In this day and age in which screens are the norm however, the attraction of tangible, printed materials hasn't diminished. It doesn't matter if it's for educational reasons, creative projects, or simply to add an individual touch to your space, How Is Retirement Income Taxed In South Carolina are a great source. For this piece, we'll take a dive into the world "How Is Retirement Income Taxed In South Carolina," exploring what they are, where to find them, and how they can improve various aspects of your life.

Get Latest How Is Retirement Income Taxed In South Carolina Below

How Is Retirement Income Taxed In South Carolina

How Is Retirement Income Taxed In South Carolina -

South Carolina allows for a deduction in retirement income based off of your age If you are under 65 you can deduct up to 3 000 of qualified retirement income If you are 65 or olde r you can deduct up to 10 000 of qualified retirement income

Deduction for those 65 and older Resident individuals who are 65 or older by the end of the tax year are allowed an Income Tax deduction of up to 15 000 against any South Carolina taxable income Amounts deducted as retirement income reduce this 15 000 deduction

How Is Retirement Income Taxed In South Carolina cover a large variety of printable, downloadable materials online, at no cost. They are available in numerous types, such as worksheets templates, coloring pages and much more. The attraction of printables that are free is in their variety and accessibility.

More of How Is Retirement Income Taxed In South Carolina

4 Types Of Income Not Taxed In Retirement FinTips YouTube

4 Types Of Income Not Taxed In Retirement FinTips YouTube

Retirement income is taxed in South Carolina but the state provides exemptions and deductions Taxpayers age 65 or older can exclude up to 10 000 of retirement income 3 000 if you re younger Those who file a

South Carolina has a state income tax with some very good tax deductions for resident retirees The highest income tax rate in South Carolina is 7 Retired persons under 65 can deduct up to 3 000 in retirement income from their state income tax bills

How Is Retirement Income Taxed In South Carolina have gained a lot of popularity due to a myriad of compelling factors:

-

Cost-Effective: They eliminate the requirement of buying physical copies of the software or expensive hardware.

-

Modifications: You can tailor designs to suit your personal needs whether it's making invitations as well as organizing your calendar, or decorating your home.

-

Educational Use: Printing educational materials for no cost can be used by students of all ages. This makes them a vital source for educators and parents.

-

An easy way to access HTML0: Fast access various designs and templates cuts down on time and efforts.

Where to Find more How Is Retirement Income Taxed In South Carolina

How Is Retirement Income Taxed Kiplinger

How Is Retirement Income Taxed Kiplinger

South Carolina income taxes in retirement Social Security Military retirement income and Railroad retirement benefits are fully exempt South Carolina sales tax South Carolina s state sales

1 Income Tax Advantage One of the most significant draws for retirees in South Carolina is the favorable income tax structure Unlike many other states South Carolina does not tax Social Security benefits

If we've already piqued your interest in printables for free and other printables, let's discover where the hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety with How Is Retirement Income Taxed In South Carolina for all needs.

- Explore categories such as furniture, education, management, and craft.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets as well as flashcards and other learning materials.

- Ideal for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers post their original designs and templates, which are free.

- The blogs covered cover a wide range of topics, that includes DIY projects to planning a party.

Maximizing How Is Retirement Income Taxed In South Carolina

Here are some ideas create the maximum value use of How Is Retirement Income Taxed In South Carolina:

1. Home Decor

- Print and frame beautiful images, quotes, or other seasonal decorations to fill your living spaces.

2. Education

- Utilize free printable worksheets to help reinforce your learning at home, or even in the classroom.

3. Event Planning

- Make invitations, banners and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

How Is Retirement Income Taxed In South Carolina are a treasure trove of fun and practical tools that satisfy a wide range of requirements and passions. Their access and versatility makes them a valuable addition to both professional and personal life. Explore the many options of How Is Retirement Income Taxed In South Carolina now and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are How Is Retirement Income Taxed In South Carolina really free?

- Yes, they are! You can download and print these items for free.

-

Can I make use of free printables for commercial uses?

- It's all dependent on the terms of use. Always check the creator's guidelines before using any printables on commercial projects.

-

Do you have any copyright issues with How Is Retirement Income Taxed In South Carolina?

- Some printables may have restrictions regarding usage. You should read the terms and conditions set forth by the author.

-

How do I print printables for free?

- Print them at home using a printer or visit the local print shop for superior prints.

-

What program do I need in order to open printables free of charge?

- A majority of printed materials are in PDF format, which can be opened with free software, such as Adobe Reader.

How Is Rental Income Taxed

How Much Will My Pension Be Taxed In South Carolina Retire Gen Z

Check more sample of How Is Retirement Income Taxed In South Carolina below

How Is Retirement Income Taxed Kiplinger

How Is Retirement Income Taxed In California Retire Gen Z

The Most Common Sources Of Retirement Income SmartZone Finance

How Is Retirement Income Taxed Kiplinger

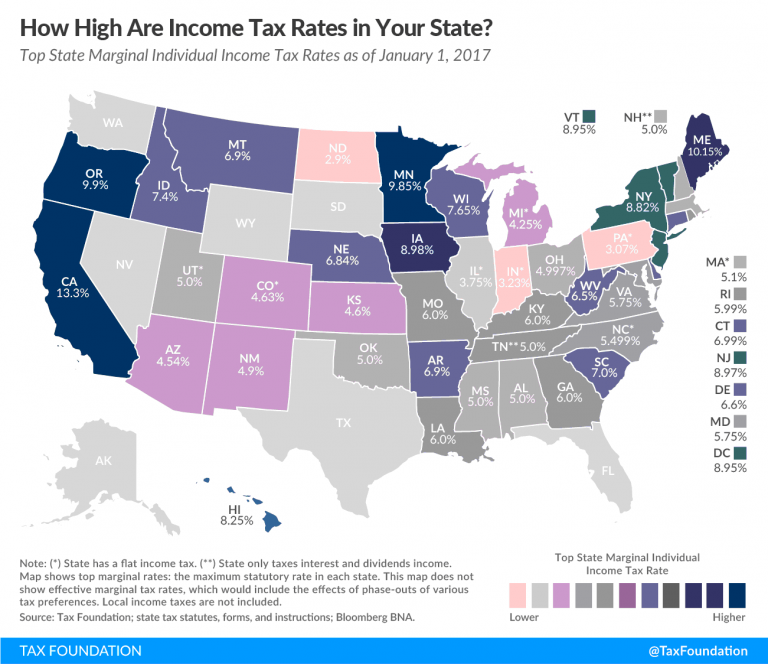

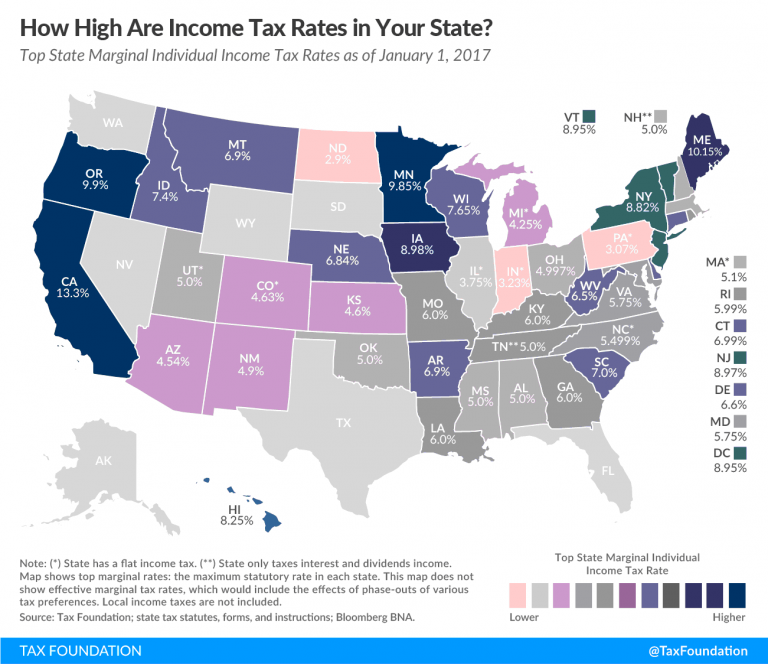

Sales Tax By State Here s How Much You re Really Paying Sales Tax

7 States That Do Not Tax Retirement Income

https://dor.sc.gov/resources-site/media-site/Pages/...

Deduction for those 65 and older Resident individuals who are 65 or older by the end of the tax year are allowed an Income Tax deduction of up to 15 000 against any South Carolina taxable income Amounts deducted as retirement income reduce this 15 000 deduction

https://www.actsretirement.org/.../south-carolina

South Carolina is very tax friendly for retirees Social Security benefits are not taxed and while retirement income is partially taxed individuals aged 65 and older can claim up to 10 000 in retirement income deductions from pensions 401 k s IRAs and other retirement accounts

Deduction for those 65 and older Resident individuals who are 65 or older by the end of the tax year are allowed an Income Tax deduction of up to 15 000 against any South Carolina taxable income Amounts deducted as retirement income reduce this 15 000 deduction

South Carolina is very tax friendly for retirees Social Security benefits are not taxed and while retirement income is partially taxed individuals aged 65 and older can claim up to 10 000 in retirement income deductions from pensions 401 k s IRAs and other retirement accounts

How Is Retirement Income Taxed Kiplinger

How Is Retirement Income Taxed In California Retire Gen Z

Sales Tax By State Here s How Much You re Really Paying Sales Tax

7 States That Do Not Tax Retirement Income

Pay Less Retirement Taxes

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra

Billionaires Income Tax Proposal Seeks To Ensure That U S Ultra

Satisfying Retirement Retirement Advice How Is Retirement Different