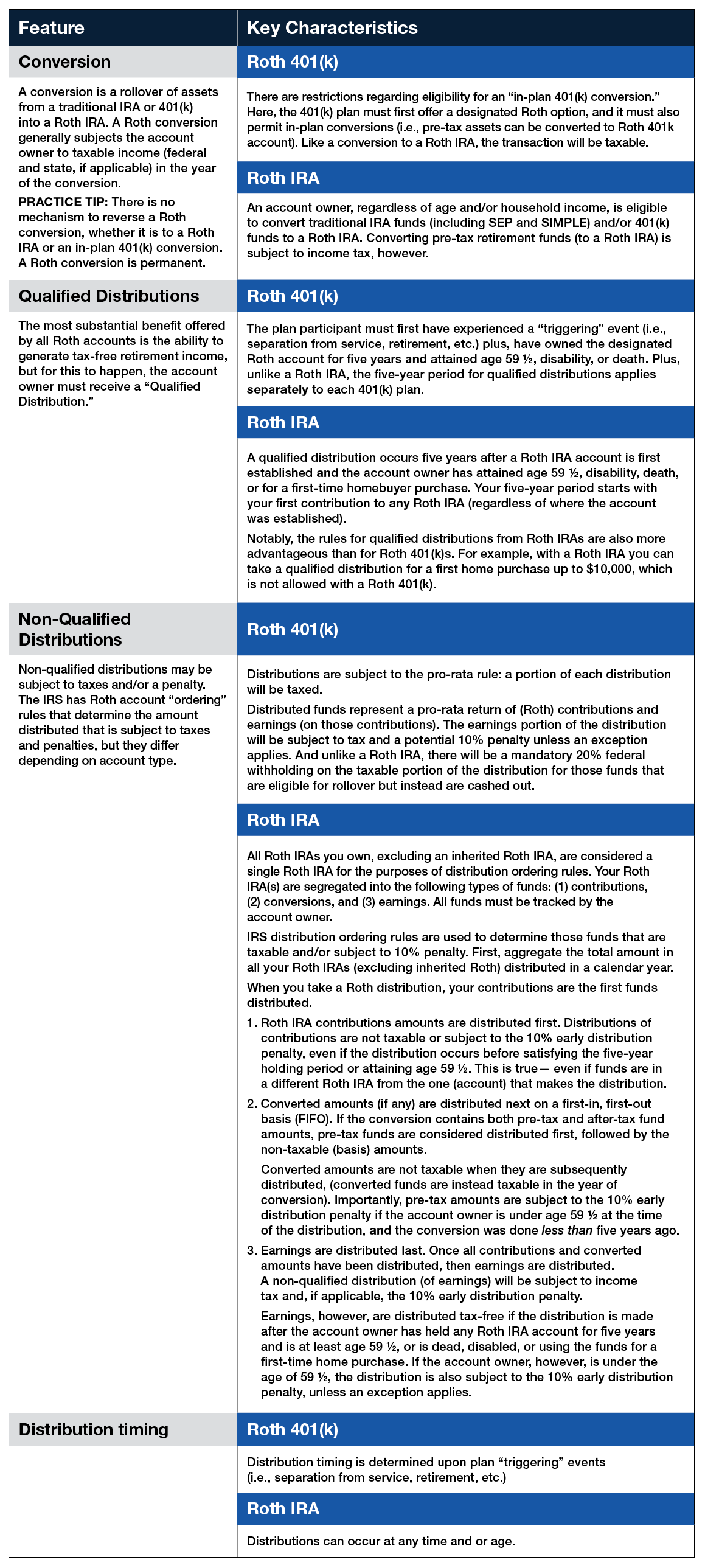

Roth 401 k Vs Roth IRA Key Differences In Contributions Distributions

Social Security Cost Of Living Adjustments 2023

How Much Tax Will I Pay On My 401k Encinitas Daily News

https://humaninterest.com/learn/articles/...

Key Takeaways Most plans allow participants to withdraw funds from their 401 k at age 59 without incurring a 10 early withdrawal tax penalty If you re withdrawing pre tax money you ll still pay taxes on your 401 k withdrawal but if you re withdrawing Roth funds you may not have to pay taxes on your contributions

https://smartasset.com/retirement/401k-tax

Whenever you withdraw money from a 401 k you have 60 days to put the money into another tax deferred retirement plan If you transfer the money within 60 days you will not have to pay any taxes or penalties on your withdrawals

Key Takeaways Most plans allow participants to withdraw funds from their 401 k at age 59 without incurring a 10 early withdrawal tax penalty If you re withdrawing pre tax money you ll still pay taxes on your 401 k withdrawal but if you re withdrawing Roth funds you may not have to pay taxes on your contributions

Whenever you withdraw money from a 401 k you have 60 days to put the money into another tax deferred retirement plan If you transfer the money within 60 days you will not have to pay any taxes or penalties on your withdrawals

Roth 401 k Vs Roth IRA Key Differences In Contributions Distributions

401 K Cash Distributions Understanding The Taxes Penalties

Social Security Cost Of Living Adjustments 2023

How Much Tax Will I Pay On My 401k Encinitas Daily News

Should I Cash Out My 401k To Pay Off Debt Gnomon Gallery

How Much Is 401K Taxed On Early Withdrawal BERITA EKONOMI

How Much Is 401K Taxed On Early Withdrawal BERITA EKONOMI

:max_bytes(150000):strip_icc()/can-i-withdraw-money-from-my-401-k-before-i-retire-2894181-FINAL-4f77dfcb474e446bb27fb9723e9f0881.png)

Can I Withdraw Money From My 401 k Before I Retire