In the age of digital, where screens dominate our lives The appeal of tangible, printed materials hasn't diminished. Whether it's for educational purposes such as creative projects or just adding an element of personalization to your space, How Much Are Property Taxes In Omaha are now a vital source. We'll dive to the depths of "How Much Are Property Taxes In Omaha," exploring what they are, where they can be found, and how they can be used to enhance different aspects of your daily life.

Get Latest How Much Are Property Taxes In Omaha Below

How Much Are Property Taxes In Omaha

How Much Are Property Taxes In Omaha -

On average the property tax in Omaha is around 2 856 dollars in Douglas Country according to CNN but that is only in metro Omaha In Sarpy the average is 2 732 dollars and in Saunders it drops to 2 522 dollars

The median property tax in Douglas County Nebraska is 2 784 per year for a home worth the median value of 141 400 Douglas County collects on average 1 97 of a property s assessed fair market value as property tax

How Much Are Property Taxes In Omaha include a broad collection of printable materials available online at no cost. The resources are offered in a variety types, such as worksheets templates, coloring pages and more. The appealingness of How Much Are Property Taxes In Omaha lies in their versatility and accessibility.

More of How Much Are Property Taxes In Omaha

Omaha Property Taxes Explained 2023

Omaha Property Taxes Explained 2023

Our Douglas County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Nebraska and across the entire United States

If the data available to the county assessor indicates that the land has a market value of 1 000 per acre for parcels in one part of the county and 500 per acre for parcels in another part of the county the assessed value for these parcels would be 750 per acre and 375 per acre respectively

The How Much Are Property Taxes In Omaha have gained huge popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the necessity of purchasing physical copies or expensive software.

-

The ability to customize: There is the possibility of tailoring designs to suit your personal needs whether it's making invitations or arranging your schedule or even decorating your home.

-

Educational Benefits: Downloads of educational content for free provide for students from all ages, making them a great tool for teachers and parents.

-

Accessibility: instant access a variety of designs and templates, which saves time as well as effort.

Where to Find more How Much Are Property Taxes In Omaha

What Is The Most Taxed State

What Is The Most Taxed State

Home Real Property Tax Search Search Page Treasurer s Home Page Tax Year Tax Amount Date Posted Principal Interest Advertising Drivers License State Id Handicapped Parking Permit Property Tax Contact Us Douglas County Treasurer 1819 Farnam St H 02 Omaha NE 68183

Taxpayer Information Mailing Address 1750 S 9 ST OMAHA NE 68108 Property Information Parcel Number 1516460000 Key Number 1646 0000 15

If we've already piqued your curiosity about How Much Are Property Taxes In Omaha Let's look into where you can find these elusive treasures:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection of How Much Are Property Taxes In Omaha suitable for many applications.

- Explore categories such as decorations for the home, education and organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing Flashcards, worksheets, and other educational materials.

- Ideal for parents, teachers and students in need of additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs as well as templates for free.

- These blogs cover a broad range of topics, everything from DIY projects to planning a party.

Maximizing How Much Are Property Taxes In Omaha

Here are some ways that you can make use use of How Much Are Property Taxes In Omaha:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations that will adorn your living areas.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home as well as in the class.

3. Event Planning

- Invitations, banners and decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Get organized with printable calendars, to-do lists, and meal planners.

Conclusion

How Much Are Property Taxes In Omaha are an abundance filled with creative and practical information that satisfy a wide range of requirements and needs and. Their availability and versatility make them a valuable addition to each day life. Explore the vast world of How Much Are Property Taxes In Omaha right now and explore new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free available for download?

- Yes, they are! You can print and download these free resources for no cost.

-

Can I download free printing templates for commercial purposes?

- It is contingent on the specific usage guidelines. Always consult the author's guidelines before utilizing their templates for commercial projects.

-

Are there any copyright concerns with printables that are free?

- Some printables may have restrictions concerning their use. You should read the terms and conditions set forth by the creator.

-

How can I print printables for free?

- Print them at home with a printer or visit a local print shop for superior prints.

-

What program will I need to access printables free of charge?

- Most PDF-based printables are available in PDF format, which is open with no cost software such as Adobe Reader.

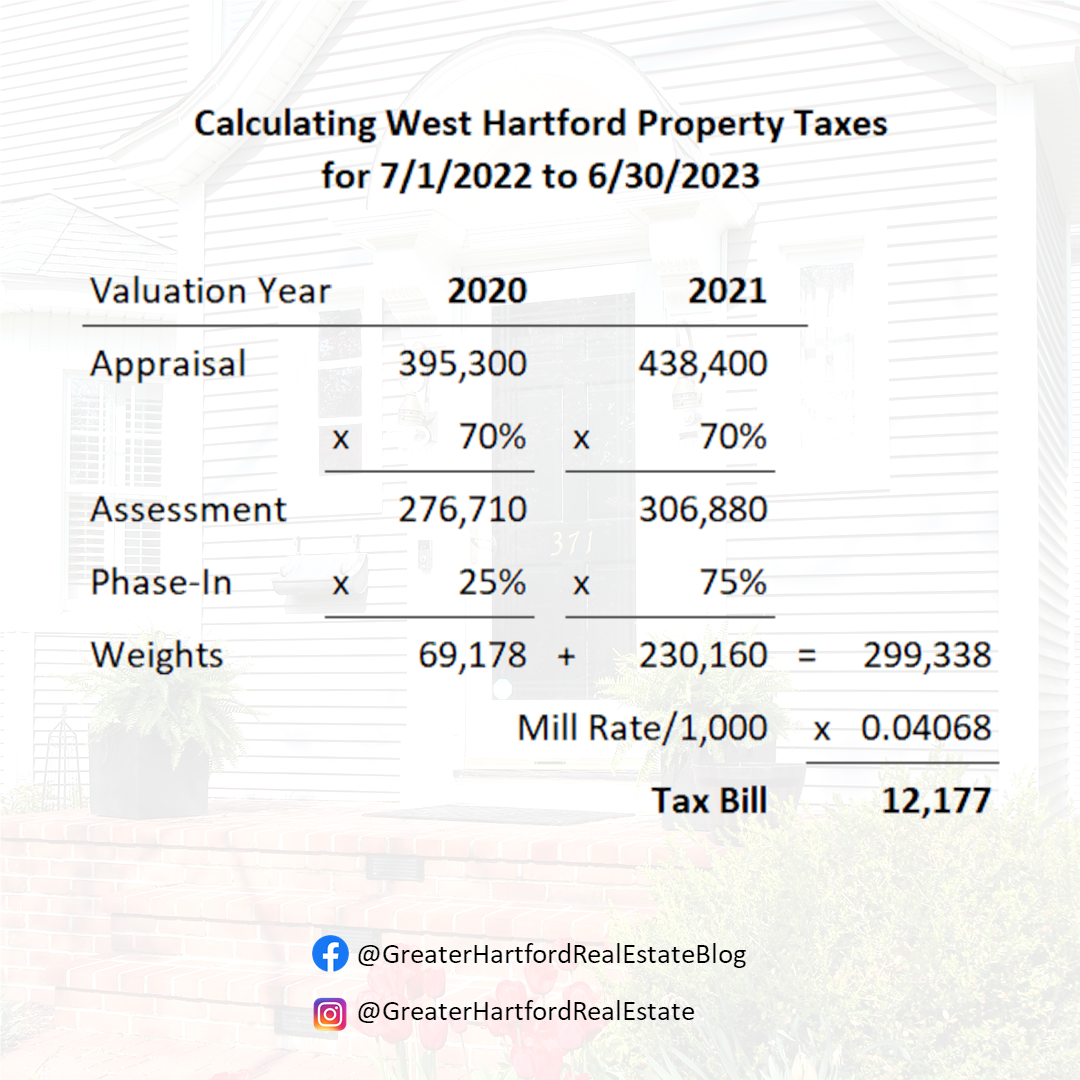

Our Guide To Understanding Your Property Taxes In market city And

Taxes Greater Hartford Real Estate

Check more sample of How Much Are Property Taxes In Omaha below

How High Are Property Taxes In Your State American Property Owners

State Taxes Can Add Up Wealth Management

How Much Does Your State Collect In Property Taxes Per Capita

These States Have The Highest Property Tax Rates TheStreet

How High Are Property Taxes In Your State Tax Foundation

Highest Property Taxes In Texas Why Are Property Taxes So High In

https://www.tax-rates.org/nebraska/douglas_county_property_tax

The median property tax in Douglas County Nebraska is 2 784 per year for a home worth the median value of 141 400 Douglas County collects on average 1 97 of a property s assessed fair market value as property tax

https://payments.dctreasurer.org/search.xhtml

Real Property Tax Search Please enter either Address info or a Parcel Number Early payments for the current year taxes may be processed online starting December 1st with statements being mailed each year by Mid December House Number

The median property tax in Douglas County Nebraska is 2 784 per year for a home worth the median value of 141 400 Douglas County collects on average 1 97 of a property s assessed fair market value as property tax

Real Property Tax Search Please enter either Address info or a Parcel Number Early payments for the current year taxes may be processed online starting December 1st with statements being mailed each year by Mid December House Number

These States Have The Highest Property Tax Rates TheStreet

State Taxes Can Add Up Wealth Management

How High Are Property Taxes In Your State Tax Foundation

Highest Property Taxes In Texas Why Are Property Taxes So High In

Best And Worst States For Property Tax

What Are Property Taxes My Perfect Mortgage

What Are Property Taxes My Perfect Mortgage

The 15 States With The Highest Property Tax Rates In The U S A Bob Vila