Today, where screens have become the dominant feature of our lives but the value of tangible printed objects hasn't waned. It doesn't matter if it's for educational reasons project ideas, artistic or simply adding an individual touch to your home, printables for free have become a valuable resource. For this piece, we'll dive deep into the realm of "How Does A Tax Deduction Differ From A Tax Credit," exploring what they are, how they are, and how they can enrich various aspects of your life.

Get Latest How Does A Tax Deduction Differ From A Tax Credit Below

How Does A Tax Deduction Differ From A Tax Credit

How Does A Tax Deduction Differ From A Tax Credit -

Beware these caveats What is a tax deduction A deduction reduces the amount of income you pay taxes on which means you could pay less in taxes You subtract deductions from your income before calculating how much taxes you owe How much a deduction saves you depends on your income tax bracket

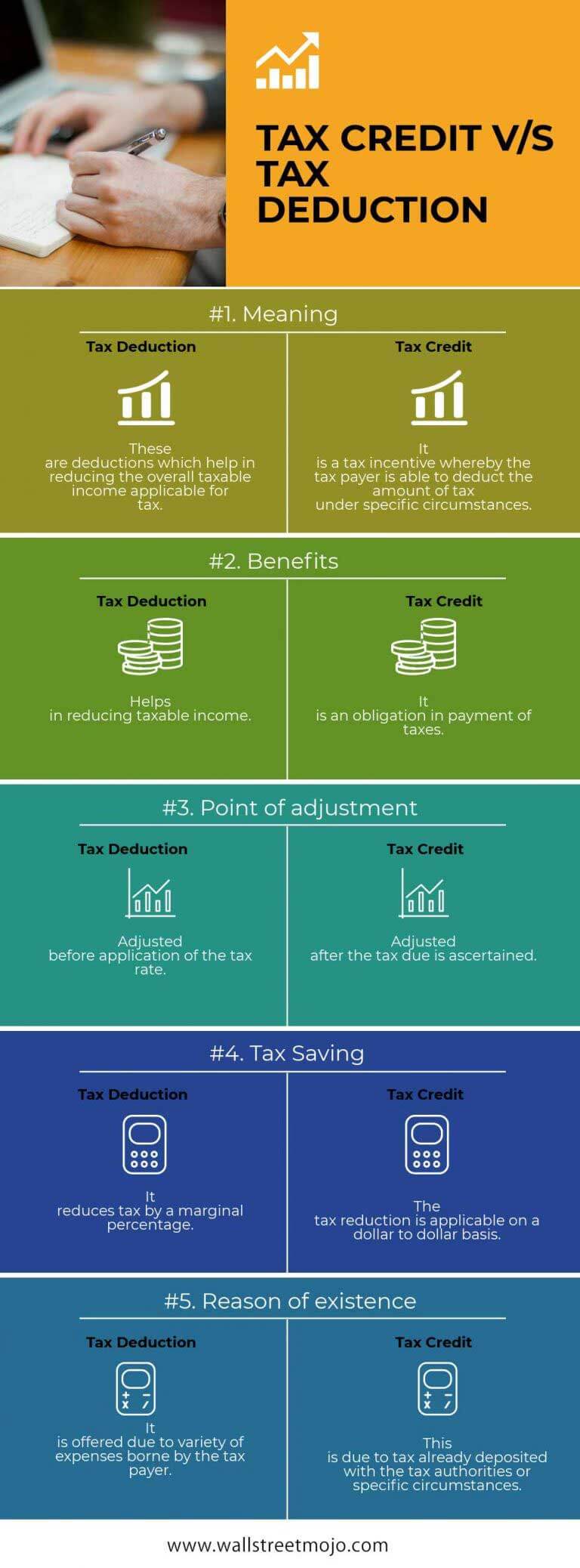

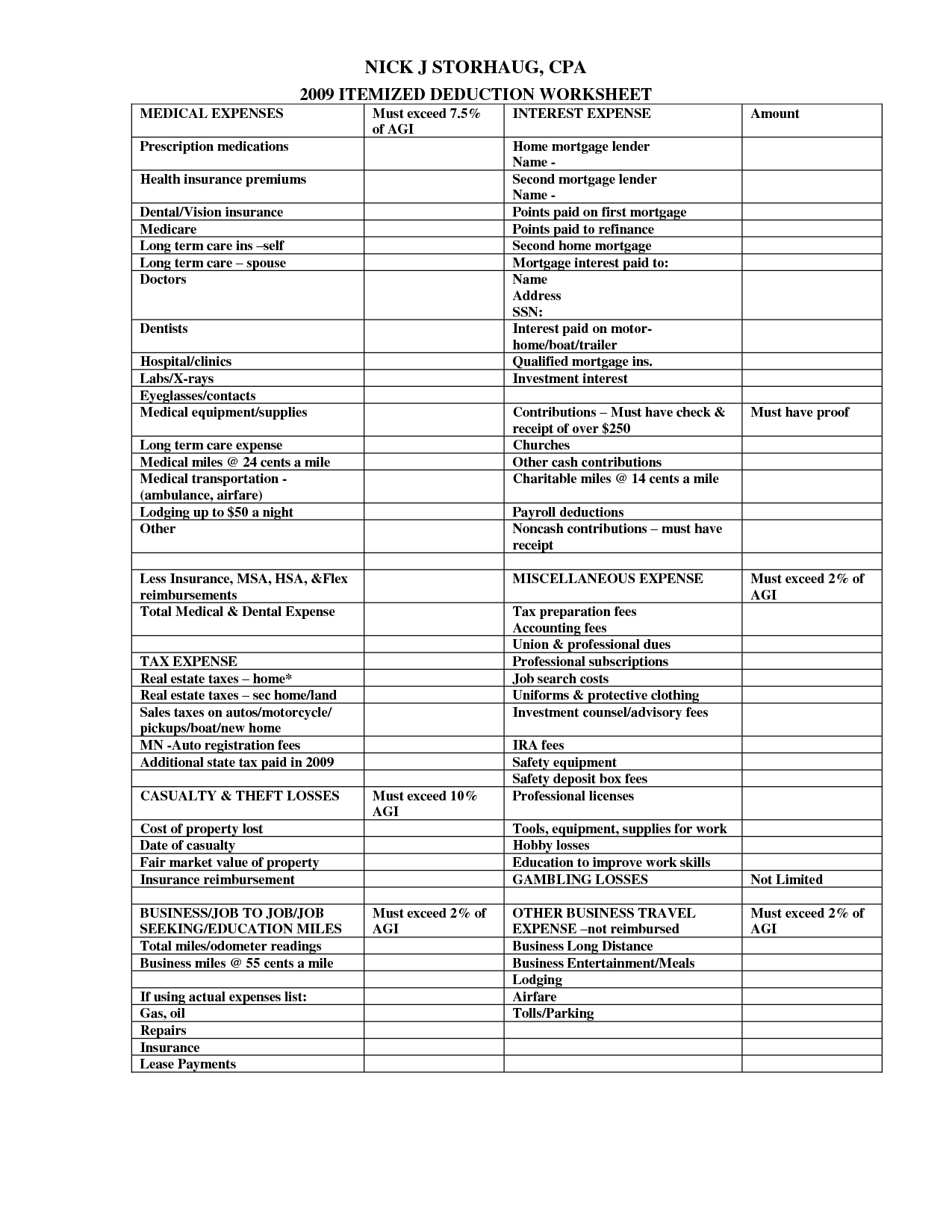

A tax credit gives you a dollar for dollar reduction of the tax you owe while a tax deduction lowers your taxable income for the year Both though can save you some cash For help with your tax strategy consider working with a financial advisor Tax Credits The Basics Tax credits reduce the amount of taxes you owe dollar for dollar

Printables for free include a vast variety of printable, downloadable materials available online at no cost. These resources come in various types, such as worksheets coloring pages, templates and more. The appealingness of How Does A Tax Deduction Differ From A Tax Credit lies in their versatility as well as accessibility.

More of How Does A Tax Deduction Differ From A Tax Credit

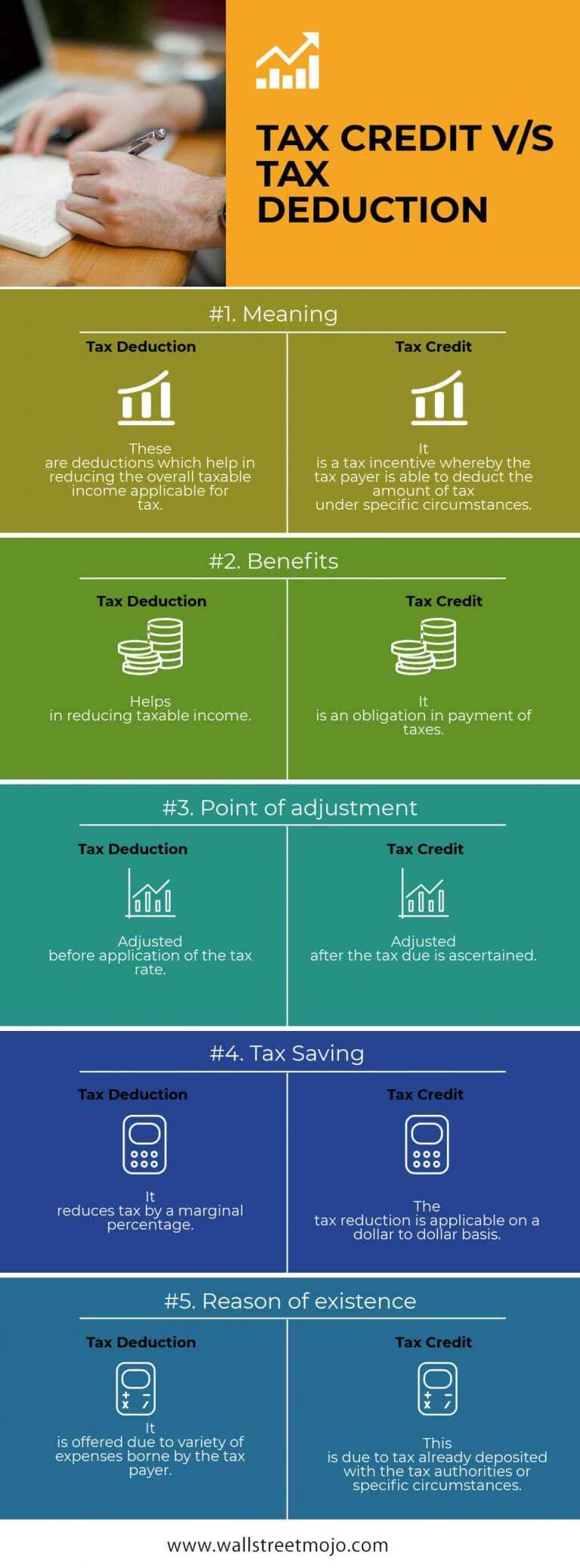

10 Business Tax Deductions Worksheet Worksheeto

10 Business Tax Deductions Worksheet Worksheeto

The IRS has a long list of tax credits and tax deductions Do you know the difference and which ones may be applicable to your situation A tax credit is applied against your tax liability A tax deduction is applied against your taxable income Need assistance EY TaxChat is here to help

Tax credits and deductions both decrease what you ll pay in taxes but in different ways Tax deductions lower your taxable income and potentially reduce what you ll pay in taxes as a result while tax credits reduce your tax bill dollar for dollar and may even increase your refund What Is a Tax Credit

How Does A Tax Deduction Differ From A Tax Credit have gained immense recognition for a variety of compelling motives:

-

Cost-Effective: They eliminate the requirement of buying physical copies or expensive software.

-

customization: It is possible to tailor the templates to meet your individual needs whether it's making invitations as well as organizing your calendar, or even decorating your house.

-

Educational Use: Free educational printables are designed to appeal to students of all ages. This makes them a valuable device for teachers and parents.

-

An easy way to access HTML0: Fast access the vast array of design and templates, which saves time as well as effort.

Where to Find more How Does A Tax Deduction Differ From A Tax Credit

Federal Income Tax Deduction Chart My XXX Hot Girl

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

Federal Income Tax Deduction Chart My XXX Hot Girl

Tax credits reduce the amount of taxes you owe but instead of doing so by reducing your taxable income tax credits reduce your actual tax liability acting as a dollar for dollar

Deductions reduce taxable income their value thus depends on the taxpayer s marginal tax rate which rises with income Tax Credits Tax credits are subtracted directly from a person s tax liability they therefore reduce taxes dollar for dollar Credits have the same value for everyone who can claim their full value

Now that we've piqued your interest in How Does A Tax Deduction Differ From A Tax Credit and other printables, let's discover where you can locate these hidden gems:

1. Online Repositories

- Websites like Pinterest, Canva, and Etsy provide a variety of printables that are free for a variety of reasons.

- Explore categories like decoration for your home, education, organisation, as well as crafts.

2. Educational Platforms

- Educational websites and forums usually offer worksheets with printables that are free with flashcards and other teaching tools.

- Perfect for teachers, parents and students looking for additional resources.

3. Creative Blogs

- Many bloggers offer their unique designs or templates for download.

- The blogs covered cover a wide range of topics, starting from DIY projects to planning a party.

Maximizing How Does A Tax Deduction Differ From A Tax Credit

Here are some inventive ways how you could make the most of How Does A Tax Deduction Differ From A Tax Credit:

1. Home Decor

- Print and frame stunning images, quotes, or seasonal decorations that will adorn your living spaces.

2. Education

- Use these printable worksheets free of charge to reinforce learning at home and in class.

3. Event Planning

- Designs invitations, banners as well as decorations for special occasions such as weddings, birthdays, and other special occasions.

4. Organization

- Stay organized with printable planners including to-do checklists, daily lists, and meal planners.

Conclusion

How Does A Tax Deduction Differ From A Tax Credit are an abundance of practical and innovative resources that meet a variety of needs and needs and. Their accessibility and flexibility make them an essential part of your professional and personal life. Explore the plethora of How Does A Tax Deduction Differ From A Tax Credit right now and discover new possibilities!

Frequently Asked Questions (FAQs)

-

Are the printables you get for free for free?

- Yes you can! You can print and download the resources for free.

-

Do I have the right to use free printables in commercial projects?

- It's based on specific rules of usage. Make sure you read the guidelines for the creator before using any printables on commercial projects.

-

Do you have any copyright issues with How Does A Tax Deduction Differ From A Tax Credit?

- Some printables may contain restrictions regarding their use. Make sure you read the terms and condition of use as provided by the creator.

-

How do I print printables for free?

- Print them at home using any printer or head to a local print shop to purchase superior prints.

-

What software will I need to access How Does A Tax Deduction Differ From A Tax Credit?

- Many printables are offered as PDF files, which can be opened using free software, such as Adobe Reader.

Tax Deductions You Can Deduct What Napkin Finance

10 2014 Itemized Deductions Worksheet Worksheeto

Check more sample of How Does A Tax Deduction Differ From A Tax Credit below

The Best Ways To Use A Few Hundred Dollars Together With Kitsap CU

Standard Deduction Vs Itemized Deduction Which Should I Choose Ramsey

GM Reveals It Received 3 8 Billion In Tax Credits From Michigan

Tax Deductions Write Offs To Save You Money Financial Gym

What Is The Standard Federal Tax Deduction Ericvisser

Printable Itemized Deductions Worksheet

https://smartasset.com/taxes/tax-credits-vs...

A tax credit gives you a dollar for dollar reduction of the tax you owe while a tax deduction lowers your taxable income for the year Both though can save you some cash For help with your tax strategy consider working with a financial advisor Tax Credits The Basics Tax credits reduce the amount of taxes you owe dollar for dollar

https://www.nerdwallet.com/article/taxes/tax...

A tax credit valued at 1 000 for instance lowers your tax bill by the corresponding 1 000 Tax deductions on the other hand reduce how much of your income is subject to taxes

A tax credit gives you a dollar for dollar reduction of the tax you owe while a tax deduction lowers your taxable income for the year Both though can save you some cash For help with your tax strategy consider working with a financial advisor Tax Credits The Basics Tax credits reduce the amount of taxes you owe dollar for dollar

A tax credit valued at 1 000 for instance lowers your tax bill by the corresponding 1 000 Tax deductions on the other hand reduce how much of your income is subject to taxes

Tax Deductions Write Offs To Save You Money Financial Gym

Standard Deduction Vs Itemized Deduction Which Should I Choose Ramsey

What Is The Standard Federal Tax Deduction Ericvisser

Printable Itemized Deductions Worksheet

What Is A Tax Deduction

-1920w.png)

Episode 215 Mailbag What Makes An HSA Better Than My Roth IRA

-1920w.png)

Episode 215 Mailbag What Makes An HSA Better Than My Roth IRA

Standard Deduction 2020 Self Employed Standard Deduction 2021