In this age of technology, where screens have become the dominant feature of our lives yet the appeal of tangible printed objects isn't diminished. It doesn't matter if it's for educational reasons such as creative projects or simply adding a personal touch to your home, printables for free have proven to be a valuable resource. The following article is a take a dive deep into the realm of "How Much Investment Under 80c," exploring their purpose, where to find them and how they can enhance various aspects of your life.

Get Latest How Much Investment Under 80c Below

How Much Investment Under 80c

How Much Investment Under 80c -

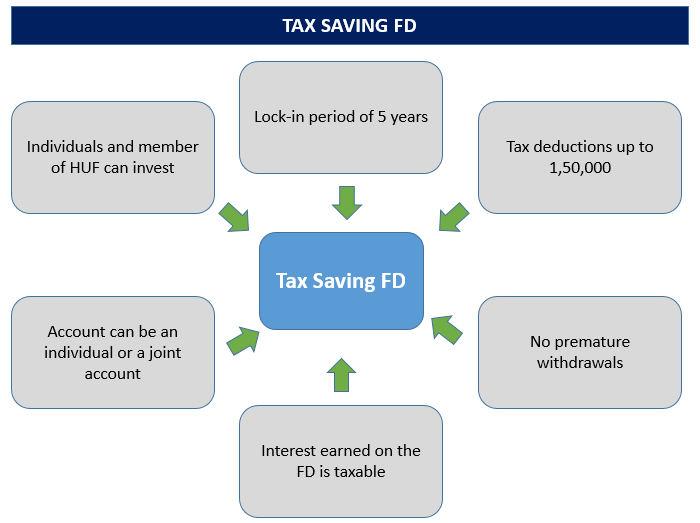

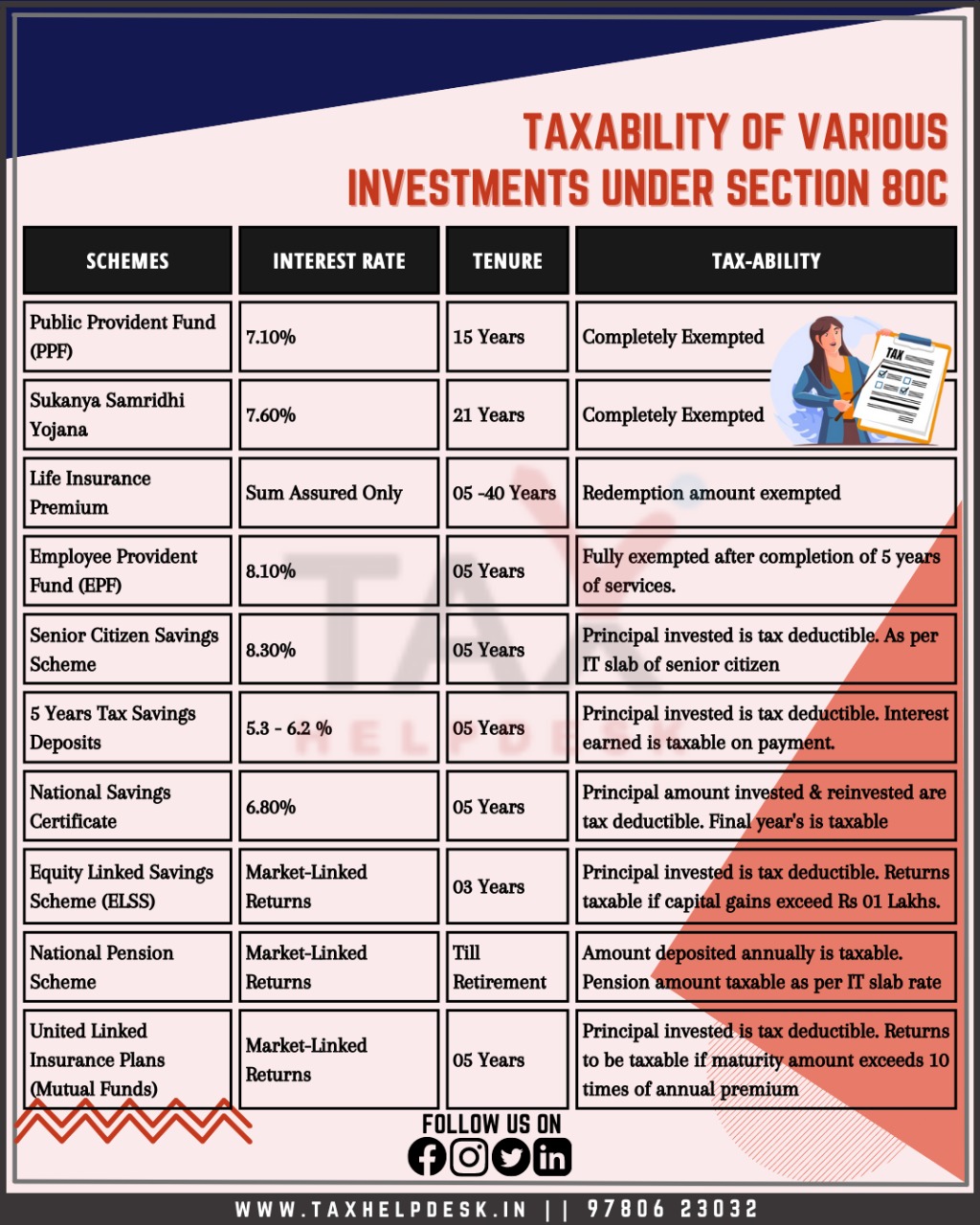

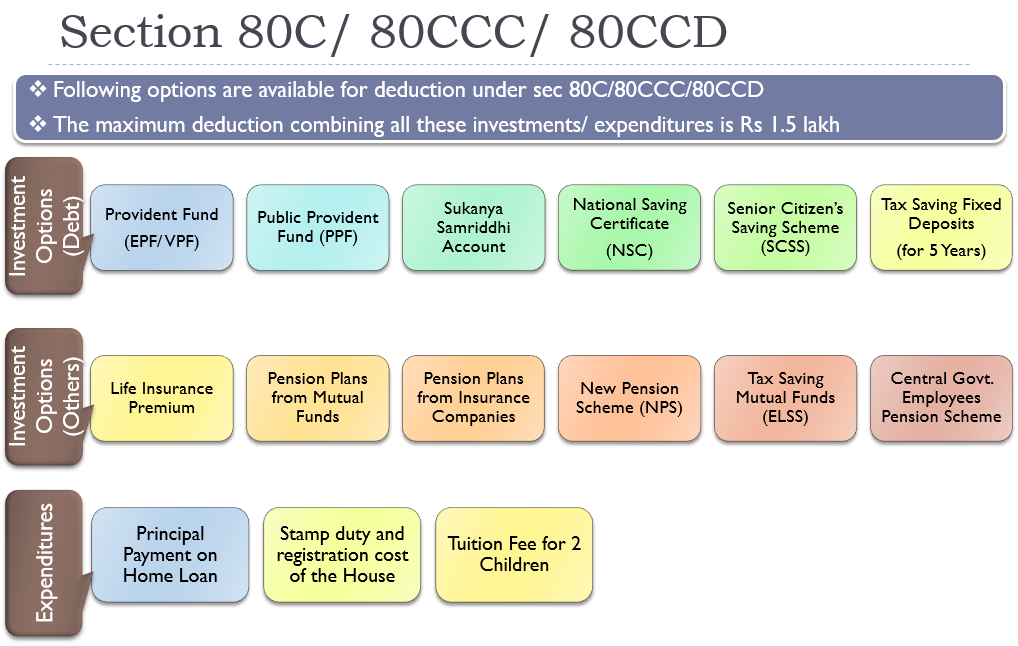

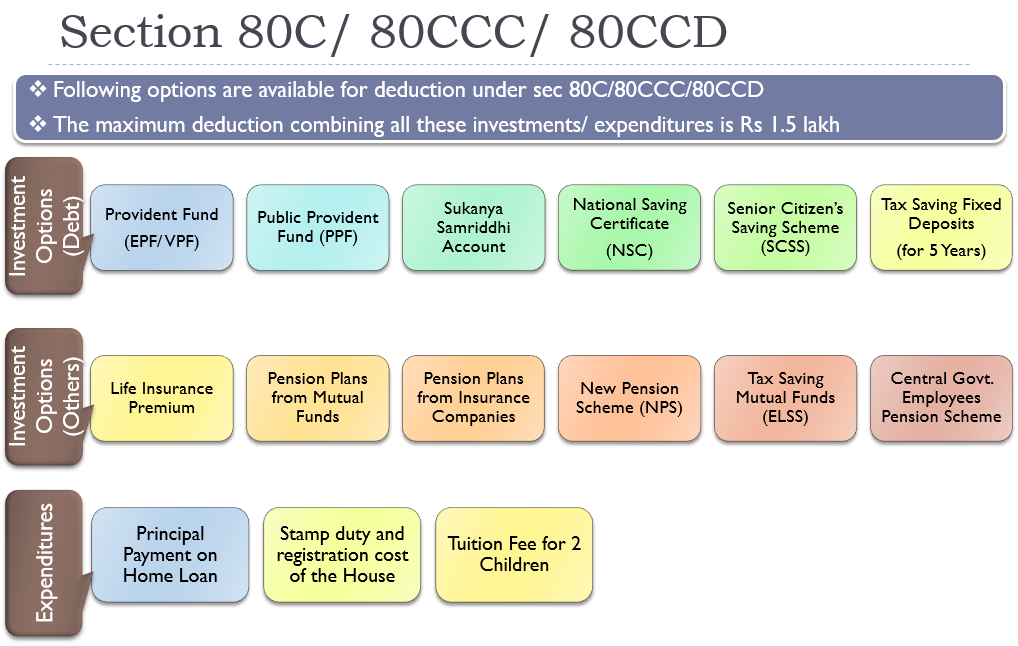

The maximum amount of deduction that can be claimed under section 80C is Rs 1 5 lakh for the current financial year The section offers various investment options to the taxpayer which not only generate returns for him but can also be claimed as deduction while calculating total taxable income

Section 80C permits certain investments and expenses to be tax exempted By well planning the 80C investments that are spread diversely across various options like NSC ULIP PPF etc an individual can claim deductions up to Rs 1 50 000 By taking tax benefits under 80C one can avail of a reduction in tax burden

Printables for free cover a broad variety of printable, downloadable documents that can be downloaded online at no cost. They are available in a variety of forms, including worksheets, templates, coloring pages, and more. One of the advantages of How Much Investment Under 80c is their flexibility and accessibility.

More of How Much Investment Under 80c

A Guide To Investments In Indian Real Estate Rate exchange

A Guide To Investments In Indian Real Estate Rate exchange

45 000 Cr Investment managed 800 Cr Monthly MF investment What is Section 80C Section 80C is a tax saving provision under the Indian Income Tax Act 1961

Section 80C of the Income Tax Act 1961 allows you a deduction of up to INR 1 5 lakhs from your taxable income You can claim a deduction under Section 80C if you invest in specified investment avenues or if you incur specific expenses in a financial year

How Much Investment Under 80c have gained immense appeal due to many compelling reasons:

-

Cost-Efficiency: They eliminate the requirement to purchase physical copies of the software or expensive hardware.

-

Customization: We can customize printed materials to meet your requirements in designing invitations and schedules, or decorating your home.

-

Educational Use: Education-related printables at no charge are designed to appeal to students from all ages, making them a useful source for educators and parents.

-

Simple: Quick access to numerous designs and templates can save you time and energy.

Where to Find more How Much Investment Under 80c

Deductions Under Section 80C Does PF Come Under 80C

Deductions Under Section 80C Does PF Come Under 80C

Deductions under section 80C Tax Saving Calculator When you make savings in specified modes of investments you will be eligible for a benefit under the Income tax Act wherein section 80C provides for a deduction of such investments from the Gross Total Income thereby lowering the tax payable

45 000 Cr Investment managed 800 Cr Monthly MF investment Categorizing Section 80C options We have seen the convenience of categorizing Section 80C instruments into savings investments and spending Comparing all of them to arrive at the best option is a

We hope we've stimulated your interest in printables for free Let's look into where you can discover these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide a wide selection with How Much Investment Under 80c for all reasons.

- Explore categories such as decorations for the home, education and organizing, and crafts.

2. Educational Platforms

- Educational websites and forums often offer worksheets with printables that are free for flashcards, lessons, and worksheets. materials.

- Perfect for teachers, parents, and students seeking supplemental sources.

3. Creative Blogs

- Many bloggers provide their inventive designs or templates for download.

- The blogs covered cover a wide range of topics, starting from DIY projects to planning a party.

Maximizing How Much Investment Under 80c

Here are some ideas of making the most of printables that are free:

1. Home Decor

- Print and frame stunning art, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Print worksheets that are free for teaching at-home, or even in the classroom.

3. Event Planning

- Design invitations for banners, invitations as well as decorations for special occasions such as weddings or birthdays.

4. Organization

- Stay organized with printable calendars for to-do list, lists of chores, and meal planners.

Conclusion

How Much Investment Under 80c are a treasure trove of innovative and useful resources that satisfy a wide range of requirements and passions. Their availability and versatility make them a wonderful addition to each day life. Explore the vast collection of How Much Investment Under 80c now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free absolutely free?

- Yes you can! You can print and download these free resources for no cost.

-

Are there any free printables for commercial purposes?

- It's contingent upon the specific conditions of use. Always consult the author's guidelines prior to using the printables in commercial projects.

-

Do you have any copyright issues in How Much Investment Under 80c?

- Some printables may contain restrictions concerning their use. You should read the terms and regulations provided by the designer.

-

How can I print How Much Investment Under 80c?

- Print them at home using any printer or head to the local print shops for the highest quality prints.

-

What program is required to open printables at no cost?

- The majority are printed as PDF files, which is open with no cost software, such as Adobe Reader.

List Of Deductions Under Section 80C Bajaj Markets

Investment options under 80c Investing Income Tax Infographic

Check more sample of How Much Investment Under 80c below

Understand About Taxability Of Various Investments Under Section 80C

How To Make SIP Investment Under 80C Investments Through ELSS Good

How Much We Can Save Tax Under 80c Know What Says Ca Charterred

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

How To Save Tax Under Section 80c In Income Tax Here s All About It

How To Make SIP Investment Under 80C Zee Business

https://groww.in/p/tax/section-80c

Section 80C permits certain investments and expenses to be tax exempted By well planning the 80C investments that are spread diversely across various options like NSC ULIP PPF etc an individual can claim deductions up to Rs 1 50 000 By taking tax benefits under 80C one can avail of a reduction in tax burden

https://cleartax.in/s/80c-80-deductions

Various sections under Chapter VI A provide deductions such as Section 80C 80D 80E for investments medical insurance premiums and education loans Maximum deduction limit under 80C 80CCC 80CCD 1 80CCE is Rs 1 5 Lakhs with an additional Rs 50 000 under 80CCD 1B

Section 80C permits certain investments and expenses to be tax exempted By well planning the 80C investments that are spread diversely across various options like NSC ULIP PPF etc an individual can claim deductions up to Rs 1 50 000 By taking tax benefits under 80C one can avail of a reduction in tax burden

Various sections under Chapter VI A provide deductions such as Section 80C 80D 80E for investments medical insurance premiums and education loans Maximum deduction limit under 80C 80CCC 80CCD 1 80CCE is Rs 1 5 Lakhs with an additional Rs 50 000 under 80CCD 1B

Download Complete Tax Planning Guide In PDF For Salaried And Professionals

How To Make SIP Investment Under 80C Investments Through ELSS Good

How To Save Tax Under Section 80c In Income Tax Here s All About It

How To Make SIP Investment Under 80C Zee Business

Section 80C Deduction For Tax Saving Investments Learn By Quicko

Section 80 C Best Tax Saving Investment Option Under Sec 80C

Section 80 C Best Tax Saving Investment Option Under Sec 80C

Tax