In this age of electronic devices, with screens dominating our lives and the appeal of physical, printed materials hasn't diminished. No matter whether it's for educational uses as well as creative projects or simply adding an extra personal touch to your home, printables for free can be an excellent source. With this guide, you'll dive in the world of "How Is Income Tax Calculated For A Partnership Firm," exploring the different types of printables, where to get them, as well as how they can enhance various aspects of your life.

Get Latest How Is Income Tax Calculated For A Partnership Firm Below

How Is Income Tax Calculated For A Partnership Firm

How Is Income Tax Calculated For A Partnership Firm -

Key Takeaways Partnerships are considered pass through entities and partners are taxed on their individual shares of the income Partnerships must file Form 1065 annually to report income deductions and distributions

How is income tax calculated for a partnership firm Step 1 Determine the company s whole business revenue According to accounting records business income can be computed as usual Deduct all permissible business related expenses including those that fall under the heading profit and loss from business or profession

How Is Income Tax Calculated For A Partnership Firm provide a diverse range of downloadable, printable content that can be downloaded from the internet at no cost. These resources come in many designs, including worksheets templates, coloring pages, and many more. The beauty of How Is Income Tax Calculated For A Partnership Firm lies in their versatility and accessibility.

More of How Is Income Tax Calculated For A Partnership Firm

Partnership Firm Authorization Letter 4 Templates Writolay

Partnership Firm Authorization Letter 4 Templates Writolay

Understanding Income Tax in Partnerships Partners must pay income tax on their share of partnership profits as reported on their personal income tax return This is essential under the Uniform Partnership Act which guides how partnerships are taxed

What is Partner s Remuneration Under the Income Tax Act Section 40 b allows firms and companies to claim a deduction of interest remuneration paid to Partners while computing their profits gains However there is a limit on the maximum amount of remuneration and interest paid under Section 40 b

Print-friendly freebies have gained tremendous popularity due to a myriad of compelling factors:

-

Cost-Efficiency: They eliminate the need to purchase physical copies or expensive software.

-

The ability to customize: You can tailor print-ready templates to your specific requirements, whether it's designing invitations for your guests, organizing your schedule or even decorating your home.

-

Educational Value: These How Is Income Tax Calculated For A Partnership Firm offer a wide range of educational content for learners of all ages, making them an invaluable tool for parents and educators.

-

Simple: instant access numerous designs and templates cuts down on time and efforts.

Where to Find more How Is Income Tax Calculated For A Partnership Firm

All About Income Tax Return In India BillClap

All About Income Tax Return In India BillClap

According to the Partnership firm tax slab structure one needs to pay 30 income tax on taxable income with possible surcharges for incomes over one crore rupees and a 4 Health and Education Cess on the total tax amount

Income of the firm is offered to tax at the following rates The firm s losses shall be carried forward by the firm and shall not be allocated to the partner Taxability of share of profit The profit of the firm is taxed in the hands of the firm

In the event that we've stirred your curiosity about How Is Income Tax Calculated For A Partnership Firm, let's explore where they are hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a large collection with How Is Income Tax Calculated For A Partnership Firm for all motives.

- Explore categories such as decorating your home, education, craft, and organization.

2. Educational Platforms

- Forums and websites for education often provide free printable worksheets along with flashcards, as well as other learning tools.

- Great for parents, teachers and students looking for extra resources.

3. Creative Blogs

- Many bloggers share their innovative designs and templates at no cost.

- These blogs cover a broad selection of subjects, from DIY projects to party planning.

Maximizing How Is Income Tax Calculated For A Partnership Firm

Here are some fresh ways ensure you get the very most of printables for free:

1. Home Decor

- Print and frame beautiful art, quotes, and seasonal decorations, to add a touch of elegance to your living areas.

2. Education

- Use printable worksheets for free to help reinforce your learning at home either in the schoolroom or at home.

3. Event Planning

- Design invitations and banners as well as decorations for special occasions like weddings or birthdays.

4. Organization

- Stay organized by using printable calendars with to-do lists, planners, and meal planners.

Conclusion

How Is Income Tax Calculated For A Partnership Firm are an abundance of innovative and useful resources that satisfy a wide range of requirements and interests. Their access and versatility makes they a beneficial addition to each day life. Explore the many options of How Is Income Tax Calculated For A Partnership Firm and open up new possibilities!

Frequently Asked Questions (FAQs)

-

Are printables that are free truly for free?

- Yes, they are! You can print and download these documents for free.

-

Can I use the free printables for commercial purposes?

- It's based on the rules of usage. Always verify the guidelines of the creator before using any printables on commercial projects.

-

Do you have any copyright rights issues with printables that are free?

- Certain printables may be subject to restrictions in their usage. Be sure to read these terms and conditions as set out by the author.

-

How can I print How Is Income Tax Calculated For A Partnership Firm?

- You can print them at home with an printer, or go to the local print shop for premium prints.

-

What software will I need to access printables for free?

- The majority of PDF documents are provided as PDF files, which can be opened with free software like Adobe Reader.

How Are Income Taxes Calculated The Tech Edvocate

Cukai Pendapatan How To File Income Tax In Malaysia JobStreet Malaysia

Check more sample of How Is Income Tax Calculated For A Partnership Firm below

How Is Income Tax Calculated Can It Be Paid Online All You Need To

)

Earned Income Tax Credit For Households With One Child 2023 Center

How Is Income Tax Calculated Efintax

29000 A Year Is How Much A Month After Taxes New Update

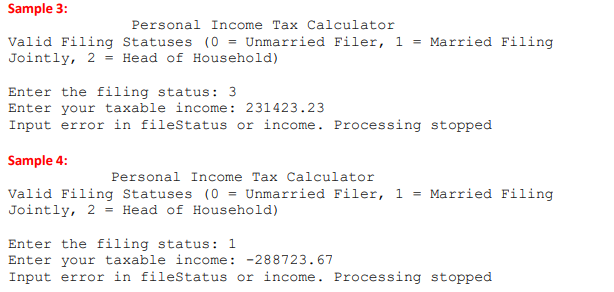

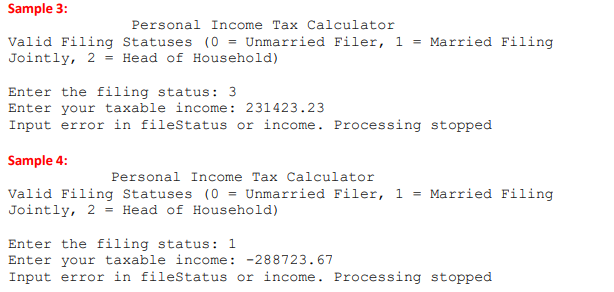

Solved In Python The United States Federal Personal Incom

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

https://instafiling.com/income-tax-calculator-for-partnership-firm

How is income tax calculated for a partnership firm Step 1 Determine the company s whole business revenue According to accounting records business income can be computed as usual Deduct all permissible business related expenses including those that fall under the heading profit and loss from business or profession

https://cleartax.in/s/partner-remuneration-taxation

Partner s remuneration is taxable for a partner under Business Income Read to know about what is partner remuneration how to calculate partner remuneration limit of remuneration allowed as a deduction for the firm

How is income tax calculated for a partnership firm Step 1 Determine the company s whole business revenue According to accounting records business income can be computed as usual Deduct all permissible business related expenses including those that fall under the heading profit and loss from business or profession

Partner s remuneration is taxable for a partner under Business Income Read to know about what is partner remuneration how to calculate partner remuneration limit of remuneration allowed as a deduction for the firm

29000 A Year Is How Much A Month After Taxes New Update

Earned Income Tax Credit For Households With One Child 2023 Center

Solved In Python The United States Federal Personal Incom

CARPE DIEM Average Federal Income Tax Rates By Income Group Are Highly

:max_bytes(150000):strip_icc()/TermDefinitions_Incomestatementcopy-9fe294644e634d1d8c6c703dc7642018.png)

Income Statement How To Read And Use It 2023

How Is Agricultural Income Tax Calculated With Example Updated 2022

How Is Agricultural Income Tax Calculated With Example Updated 2022

Q A How Is Income Tax Calculated J P Accountants