In this age of technology, where screens rule our lives however, the attraction of tangible printed products hasn't decreased. For educational purposes such as creative projects or simply adding the personal touch to your home, printables for free have proven to be a valuable source. This article will take a dive into the world of "How Is Personal Property Tax Calculated In Arkansas," exploring the benefits of them, where to locate them, and what they can do to improve different aspects of your daily life.

Get Latest How Is Personal Property Tax Calculated In Arkansas Below

How Is Personal Property Tax Calculated In Arkansas

How Is Personal Property Tax Calculated In Arkansas -

Assessment and taxation of intangible personal property on and after January 1 1976 and ad valorem taxes shall not be assessed or collected The Arkansas Public

Calculate how much you ll pay in property taxes on your home given your location and assessed home value Compare your rate to the Arkansas and U S average

Printables for free include a vast assortment of printable, downloadable materials online, at no cost. These resources come in various designs, including worksheets coloring pages, templates and many more. The beauty of How Is Personal Property Tax Calculated In Arkansas lies in their versatility and accessibility.

More of How Is Personal Property Tax Calculated In Arkansas

Hecht Group Paying Real Property Taxes In Bulacan A Step By Step Guide

Hecht Group Paying Real Property Taxes In Bulacan A Step By Step Guide

The amount of property tax owed is based on the assessed value of the property which is determined by the county assessor Property owners in Arkansas can also claim a

2 What is property tax in Arkansas based upon All real and tangible personal property subject to taxation shall be taxable ac cording to its value Ark Const Art 16 5

Printables that are free have gained enormous appeal due to many compelling reasons:

-

Cost-Effective: They eliminate the need to buy physical copies of the software or expensive hardware.

-

Modifications: The Customization feature lets you tailor print-ready templates to your specific requirements when it comes to designing invitations as well as organizing your calendar, or decorating your home.

-

Educational Impact: Downloads of educational content for free can be used by students of all ages, making them a vital tool for teachers and parents.

-

Simple: instant access an array of designs and templates cuts down on time and efforts.

Where to Find more How Is Personal Property Tax Calculated In Arkansas

Should You Pay Your Commercial Property Taxes Early Hegwood Group

Should You Pay Your Commercial Property Taxes Early Hegwood Group

Individual tax bills are calculated by multiplying the total assessment value by the current millage rate A mill is equal to 1 1000 or one tenth of a percent So if your

Individual property tax bills are calculated by the total millage rate for that location Assessments Each year every Arkansas taxpayer must report personal property owned

We hope we've stimulated your interest in How Is Personal Property Tax Calculated In Arkansas We'll take a look around to see where you can find these elusive treasures:

1. Online Repositories

- Websites such as Pinterest, Canva, and Etsy provide an extensive selection in How Is Personal Property Tax Calculated In Arkansas for different objectives.

- Explore categories like design, home decor, organisation, as well as crafts.

2. Educational Platforms

- Forums and websites for education often offer free worksheets and worksheets for printing with flashcards and other teaching materials.

- Ideal for teachers, parents and students who are in need of supplementary sources.

3. Creative Blogs

- Many bloggers share their imaginative designs as well as templates for free.

- These blogs cover a wide spectrum of interests, from DIY projects to planning a party.

Maximizing How Is Personal Property Tax Calculated In Arkansas

Here are some new ways create the maximum value of How Is Personal Property Tax Calculated In Arkansas:

1. Home Decor

- Print and frame beautiful artwork, quotes or seasonal decorations that will adorn your living areas.

2. Education

- Use these printable worksheets free of charge for reinforcement of learning at home for the classroom.

3. Event Planning

- Create invitations, banners, and other decorations for special occasions such as weddings and birthdays.

4. Organization

- Keep track of your schedule with printable calendars checklists for tasks, as well as meal planners.

Conclusion

How Is Personal Property Tax Calculated In Arkansas are a treasure trove of fun and practical tools which cater to a wide range of needs and preferences. Their access and versatility makes them a fantastic addition to each day life. Explore the many options of How Is Personal Property Tax Calculated In Arkansas today to discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables for free really gratis?

- Yes you can! You can download and print these resources at no cost.

-

Are there any free printables for commercial purposes?

- It depends on the specific terms of use. Make sure you read the guidelines for the creator before utilizing their templates for commercial projects.

-

Are there any copyright issues in How Is Personal Property Tax Calculated In Arkansas?

- Certain printables might have limitations on their use. Make sure you read the terms of service and conditions provided by the creator.

-

How do I print printables for free?

- Print them at home using an printer, or go to the local print shop for superior prints.

-

What software do I need to open printables free of charge?

- Many printables are offered as PDF files, which is open with no cost software, such as Adobe Reader.

How High Are Property Taxes In Your State American Property Owners

How To Calculate Property Tax Ownerly

/filters:quality(80)/2021-08-01-How-to-Calculate-Property-Tax-equation-1.png)

Check more sample of How Is Personal Property Tax Calculated In Arkansas below

The Property Tax Equation

Personal Property Tax SDG Accountants

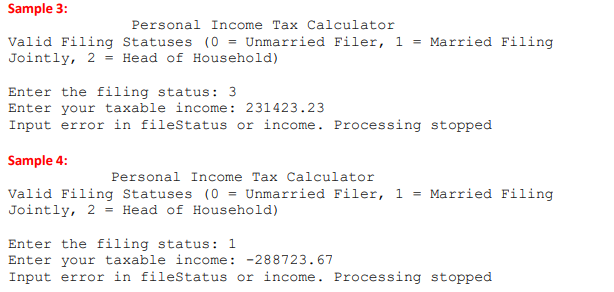

Solved In Python The United States Federal Personal Incom

Property Tax Consultants Commercial Property Tax Invoke Tax

What Income Is Subject To The 3 8 Medicare Tax

Hecht Group The States With The Highest And Lowest Rates Of Personal

https:// smartasset.com /taxes/arkansas-prop…

Calculate how much you ll pay in property taxes on your home given your location and assessed home value Compare your rate to the Arkansas and U S average

https://www. arkansasassessment.com /perso…

Arkansas Assessment Coordination Division 1900 West 7th Street Room 2140 Ragland Bldg Little Rock AR 72201 Tel 501 324 9240

Calculate how much you ll pay in property taxes on your home given your location and assessed home value Compare your rate to the Arkansas and U S average

Arkansas Assessment Coordination Division 1900 West 7th Street Room 2140 Ragland Bldg Little Rock AR 72201 Tel 501 324 9240

Property Tax Consultants Commercial Property Tax Invoke Tax

Personal Property Tax SDG Accountants

What Income Is Subject To The 3 8 Medicare Tax

Hecht Group The States With The Highest And Lowest Rates Of Personal

Hecht Group Do I Have To Pay Personal Property Tax On My Office

Hecht Group Personal Property Taxes By State

Hecht Group Personal Property Taxes By State

How Is Commercial Property Tax Calculated