Today, where screens dominate our lives yet the appeal of tangible printed material hasn't diminished. In the case of educational materials and creative work, or just adding a personal touch to your area, How Is Personal Property Tax Calculated In Jackson County Missouri are now an essential source. This article will take a dive into the world "How Is Personal Property Tax Calculated In Jackson County Missouri," exploring their purpose, where you can find them, and how they can enhance various aspects of your life.

Get Latest How Is Personal Property Tax Calculated In Jackson County Missouri Below

How Is Personal Property Tax Calculated In Jackson County Missouri

How Is Personal Property Tax Calculated In Jackson County Missouri -

Personal property tax is calculated based on what you owned on Jan 1 of a given year That means that if you bought a car or moved to Missouri with your car on Jan 2 or later you won t

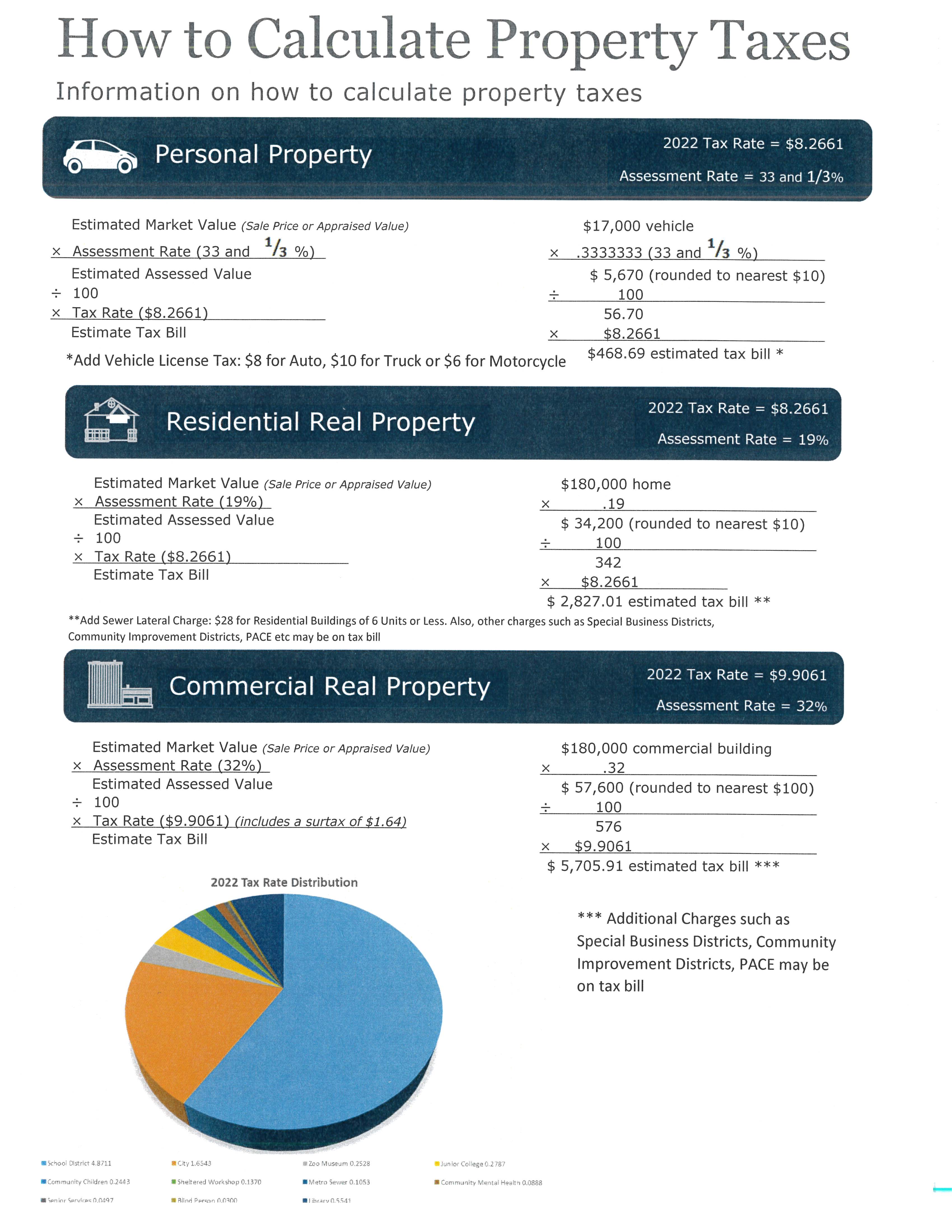

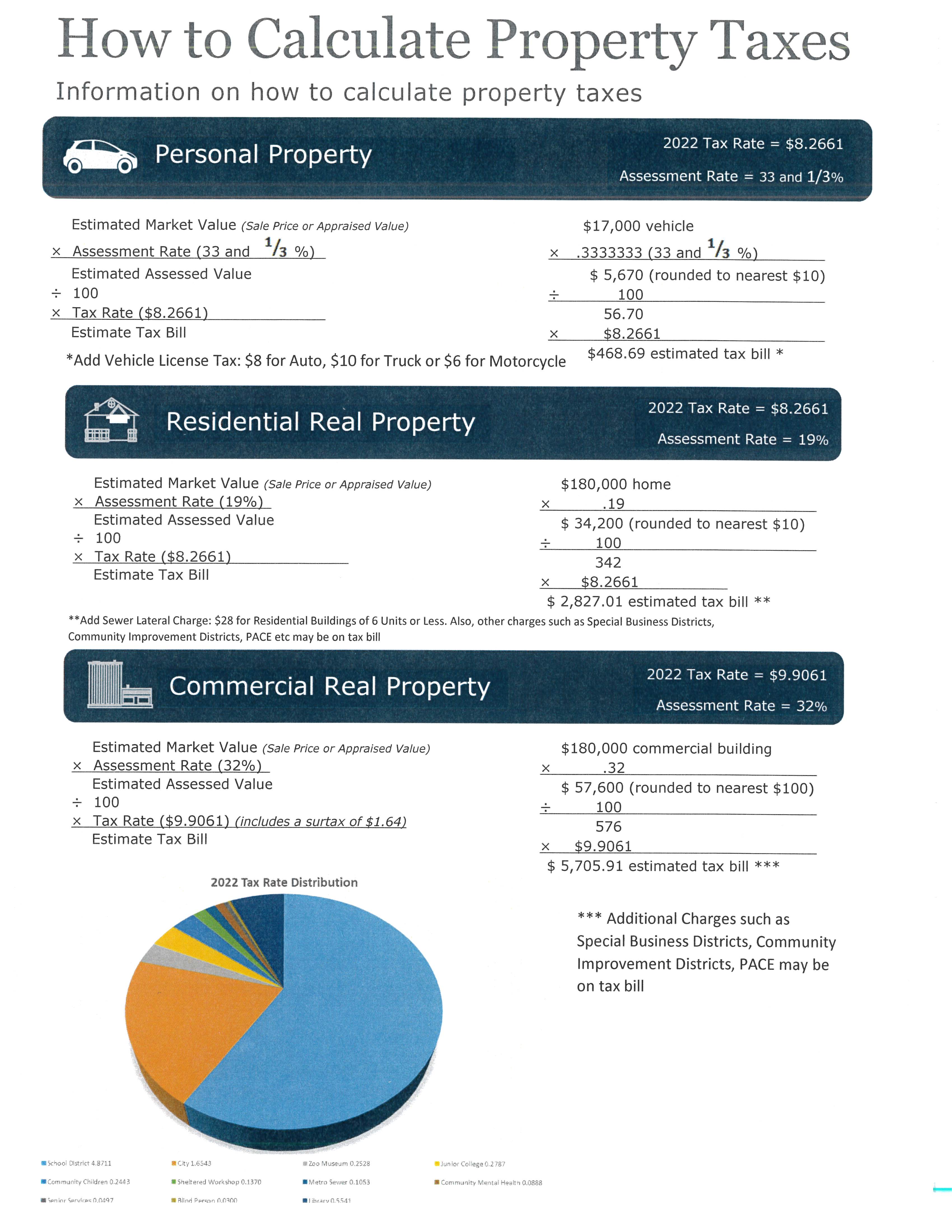

Your personal property tax is calculated by dividing the assessed value of the property by 100 and then multiplying that value by the levy rate for your area Personal Property Tax Assessed Value 100 x Levy Rate

How Is Personal Property Tax Calculated In Jackson County Missouri offer a wide assortment of printable materials available online at no cost. They come in many kinds, including worksheets templates, coloring pages, and many more. The value of How Is Personal Property Tax Calculated In Jackson County Missouri is their flexibility and accessibility.

More of How Is Personal Property Tax Calculated In Jackson County Missouri

Hecht Group Paying Real Property Taxes In Bulacan A Step By Step Guide

Hecht Group Paying Real Property Taxes In Bulacan A Step By Step Guide

Your real estate property tax is calculated by dividing the taxable value of the property by 100 and then multiplying that value by the levy rate for your area Real Estate Property Tax Taxable Value 100 x Levy Rate

Our Jackson County Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Missouri and across the entire United States

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the necessity of purchasing physical copies or expensive software.

-

Modifications: It is possible to tailor printing templates to your own specific requirements for invitations, whether that's creating them or arranging your schedule or even decorating your home.

-

Educational Value: Downloads of educational content for free are designed to appeal to students of all ages. This makes them a valuable source for educators and parents.

-

An easy way to access HTML0: Instant access to the vast array of design and templates saves time and effort.

Where to Find more How Is Personal Property Tax Calculated In Jackson County Missouri

How To Calculate Property Tax Ownerly

/filters:quality(80)/2021-08-01-How-to-Calculate-Property-Tax-equation-1.png)

How To Calculate Property Tax Ownerly

Once an assessor determines the total value of a taxpayer s taxable real and personal property he she calculates the portion that is assessed value by multiplying the total value by the percentages set by law for each type of property Tax rates set by local governments are then multiplied by the assessed value

The Assessed Value of an item multiplied by the tax rate levy for your district determines the amount of personal property tax you pay All taxable personal property shall be assessed in the county in which the owner resides the first day of January each year

In the event that we've stirred your interest in printables for free We'll take a look around to see where you can find these hidden gems:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy offer an extensive collection of printables that are free for a variety of objectives.

- Explore categories such as decorating your home, education, organizational, and arts and crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing along with flashcards, as well as other learning materials.

- It is ideal for teachers, parents and students looking for additional sources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates, which are free.

- The blogs covered cover a wide variety of topics, everything from DIY projects to party planning.

Maximizing How Is Personal Property Tax Calculated In Jackson County Missouri

Here are some ideas of making the most use of printables for free:

1. Home Decor

- Print and frame gorgeous art, quotes, or decorations for the holidays to beautify your living spaces.

2. Education

- Use these printable worksheets free of charge to enhance learning at home or in the classroom.

3. Event Planning

- Make invitations, banners as well as decorations for special occasions such as weddings and birthdays.

4. Organization

- Stay organized by using printable calendars including to-do checklists, daily lists, and meal planners.

Conclusion

How Is Personal Property Tax Calculated In Jackson County Missouri are a treasure trove of fun and practical tools catering to different needs and interest. Their access and versatility makes them an invaluable addition to each day life. Explore the world of How Is Personal Property Tax Calculated In Jackson County Missouri today and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Do printables with no cost really for free?

- Yes they are! You can print and download these materials for free.

-

Can I use free printables to make commercial products?

- It's contingent upon the specific rules of usage. Always read the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright rights issues with How Is Personal Property Tax Calculated In Jackson County Missouri?

- Certain printables might have limitations on usage. Be sure to review the terms and conditions offered by the author.

-

How do I print printables for free?

- Print them at home using either a printer or go to the local print shops for more high-quality prints.

-

What software do I need in order to open printables for free?

- The majority are printed in PDF format. They can be opened using free programs like Adobe Reader.

The Property Tax Equation

How Are Personal Property Taxes Calculated YouTube

Check more sample of How Is Personal Property Tax Calculated In Jackson County Missouri below

Personal Property Tax SDG Accountants

Hecht Group Do I Have To Pay Personal Property Tax On My Office

Jackson County Missouri Place

How Is Commercial Property Tax Calculated

Easy Steps How Is Personal Property Tax Calculated Track And Receive

How To Obtain Your Tax Calculations And Tax Year Overviews

https://www.jacksongov.org/.../Personal-Property

Your personal property tax is calculated by dividing the assessed value of the property by 100 and then multiplying that value by the levy rate for your area Personal Property Tax Assessed Value 100 x Levy Rate

https://smartasset.com/taxes/jackson-county...

Calculate how much you can expect to pay in property taxes on your home in Jackson County Missouri Compare your rate to the state and national average

Your personal property tax is calculated by dividing the assessed value of the property by 100 and then multiplying that value by the levy rate for your area Personal Property Tax Assessed Value 100 x Levy Rate

Calculate how much you can expect to pay in property taxes on your home in Jackson County Missouri Compare your rate to the state and national average

How Is Commercial Property Tax Calculated

Hecht Group Do I Have To Pay Personal Property Tax On My Office

Easy Steps How Is Personal Property Tax Calculated Track And Receive

How To Obtain Your Tax Calculations And Tax Year Overviews

Image Taken From Page 423 Of The History Of Jackson County Missouri

Property Tax AwesomeFinTech Blog

Property Tax AwesomeFinTech Blog

How Is Agricultural Income Tax Calculated With Example Updated 2022